Rising Star: Meet Michael Cardman

Using tasty mechanics reduces risk and attracts luck, and then we really get rolling when the VIX passes 50

Michael Cardman, who teaches engineering and finance, began investing passively in 2012 and made the transition to options trading for its strategic complexity. Despite significant losses in 2022, largely because of futures missteps, he rebounded last year by refining his risk management and leveraging defined risk strategies.

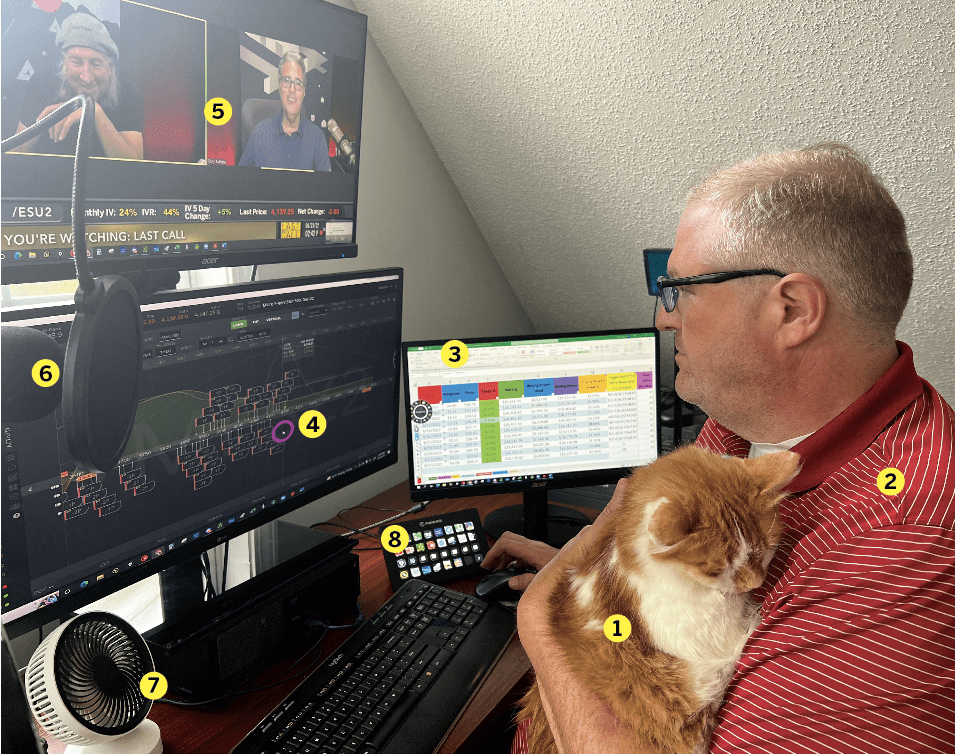

4. Trusty HP-12c (with a backup) at the ready for any spur of the moment financial calculations (they almost never come up) 5. Table chip from Monaco’s Casino de Monte-Carlo 6. QLOCKTWO clock

Home/Office location: Virginia

Age: Lost in the 30s

Years trading: 20

How did you start trading?

Opened my first brokerage account as an 18th birthday present to myself. I didn’t actively trade too much—just bought single-named stocks that I knew, as well as some broad-based mutual funds. It was simple buy, hold, buy some more and hold longer. I still watched the market as much as I could, trying to learn whatever I could. I didn’t learn about options and derivates until my master’s program some years later. It was after that exposure that I opened my first options account and began to marry theory and practice (thanks for letting me borrow the tag line Jim Schultz).

Favorite trading strategy?

Everything is put on a premium selling position. I balance about 60% undefined and 40% defined risk strategies (give or take). The undefined positions tend to be a mix of ratio spreads, broken heart butterflies and lizards. The defined positions are simple spreads or iron condors. Regardless, each trade entry comes down to liquidity and implied volatility rank. From there, it’s a bit of directional luck and proper position and portfolio-level Greek management.

Average number of trades per day?

One to three. Again, depends on the VIX and the market environment. Some days could be zero. The market has taught me to be humble and patient. You can always force a trade, but it almost always blows up on you.

What percentage of your outcomes do you attribute to luck?

I wouldn’t be able to consider myself a trader worth my weight if I didn’t have my fair share of luckbox trades. But to be honest, keeping to the tasty mechanics is the biggest risk-reducer (and luck magnet). It’s about building a strategy of winning; the profits will follow.

Favorite trading moment?

Every time VIX pops its head up above 30. In the 40s it gets exciting, and when we cross 50 we’re really rolling.

Worst trading moment?

Thinking I know something (I don’t) and waiting for the market to accommodate me (it doesn’t care about my position).

Favorite trading book

Obviously, How I learned to Trade like Tom Sosnoff and Tony Battista: Book One, Trade Mechanics and The Unlucky Investor’s Guide to Options Trading.

Check out all the previous rising stars here.