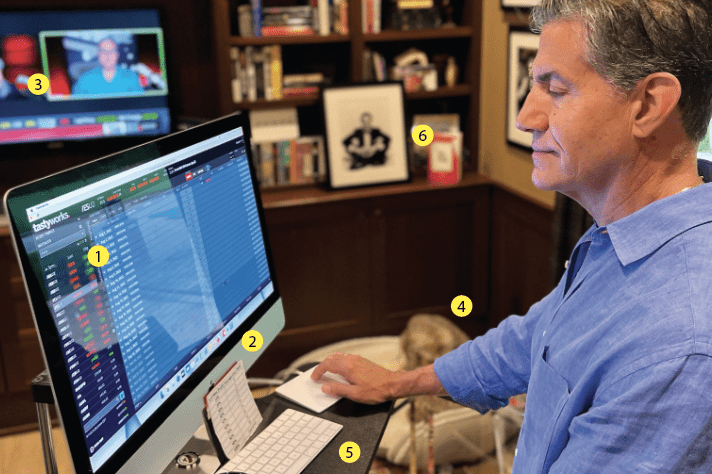

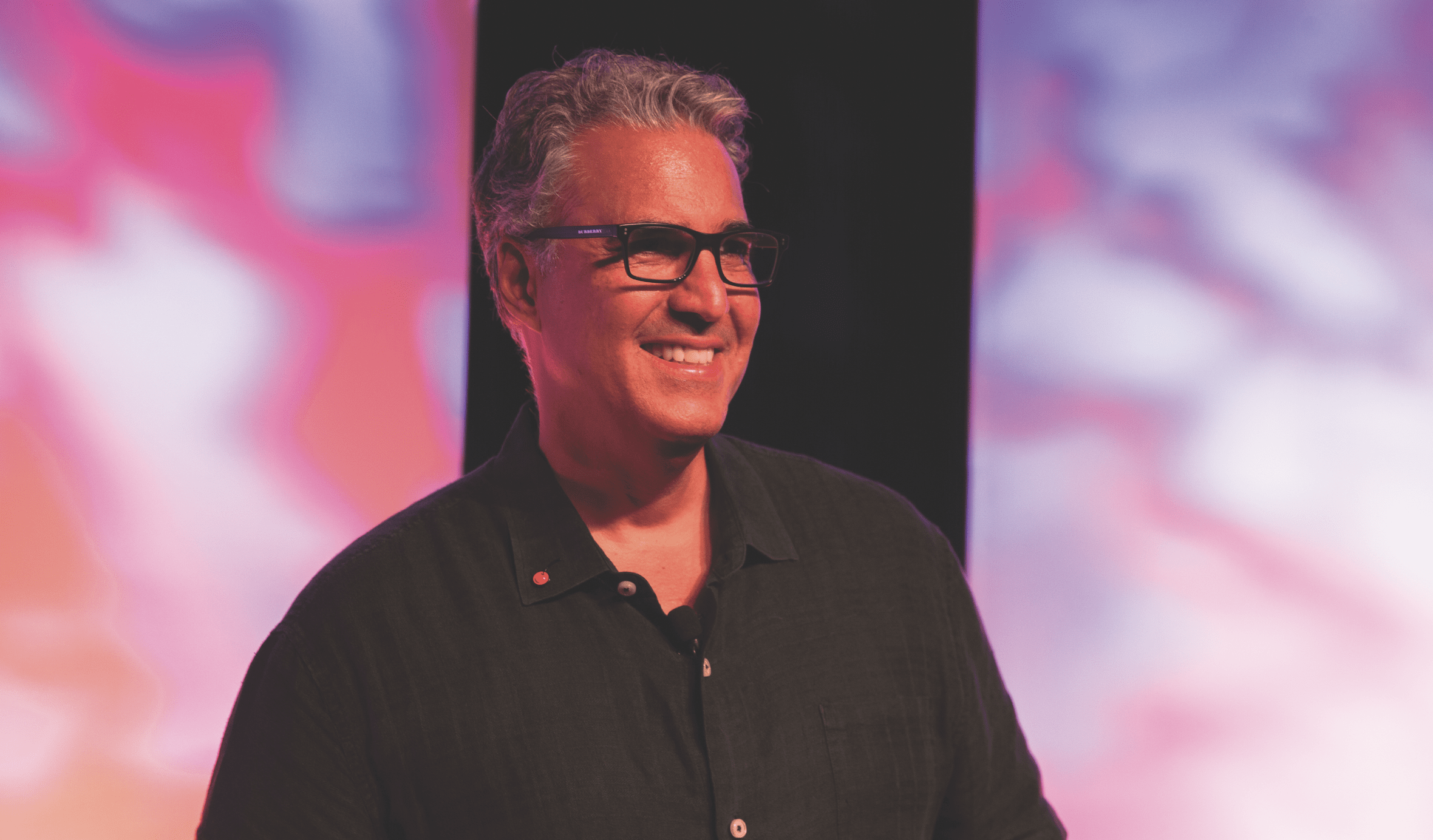

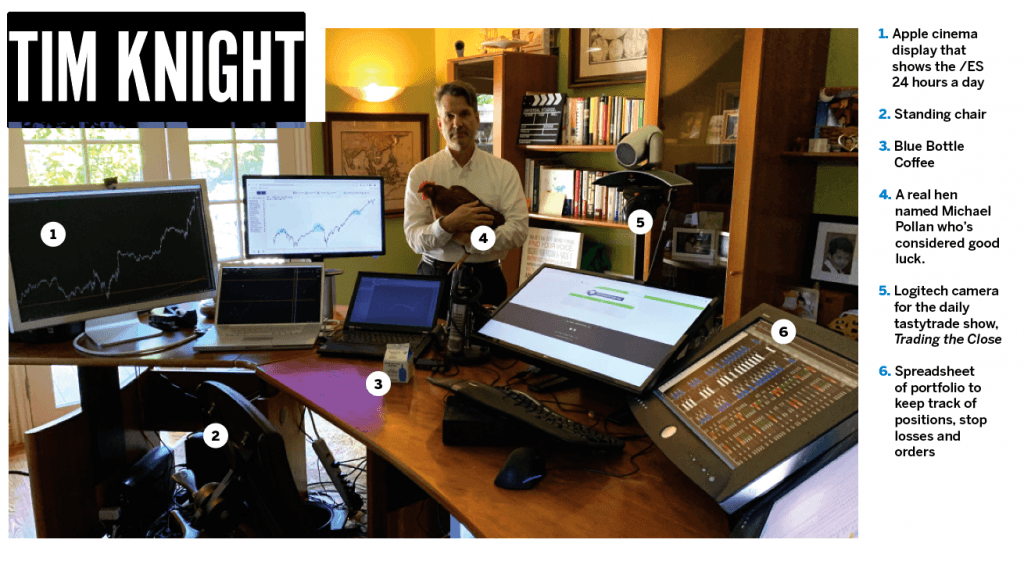

Meet Tim Knight

- luckbox columnist The Technician

- Office Palo Alto, California

Origin story as a trader

I am a visual person. I can’t remember a person’s name, but I never forget a face. Likewise, with investments, I’ve never been into the numbers of statistics, but instead the big picture that they can represent. I started trading stocks and options early in my college years. I was doing it via charts from Day One, and I’ve been doing it ever since.

Best trade

Sept. 19, 2008. It was an amazing day. Before the market opened, the government announced that it was banning the short-selling of financial stocks. There were hundreds of them on their list. The cool thing was that I was already heavily short and in position. When the market opened, equities absolutely exploded higher—in fact, the Russell 2000 hit the highest point in its history up to that time—but not long after, the market started absolutely falling to pieces. That was the beginning of the most crazy-profitable trading period of my life.

Worst trade

Sept. 1, 2010. It was following the weekend in which then Federal Reserve Chair Ben Bernanke pledged even more help from the Federal Reserve. Stocks went ripping higher that Monday, and that was the worst trading day of my entire life. I felt like crawling into bed at that point and never coming out. I lightened up considerably, licked my wounds and moved on. There’s really no other choice.

Average number of trades per day

Ten to 20. I’m a swing trader at heart, so I’d much prefer just tending to positions as opposed to leaping in and out of them every day. I would say this is typical for me.

- Host tastytrade’s Trading the Close with Tim Knight

- Age Well over 30!

- Years trading Well over 30!

Favorite trading strategy

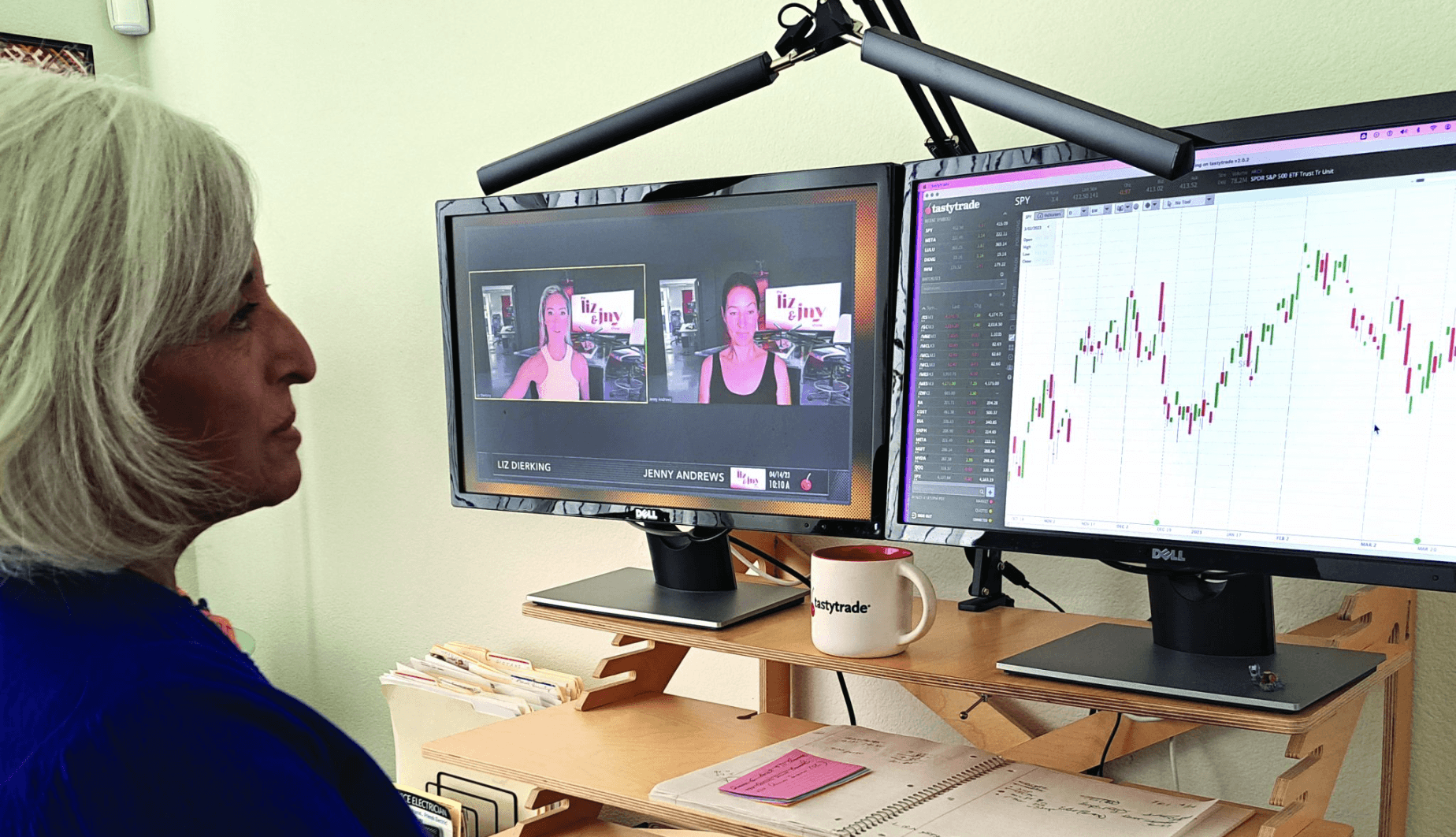

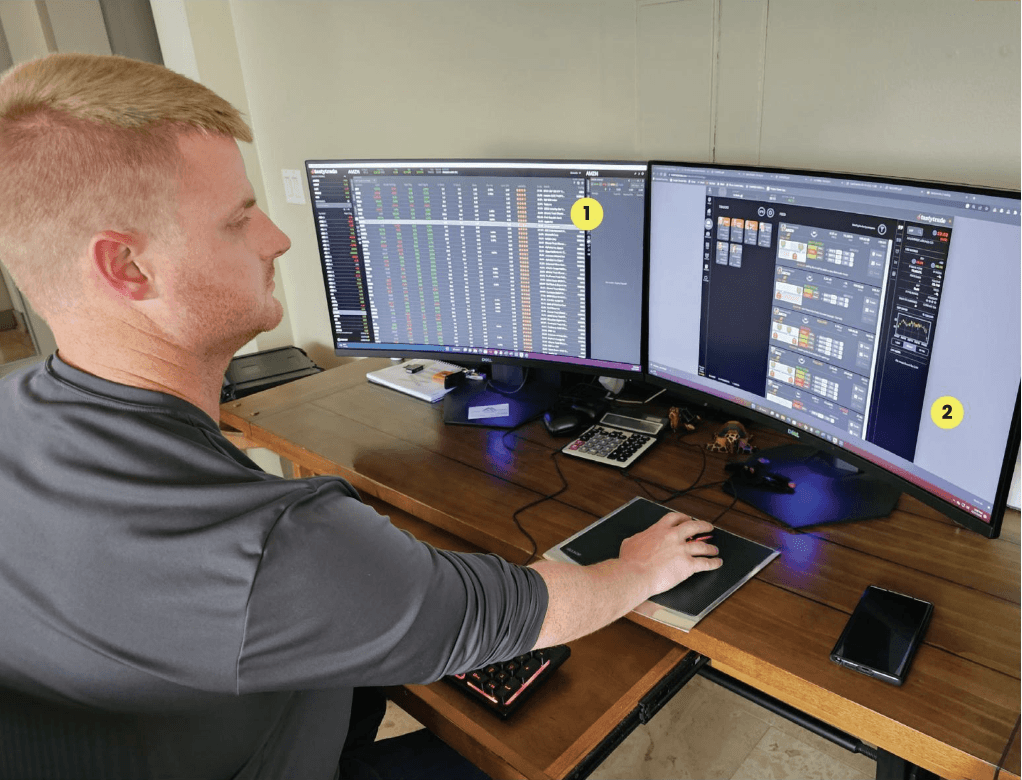

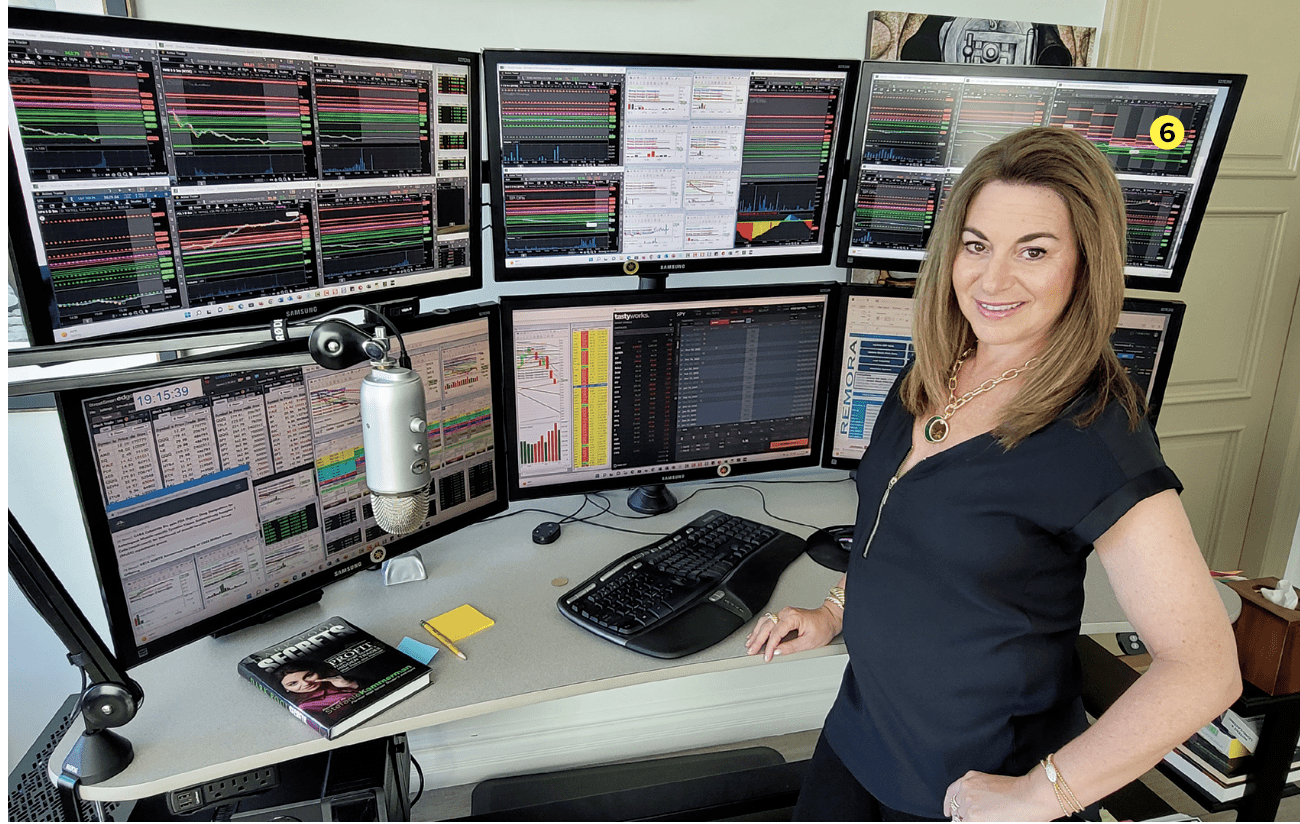

I’m not sure I would describe it as a strategy, but more of a way of doing things: I tend to trade a relatively large number of small positions, as opposed to just two or three. There have been times when I’ve had more than 100 positions going at once. There are a few things I do to make this feasible. First, I’m really organized with my charts and how I group my watch lists into various opportunities; second, I have a spreadsheet that tracks every position, its relationship to my stop-loss prices, and every position’s risk; third, and most important to me, I am religious about keeping my stop-loss prices fresh and updated. Managing risk is more important to me than exploiting opportunity, so I constantly stay on top of the charts and numbers in order to stay prudent.

The percentage of your outcomes that you attribute to luck

Almost none. There have been times when I’ve been very lucky, and other times when I’ve been very unlucky due to some kind of “shock event” news that the charts couldn’t anticipate. On the whole, I’d say my outcomes were anchored in the analysis of the chart that I made in the first place.