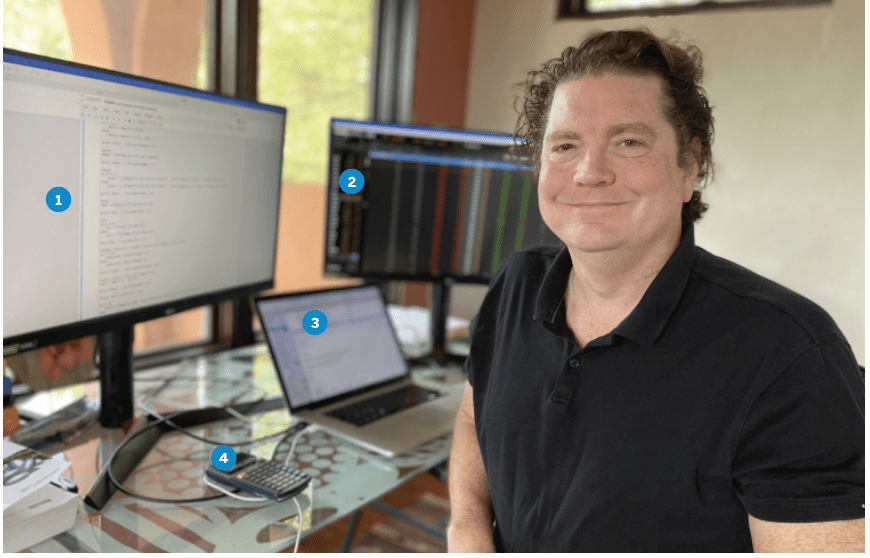

Meet Tom Preston

4. Calculator

Chief Trading Strategist, tastytrade

Office Austin, Texas

Age 56

Years trading 27

How did you start trading?

Trading was the only business where it didn’t matter where you came from, but how you performed. I grew up watching Lou Ruykeyser’s Wall $treet Week back in the ‘70s with my grandmother in Fitchburg, Mass. Then I found Larry McMillan’s Options as a Strategic Investment in the local library when I was in high school, and I had it memorized in a week. I thought it would be cool to do that for a living, but I didn’t quite know how. I got degrees in Greek and Latin. Then I had a stint as a stock broker before I made it to Chicago in the early ‘90s to get an MBA and trade bond options.

Favorite trading strategy

Selling out-of-the-money options that are liquid, have a high probability of making money and have a high implied volatility. I’m product-agnostic and will trade options on stocks, futures, indexes and ETFs as long as they meet those requirements. I don’t make a lot of money on any one trade, but I build a portfolio of short options so my total theta gives me a good return on capital.

Average number of trades per day 15

What percentage of your outcomes do you attribute to luck?

Zero. What some traders attribute to luck is just the statistical behavior of a standard normal variable, which is what stocks, futures and indexes are. Once I understood that, it made trading options purely mechanical and much less stressful.

Favorite trading moment

The night of the 2016 election was great. I had bought VIX futures the day before, after they had dropped sharply, and I was short S&P 500 futures. As the returns came in and it looked like an upset, the /ES dropped 100 points in the overnight market and sent the VIX soaring. I didn’t have a dog in the election fight, but as everyone was watching the news, I was taking in profits.

Worst trading moment

I was short strangles in the yen in October 1998, when it dropped something like 10% in two days and blasted through my short put. I rolled and adjusted the strikes for a couple months after that, but still had an overall loss on the trade. I had had a decent year up to that point, but that yen trade ate up a good chunk of my profits.