Meet Payal Swami

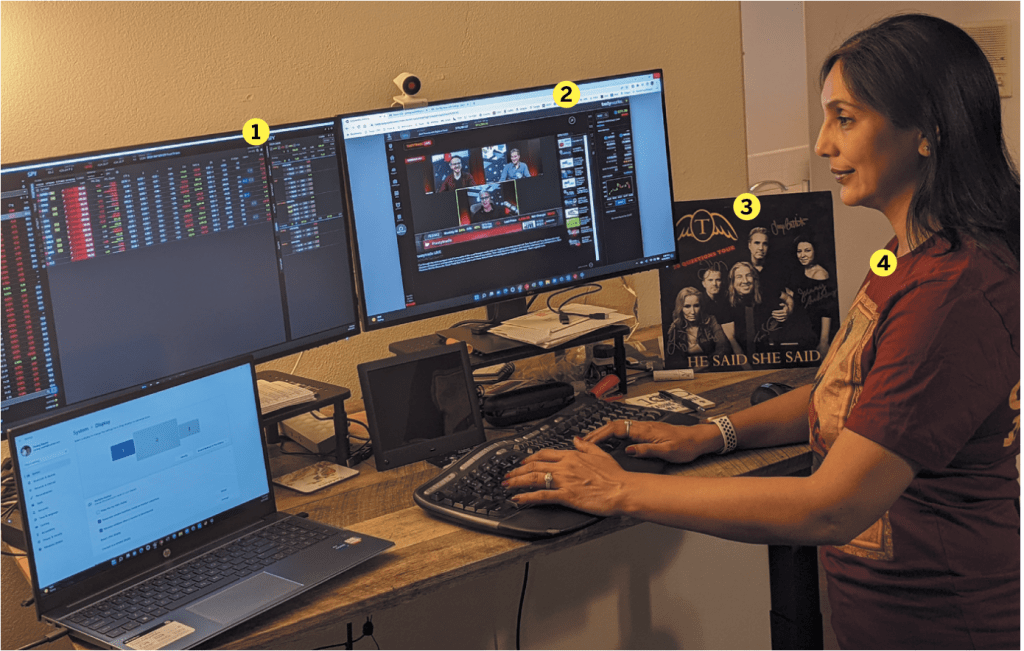

3. Album cover from the He Said She Said tour; 4. The Tony Battista T-shirt

Home/Office location

Tustin, California

Age

45

Years trading

Seven

How did you start trading?

My sister introduced me to options trading. I had just walked away from a 20-year career in technology but wanted to continue to challenge myself with learning new skills while trying to find that elusive work-life balance. I had no finance background but was interested in learning how to manage my own money. A few months after the first tutorial from my sister, I stumbled across tastytrade videos on YouTube and was hooked! I watch the live tastytrade network online almost every day. Who knew learning could be so much fun?

Favorite trading strategy?

For stock and exchange-traded funds that I want to trade long-term, I like to own the stock—ideally starting with a naked put for a better entry price—then sell strangles around it each month. For short-term trades, I like the jade lizard.

Average number of trades per day?

Two to three

What percentage of your outcomes do you attribute to luck?

I don’t think I can put a number on the luck factor, but it is definitely a part of trading. The key is to stay mechanical and not get emotional about trades that go horribly wrong. It is easier said than done. I still find myself staying in certain positions longer than I should.

Favorite trading moment?

It took me a really long time to find a short delta strategy that works well for my portfolio size. I needed something where I am not taking unlimited upside risk and that also serves the purpose of why I want those short deltas—whether it be for balancing portfolio delta or if I had a directional bias in an underlying. I set up a poor man’s covered put strategy in SPY. [A poor man’s covered put strategy is a put diagonal debit spread that’s used to replicate a covered put position.] The strategy gets its name from the reduced risk and capital requirement relative to a standard covered put. It was enough short deltas to make my portfolio lean slightly short, which is what I wanted at that point. I then happened to get the directional move I needed within a couple of days of placing that trade, and it was exhilarating to take in a very nice profit in such a short time and have my portfolio profit/loss be up on a down day!

Favorite trading book

Don’t have one. I learn everything from the tastytrade shows. One of my favorites

is the Jade Lizard Options Strategy (see QR code).