Straightforwardly Successful

The idea that volatility is often overpriced and fear is inflated gave me the edge I needed

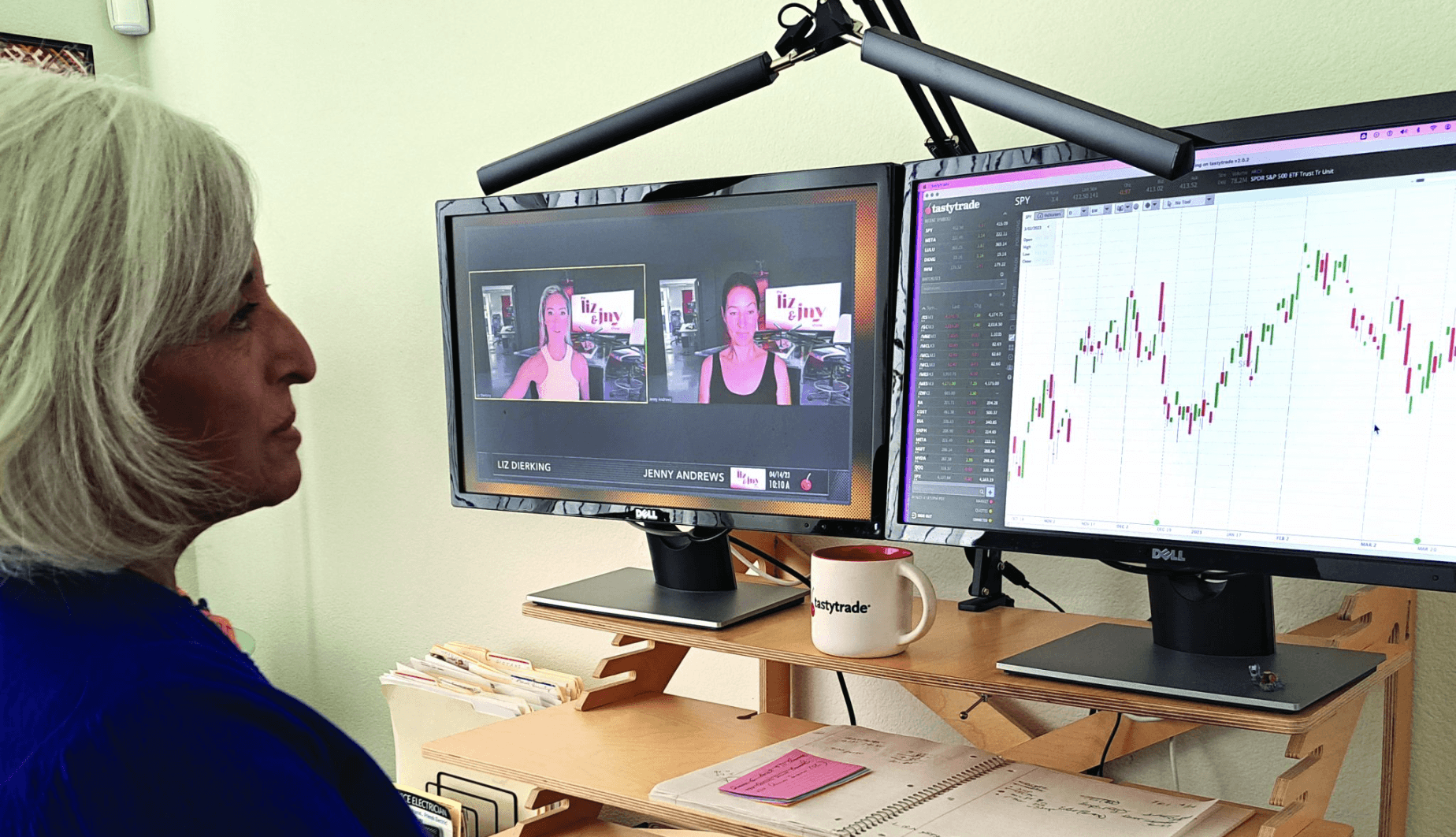

Dennis K. Maritim, 36, Winnipeg, Manitoba, trading for seven years, premium seller for two years

Losses don’t discourage Maritim because a strategy of trading small and trading often works in his favor.

How did you start trading?

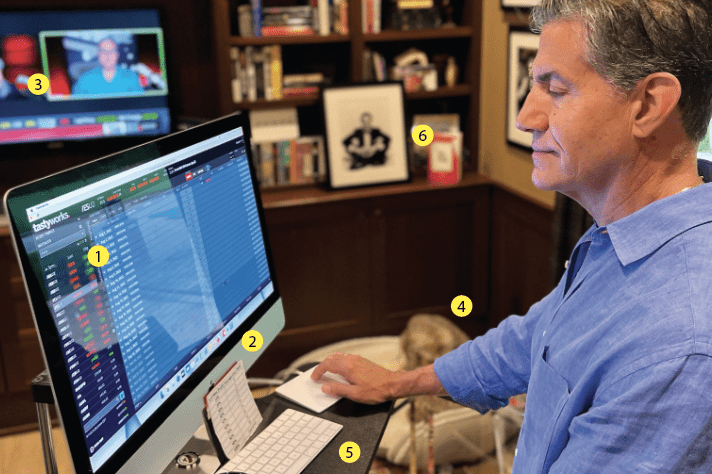

I began trading in September 2022 after a friend introduced me to tastytrade/tastylive videos. Before that, I was primarily a net buyer, always taking long positions. However, I was drawn to the concept of premium selling, which shifted my approach completely. The idea that volatility is often overpriced and fear is inflated gave me the edge I needed to change my strategy. What I appreciate most now is that time works in my favor through theta decay.

Favorite trading strategy?

I have several favorite strategies, but one I really enjoy is the broken wing butterfly because of its versatility. It can be profitable regardless of market direction, with the potential to earn more than the initial credit if the price lands in that “sweet spot” — which is above the short put but below the nearest long put (or, in the case of a call broken wing butterfly, between the short call and the closest long call). I also appreciate the straightforwardness of cash-secured puts and the defined risk of vertical spreads placed for a credit. All my trades are designed to generate a credit upon entry.

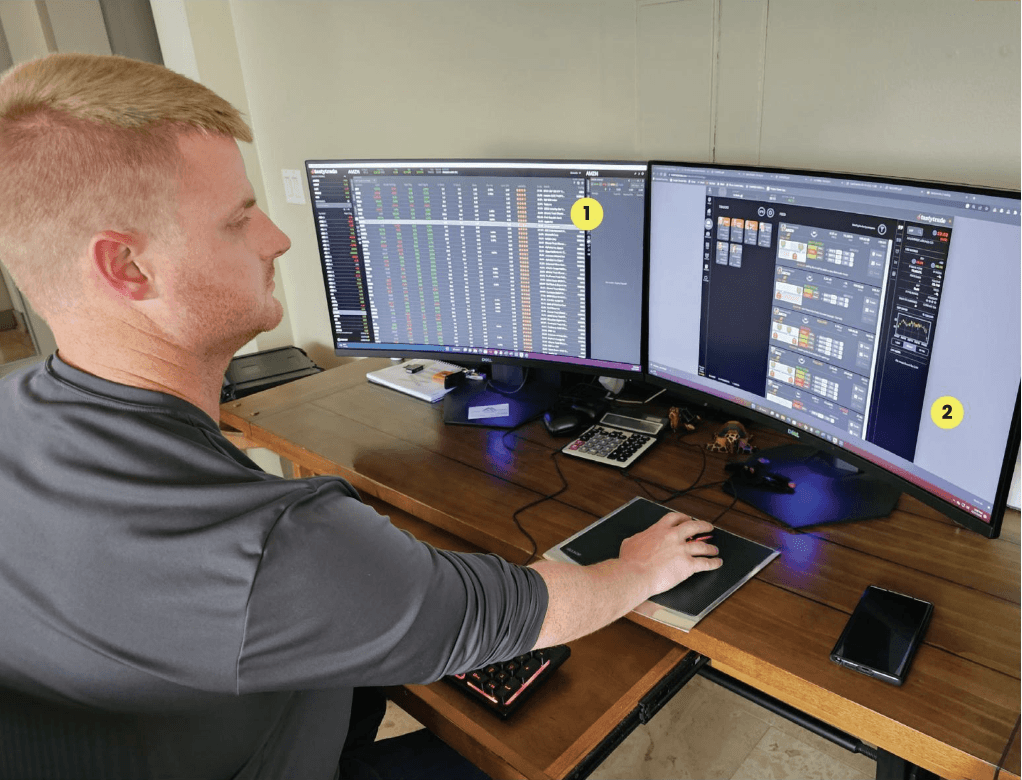

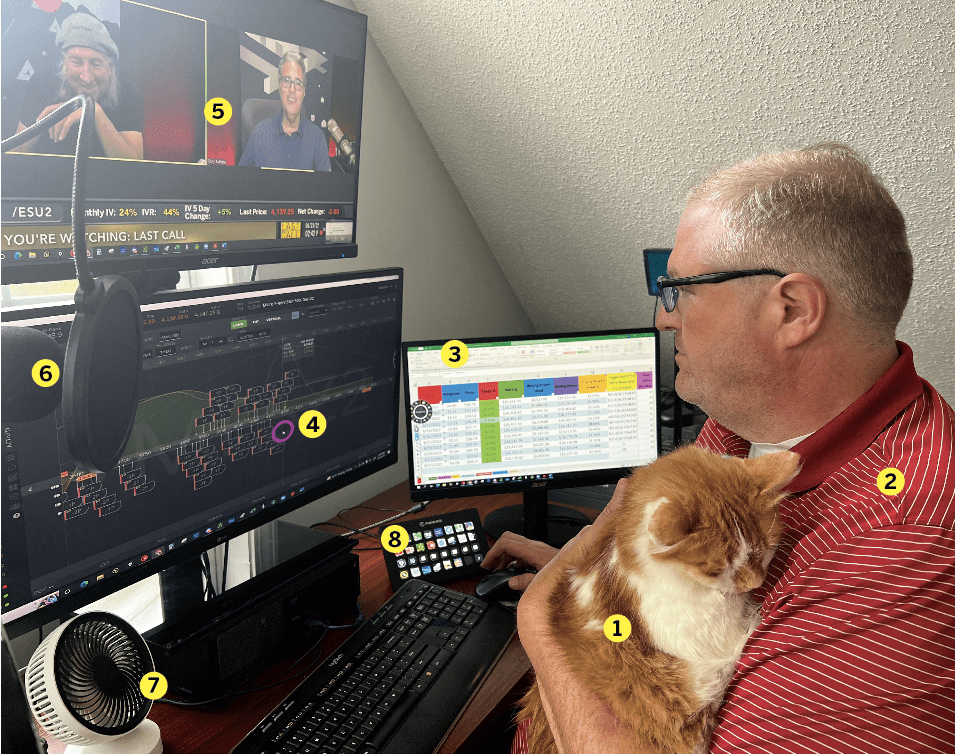

Average number of trades per day?

I aim to make at least five trades a day, but recently I adjusted my strategy to keep 50% of my account in dry powder for buying power. I got hit with a margin call during the downturn of the Japan carry trade in August, so my trading volume has been lower than I’d like. I’m actively looking to secure more capital so I can trade more frequently—being on the sidelines isn’t ideal.

What percentage of your outcomes do you attribute to luck?

I’d say 22.47%, as most of what I do is, I believe, within my control. However, I can’t deny that luck also plays a part.

Favorite trading moment?

My favorite trading moment was on Sept. 21, 2023, when hawkish comments from the Federal Open Market Committee sent the markets lower. I had diversified my strategies with some bearish positions, and as a result I was able to close trades that had reached 50% profitability or more during the downturn.

Worst trading moment?

Aug. 5, 2024, was a challenging day for me. I received a margin call because I was overextended. This experience prompted me to reevaluate my trading approach and implement risk mitigation strategies. Unfortunately, I had to sell some stocks at a loss. I later realized I could have held onto them for better returns because they have since recovered. I needed to sell in order to bring my account back to acceptable buying power levels.

Favorite trading books?

The Unlucky Investor’s Guide to Options Trading by Julia Spina

The Complete Turtle Trader: The Legend, The Lessons, The Results by Michael W. Covel