The Art of Sector Selection

As the world economy struggles through the COVID-19 pandemic, market turbulence may continue for the foreseeable future. But where some see panic and volatility, others find opportunity.

Younger, more passive investors know they have plenty of time until retirement and can therefore rest easy while their 401(k) plans buy more shares at lower prices. Meanwhile, active traders can thrive in times like these because larger price swings can mean larger profits—or larger losses when risks aren’t managed.

Regardless of investing experience, everyone can find opportunity in market downturns. While some scramble to pick which beaten-down hospitality or airline stock may skyrocket in recovery, others look to exchange-traded funds (ETFs) for baked-in diversification that could mitigate risk.

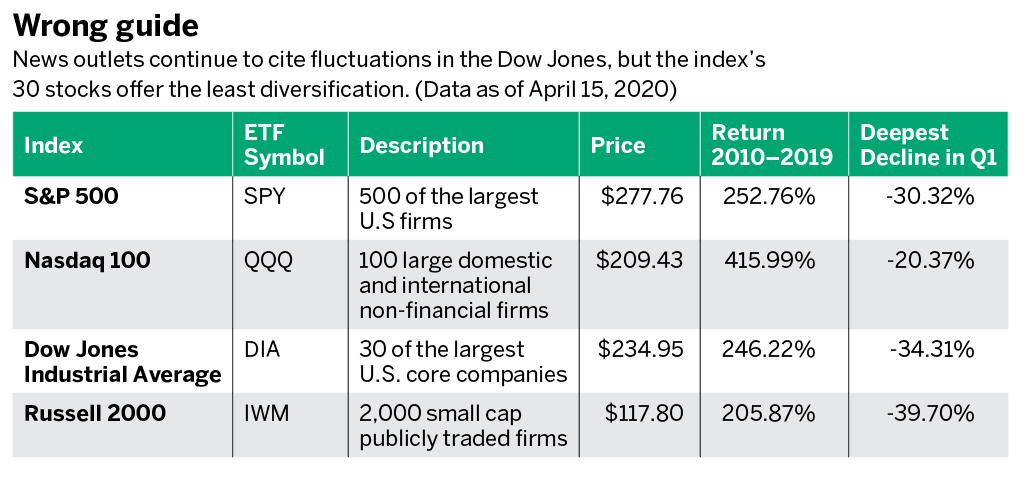

Using an ETF to purchase stocks enables these investors to buy a basket of stocks without piecemealing their funds and figuring out how much of each firm they need or want to purchase. A good starting point for newer investors is the index ETFs, products that provide exposure to the broad U.S. stock market indexes (see “Wrong guide,” below). News outlets continue to quote the Dow Jones, but it offers the least diversification with only 30 stocks.

Because the Dow assigns higher weightings to the highest-priced stock, Boeing (BA) was the largest component before falling from grace recently. The current largest holding is UnitedHealth Group (UNH) at 8.2%.

Both the S&P 500 and Nasdaq 100 likely offer a more compelling investment for those seeking diversified, broad market exposure. While both offer access to the largest publicly traded firms, it’s important to note the heavy concentration of some stocks in both indexes.

Just five stocks—Microsoft (MSFT), Apple (AAPL), Alphabet/Google (GOOG & GOOGL), Amazon (AMZN) and Facebook (FB)—constitute over 23% of the S&P 500 Index and nearly 55% of the Nasdaq 100 Index. Investors may be comfortable with the exposure to those large, household-name firms, but keep this in mind if considering a portfolio with both the Nasdaq and S&P ETFs.

The Russell 2000 Index ETF differs from the other three indexes. Its 2,000 firms are far smaller, with the median for company value at $560 million, versus the S&P 500 median of $19.3 billion. As the concentration of the S&P and Nasdaq push more and more into the mega-cap tech firms, the Russell 2000 ETF provides investors a sliver of exposure to each of the component stocks.

The largest component equals just 0.86% of the total portfolio. Regardless of the diversification offered by the Russell 2000, the index has underperformed the other three over the past decade. An investment in the Russell ETF returned only half of the Nasdaq ETF gains from 2010-2019.

The COVID-19 outbreak had a greater impact on the Russell 2000 in Q1, posting nearly a 40% drawdown compared with 20% in the Nasdaq. A contrarian-minded investor may even bet that the Russell’s small cap firms could be due for a resurgence over the next decade.

Some investors will look to get more granular than the index ETFs without assuming the risk of individual stocks. One potential strategy for that is to use sector ETFs to supplement a diversified portfolio.

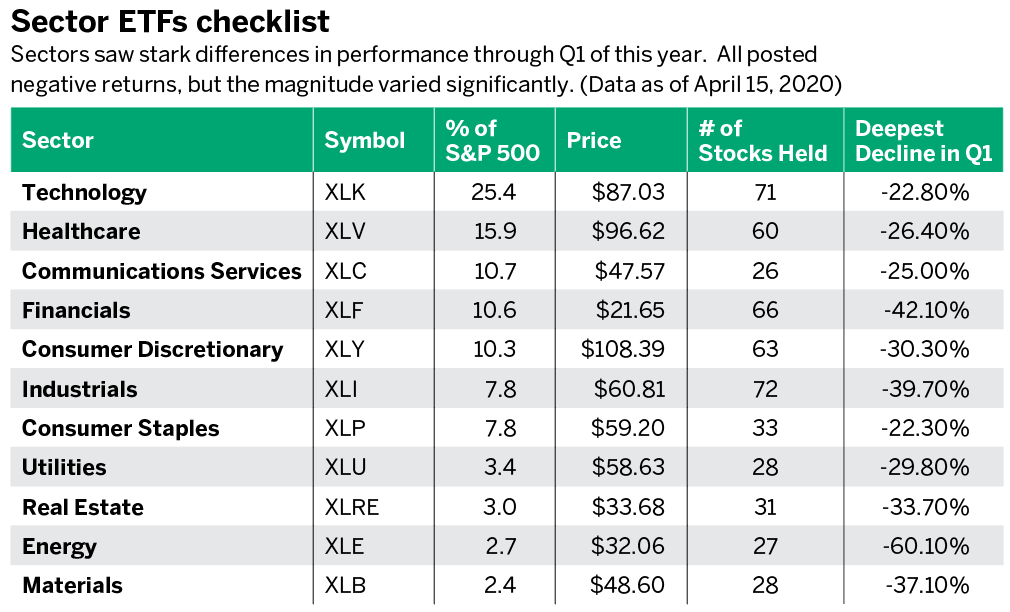

Investors can choose from a plethora of sector ETFs offered by a variety of ETF issuers. The SPDR Select Sector ETFs offer a comprehensive breakdown of the sectors in the S&P 500 index. (See “Sector ETFs checklist,” below.).

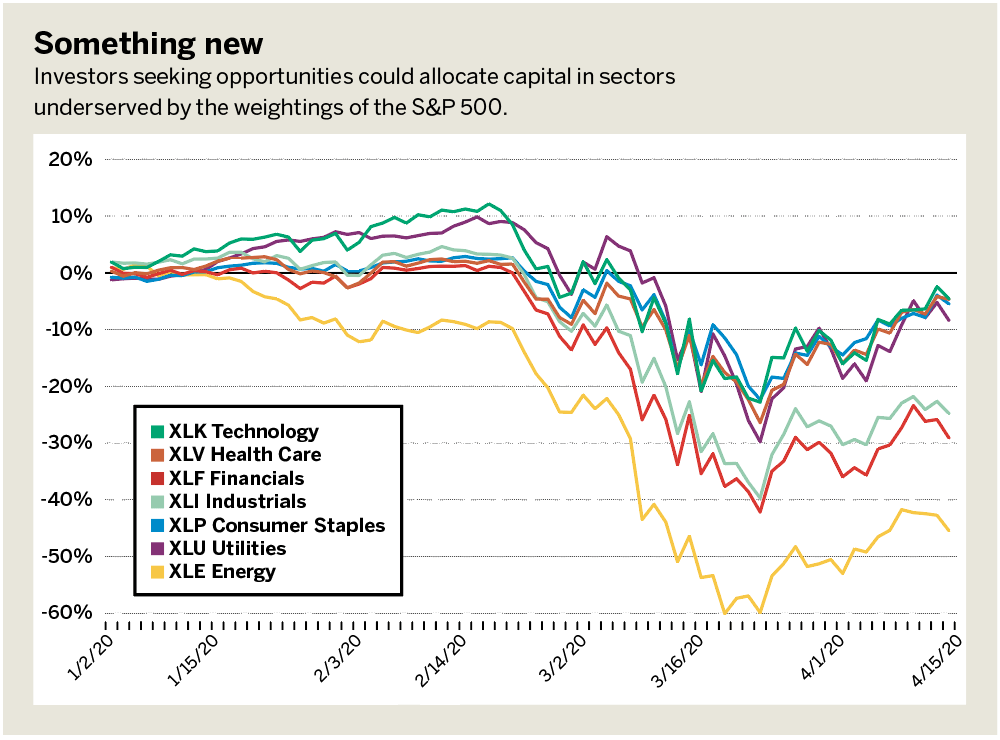

As expected, the sectors saw stark differences in performance through Q1 of this year. Despite all seeing a negative return, the magnitudes across the sectors varied significantly.

The technology sector, perhaps unsurprisingly, saw one of the shallowest drops, combined with a fairly rapid recovery. The consumer staples sector saw very similar price action. That’s because of the fairly limited impact on business for both sectors during shelter-in-place orders.

Another sector to watch is healthcare. The SPDR healthcare ETF followed a similar trajectory as consumer staples and technology because of an ever-present demand for healthcare products. The healthcare ETF focuses on firms that specialize in the production of drugs and medical equipment.

Is it worth investing excess funds in sectors that saw limited impact from COVID-19? Probably not. A more prudent use of funds may be to diversify into sectors that have been harder hit but could recover. Note that any investor who has exposure to the S&P 500 as a whole has large holdings in technology and healthcare, as they combine to account for 40% of the total index.

Investors seeking opportunities could allocate capital in sectors underserved by the weightings of the S&P 500, like the energy sector. The virus hit energy companies hard, and weak demand for fuel caused oil futures to plummet. At points in Q1, this sector ETF was down more than 60% on the year with limited signs of a full recovery in the immediate future. Some energy firms may not survive low demand and low prices in oil. However, the sector ETF provides access to 27 of the largest American energy firms that can likely withstand tough times.

A strategy to consider for investors already exposed to the S&P 500 or another market index ETF is to add exposure to sectors, like energy, that have been weak in the early part of 2020 and are underserved by the broad index.

Other sectors that make up less than 4% of the S&P 500 include materials, real estate and utilities. As with energy, investors could add exposure in these underserved sectors.

Stock analysts are struggling to come to grips with new revenue projections as they issue new guidance on stock prices. ETF retail investors can avoid most of this guesswork by being exposed to an industry or sector instead of a specific stock.

Optimistic investors can simply look at pre-COVID ETF prices as rough guidance on how far they might expect an ETF to rise and consider the ETF discounted. By the end of Q1, the energy sector ETF was trading at 50% below its price at the end of 2019.

It’s possible to consider this a 50% discount on the ETF. If investors assume that in the next few years the world will return to normal pre-COVID global economic conditions, the demand for oil and energy will return. Thus, the industry and the sector ETF should recover.

Investors who use options may also capitalize on these sector ETFs. As with most products, the sector ETFs are demonstrating heightened volatility, which translates into higher options prices. Investors willing to buy these sectors at lower prices can sell put options in an attempt to capture these higher premiums.

Whether purchasing ETF shares or trading options, index investors should evaluate their sector exposure to decide if they want to expand their allocation to lagging sectors that could rebound. As always, passive and active investors should be mindful of the ever-changing investment landscape and always do their due diligence.

Click here to evaluate any portfolio with Quiet Foundation.

James Blakeway serves as CEO of Quiet Foundation, a data science-driven subsidiary of tastytrade that provides fee-free investment analysis services for self-directed investors. @jamesblakeway