Getting REITs Right

Investing in real estate can be tough. Getting the timing right and choosing a city—or a sector—on the rise could reap large returns, but watch out if a hurricane flattens that near-beach condo and turns the formerly booming resort town into a has-been hotspot.

Owning commercial or residential properties to collect rental income can also prove cumbersome. Dealing with disrespectful tenants, performing perpetual property maintenance and shouldering the burden of a second mortgage can combine to produce a splitting headache.

Investing in physical property also comes with a cost barrier to entry. For a mortgage on a $200,000 condo, the likely down payment would be 20%, which is $40,000. For most investors, that’s an incredible amount of money to tie up in a single, illiquid asset.

Worth the trouble?

So should investors just give up and stick with stocks and bonds? On the contrary. They can participate in the real estate market regardless of their available capital. They can do it by purchasing shares of real estate investment trust companies (REITs). REITs generate income by owning physical real estate or through mortgages and mortgage-backed securities.

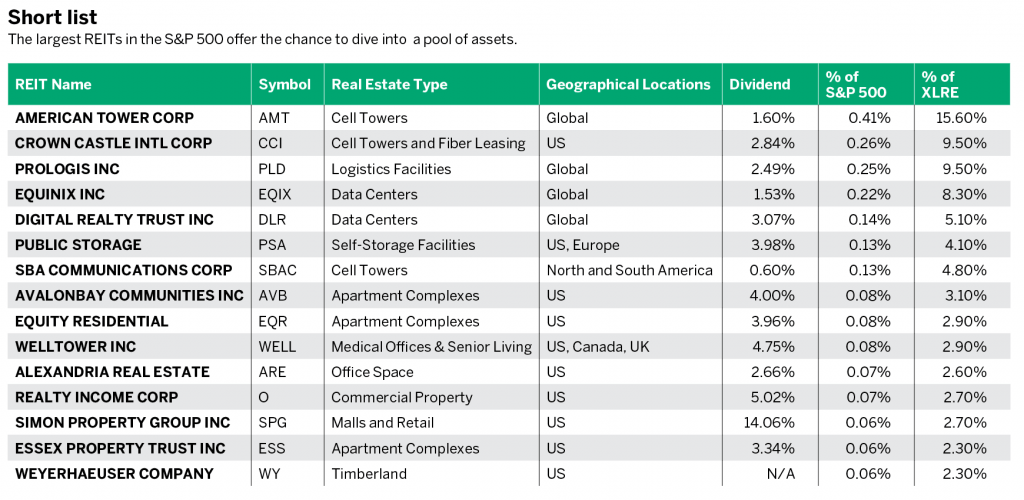

While some REITs are private and thus unavailable to individual investors, 186 publicly traded REITs are listed on the New York Stock Exchange. Many are large enough to make the S&P 500 stock index. They have a combined value of approximately $940 billion. This gives investors a huge amount of choice and flexibility to participate in diversified real estate portfolios. (See “Short list,” below.)

Take, for example, Equity Residential (EQR). It owns 309 apartment properties with approximately 80,000 units across the country. They’re in large cities and suburbs, including locations in and around San Francisco, New York and Boston. Investors who purchase 100 shares at the current price of around $60 have a $6,000 investment with no unit-specific or even region-specific risk.

Not just houses

REITs also offer investors opportunities outside of residential real estate. American Tower Corp. (AMT), one of the largest publicly traded REITs, specializes in cell tower ownership and management. American Tower owns approximately 180,000 towers around the globe, renting space on the towers to wireless carriers. Individuals might find it difficult to buy cell towers, but REITs make it possible to participate.

Some REITs struggled early this year because of COVID-19. Take the example of Simon Property Group (SPG), which owns and operates 207 properties, 85% of which are malls or outlet malls. The future of the American mall has been in question for some time and became drastically bleaker with statewide stay-at-home orders and people’s reluctance to enter crowded spaces upon reopening. Simon Property started the year above $145/share before dropping below $45 several times in Q1. While Simon may be a tough investment with brick-and-mortar retail in the grip of COVID-19, it could be an attractive opportunity in coming months if the situation improves.

Clearly, the individual investor is well-served by the REITs market, with plenty of publicly traded choices. However, as with most investing vehicles, the choices can become overwhelming. How does one select which REITs to invest in to complement a portfolio?

Selecting a REIT

Luckily, investors can choose from several REIT exchange-traded funds (ETFs). They trade like any other ETF and offer a slice of a portfolio constructed with multiple REITs. Investing in a REIT ETF can give investors access to a highly diversified global real estate portfolio.

One such REIT ETF is the Real Estate Select Sector SPDR fund (XLRE). As with other select sector funds, the Real Estate SPDR is designed to track the real estate stocks in the S&P 500. So, the top holdings are the same as the top REITs in the S&P index. The Real Estate SPDR holds 31 REITs. By the end of May, the SPDR fund was still down 10.4% year-to-date which, combined with a 3.55% dividend, could make for a compelling longer-term income investment. Any investment in the Real Estate SPDR provides a slice of a $729 billion diversified real estate portfolio.

Reviewing the Real Estate SPDR fund further, consider an analysis conducted by Quiet Foundation’s free online platform. The REIT components were entered into the system in the same weightings as in the ETF to gather more insight. The report highlights that this ETF may have more opportunity for growth than the overall S&P 500 ETF over the next year. Also highlighted is the recent price move relative to the volatility. The REIT ETF has lagged behind the overall

S&P 500 in recovery but also has seen larger price swings. This potentially points to opportunity in the REIT ETF as it may continue to recover and catch up with the overall S&P 500. The Quiet Foundation report also commends the liquidity of the REIT ETF portfolio, given most of the REITs held are extremely liquid products.

One point to consider is the correlation between the REIT ETF and the S&P 500 Index, which sits at 0.81. This suggests the REITs are moving in the same direction as the stock market. This may be a warning sign to investors who are looking to REITs as a diversified asset in a portfolio. Note that this correlation figure is high as a result of COVID-19, where multiple asset classes trended downward with the sell-off in the stock market. Historically, the real estate ETF has moved more independently from the overall market, with an average correlation to the S&P 500 of 0.45 in 2019. This would indicate that REITs can serve as a diversified asset in more normalized times.

Options traders may also find opportunity in REITs in the second half of 2020. As implied volatility in the S&P 500 trended back below 30, REITs still exhibited higher than average volatility and thus higher options premium. Investors who would be willing to purchase a REIT, such as Simon Properties, at lower than current prices could consider selling put options.

Whether through REITs, REIT options or REIT ETFs, there’s a diversified real estate investment for nearly any investor. While they don’t have the same wow factor as a Naples condo, REITs can serve as an additional asset class in a well-balanced portfolio.Regardless of the REIT product of choice, do the research and do the due diligence.

James Blakeway serves as CEO of Quiet Foundation, a data science-driven subsidiary of tastytrade that provides fee-free investment analysis services for self-directed investors.@jamesblakeway