Healthy ETFs

The risks and rewards that investors face when making investment decisions often can lead to more volatility than expected. This concept applies to the biotechnology sector, where the

U.S. Food & Drug Administration’s approval can determine a company’s profits and, by extension, its stock price.

Investors who bet on the right biotech horse can reap huge returns, while the less-lucky can see sharp losses. A recent example arose with Inovio Pharmaceuticals (INO), which received a grant to develop a vaccine for COVID-19. Investors bid up the stock from under $4 to $18 in eight days. Invio traded back below $6 two days later.

Even the larger biotech firms are often susceptible to excessive volatility. Take Gilead Sciences (GILD) for example. Gilead, a component of the S&P 500 Index, ranks by all measures as a large corporation with stable income. Despite that, Gilead shares consistently exhibit higher volatility than the overall S&P 500 Index and many of its components. That volatility has made Gilead a famous (or infamous) trading vehicle for active stock and options traders.

Investors may think that sticking with blue chip pharmaceutical names like UnitedHealth Group (UNH) and Johnson & Johnson (JNJ) reduces pharma-volatility thanks to size and diverse product offerings. In many ways it does, and both companies are components of the S&P 500 and the Dow Jones Industrial Average and exhibit far lower volatility than Gilead or Inovio. However, UnitedHealth and Johnson & Johnson can exhibit excessive moves from stock-specific news. Johnson & Johnson weathered some rough days in the last few years when it faced large-scale lawsuits by plaintiffs who alleged its products caused mesothelioma.

So, regardless of size or product diversity, all of these firms open investors up to stock-specific risk. While acquisitions and restructuring occur in any industry, healthcare has seen multiple examples in the past decade. It meant investors purchased stock in a particular firm and wound up owning a piece of a completely different entity.

As an extreme example, consider shares of Baxter Inc. (BAX). Baxter investors in 2015 saw their stock split into two as the company separated itself into Baxter and Baxalta (BXLT). One year later, Shire (SHPG) purchased Baxalta outright, so investors held Baxter and Shire shares. Fast forward to 2018 when Takeda (TAK) purchased Shire.

So, investors who bought Baxter stock at the turn of the decade were left with half of their Baxter shares, the new Takeda shares, two rounds of potentially taxable cash and probably a headache.

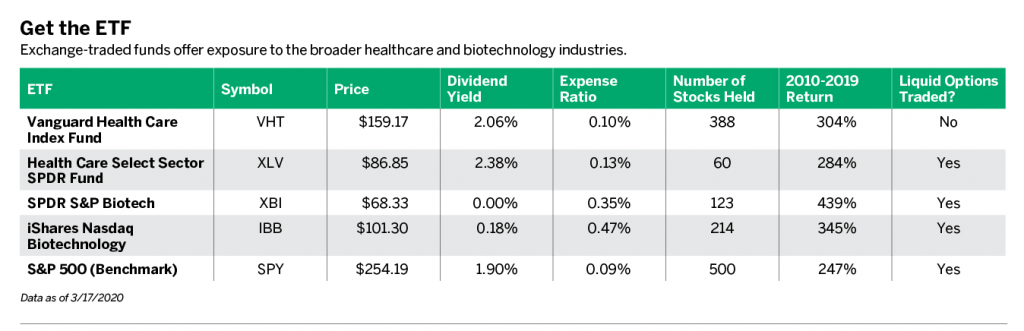

Typically, investors can limit volatility in long-term positions by diversifying their risk, and the same logic applies to healthcare stocks. Investors who own a basket of biotech and pharmaceutical companies experience lower exposure to large moves in single stocks. The healthcare sector is well represented in the exchange-traded fund (ETF) industry with many choices available. ETFs offer exposure to the broader healthcare industry and also in biotechnology. (See “Get the ETF,” below.)

The Vanguard Healthcare Index Fund (VHT) and Health Care Select Sector SPDR Fund (XLV) both focus on the broader healthcare industry. Both own many of the same stocks in their top holdings, with Johnson & Johnson and UnitedHealth as the largest holdings in each ETF. Other top stocks in both ETFs include Pfizer (PFE), Merck & Co. (MRK) and Bristol-Meyers Squibb (BMY).

Likewise, the two Biotech ETFs, iShares NASDAQ Biotechnology Index (IBB) and SPDR S&P Biotech (XBI), have similar portfolios. Each has Gilead in their top holdings, and others include Biogen (BIIB), Regeneron Pharmaceuticals (REGN) and Vertex Pharmaceuticals (VRTX).

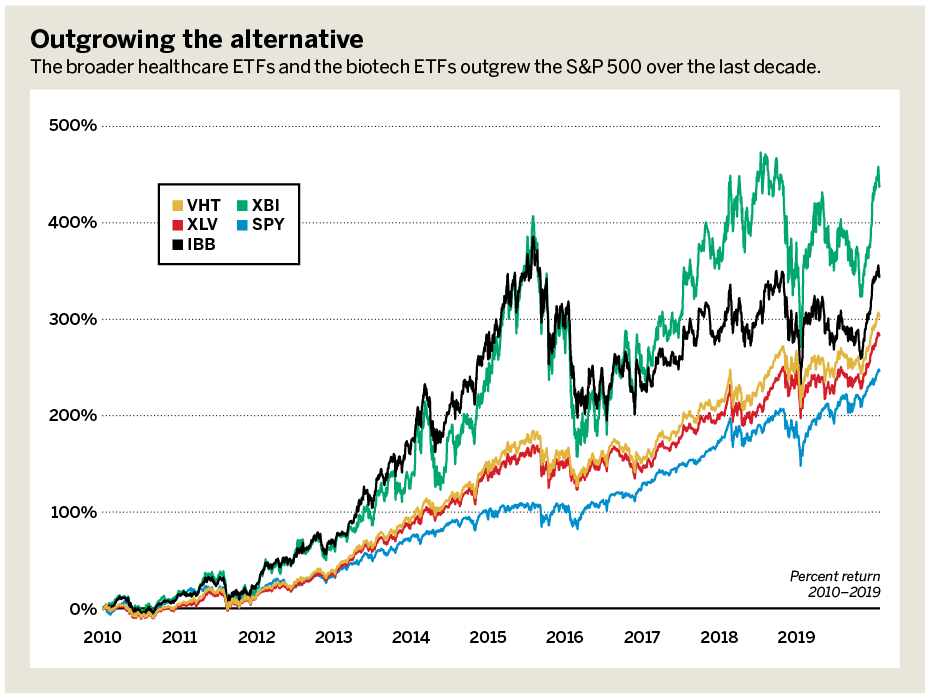

The broader healthcare ETFs and the biotech ETFs outgrew the S&P 500 over the last decade. (See “Outgrowing the alternative,” below.)

What’s more compelling is the comparison between biotech and broad healthcare. Both biotech ETFs outgrew XLV and VHT, but they did so with more volatility. This means the biotech stocks, even as a basket in an ETF, exhibit higher volatility then a basket of broad healthcare stocks.

Investors can use a calculated beta value to compare all four healthcare ETFs to the S&P 500. The beta measures the magnitude of the moves in each ETF compared with the index. A beta value above 1.0 means the ETF experiences larger price fluctuations compared with the index, and a beta value below 1.0 means the ETF experiences a smaller price fluctuation than the index.

Unsurprisingly, both biotech ETFs exhibited betas above 1.0. XBI averaged a 1.5 beta in 2019, while iShares NASDAQ Biotechnology Index had an average 1.2 beta. Vanguard Health Care ETF and Health Care SPDR actually exhibited betas below 1.0 in 2019, both approximately 0.9.

The more blue-chip nature of the general healthcare stocks is also apparent in dividends paid by Vanguard Health Care ETF and Health Care SPDR. SPDR S&P Biotech pays no dividend currently, and the dividend yield of iShares Nasdaq Biotechnology Index is below 0.2%, indicating very fewer biotech stocks are paying dividends than other firms in the healthcare sector.

Taken together, these metrics indicate healthcare stocks offer choices regardless of an investor’s risk profile. The more conservative could stick with the general healthcare ETFs, while younger or more aggressive investors may be tempted by the biotech ETFs. Those willing to accept more risk to seek big potential rewards can move into single stocks and the options traded on the stocks or ETFs. Regardless of product or strategy, investors should, as always, do their due diligence.

James Blakeway serves as CEO of Quiet Foundation, a data science-driven subsidiary of tastytrade that provides fee-free investment analysis services for self-directed investors. @jamesblakeway