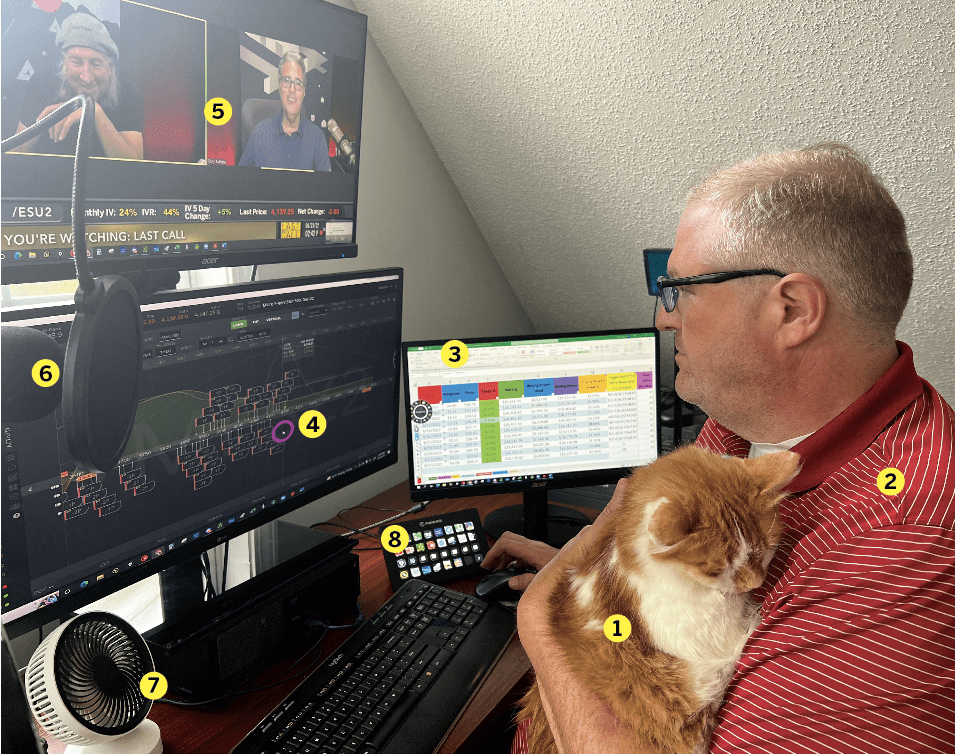

Meet the Trader: Jonathan Haas

Focusing on options while avoiding single stocks became his winning strategy

- Jonathan Haas, 36

- Home: England

- Years trading: Seven

Jonathan Haas, an Oxford graduate and former employee of Blackstone asset management, has achieved remarkable returns through options trading: 61% in 2023 and 45% in 2024. Despite warnings from denizens of Wall Street that his trading approach would fail, his consistent use of skewed strangles has grown his account to $2.6 million.

But miscues preceded his life as a trader. In 2022, Haas tried (and failed) to set up his own mortgage lending business for foreign nationals.

So in 2024, he took a leap and quit his job at the Royal Bank of Canada, where he was a director for the commercial real estate lending business in Europe. Now, he concentrates on his portfolio and basks in the freedom of complete flexibility in where and how he trades.

In the video below, Haas describes how focusing on futures options while avoiding single stocks became his winning strategy.

How did you start trading?

I started trading by just passively buying (and holding) stocks and exchange-traded funds (ETFs), and half the time I was choosing the wrong direction. It was like watching paint dry in the worst ways. So, that’s when I got started trading in options.

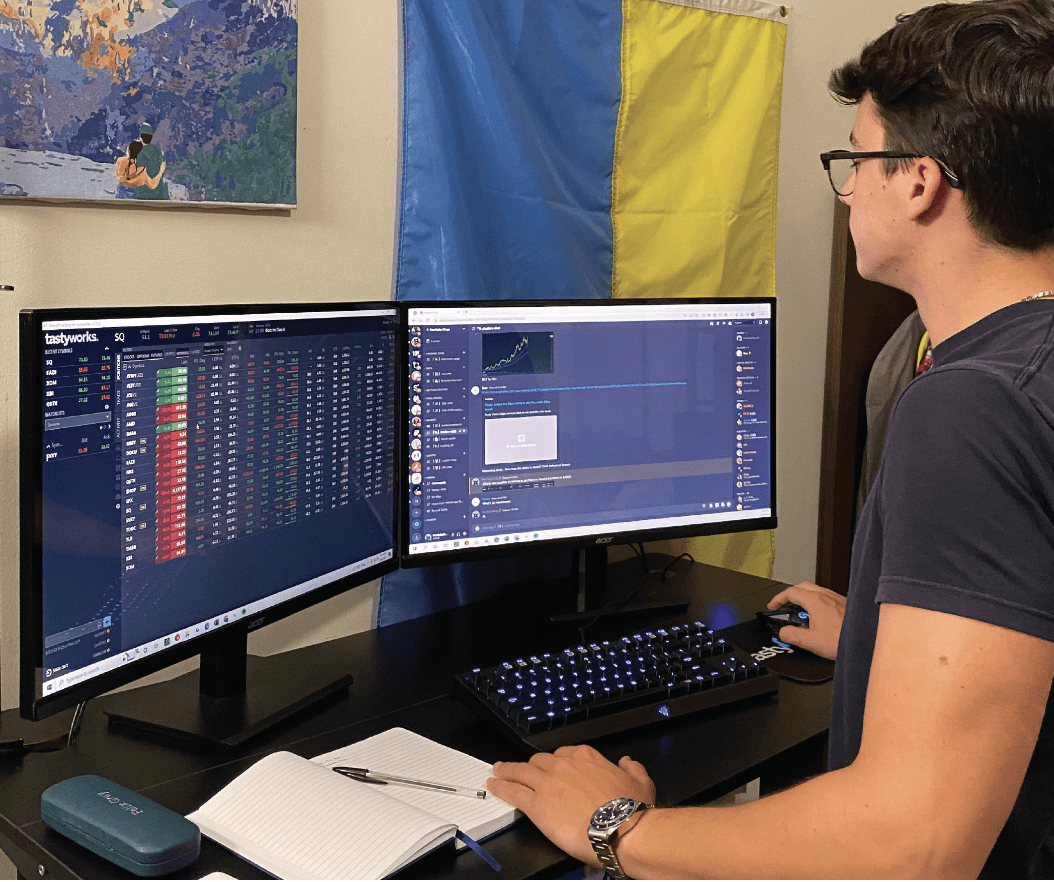

When I first moved to the United States from the U.K., I lived in New York for five years. I realized how much more flexibility individual investors in the U.S. have through the quality of the brokerages (like tastytrade). I saw that I could trade options in the “trading permissions” section of some of the brokerages. Level 1 is usually buying options, and I had taken finance classes at university, so I started doing that to “take more control of my portfolio.”

At the same time, I researched options trading online to learn a bit more and saw the tastytrade education programming— particularly Mike And His Whiteboard on YouTube at the time. I learned about Tom Sosnoff’s history in the business, and that was the beginning of my ride in the market and with tastytrade and the methodology. I’m pretty sure I watched every video on the website and went deep down the rabbit hole of strategies, methodologies, etc.

My job at the time (commercial real estate lending at Blackstone) is conceptually a bit like selling puts (limited upside and disproportionate downside) and I’d always been fascinated by the mathematics behind options and fascinated with the “wall street trader” persona you see in movies, so it was like a duck to water once I had someone break down the concepts and the practicalities of how it works.

I’m convinced now that most Wall Street traders with their risk limits and strategies don’t hold a candle to most sophisticated tastytraders in terms of practical options knowledge and risk management.

Favorite trading strategy?

I love skewed strangles, with generally lower delta calls as “hedge” in an upward drifting market.

Which financial instruments do you most frequently trade?

At this point, I trade all the futures products—currencies, bonds, indices, energy and agriculture—both for capital efficiency, as well as 23 hours per day flexibility and tax efficiency. Because I worked for regulated finance companies for most of my career, I rarely trade single-name stocks and as a result built my strategy around not trading single names.

Tell us about your success with trading.

I was up 39% in 2021, 61% in 2023 and 45% in 2024 on a seven-figure (~$1.8mm) trading account by end of 2024. I was down ~30% in 2022.

What was your worst trading moment?

I had a bad year in the beginning of 2022. I had left my job at the end of 2021 to start a start-up in the fintech/lendtech space. There was the combination of “finally” being able to trade single names, the stress of being a first-time founder at a difficult time for raising venture capital and getting caught up in the “start up tech” environment. I got too big in terms of buying power utilization/sizing up at the wrong time. For example, I still remember selling puts on Peloton Interactive (PTON) because the venture capital fund folks I was talking to kept telling me it would be as big as Nike (NKE). I had a massive drawdown as a result in 2022 (I was down 50% at one point.

I then “woke up” and killed every position and started sticking to my previous strategy again.

I learned a huge lesson of not straying from my previous strategy. I now stick to futures and no single-names because of the binary event risk and stick to my mechanics and not let myself be influenced by the “shiny new object.” I “stick to what works,” as Tom Sosnoff and Tony Battista always say.

In hindsight, I’m glad this happened, and I paid my “tuition” and feel great about my takeaways here—although it didn’t feel great at the time.

Check out all the previous Rising Stars here.

Yesenia Duran — not an alien, not a zombie; just an editor.