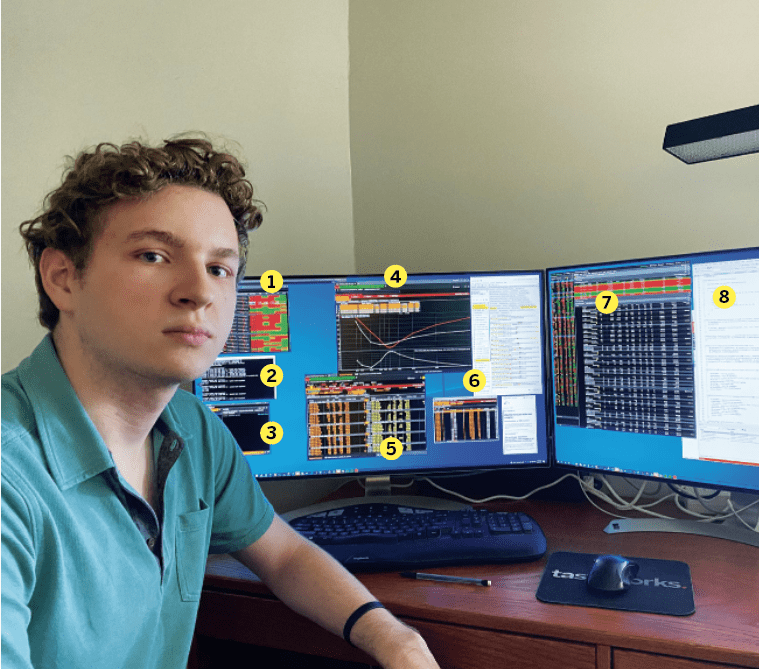

Meet Alex Weisenbach

Home/Office location Cornell University (Class of 2023)

Age 20

Alex Weisenbach began investing when he was 9 years old. Upon discovering tastytrade, a network that covers stocks and options, he called in so often to express his opinion that co-CEO Tom Sosnoff invited him to appear on a show.

Years trading 10

How did you start trading?

I became interested in investing in 2009 at the age of eight. I started following the economy and wanted to learn more about seemingly “invisible forces” that appeared to govern everybody’s lives. I started “investing” when I was nine. I told my dad I wanted to open a Uniform Gift to Minors brokerage account, and he agreed under the condition that I fund it with my own money. I spent six months saving up $500, and after my ninth birthday, I opened my first brokerage account. When I was around 11, I became fascinated with the dynamics of options trading. There was a lot more complexity in the thinking required to understand an options trade, and that seemed to catch my attention. I thought the greeks and the dynamics of non-linear payoffs were fascinating. Although I wasn’t learning calculus or differential equations at that age, I still think my interest in options helped me develop better intuition for math that I didn’t learn more about until college.

Favorite trading strategy for what you trade most?

My approach to trading differs significantly from that of most retail traders because I trade with the goal of capturing a theoretical edge. My goal is to identify options that are mispriced from theoretical value, trade the option and try to minimize my exposure to both volatility and directional risk. My ideal scenario is a trade that is absolutely delta and vega neutral. Therefore, I rarely enforce any particular risk structure. Generally, my positions include relatively complex combinations of stock and options—both long and short across tenors and strikes. However, because I am not making markets, I have the freedom to choose which positions I accumulate. I tend to accumulate very large positions relative to the size of my account if I can structure a position with an asymmetric payoff and get the edge while doing so.

Average number of trades per day?

When I am actively trading, I typically make 50-100 trades a day. In March of 2020, I was doing in excess of 1,000 trades a day. My approach to markets depends on the opportunities available on a particular day.

What percentage of your outcomes do you attribute to luck?

Most of the trades I do have very uninteresting payoffs. There are a lot of small profits and losses, with perhaps 5% having larger P&L swings. Typically, my goal is to accumulate a lot of trades with a positive edge and manage the risk around those trades.

Favorite trading moment?

Around expiration, I end up with a lot of expiring positions in random and often otherwise illiquid stocks. In one situation, someone really wanted to buy the 7.5 strike puts in a relatively illiquid biotech stock on Friday right before options expiration. This is strange behavior. The stock was trading a bit higher than $15 per share, so these options were deep out-of-the-money (OTM) and likely to expire worthless. This buyer was willing to buy the $7.5 put for five cents in size. It just so happened that the $15 put at the time was trading at a 10-cent offer. That means I could sell the $7.5 puts and buy the $15 puts (two 7.5 puts to one 15-put) and create a position that could not lose at any stock price. This was clear arbitrage sitting on the screen and nobody was trading it! I obviously took the trade. After the market closed, the stock began to crater (trading just slightly above my short strike). As the stock dropped after the close, I had to exercise all the puts I was long because I couldn’t be sure what closing print the OCC would choose for automatic exercise. I ended up short a lot of shares of stock over the weekend because the $7.5 put was still clearly OTM. The stock opened up around maybe $8 a share on the Monday morning, and having exercised my $15 puts, I received short shares for $15 per share and I bought most of those shares back around $8.

Worst trading moment?

The worst situation I have ever been in was around the Brexit vote in 2016. I had significant short-volatility exposure in /ES futures before the upcoming Brexit event. Obviously, I was expecting that it would be a non-event and that the volatility was inflated, similar to an earnings trade. After the results of the vote, the /ES futures tanked, requiring me to short the futures to try and neutralize some of my delta risk. I essentially had to accumulate around $1 million of notional in /ES. The /ES ended up locked limit down overnight. In the morning, /ES began to rise and continued to do so for the next few days. This is the absolute worst position to be in if you were short gamma and volatility.

More Alex

Watch The Making of a “Future Rising Star” here