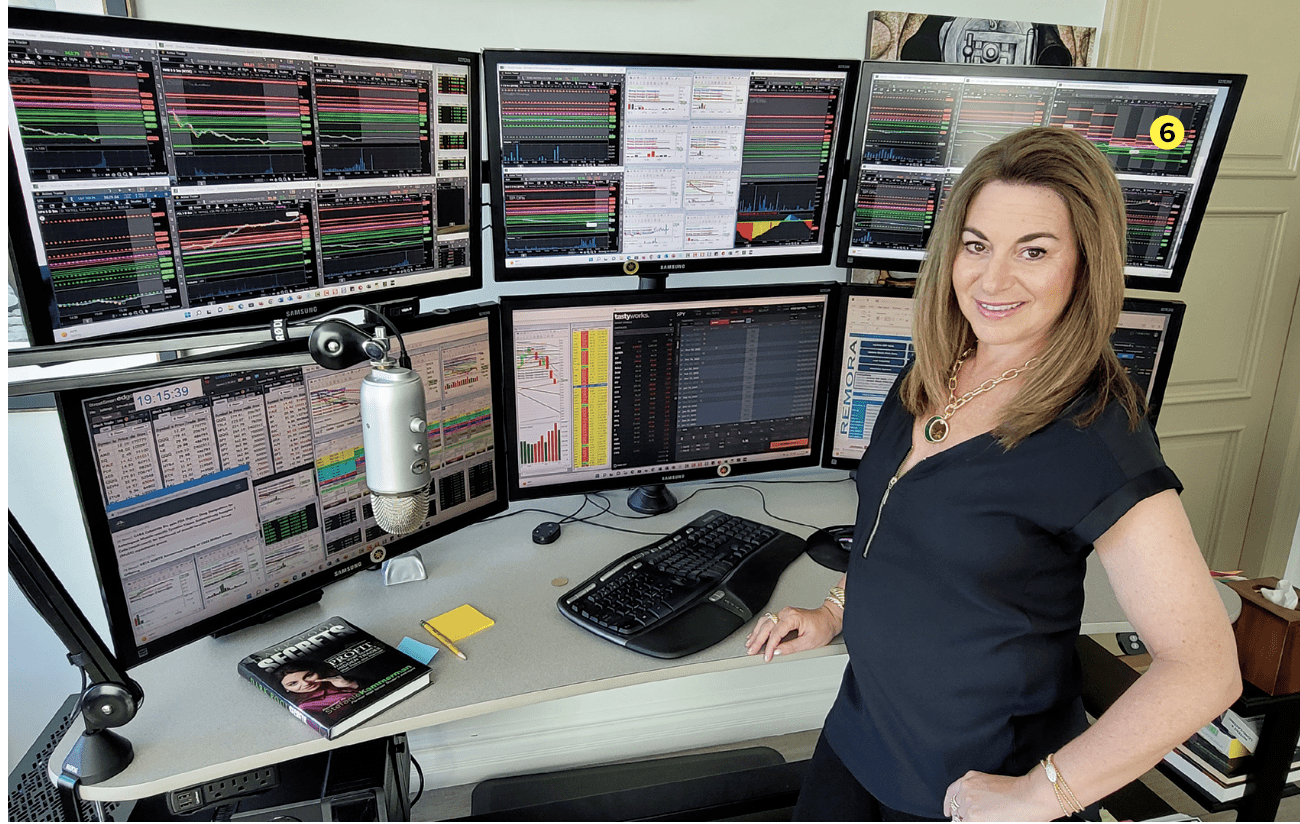

Meet Kimberly Jane

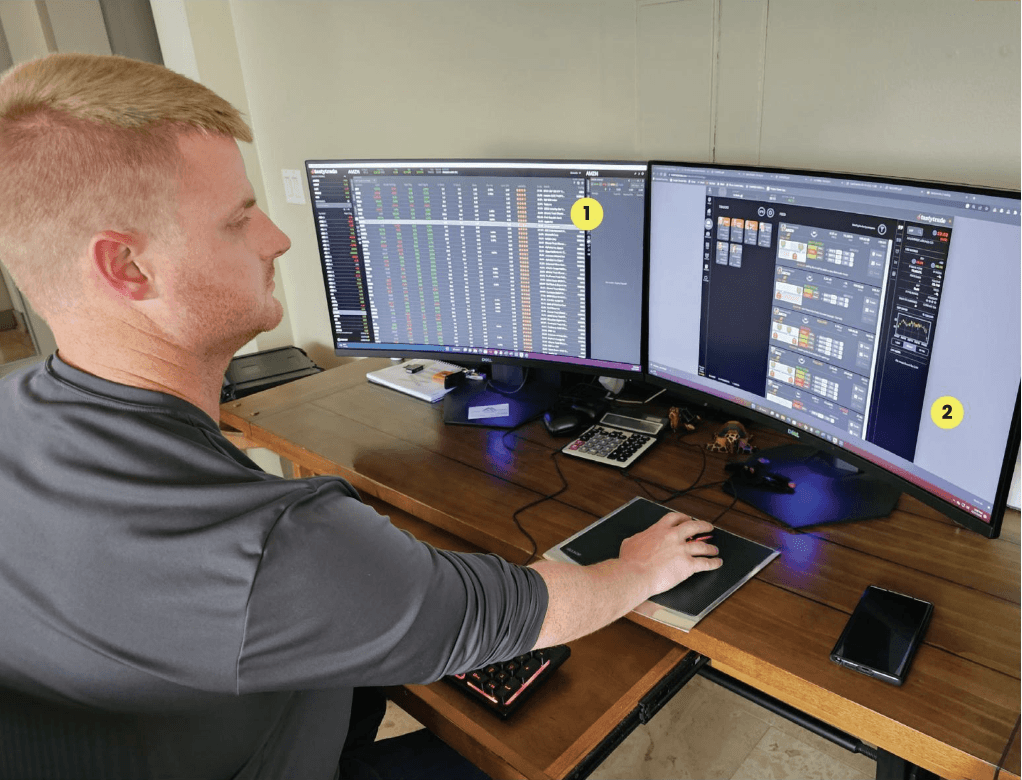

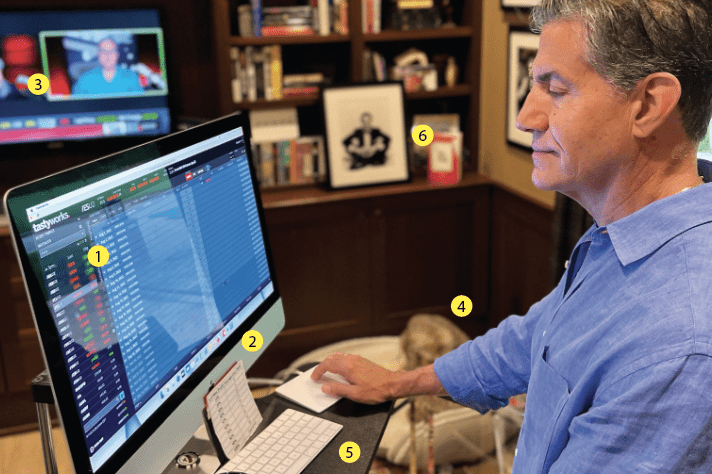

4. MNQ future fills; 5. Market news and analytics; 6. NQ futures 15-min daily chart

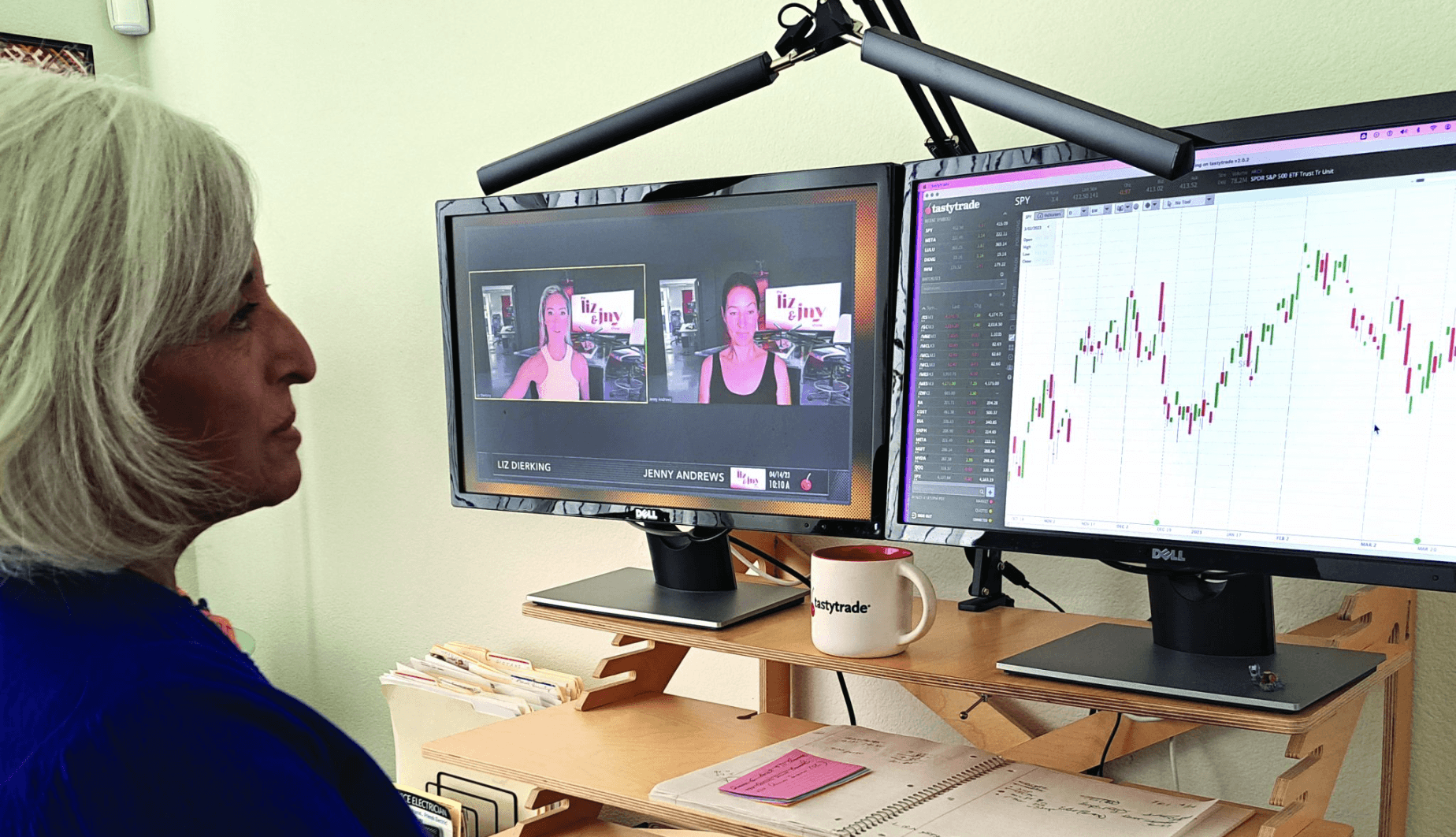

@mommavestor

Home/Office location

Washington

Years trading

Three

How did you start trading?

I have been engaged in the stock market for most of my adult life, but at first I invested in the market through a portfolio manager. When the market pulled back in 2018, I began to manage one of my accounts. I began to research investment strategies and plunged headfirst into trading.

It was then that I recognized my ability as a woman to direct my own financial outcome, which was both enlightening and empowering. However, as a woman, mom and wife, I felt lonely in the trading realm. I did not know other female traders. I became passionate about connecting with women traders because our financial priorities and trading styles can be different from those of men. I began encouraging women to become financially literate.

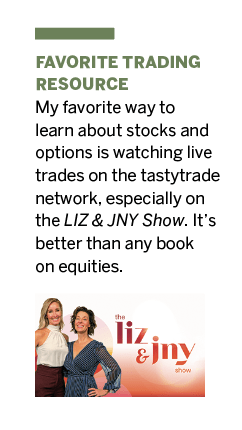

Then I came across the LIZ & JNY Show about trading on tastytrade, and this took my interest and passion for trading to a whole new level. To watch two moms trade together while talking about their kids and everyday lives helped me find my place as a female trader. Now I have a strong trading community.

Favorite trading strategy for what you trade most?

I employ a wide range of trading

strategies, as I like to try new methods and diversify my trading tactics to lower my overall portfolio risk. That said, I have two favorite trading strategies: the superbull and scooping micro futures.

First, the superbull is a directional trade whereby the underlying premise is that the stock, index or commodity will go higher by expiration. To place the trade, I structure a debit spread with the long call around the .45 delta and the short call 1/3-1/2 the width of the long call. I then sell a put as far away from the current stock price as possible, either in the same month or back a month, to pay for the cost of the debit call spread, thus yielding a credit for the superbull trade.

My second favorite trade is “scooping” micro futures. To place the trade, I make a directional assumption buying or selling one of the micro futures. Typically, I trade the equities or volatility such as the /M2K, /MES, /MNQ or /VXM.

On Twitter there is a hashtag #scoopyscoopy where members of our trading community post their daily micro futures trades with the goal of booking $100 a day, which amounts to $24,000 a year. We call this the $100-a-day challenge. Most important, trading small and booking realistic gains while minimizing risk is the best way to have a profitable profit and loss ratio.

Average number of trades per day?

Eight

What percentage of your outcomes do you attribute to luck?

When I began trading, I was less knowledgeable about the trades I was placing. Thus, I attribute more of my gains to luck. However, as I have become a more educated trader regarding IVR (implied volatility rank), probabilities of success and portfolio risk, there is less luck involved and more ability to manage my profit/loss ratio and overall portfolio outcome.

Moreover, what replaces luck is working on my patience, resisting fear of missing out (FOMO) by chasing, giving a trade time to go my way, trading small (which is key), reducing risk on any single trade and diversifying my portfolio.

Also, I have become a more successful trader through continued education related to trading strategies, probabilities, the “Greeks,” and expanding my trading toolbox with the help of charts and technical tools, such as Fibonacci retracement and RSI (Relative Strength Index).

The bottom line for me in trading is engaging in personal growth and knowing my weaknesses and my strengths. That puts me in control of my trading outcome, and luck plays a less relevant role.

Worst trading moment?

It was during the March 2020 COVID correction. Though I had made portfolio gains of 6% during the market correction, I did not recognize that the liquidity injected by the Federal Reserve through quantitative easing and zero interest rates would lead to a rapid V-shaped recovery.

I thought I had time on my side to redeploy capital, and therefore I mostly sat on the sidelines predominately in cash through April 2020.

By the time I began reinvesting the cash in mid-May, the equity markets had run up at a furious pace. As such, this is where a deep understanding of how and when to use various options strategies might have worked in my favor.

For example, in a stock or index that I wanted to own, such as Apple (AAPL) or the SPDR S&P 500 Trust exchange-traded fund (SPY), I could have sold a put, collecting the premium and making money as the stock/index kept rising.

Or, I could have used a debit call spread, superbull trade or poor person’s covered call, but because I lacked education on options strategies, I invested very little and thus underperformed the market at the end of 2020.

The lessons from my worst trading moments are these: Learn all you can about a variety of investment and options strategies, use a wide range of trading tools, challenge your assumptions, discuss the markets and ideas with traders who care about your success, and move past your previous trading errors. Learn all this and place the next trade.

Most important, trade small so that one trade does not make or break your P&L. As Liz and Jenny say on their trading show, “there’s no crying in trading.” I remind myself to stay humble. There is always a new trade.

Do you trade and want to be featured in this section? Please email yd@luckboxmagazine with a photo of your setup and we will contact you.