Millennials are Overexposed to Cannabis

Across the world of financial media one topic pops up repeatedly: “How are millennials saving and investing?” Born from 1981 to 1996, millennials have now reached ages 23 to 38. As baby boomers (1946-1964) retire and members of Generation X (1965-1980) become content with their investing and savings habits, financial firms are shifting their focus to millennials for

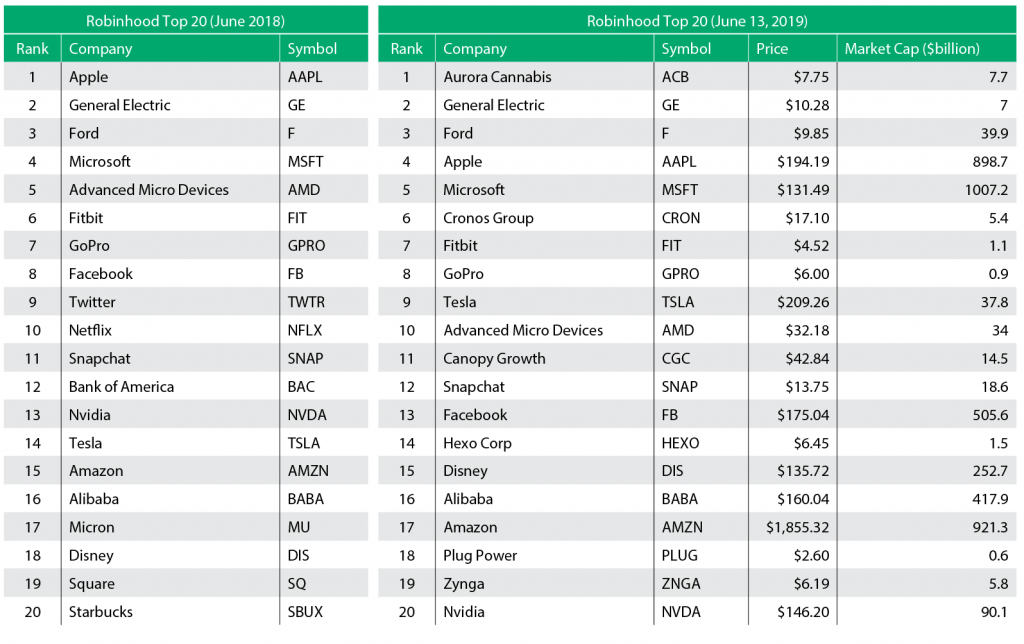

Robinhood’s basic, intuitive mobile app, combined with its pricing, has secured the company a place with millennials over the last several years. Perhaps the most interesting component of Robinhood is the “Top Stocks” list it displays to clients. It’s akin to the “Trending” topics on Twitter or top videos on YouTube, except it’s populated with the stocks that Robinhood customers, primarily first-time or novice millennials, are investing in at the firm. The table shows the Top 20 stocks held by Robinhood customers in June 2018 and the more recent list from June 2019.

A year ago, the list consisted of 20 well-known publicly traded corporations that were mainly household brand names. Interestingly, 14 of the 20 were S&P 500 components. However, these 20 stocks, in an equally weighted portfolio, have underperformed the S&P 500 during that period (-1.23% compared to 5.4%).

Fast forward one year, and several companies were replaced in the June 2019 list, including Twitter (TWTR), Netflix (NFLX), Bank of America (BAC), Micron (MU), Square (SQ) and Starbucks (SBUX). Even more interesting are the companies that were added. Most notably, four of the six new stocks are in the marijuana industry.

Of the four marijuana stocks on the Top 20 list, only No. 1-rated Aurora Cannabis posted a positive net income in its last annual filing

Of the four marijuana stocks, Aurora Cannabis was the only company with a positive net income in its last annual filing. It seems fair to assume this shift in interest is driven primarily by the constant presence of marijuana in financial and lifestyle news headlines.

Additionally, this bet by millennials falls in line with a wider national acceptance of legalized marijuana, which was illustrated recently when the governor of Illinois signed a legalization bill into law. Millennials are likely hoping to be invested in the next Tilray (TLRY), a marijuana stock that surged from the mid-$20s up to $300 before crashing back into the $40 range.

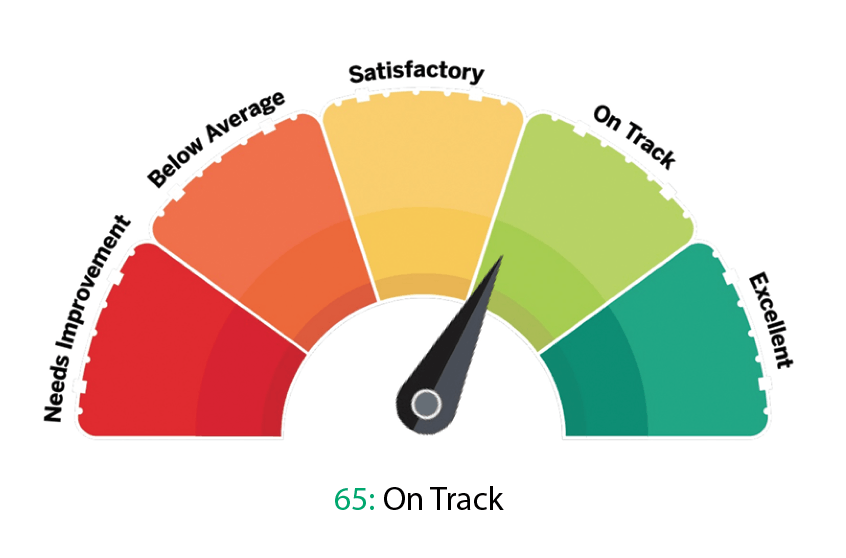

Analyzing an equally weighted portfolio of Robinhood’s June 2019 stocks with Quiet Foundation’s free portfolio assessment yields some interesting metrics and insight. Overall, the portfolio scored 65 (out of 100) indicating it’s “On Track.” The report commended the portfolio’s inclusion of only liquid stocks, the majority of which have liquid options markets, potentially enabling investors to enhance long positions with short calls.

A metric where the portfolio falls short—receiving the lowest possible score—is recent performance relative to the overall stock market. These combined stocks saw a 3.4% loss compared to a 2.5% gain in the S&P 500 during the prior three-month period. The S&P 500 returned this gain with a 14.9% volatility, versus 49.8% for the portfolio’s loss.

Of course, this “On Track” score is awarded with the assumption of an equally weighted portfolio across all 20 stocks. Because of the expense of several of these stocks, especially Amazon (AMZN), it’s probably safe to assume that most millennials do not hold this equally weighted portfolio. It would require a minimum of $37,000, likely above the average millennial brokerage account budget, and far above the widely estimated $3,000 average account size for a Robinhood client. It’s far more likely that a millennial’s account would consist of one or two of the marijuana stocks or, in some cases, it might be fully invested in a single share of Amazon.

Robinhood’s Top 20

Robinhood’s Top Stocks list alerts customers to the most popular stocks, as measured by purchases of Robinhood customers

By focusing on “Top Stocks,” millennials may fall into the age-old trap of over-concentration and diversification. As an example, investors interested in marijuana stocks may be better served by investigating products such as the ETFMG Alternative Harvest ETF (MJ). This fund is invested in 40 marijuana companies, significantly lowering specific stock risk.

Anyway, Robinhood has done something impressive: It persuaded a large number of millennials to become interested in investing. However, it’s now the mission of educational finance platforms like tastytrade and Quiet Foundation to take that education a step farther by opening millennials’ eyes to thoughtful diversification, risk management and strategy.

James Blakeway is CEO of Quiet Foundation, a data science-driven subsidiary of tastytrade that provides fee-free investment analysis services for self-directed investors.

Past performance is no guarantee of future results. Information provided in an EPI Report does not consider the specific profile, objectives or circumstances of any particular investor or suggest any specific course of action. Investment decisions should be made based on an investor’s objectives and circumstances and in consultation with his or her investment professional. Investment suitability must be independently determined for each individual investor. QF does not make suitability determinations or investment recommendations for investors. EPI utilizes the S&P 500 as its benchmark given that the S&P 500 is considered a barometer of stock performance in the United States. Aspects of the analysis and information found in an EPI Report are based upon simulated and/or hypothetical performance. Simulated and hypothetical performance have inherent limitations and do not represent the actual performance results of any particular investment products. The EPI Report does not guarantee any results or outcomes in the financial markets. Investors should be aware of the methodology used to produce an EPI Report and the inherent limitations when placing reliance on the results. For additional information about EPI Reports, visit the QF website: quietfoundation.com.