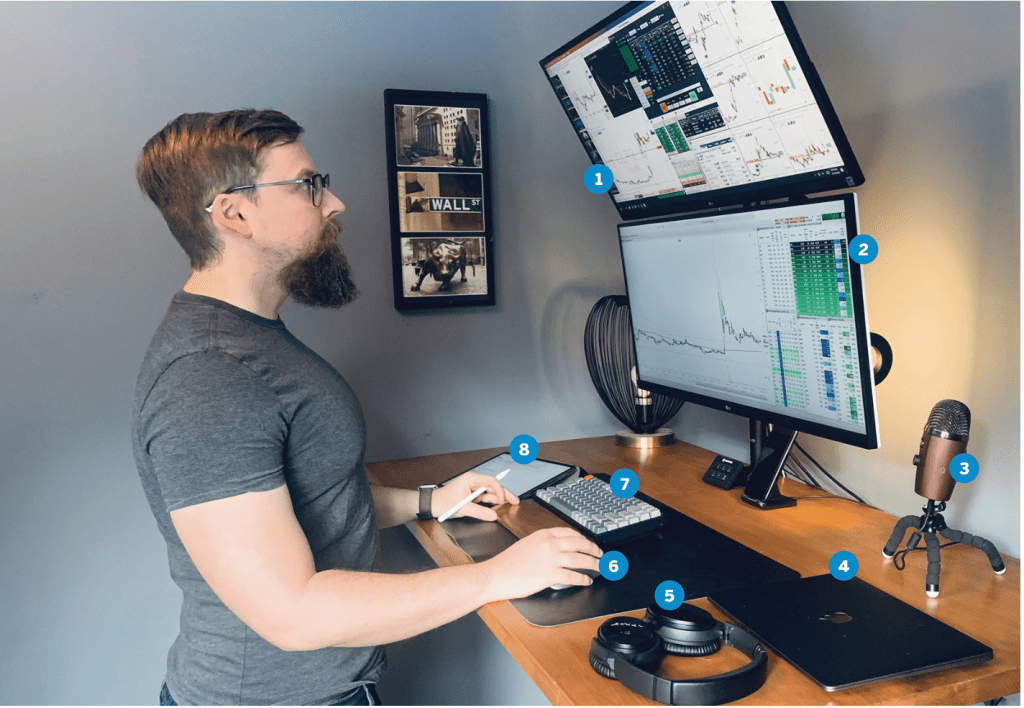

Meet Michael Nauss

2. Monitors are both LG 34-inch ultra-wide monitors 34wk650 3. Yeti Nano microphone

4. M1 MacBook Air with 16 gigs of ram for travel 5. Bose QC35 headphones 6. Logitech MX Master 2 mouse 7. Keycron k2 keyboard 8. 11-inch iPad Pro for note-taking & mobile trading

Trader/Consultant, @bonpara

Age 35

Office Halifax, Nova Scotia

Years trading 15

How did you start trading?

It was a very random occurrence during a job fair at university. A proprietary trading firm was looking for people in finance to scalp at their firm. After the first few days, I was hooked. The ability to solve puzzles for a job was a joy, and I knew this was what I would be doing for a living.

Favorite trading strategy?

I am a systematic trader. I build systems using a trade ideas backtester and the ability to autotrade to remove the emotion of trading and to allow me to quantify my edge. My basic strategy is to use trade ideas to find stocks stronger and weaker than the overall market and then test patterns to get involved in that relative strength and weakness. Then I allow the system to deal with trade entry and management.

Average number of trades per day? Three

Favorite trading moment?

My best trading moment has nothing to do with a single trade or stock. It was a conversation I had with another group of successful traders while travelling. We were comparing strategies and win rates. I noticed that we were all around the same when it came to stats. The traders doing the best were simply the ones with the best risk management. This completely flipped my focus on trading so that I was focused on risk over everything else.

Worst trading moment?

Like most traders, I blew up an account early in my trading career. It was wild risk with no stops and no thought of what I would do if things went wrong. In those moments, you need to have a hard look at yourself and your goals. If you find yourself blaming anything but your trading and your own decisions, then you are not ready to trade for a living.

What percentage of your outcomes do you attribute to luck?

All outcomes in trading are probabilistic (luck) based. I believe that 100% of our job as traders is to make sure to understand the math and make sure to limit the downside each time you have bad luck—and capitalize as much as you can every time you have good luck.