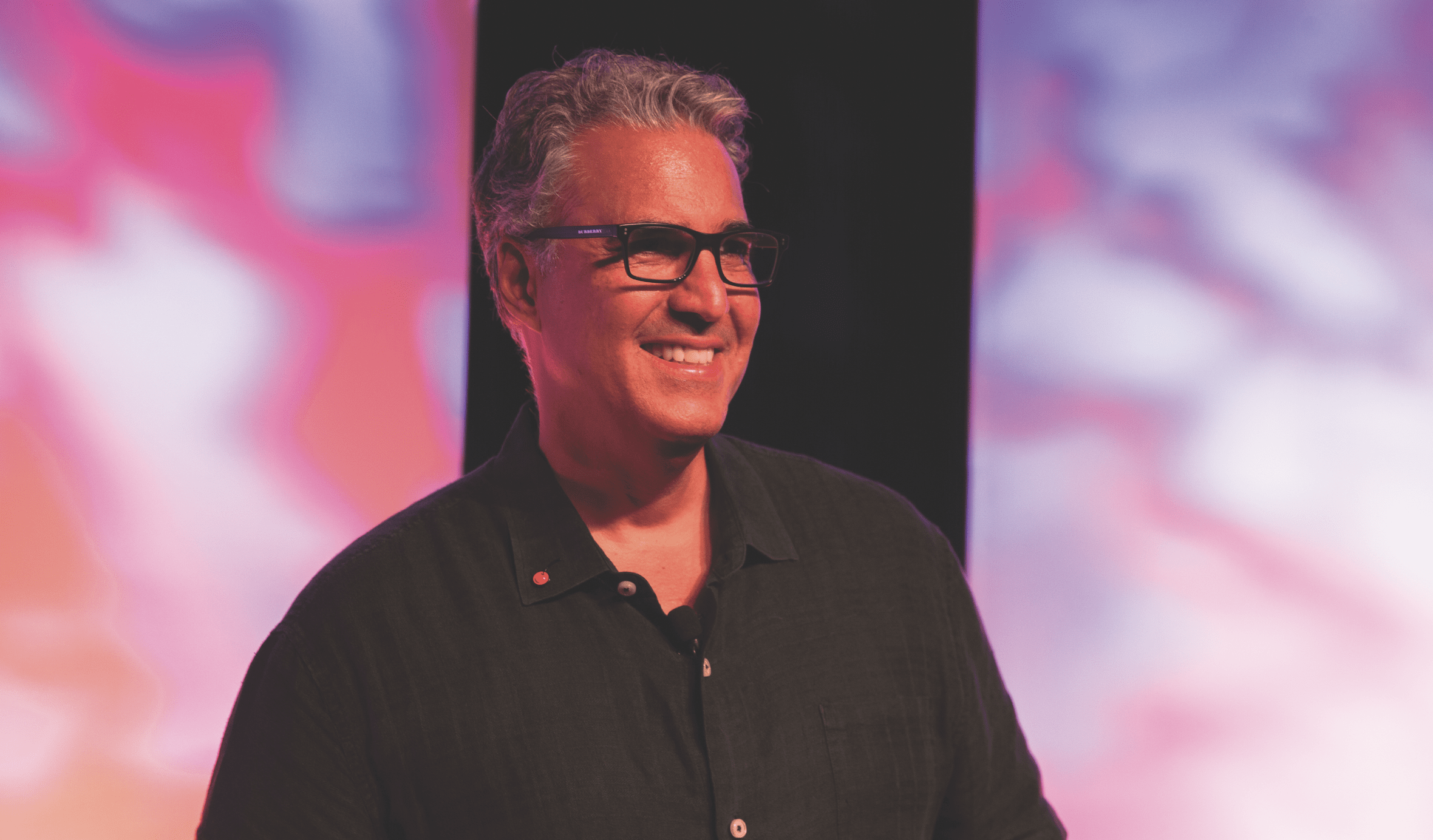

Meet John Carter

John Carter, founder, Simpler Trading

Age 51

Office Austin, Texas

Years trading 31

How did you start trading?

I spent my junior year of high school working at a cookie store at the mall making minimum wage. After a while, I saved up $1,000. One night when I got home my dad and his buddies were sitting around the table talking about call options on Intel (INTC) I didn’t know what a call, an option or Intel was, but I was intrigued. I put up my savings and they spotted a 10-lot trade for me. A few weeks later I got my $1,000 back, plus another $800. I don’t even know if the trade worked or not, but I was hooked. I could make money with ideas instead of just my hands.

Favorite trading strategy?

My favorite trade involves a compression of the Bollinger Bands into what’s known as a “squeeze.” This generates a high-probability situation for a greater-than-expected move. With that scenario, for a long setup, I like to buy a Delta .70 call 30 days out or longer and then look to sell delta .20 calls against it 10 days out or shorter. In a perfect world, the short calls expire worthless and I let the long calls ride. I’ll do the same trade in reverse for short signals, buying the delta .70 put 30 days out and selling the delta .20 puts 10 days out or less. I prefer to leg into these diagonals, starting off with the long option, then getting a move in my favor for the length of one ATR (average true range) and then using that momentum to leg into and sell the delta .20 options.

Average number of trades per day? Five

Favorite trading moment or best trade?

This year, for me, has all of my favorite trading moments centered around Tesla (TSLA). I’ve done five big trades on it this year. My favorite one was a large 1700/1800 call debit spread when the stock was trading at 1650. The debit spread expired the following week, meaning Tesla had to have a huge move and had to do it quickly. I bought the debit spread at 17 and sold it three trading days later for 86. I was hoping to sell it for $35, but the stock had a huge gap up and just kept running, making it very easy to hold onto, relatively speaking. That was the biggest trade I’ve ever done, netting $3.45 million on a 500-lot trade.

Worst trading moment?

My worst trading moment happened when I was newly married in the late ‘90s. I was working a corporate job and had built up a trading account of $150,000. I was ready to quit my job and trade full time, but we wanted to buy a house. It’s easier to buy a house when you have a job. We were going to take the down payment of $30,000 from my trading account. One night I started thinking, “I really don’t want to pull my trading account down to $120,000. I know, I’ll just do a big trade, make $30,000, and then I can still have a $150,000 trading account when I quit my job.” The next day I put half my account into OEX [S&P 100] puts. It was doing well, so I put the other half of my account into it. By the close I was up $15,000, so I could probably close it at the open and make my $30K. What happened? The markets gapped up and ran for five days, right into the house closing. I went into “deer in the headlights” mode and froze. I finally got out the day before my house closing. My account had $8,000 left in it. Poof. I ended up maxing out my credit cards to transfer cash into my checking account so we could get the house. I didn’t tell my wife for 10 years. I took six months off and read Mark Douglas’ works on the mental game of trading and worked with a few mentors and started over. My main lesson was learning to focus on the setup and not the money, and from there learning to dissipate my anxiety when it popped up rather than letting it control me.

What percentage of your outcomes do you attribute to luck?

I’m very probabilities-based. The luck part comes when I’m doing a directional trade instead of selling a credit spread. With a credit spread, you can get sideways action and still hit your profit goal, typically 70% to 80% of max on the credit received. But with a directional trade, the movement of the underlying—how far and how fast—makes a huge difference. Will I get a normal one ATR move, and will it happen over five trading days? Or will it turn into something silly like Tesla and do a three ATR move in two days? The one ATR move hits my probabilities range. But a silly Tesla-like move is a combination of luck that it happened, luck that I was trading a directional long call instead of selling a put credit spread, and the experience to recognize what is happening and to let it ride.

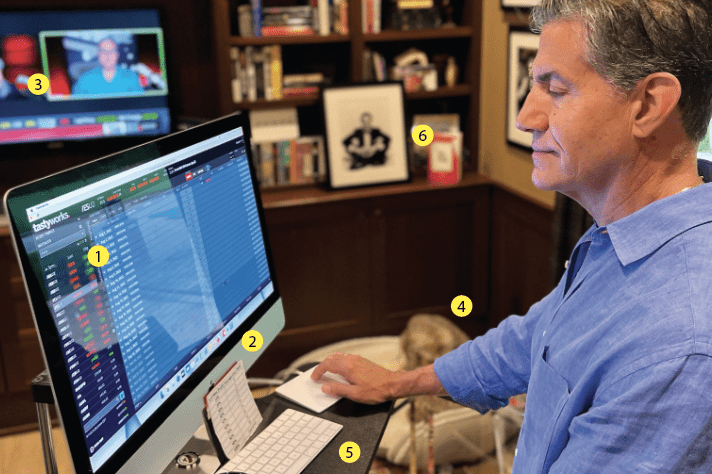

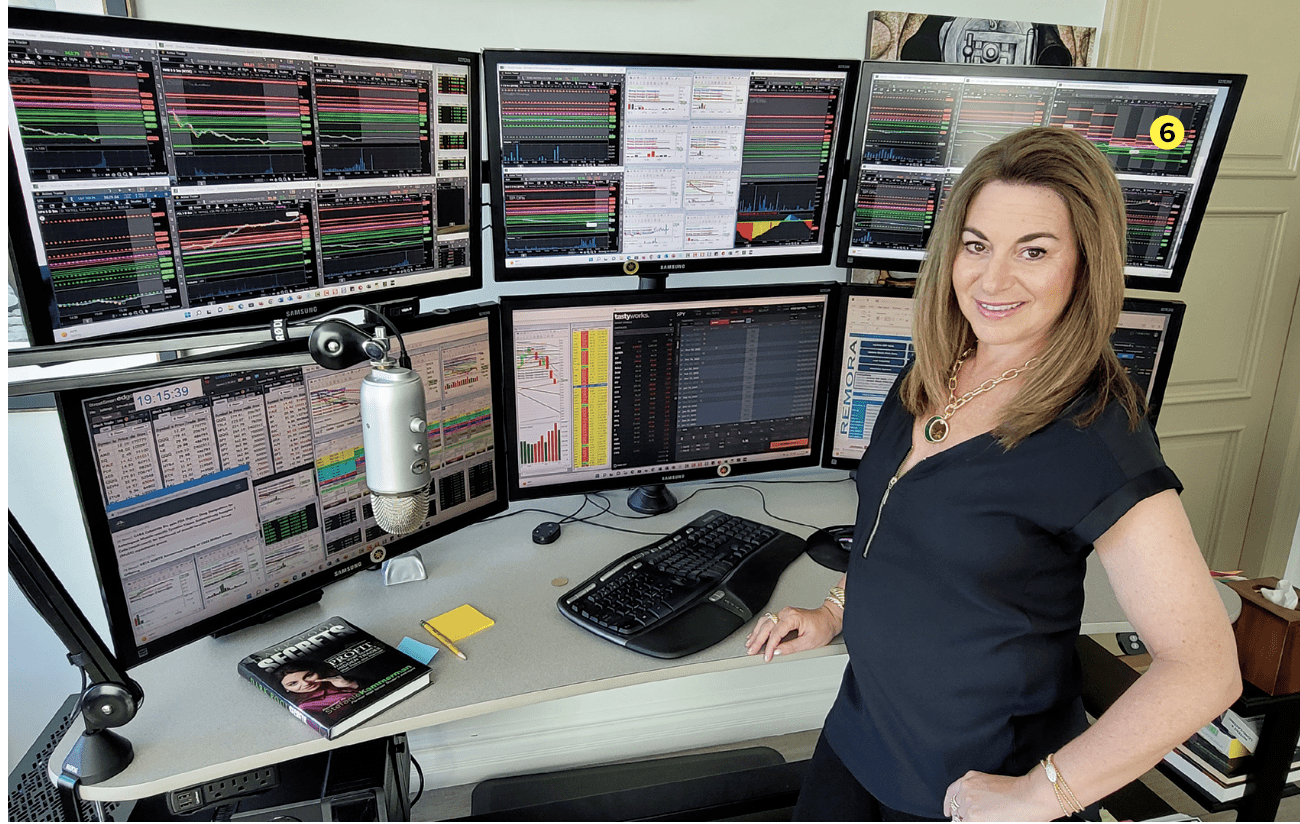

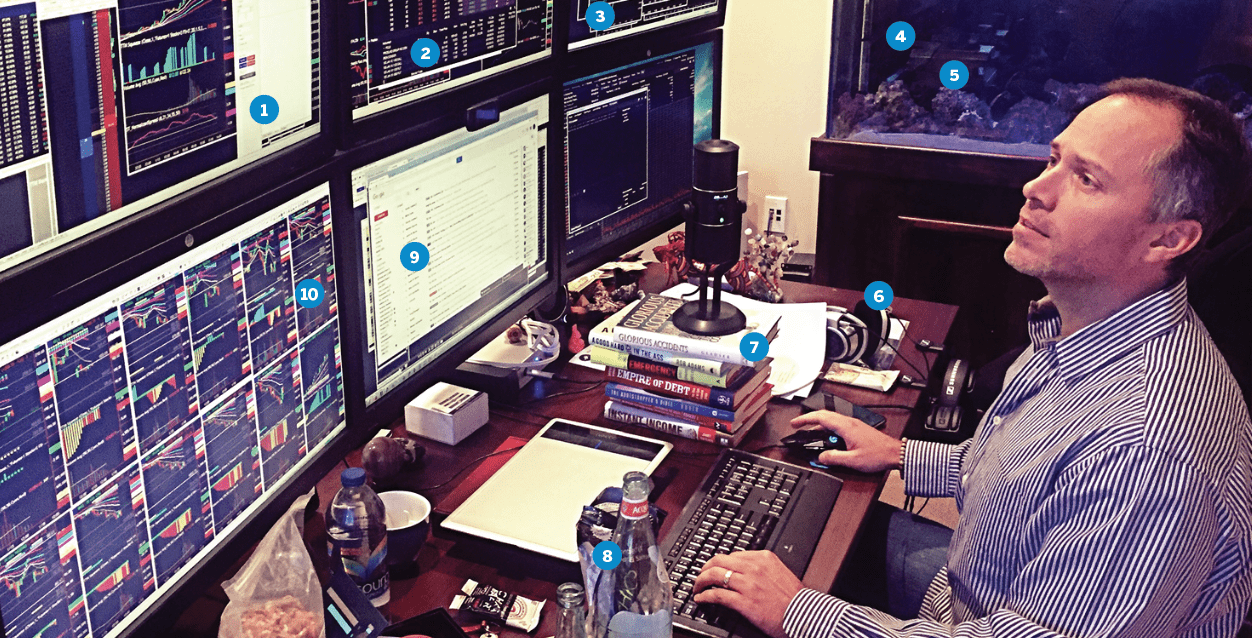

In the picture:

- Charts on various time frames (typically weekly, daily, two-hour and 30-minute)

2. Indexes to get a sense of market conditions

3. List of stocks that meet my setup criteria

4. Fish tank

5. Crystals (it can’t hurt)

6. Headphones

7. Pile of books:

How I Made $2 Million in the Stock Market by Nicolas Darvas

Trading in the Zone by Mark Douglas

Letting Go by David R. Hawkins

Glorious Accidents: How Everyday Americans Create Thriving Companies

by Michael J. Glauser

A Good Hard Kick in the Ass: Basic Training for Entrepreneurs by Rob Adams

Empire of Debt by William Bonner & Addison Wiggin

The Bootstrapper’s Bible by Seth Godin

Instant Income by Janet Switzer

8. Water—2.5 liters/day

9. Email & Slack

10. Trades execution platform