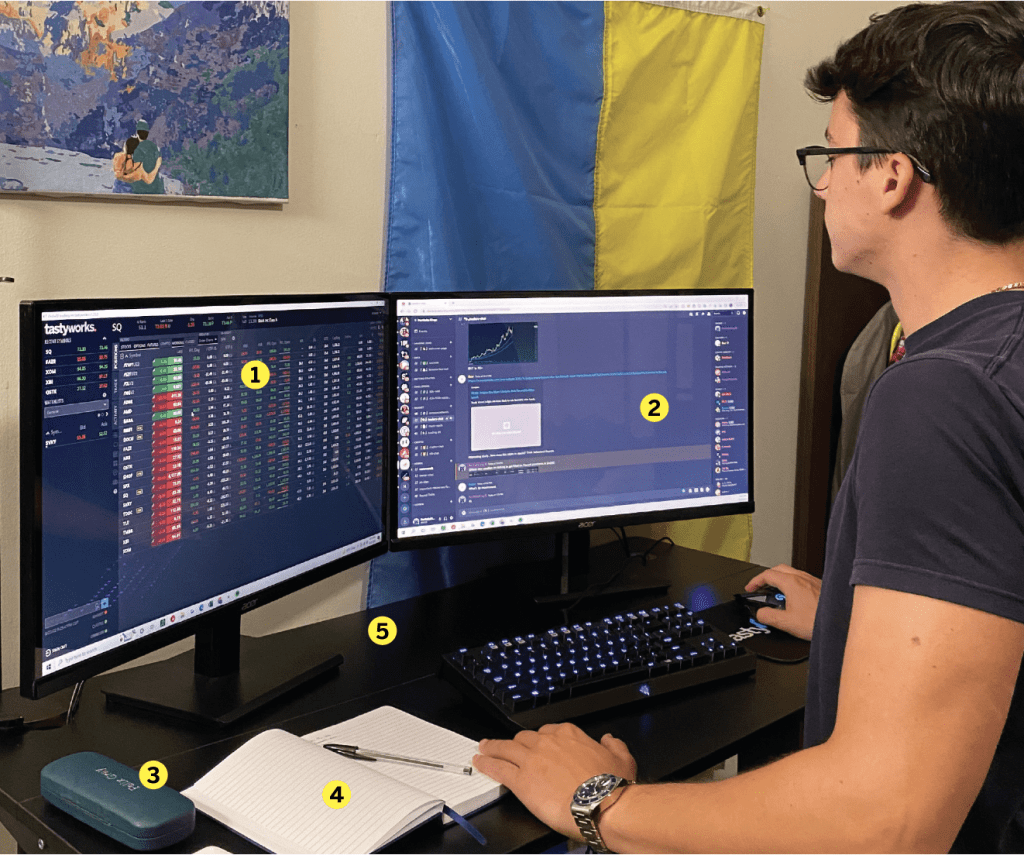

Meet Ivan Fediv

3. Blue light glasses to save my eyes; 4. Trading journal; 5. Standing desk

Home/Office location: Chicago

Age: 20

Years trading: 3

How did you start trading?

In high school, I ran a high-end streetwear and sneaker reselling business, which taught me how to assess investment risk and led to my interest in capital markets. Soon enough, I purchased a course on fundamental investing and technical analysis, only to grow overwhelmed by the seemingly infinite number of indicators and subjective financial ratios. After traversing many more books, I learned some costly lessons by actually “trading.” (If you could even call it that.) I was ready to close up shop—until Reddit saved me. After scouring the internet for hours, searching for a more objective way to trade, I stumbled across an options-selling subreddit. I was intrigued by the idea of being able to profit from a trade even if I was wrong on the directionality of an underlying. My research intensified during the pandemic, and soon enough I was spending half my day learning the ins and outs of volatility arbitrage strategies. As I learned, the markets continued to slide and options premiums exploded. I was learning the right strategy at the right time with ample liquidity.

Favorite trading strategy?

Double diagonals during earnings season. This is an iron condor on steroids. There is no better feeling than reducing the cost basis of your trade by 20%-40% in just a few days. Derisking is the name of the game and I believe it’s an important equation that many traders overlook because they want to hit home runs.

Average number of trades per day?

1 to 2

What percentage of your outcomes do you attribute to luck?

About 10%. I focus on objective trading strategies and don’t care much for luck. Given that I focus on delta-neutral strategies (which oftentimes give me room to be wrong), I focus more on protecting myself from unlucky moves instead of making money from lucky moves.

Favorite trading moment?

When I realized the power of simplicity. Too many traders complicate too many variables.

Worst trading moment?

In fall 2021, natural gas futures doubled. In the midst of this move, I decided to sell additional strangles every time volatility expanded. After about a month, I had a five-lot position open and quickly realized how oversized I was after waking up to a $30,000 loss on the day. Luckily, this trade ended in the green but could have easily been a widow maker.

Favorite trading book

The Missing Risk Premium:

Why Low Volatility Investing Works

by Eric Falkenstein

Want to be featured as the next issue’s trader? Have story ideas?

Let us know: tips@luckboxmagazine.com