What’s Really Going on Inside That Mutual Fund?

In the land of the free, the financial markets offer a nearly limitless choice of stocks. That makes isolating which equities to purchase a painstaking endeavor for large investment firms, let alone do-it-yourself investors.

In fact, the difficulties of stock and asset selection explain the long reign of mutual funds. From 401(k) plans to pension funds, from investment advisers to individual investors, mutual funds have been a staple choice to acquire diversification through the research and management of “industry professionals.” Between 1999 and 2018, the total assets of U.S.-registered mutual funds grew from $6.8 trillion to $17.7 trillion.

Recent years, however, saw a shift away from more traditional mutual funds in favor of index and sector-tracking funds. The latter seek to replicate a market index while benchmarking their asset allocations to match the index weightings. While that seems like the perfect manifestation of “If you can’t beat ‘em, join ‘em,” it has led to cheaper mutual funds for investors.

These funds typically charge a much lower fee for replicating an index, compared with traditional mutual funds where the fees pay for the research and active management of the assets. So, the questions remain: How do both traditionally managed and index mutual funds affect investors’ portfolios, and how do they compare to the overall market?

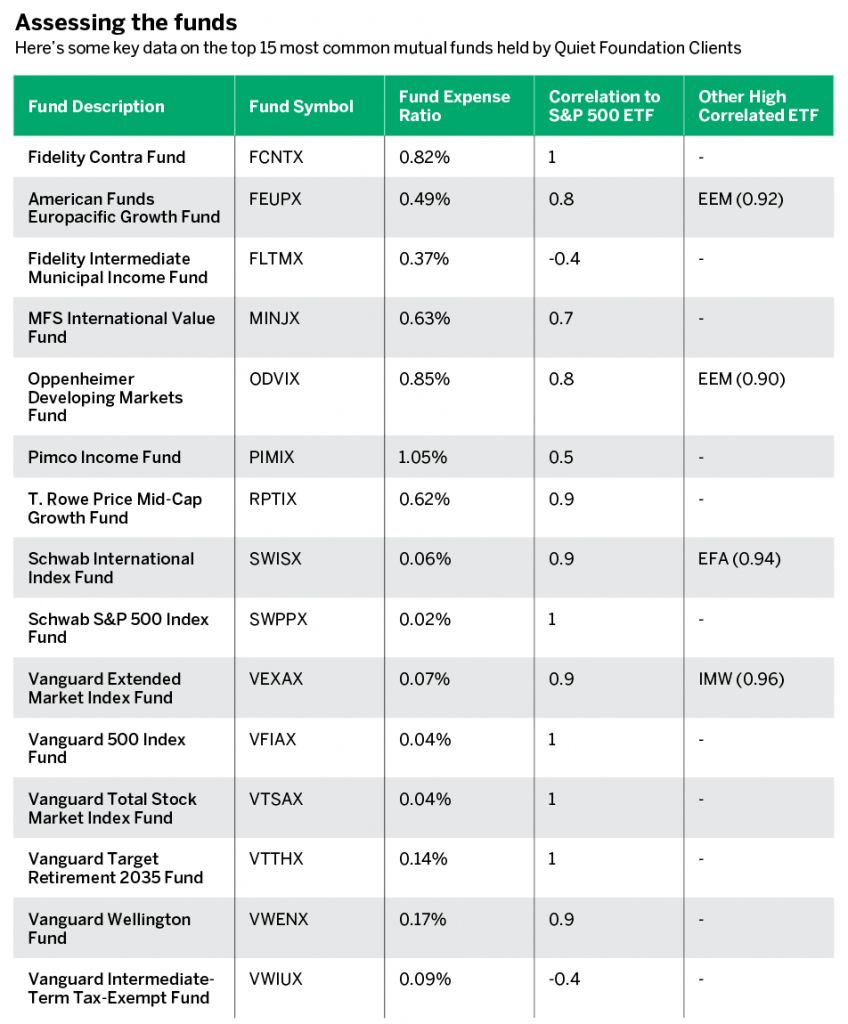

Consider the 15 most common mutual funds held by Quiet Foundation clients that use the free portfolio analysis tool built on proprietary Exploratory Portfolio Intelligence (EPI) technology (see “Assessing the funds, below).

These investors represent a subsector of the financial world because they’re decidedly more “hands-on” investors and traders for at least a portion of their net worth.

Entering these mutual funds as an equally weighted hypothetical portfolio into the Quiet Foundation’s EPI system yields some interesting results. One important metric is the correlation of each mutual fund to the S&P 500 Index. The aggregated portfolio correlation to the S&P 500 was 0.7, lowered by the inclusion of popular income and bond-focused mutual funds.

However, many of the equity-focused mutual funds had correlations to the S&P 500 between 0.9 and 1.0. This high correlation makes sense for the Vanguard 500 Index Fund (VFIAX) and the Schwab S&P 500 Index Fund (SWPPX) because those two funds both seek to track the S&P 500 Index. Research indicates they have done so with relative success and at a low cost to investors (0.04% and 0.02% expense ratios respectively).

More surprising is the high index correlation of funds like the Fidelity Contra Fund (FCNTX). The Fidelity Contra investment goal is capital appreciation through the purchase of stocks that fund managers deem undervalued. Fidelity Contra has underperformed compared to the S&P 500 benchmark in five of the last 10 years. Additionally, the fund’s expense ratio is 0.82%, 20 times the expense ratio for the Vanguard 500 Index Fund, meaning investors are paying 20 times more in fees for these results.

The Quiet Foundation analysis yielded an overall score for the mutual fund portfolio of 42 of 100, earning a rating of “Satisfactory.” The analysis report highlighted the portfolio’s potential for growth over the next year. The portfolio scored poorly in the diversification category because of a cluster of highly correlated equity mutual funds. The portfolio also received low scores in the liquidity and net opportunity categories.

The liquidity metric ranks securities based on an investor’s opportunity to move in and out of that product, which is primarily analyzed via share volume. Because mutual funds are not traded on an exchange, they score poorly in this category. While investors can purchase or redeem mutual fund shares at the end of each business day, they cannot execute fund orders intraday.

The Quiet Foundation report highlights mutual funds highly correlated to liquid exchange-traded funds (ETFs). For example, in this portfolio, the American Funds Europacific Growth Fund (FEUPX) has a 0.92 correlation to the highly liquid iShares MSCI Emerging Markets ETF (EEM).

Quiet Foundation’s analysis also identifies securities in the portfolio with active options markets. As mutual funds do not have listed options contracts, this all-mutual fund portfolio does not earn a high score in this category either.

Note that many Quiet Foundation clients with portfolios consisting of stocks, ETFs and mutual funds have seen high scores on their analysis reports. A broad product mix enables customers to maintain portfolios that have opportunity, stability and—perhaps most importantly—diversification.

Mutual funds still make up an overwhelming percentage of available investment choices for Americans. In many cases, such as retirement plans, they may be the only choice available. If cornered and presented only with mutual fund selections, investors should pay close attention to the details, calculate what each fund will cost in the long run and, as always, do their due diligence.

James Blakeway serves as CEO of Quiet Foundation, a data science-driven subsidiary of tastytrade that provides fee-free investment analysis services for self-directed investors.