Trends

The LAST Picture

By Luckbox

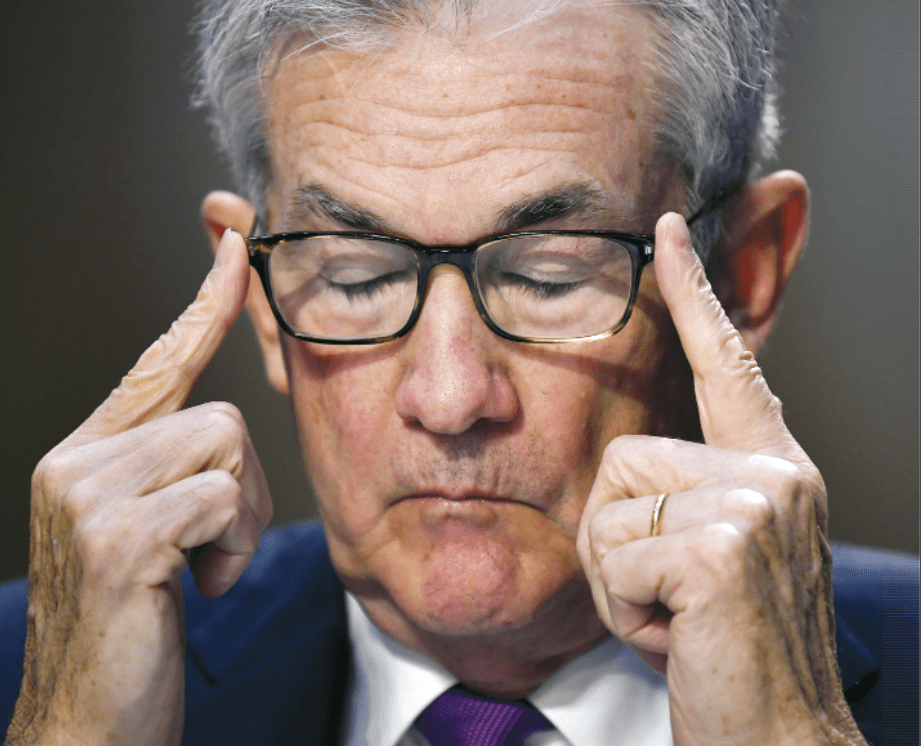

Tempering a Taper Tantrum?

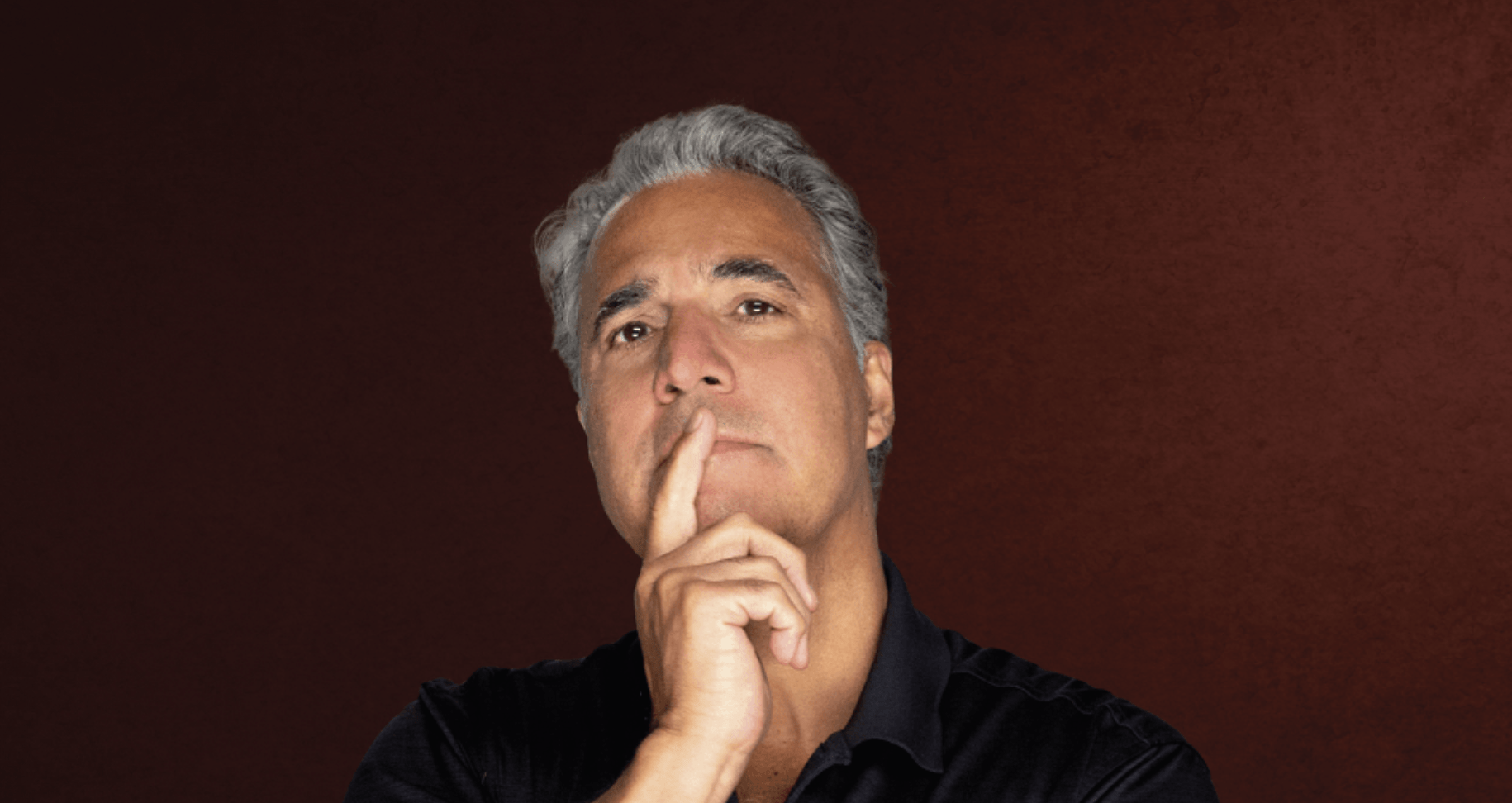

Fed Chair Jerome Powell looks as though he may have a lot on his mind these days. But who could blame him? COVID-19 is interrupting supply chains, hourly workers seem reluctant to return to the labor force after quarantine, and the specter of inflation is once again casting a shadow over the economy.

To make matters worse, Powell’s own job security is in question. His term in office

ends in February, and progressives like Sen. Elizabeth Warren of Massachusetts are calling for President Joe Biden to find somebody new

for the post.

Perhaps Powell is also reconsidering his laissez-faire approach to pre-empting inflation. He may soon choose to retreat on quantitative easing as Ben Bernanke ultimately did as chair of the Federal Reserve in 2013.

That policy called for tapering off the Fed’s aggressive purchases of Treasury bonds, which had provided liquidity to the economy. The subsequent correction in stock prices and rise in bond yields was called a “taper tantrum.”

Thinking about rising prices a lot these days? Check out the upcoming December issue for the Luckbox take on the perils of inflation.

The Last Picture

-

THE LAST PICTURE

By Luckbox

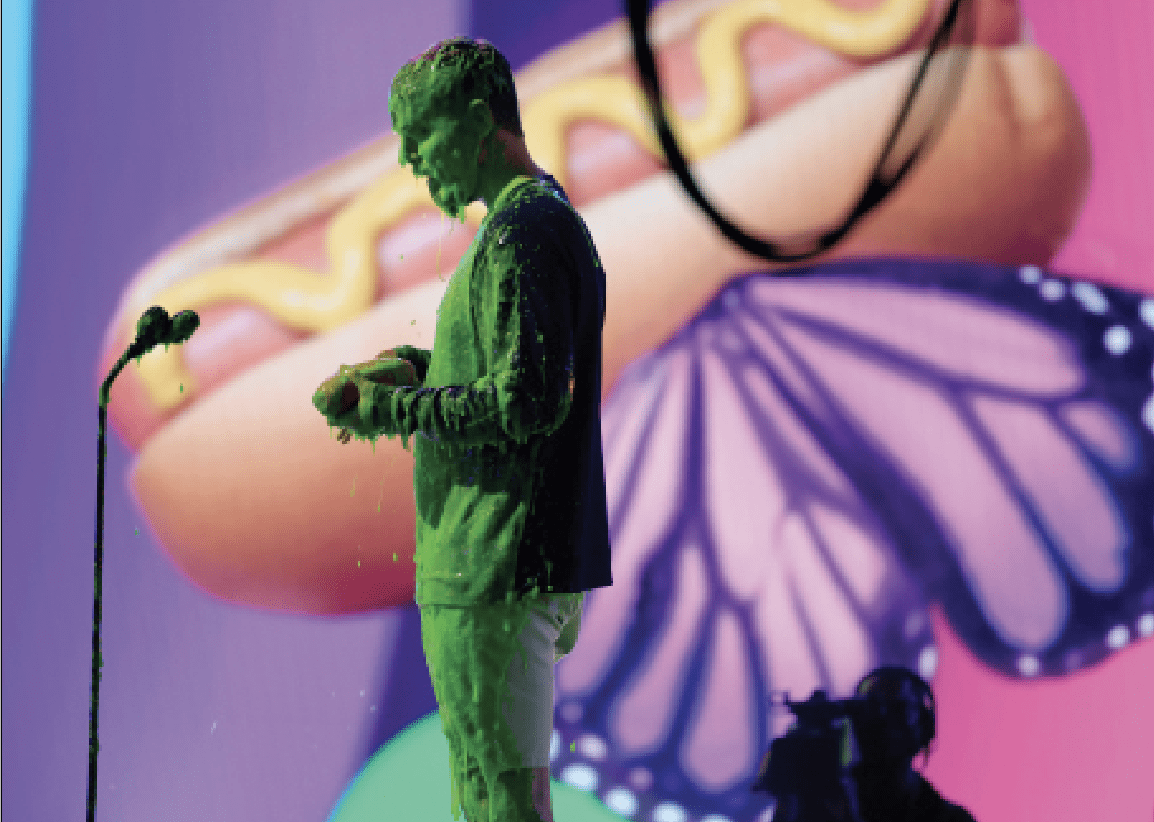

|YouTube’s Beast Mode Jimmy Donaldson, better known to his 136 million YouTube subscribers as MrBeast, became the medium’s all-time top earner when he raked in $54 million in 2021. The… -

Taking Stock in Big Pharma

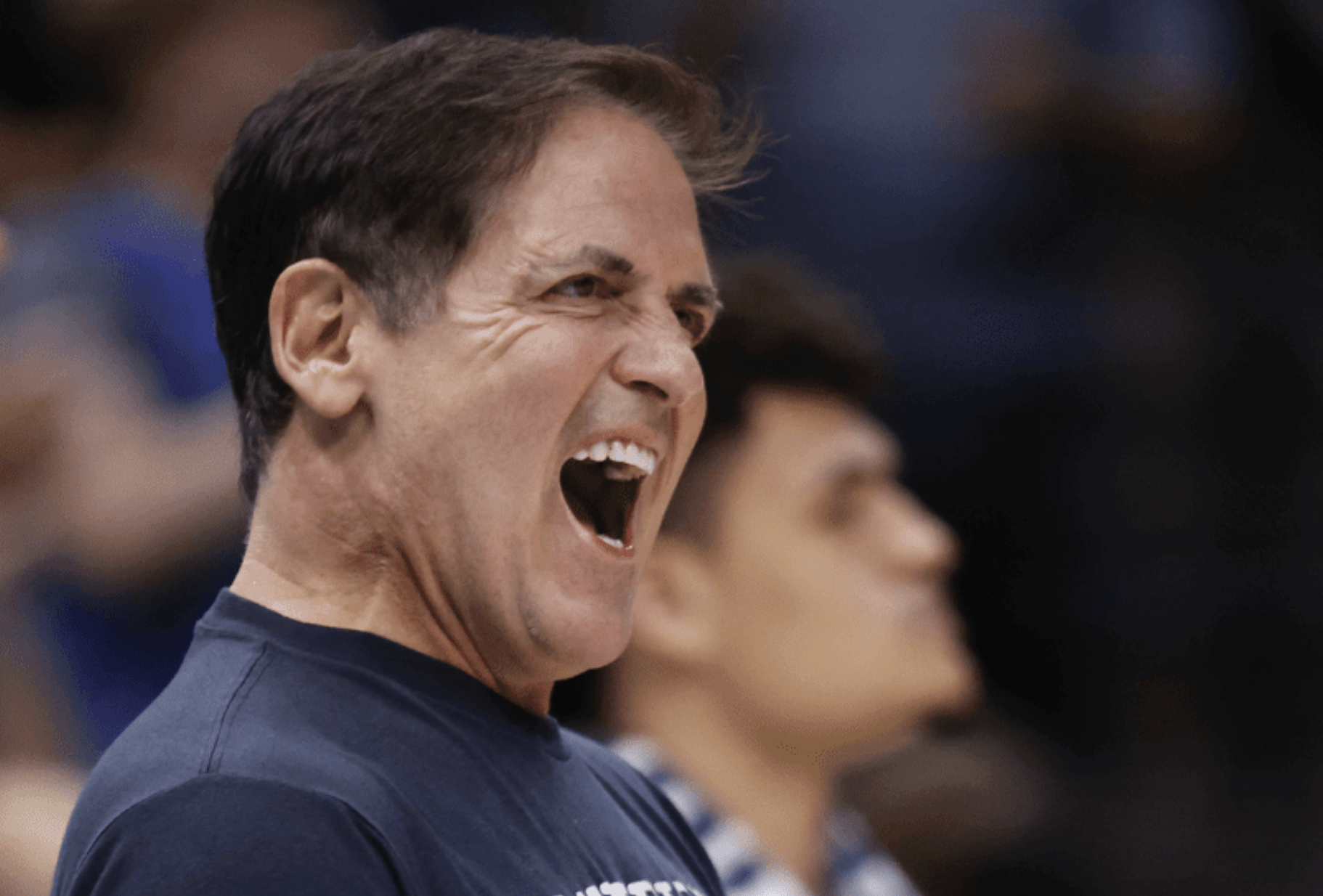

|Billionaire Mark Cuban wants to pull the pharmaceutical industry up by the roots and plant something new. In the next issue, Luckbox leans in with Cuban for details on how… -

Are You Ready to Get Active?

|History suggests the convergence of a recession (yes, we’re in one) and inflation (no, it’s not transitory) and Fed tightening (six hikes so far this year, 3.75% in all) typically… -

The Last Picture

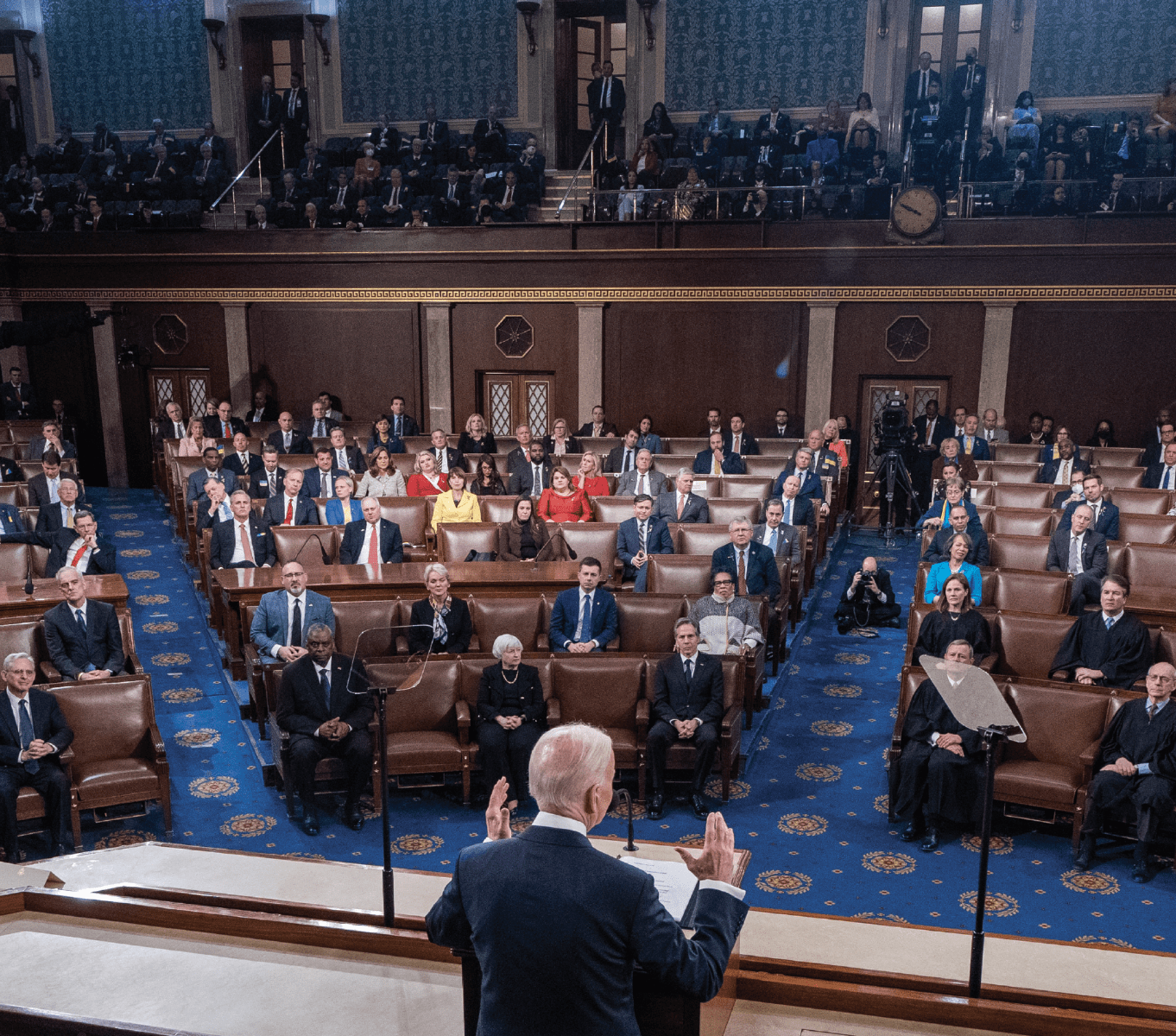

|A Pretty Safe Prediction U.S. Treasury Secretary Janet Yellen isn’t the only one seemingly in the dark about inflation. The whole world’s wondering when the pain will end and what’s… -

Politics, Policy, the Markets & the Midterms

|As Americans prepare to cast their ballots in the midterm elections, the November issue of Luckbox digs into policy, politics and voting reforms. We’ll explore the ways open primaries give… -

The Business of Education

|College students protested in front of the U.S. Department of Education in Washington, D.C., earlier this year, calling for President Joe Biden to abolish all student loan debt by executive… -

Retro Reboot

|What’s with the nation’s ongoing fascination with the past? Americans tend to treat just about anything retro as an iconic piece of history worth remembering, exploring and embracing. They’re not… -

The LAST Picture

By Luckbox

|The Future of Antitrust Progressive trustbuster Lina Khan, shown here testifying in April on Capitol Hill, was seemingly poised for Senate confirmation as head of the Federal Trade Commission as… -

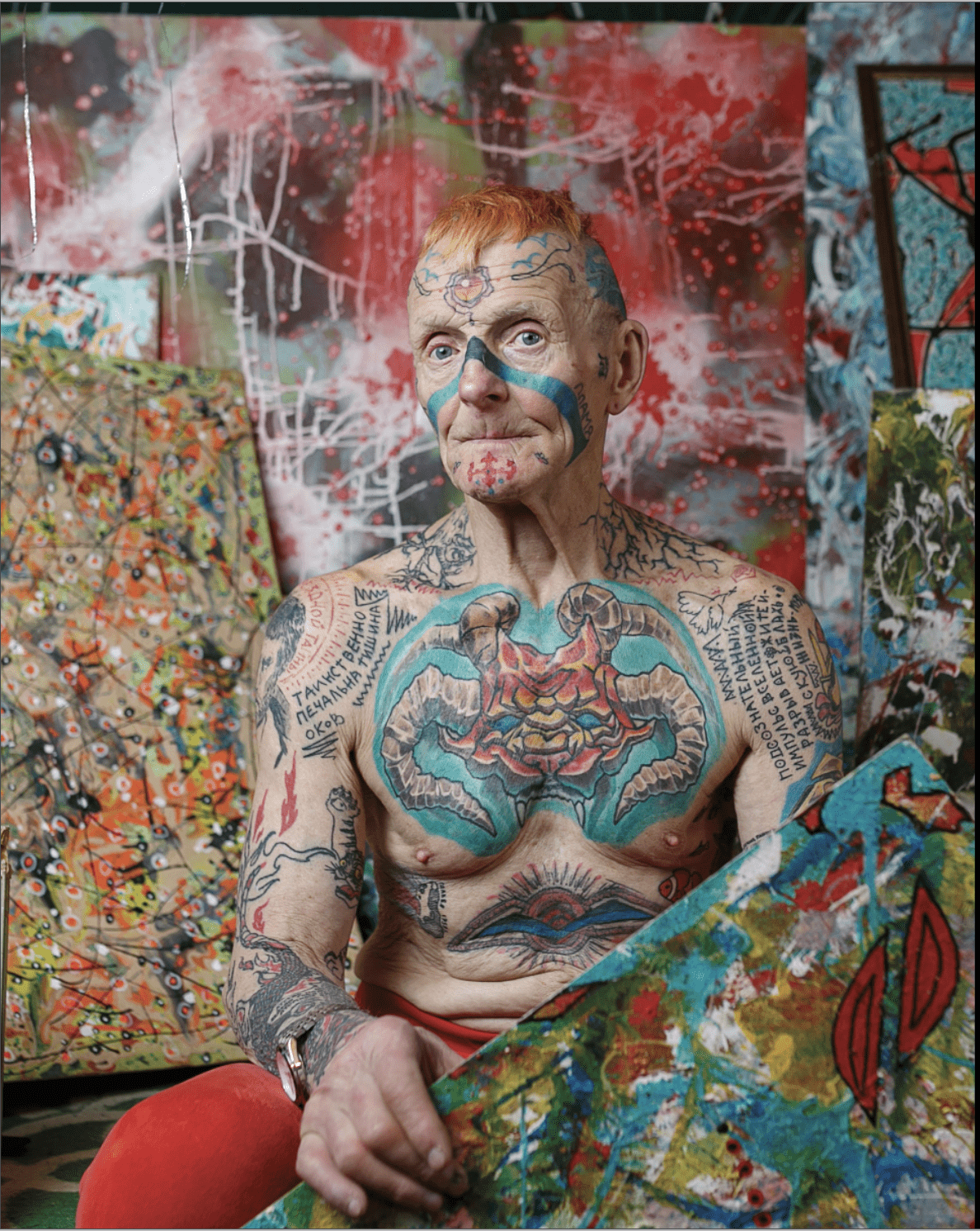

The Last Picture

By Jeff Joseph

|Retirement Ink Comes Pensioner Vladimir Sedakov, pictured here at his home in Yekaterinburg, Russia, says he’s determined to cover his entire body in tatoos. In the meantime, he’s maintaining an… -

The LAST Picture

By Luckbox

|“A few hours before leaving space for the last time, I went to the Cupola to take a few final shots. After I shot this one, I looked at the preview screen… -

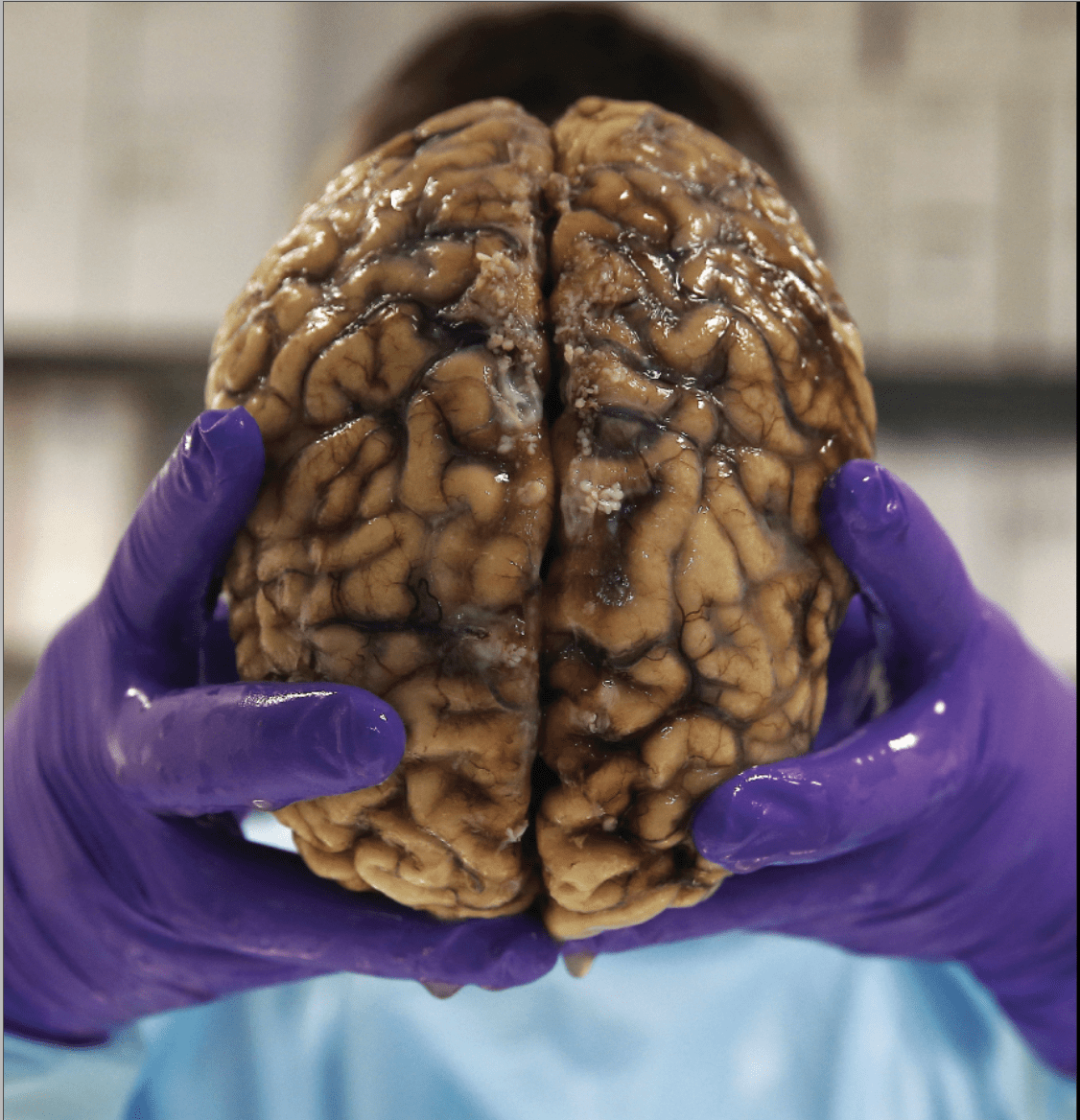

The Last Picture

By Luckbox

|Brain Matters Our brains contain roughly 86 billion brain cells • In general, men’s brains are 10% bigger than women’s. However, the hippocampus, the part of the brain most strongly…