THE JOURNEYMAN: THE PATH TO A 153,000% RETURN

Son Dao has made a fortune in almost no time by bucking the market’s bearishness. He turned $1,600 into $2.5 million in 17 months. Yes, Luckbox verified the numbers.

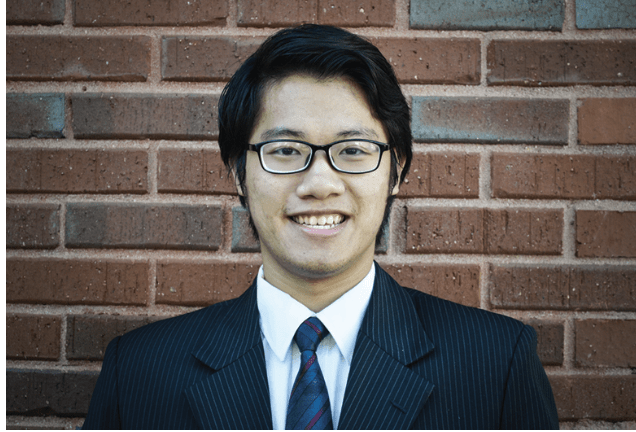

Twenty-eight-year-old Son Dao was born in Vietnam, but now he’s living a spectacular version of the American dream just outside Atlanta.

Despite a bear market—or really because of it—he traded stocks, options and exchange-traded funds skillfully enough to turn an initial stake of $1,600 into more than $2.5 million in just 17 months.

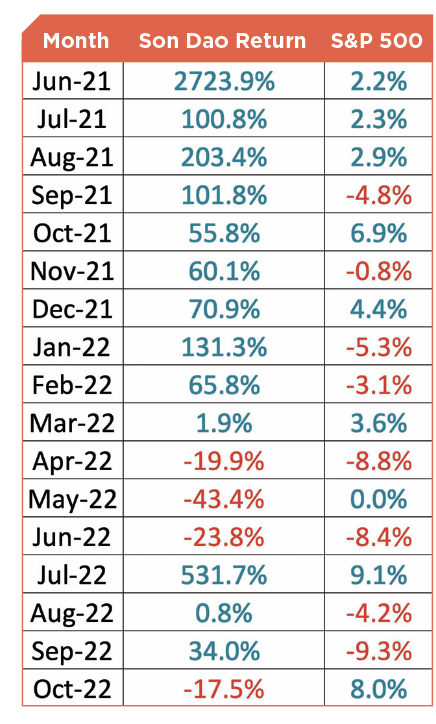

Think of it this way: His tastyworks brokerage account posted a 153,182.48% return between June 2021 and November 2022—while the Standard & Poor’s 500 declined 7.9%.

Translating those dizzying numbers into human terms, he made more than enough money to retire from his job as a mechanical engineer long before reaching the age of 30.

Still, Dao wasn’t the overnight success his triumphant run might suggest. His unshakable desire to avoid spending 40 years in a cubicle helped him overcome five years of stumbling badly as he learned to trade stocks.

His admirable perseverance aside, he benefitted from the reluctant acquiescence of his long-suffering wife, the encyclopedic knowledge he gathered from studying nearly 30 books on stock trading and his fruitful collaboration with fellow traders.

Yes, Dao combined the time-honored virtues of hard work, determination and something that used to be called “pluck.”

Looking back, he describes a personal trading history that began on the printed page.

“I read about Warren Buffett when I was 20 years old or so, and I find it so cool that all he did was investing in stocks to become one of the richest people on Earth,” recalls Dao, who came to America at the age of 15.

He became fascinated with the idea of using compound interest to put money to work even while you’re asleep.

Yet simply holding stock for the long term became boring, and soon enough he found himself making the transition from passive investor to active trader—but not just any kind of active trader.

An event specialist

When deciding on a trade, Dao doesn’t engage in fundamental analysis—which is based on evaluating the underlying company’s performance, the prospects for its industry and the state of the economy in general.

He also disregards technical analysis, the study of charts that plot stock prices over time in the hope the past predicts the future.

“I’m neither a fundamental trader nor technical trader,” Dao maintains. “I believe these fields are too crowded, so it would be impossible, or nearly impossible, to find an edge or a holy grail in fundamental or technical trading.”

Instead, he specializes in event-driven trading, placing his trades before, during and after company earnings reports and breaking financial news stories.

He prides himself on discovering market makers’ mistakes and turning those errors to his advantage.

Volatile stocks attract Dao’s attention, and he pays particular attention to implied volatility (IV).

Dao also considers himself something of a contrarian who thrives on parting ways with the masses. That mentality emboldens him to make bullish trades on single stocks when most investors are feeling bearish.

But he doesn’t necessarily pursue his maverick tendencies when market sentiment turns bullish. “I believe markets always go up over time, so no point fighting the long-term trend,” he says.

As Dao was developing his philosophy of trading, he honed his skill at choosing the right strategies to help him execute on his ideas.

Trading strategies

Dao identifies his favorite gambits as the call calendar, double calendar, double diagonal and short naked put. His entry requirements for a trade vary depending upon the strategy.

He sells at-the-money (ATM) naked short puts at the nearest expiration when the market is expressing bearish sentiment before an earnings report. Recent examples have included Meta Platforms (META), Carvana (CVNA), Beyond Meat (BYND), Redfin (RDFN), Robinhood Markets (HOOD) and Coinbase Global (COIN).

Several sources help Dao gauge the market’s mood, but to maintain his edge over other traders, he chose to reveal just one—WallStreetBets, a subreddit where investors discuss their views.

Dao chooses long strangles for stocks he believes will report earnings with the options’ implied move much lower than average moves of previous recent earnings. He opens the position before earnings and closes it before the report, playing for the implied volatility ramp up.

For stocks that reported preliminary earnings or updated guidance, he sells short straddles through their earnings reports.

He characterizes call calendars, call diagonals, double calendars and double diagonals as his “bread and butter.” When implied volatility is at the bottom and the implied move is lower than it should be, the best trades to take are double calendars and double diagonals, Dao says.

“Calendars and diagonals are time spreads, and because you’re trading the difference between the short legs’ premium and the long legs’ premium, you are effectively trading volatility,” he notes.

Theta, which tells how much the price should decrease as an option nears expiration, is well known and built into calendars and diagonals, but it’s not as important as vega, the measure of how sensitive an option’s price is to changes in the volatility of the underlying asset, according to Dao.

“I would open a calendar or diagonal trade if I expect IV on the short leg that’s near expiration is about to collapse a lot more than IV on the long leg that’s far from expiration,” he continued, “or if I expect the IV on the long leg to climb up while the IV on the short leg stays the same or goes down.”

He uses a calendar if he thinks the stock won’t move much. If he anticipates big movement, he uses a diagonal, which locks in a gain if the stock moves far from the long strike. With a double diagonal he buys either a straddle or a strangle, then sells a strangle farther out-the-money (OTM) than the ones purchased for a nearer expiration.

Trading frequency

Dao prefers swing trades and tends to hold them anywhere from a day to two weeks. “I rarely make a day trade nowadays,” he says.

When earnings reports season reaches its peaks from mid-January to mid-February, mid-April to mid-May, mid-July to mid-August, and mid-October to mid-November, Dao may open five to 10 trades a day, mostly during the last hour before market close.

When earnings seasons end in early March to mid-April, early June to mid-July, early September to mid-October, and early December to mid-January, he might make only one or two trades a week.

Profit and loss

The three products that brought Dao the biggest gains during his run of good fortune have been the S&P 500 (SPX), which netted him $819,830; Taiwan Semiconductor (TSM), which earned $783,835 for him; and Twitter (TWTR), which poured $700,093 into his coffers.

One of the best trades he made during that time was when he bought 400 SPX call calendars for $490 each on Sept. 8, 2022, and sold them for $2,400 each on Sept. 12, netting a gain of $764,000 or 400%.

But nobody wins every time. Dao opened 300 Meta short puts at the 115 strike on Oct. 26, 2022, and closed them the next day for a $365,100 loss.

He suffered his biggest drawdown in dollars between Oct. 11 and Oct. 27, 2022, when he dropped $1.4 million from top to bottom. His biggest drawdown as a percentage took place from March 7 to June 27 of 2022, when his trading account plummeted from nearly $1 million to about $200,000, a drop of almost 80%.

That’s a lot to lose, so Dao has learned to rein in risk.

Managing the downside

Dao has erected guardrails to keep from veering off the road to profitable trading.

“Everything is wrapped around losing no more than 3% of the account on any given trade,” he says.

For long premium trades, like buying call calendars or strangles, the dollar amount he allocates—therefore the maximum loss—is 3% of the value of his account.

For short premium trades, like short strangles and straddles, he computes the specific trade’s two standard deviation loss—an outlier move—and then limits the amount he allocates so the loss would be no more than 3% of his account.

That cautious approach is something Dao learned the hard way.

“I had no respect for risk management until after I turned the initial $1,600 into hundreds of thousands of dollars,” Dao recalls, “and even after that, there were a few times I opened a huge position that could cut my account in half if I were wrong, and it did happen a few times.”

Worst moments

On March 30, 2022, Dao opened a huge long strangle position in the publishing company Houghton Mifflin Harcourt (HMHC) for $164,680. The company’s options were priced low because market makers believed a tender buyout at $21 would be approved. Some sources said the shareholders wouldn’t approve the deal and the company would get a buyout at a higher price.

Dao knew that if the tender buyout failed, the stock would either go up or down, and options premiums would go up. So, he bought a strangle (an OTM call and OTM put) because it offered an asymmetric risk versus reward ratio.

“If I’m wrong, I would lose 100% of the position,” he says. “But if I’m right, I would make roughly 1,000% on the position—a 10-bagger! Well, I was wrong. Approval votes were only a little bit higher than 50%, but it was enough to make me take a 100% loss of $164,680.”

Another rough patch lasted from Aug. 29 to Sept. 13, 2022, when Dao invested in Zim Integrated Shipping Services (ZIM).

“I opened a lot of short naked puts on Zim—and I mean a lot,” Dao laments. “In total, I sold 3,680 naked puts at strikes $35, $30 and $25, all with expiration on Oct. 21.”

Zim was trading below net cash value with a price-to-earnings (P/E) ratio of 0.7. In the previous three quarters, the company made more in profits than their market capitalization. Its forward P/E was two, which meant that in the next year Zim was expected to post a net profit equal to half of its market cap.

That looked great to Dao, but he was wrong. He closed his positions for a $612,311 loss, his biggest ever on a single company.

After that, it would take another $154,750 loss on Snap (SNAP) short OTM naked puts and a $365,100 loss on Meta Platforms (META) with the same strategy for him to realize the most important rule of selling a naked put: Always sell an ATM put—never sell an OTM put.

“Selling an OTM put is like picking up pennies in front of a steam roller,” Dao says. “When a black swan event happens, one loss will wipe out six, seven or even 10 winning trades’ gain. You eat like a bird and poop like an elephant.”

Selling an ATM put protects against an unusual move in the price of a stock and enables investors to take advantage of the rule of large numbers, he notes, adding that one loss then offsets the gains of only three or four winning trades.

But for Dao, the wins have far outweighed the losses.

Best moments

In June 2021, the meme-stocks phenomenon helped Dao turn $1,130 into $40,000 in one week with call calendar trades in BlackBerry (BB), Workhorse Group (WKHS), Microvision (MVIS), Clover Health Investments (CLOV) and Wendy’s (WEN).

“Market makers were not prepared for the wave of retail trading,” he says of the meme-stocks spectacle. “They got caught in the storm and mispriced a bunch of options, so I was able to take advantage of it and opened these trades, which are very close to risk-free.”

Good fortune came Dao’s way again in September 2022 when market sentiment was bearish in the days leading up to the announcement of consumer price index data. As a contrarian, he made a big bullish bet the market would go up before the report was released Sept. 13.

On Sept. 8, he opened an SPX call calendar at a $4,100C strike, sold Sept. 12 expiration and bought Sept. 13 expiration. For 400 at $490 each, he had a $196,000 position. SPY pumped $10 (2.64%) in two days, which is a 100-points jump in SPX. He closed the position on Sept. 12 at $2,400 each for a $764,000 gain of 390%.

“It feels great to be contrarian and right,” Dao says.

Great enough that he managed to do it again a month later. On Oct. 6, he opened 4,000 put calendar spreads on Twitter (TWTR) at $50 strike, selling Oct. 14 and buying Jan. 20 expiration. The Jan. 20 expiration was selling for just a little more than the Oct. 14 expiration.

He later rolled the short put from Oct. 14 to Oct. 28 and then closed the whole position on Oct. 27. Twitter was delisted the next day, and he netted a $483,331 gain on the original $400,000 position, a return of 120.8%.

For Dao, it seems the American dream of prosperity just keeps rolling along—all it takes is courage, hard work and plenty of savvy.

Finding the Edge in Trading

The United States isn’t the land of opportunity it once was. In fact, the World Economic Forum says America has slipped to 27th place among nations when it comes to economic mobility—the probability of making more money than your parents.

But don’t bring up that gloomy prospect with Son Dao, a 28-year-old immigrant from Vietnam who grew an initial stake of $1,600 into $2.5 million in just 17 months of trading options on stocks.

Dao came to the United States with his parents at the age of 15. The family settled in Atlanta, where his grandparents had already begun building a new life.

His parents had made a living in their hometown of Bien Ho by running a small hardware store. It’s notable that Dao, a confirmed capitalist, calls Ho Chi Min City by its former name of Saigon—the appellation it bore before falling to Communist rule.

The Dao family was making it in Vietnam. They had a motorcycle there, but the good life that included a car seemed out of reach.

So, they came to the promised land. Dao’s parents couldn’t speak much English, which relegated them to working for just a bit more than minimum wage preparing in-flight meals for Delta Airlines.

But in the classic fashion of the offspring of immigrants, Dao climbed the socio-economic ladder and earned a degree in mechanical engineering at Georgia Tech, graduating in 2017.

Still, he didn’t believe he was destined for the 9-5 confines of a regular job. In 2015, he used $2,000 he’d made as an engineering intern to begin trading stocks.

It didn’t work out, and soon the money was gone. Dao’s wife, who studied to become an elementary school teacher, urged him to forget the market, focus on academics and get a “real job” in engineering.

So, he took care of business on the “practical” side of life. But at the same time he read nearly 30 books on trading the markets. He got back into investing with a $1,000 stake and lost it.

Gains and losses followed, and by 2021 Dao was gradually becoming desensitized to the ups and downs. He learned to buy and sell stocks almost without emotion.

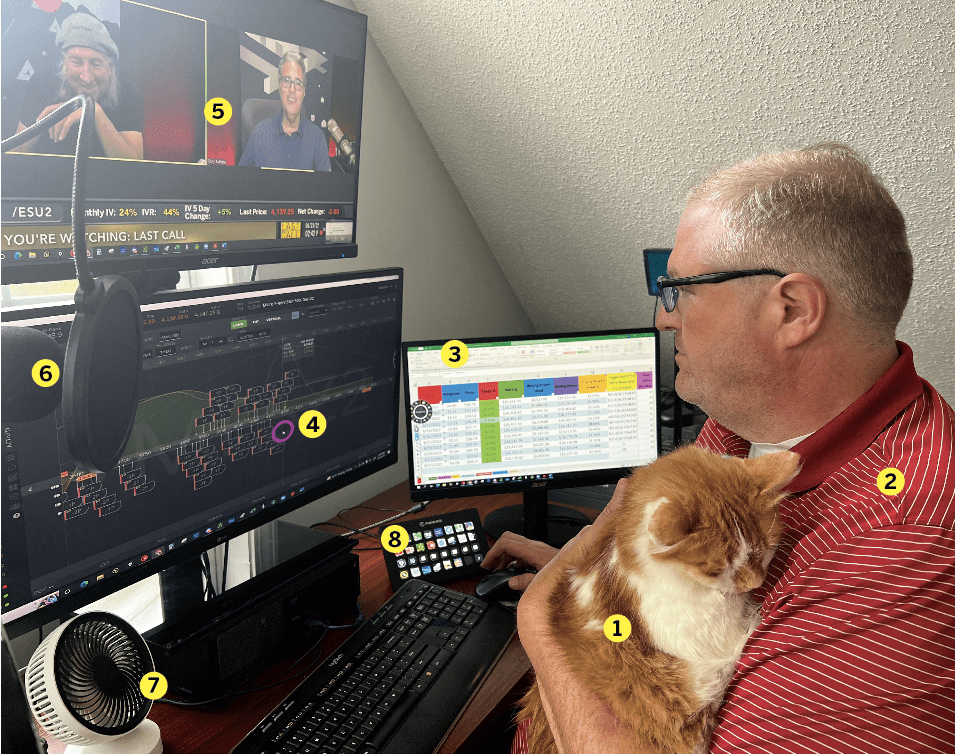

Dao kept trading until he became a journeyman. Along the way, he collaborated with other traders on a Discord server, but that didn’t have much influence on his trades.

Today, he lives in Snellville, Georgia, with his wife and 4-year-old daughter in a house big enough to accommodate a heated indoor pool. A second child is on the way.

Besides bringing him wealth, the journey has taught Dao something. “You have to have an edge that gives you an advantage over other traders,” he advised. “That—and risk management.”