Solar Stocks Shine in 2022 as Industry Defies Inflationary Pressures

Amidst record inflation, the solar sector has been a bright spot in 2022, as solar panels prices are trading roughly in line with 2021 levels.

Inflation has been running red-hot in 2022, but based on recent price trends in the solar industry, one would hardly know it.

Somewhat amazingly, the average price for solar panels actually dropped from 2020 to 2021—by roughly 11%. And that trend appears to be holding steady in 2022, as well.

This year, market data indicates that solar panel prices have remained relatively flat versus 2021. That’s an impressive achievement, especially considering the broader inflation narrative this year.

Not surprisingly, falling prices have had a positive impact on demand.

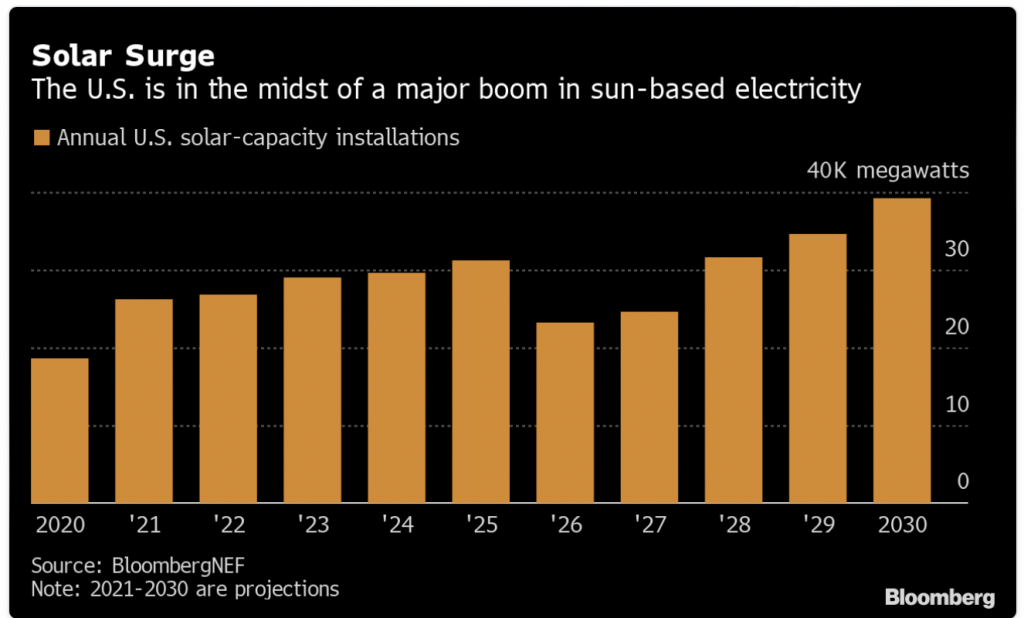

Last year, new solar installations in the United States hit a fresh record. The U.S. Department of Energy estimates that shipments of solar photovoltaic (PV) modules increased to 28.8 million in peak kW during 2021, as compared to 21.8 million in peak kW during 2020.

In terms of large, utility-scale solar installs, the United States added over 13.2 gigawatts (GW) of new capacity in 2021, bringing the total installed capacity in the country to over 50 gigawatts. Moreover, estimates suggest that solar accounted for 45% of the fresh generating capacity added to the grid in 2021.

The falling cost of solar panels has obviously been a key driver of recent growth. Based on Department of Energy (DOE) estimates, the cost to build a large-scale solar plant is now 75% less than it was in 2010.

And those figures have real meaning in the broader energy sector. With oil and gas prices spiking in 2021, the DOE now estimates that it’s cheaper to build a new solar plant than it is to fuel traditional gas-fired generators.

Mirroring the aforementioned trends, small-scale solar projects have also taken flight in the U.S. during the last couple of years. Current projections suggest that U.S. homeowners will install a record 5.6 GW of residential solar in 2022. That’s nearly double the amount added in 2020.

California and Nevada are two of the top states in the country when it comes to solar utilization. Roughly 25% of the total electricity used by the state of California comes from solar energy. In Nevada, that figure is 16%. The District of Columbia, Massachusetts and Vermont aren’t far behind.

When accounting for both solar and wind-powered electricity, there are now 22 states in the U.S. that receive at least 15% of their electricity requirements from wind and solar. That number is even higher when including hydroelectric power—a “legacy renewable.”

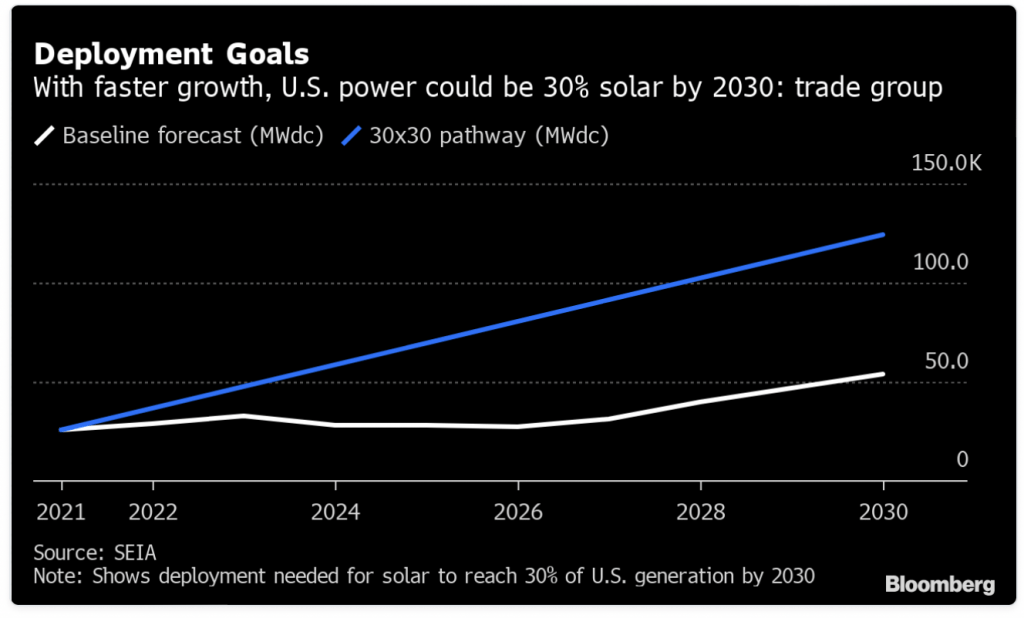

Based on current projections, the amount of electricity generated by solar energy should only increase going forward. The Department of Energy expects that total annual commercial/residential installs will triple from current levels by the end of the decade. And those figures don’t account for the recent passage of the Inflation Reduction Act.

Based on current projections, the amount of electricity generated by solar energy should only increase going forward. The Department of Energy expects that total annual commercial/residential installs will triple from current levels by the end of the decade. And those figures don’t account for the recent passage of the Inflation Reduction Act.

Importantly, the recently passed Inflation Reduction Act includes provisions for both individuals and companies as it relates to renewable energy projects. For homeowners, the primary benefit is an aggressive tax credit. That means homeowners installing solar equipment are entitled to a nonrefundable credit that is equal to 30% of eligible expenses.

And the new legislation includes equally progressive tax incentives for businesses, as well. The Inflation Reduction Act attempts to grow domestic renewable energy manufacturing activity through the use of direct tax credits, and also attaches a domestic content requirement to the full value of tax credits for wind and solar installations.

Industry experts expect that these manufacturing tax credits will catalyze significant growth in the domestic production of clean energy (wind, solar, and batteries).

Case in point, in the wake of the new legislation’s passage, multiple companies in the renewables sector have announced plans for new production facilities, or expansions of existing operations.

Last month, First Solar (FSLR)—a prominent U.S.-based manufacturer of solar equipment—announced an investment of $1.2 billion that will be used to ramp up production of American-made PV modules. Toledo Solar, another large domestic producer, announced a similar plan to expand its existing manufacturing operations after the passage of the Inflation Reduction Act.

Judging by recent performance in FSLR’s stock price, investors and traders have clearly bought into the company’s future prospects. FSLR is currently trading near its 52-week high, and is up 50% year-to-date. That’s impressive in its own right, but especially so when one considers that the broader S&P 500 is down 22% so far this year.

Some of the other standouts from the solar sector in 2022 include Enphase Energy (ENPH) +42%, Canadian Solar (CSIQ), +19% and SunPower Corp (SPWR) +8%.

Interestingly, that same optimism has not spread carte blanche to the entire solar sector. The main solar exchange-traded fund—the Invesco Solar ETF (TAN)—is trading flat in 2022. But then again, a zero percent return in TAN is still quite a bit better than the 22% decline suffered by the broader S&P 500.

Sage Anderson is a pseudonym. He’s an experienced trader of equity derivatives and has managed volatility-based portfolios as a former prop trading firm employee. He’s not an employee of Luckbox, tastytrade or any affiliated companies. Readers can direct questions about this blog or other trading-related subjects, to support@luckboxmagazine.com.

For daily updates on everything moving the markets—including in the solar sector—readers can check out TASTYTRADE LIVE—weekdays from 7 a.m. to 4 p.m. CDT.