The U.S. Dollar Will Crash

A mean-reverting macro currency trade explained by a meaty metaphor

Extreme prices can make an active investor salivate. Contrarians and trend followers alike tend to view hamburger meat as Kobe beef if the market is climbing to an all-time high or descending profoundly lower—the more extreme the move, the better.

So, let’s pursue the meat metaphor. Think of 2021 as an 8-ounce filet mignon and the last decade as a 22-ounce dry-aged ribeye. The last 30 years? How about a 48-ounce porterhouse for two?

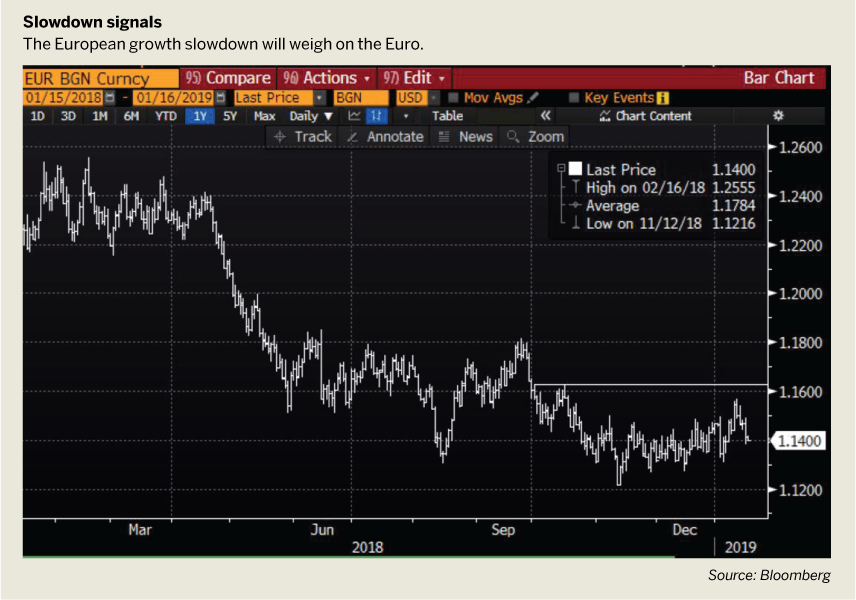

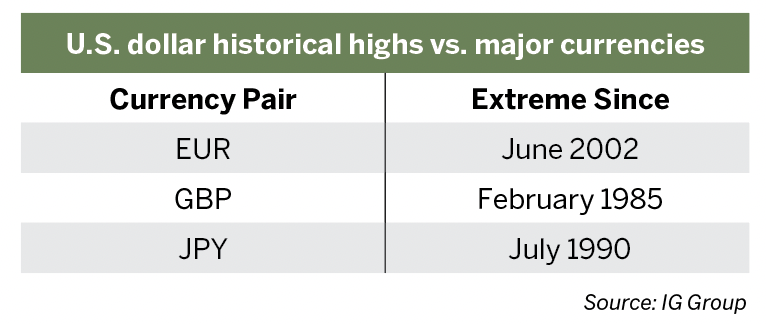

In 2022, the U.S. dollar market seemed like the A porterhouse on the menu because it enticed too many investors to bite off more than they could chew. The dollar reached new multi-year highs against a whole host of currency pair partners, including majors like the euro, British pound and Japanese yen.

Why the U.S. dollar’s appreciating

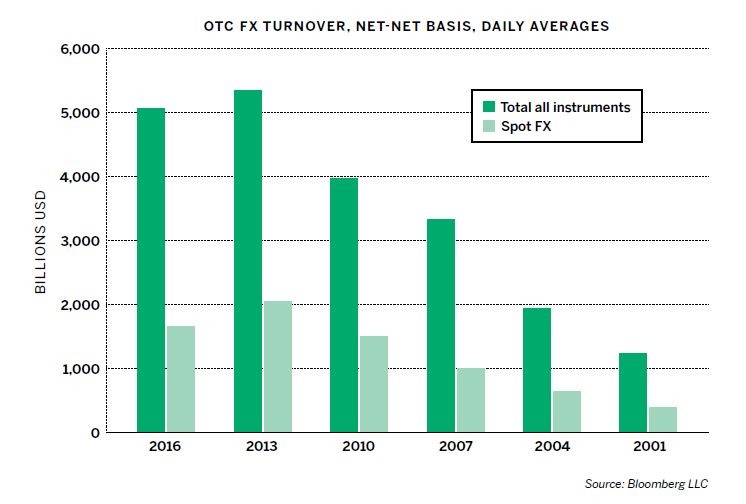

Inflation data, which has been highly correlated with dollars in recent years, is also reaching multi-year highs and causing central banks across the globe to consider more aggressive interest rate hikes. Theoretically, higher interest rates disincentivize spending and can thus curb inflation.

The U.S. central bank—the Federal Reserve or Fed—has been hiking rates more aggressively than its counterparts in other major economies, which has sent many foreign funds into U.S. dollars to invest risk-free at higher interest rates.

So, while inflation has led to currency depreciation for many countries, the U.S. dollar market has been the true outlier in more ways than one, given the relative strength of the U.S. economy.

The case for a crash

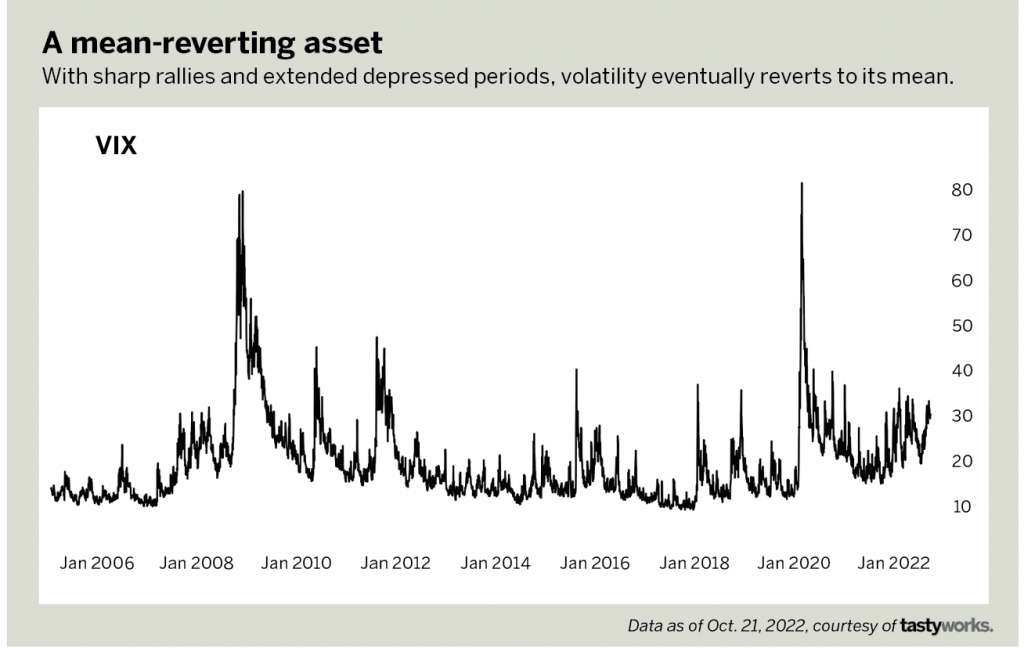

Any active investor who’s studied implied volatility (IV) or simply looked at a historical chart of the VIX—the Chicago Board Options Exchange’s volatility index—has likely dreamt of retiring early after buying low and selling high.

Though it’s hard to achieve financial independence, the theory is sound: VIX is a mean-reverting market; VIX can move far from its mean in times of great fear or lack thereof; and VIX has always come back to its mean at some point.

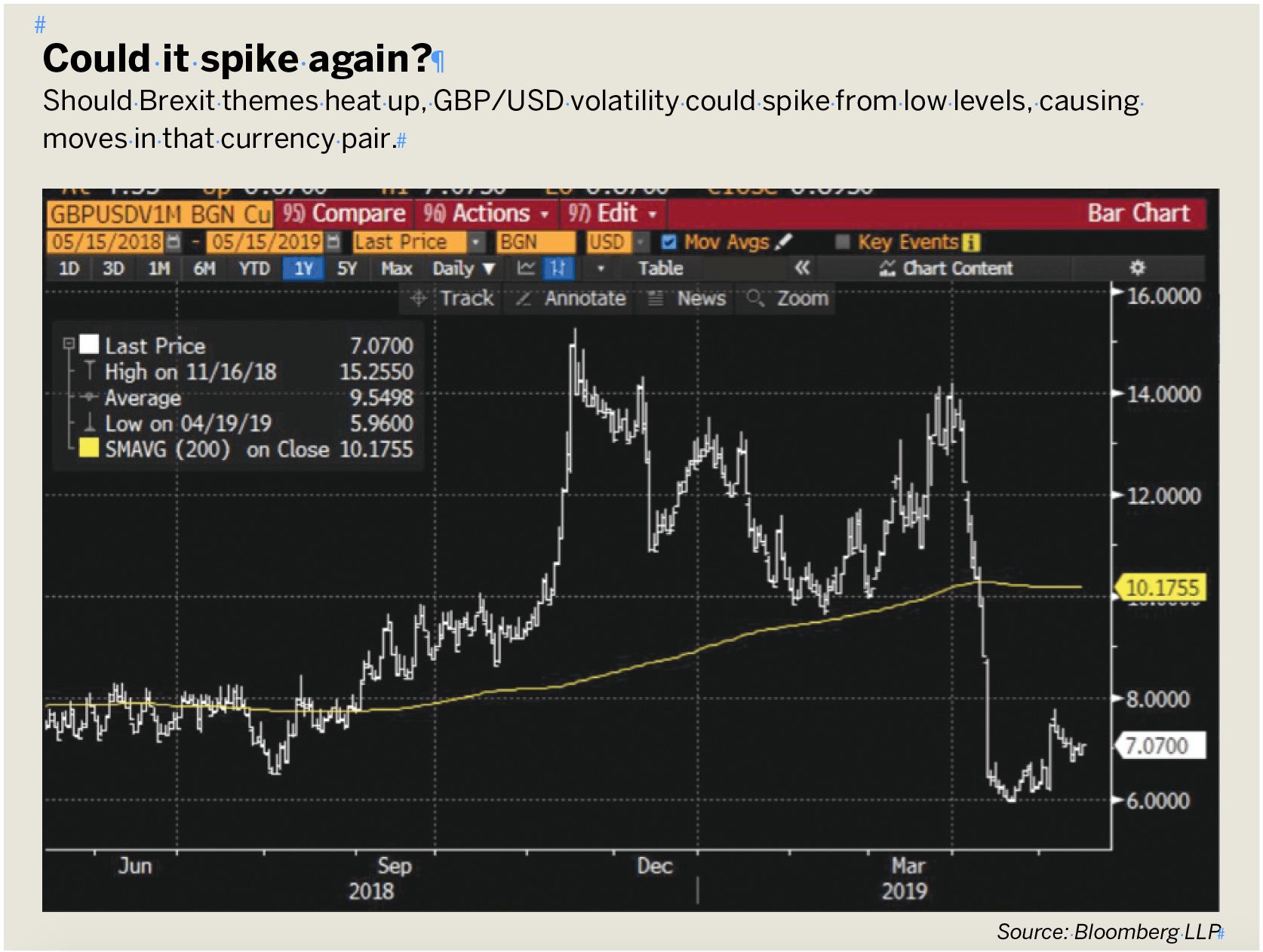

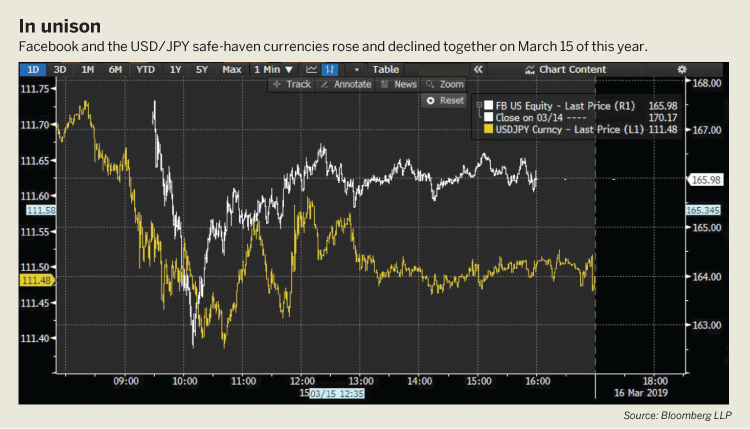

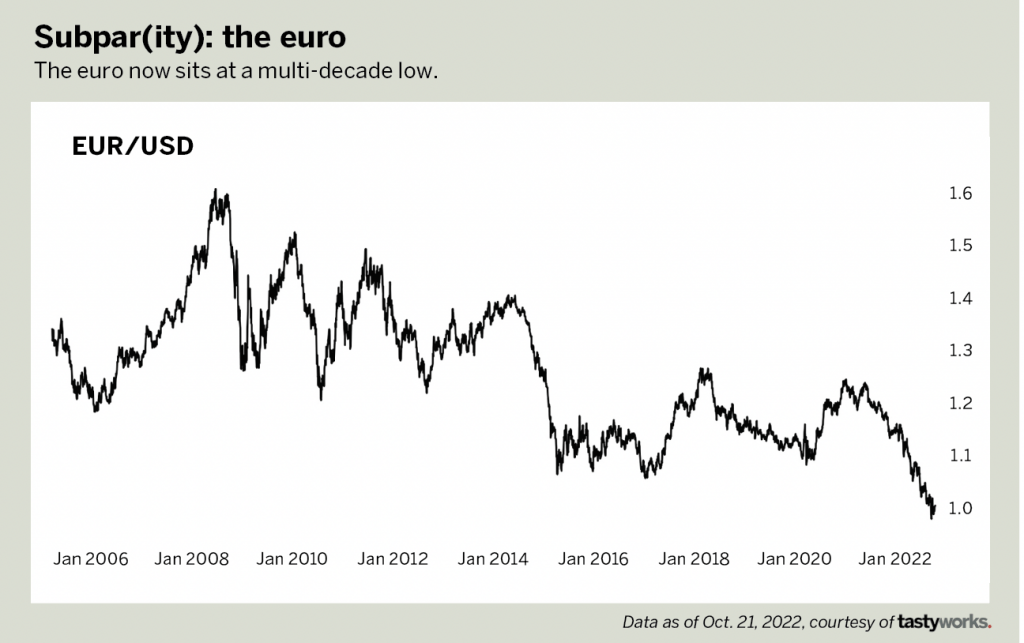

Currencies—and interest rates for that matter—share many mean-reverting qualities, and they have since long before VIX was a market. Take the euro-U.S. dollar (EUR/USD) market, for example.

Since 2005, the exchange rate between euros and dollars has traded as high as $1.50 and as low as $0.95—approximately where the market is now. The average price has been around $1.25. Like VIX, the currency market has reversed course in dramatic fashion from both historical highs and lows.

While it can be more interesting to predict a new normal, history repeats itself more often than not and history says the U.S. dollar is due for a collapse.

Timing: the toughest prediction

Any active investor who has traded implied volatility via options or a VIX product has likely lost money by being right directionally with the wrong timing.

The most clairvoyant economist could forecast a 50% drop in VIX, and a single bearish position could wipe out thousands before the prophecy came true.

Looking back upon history again, U.S. dollars have traded around similarly high highs against the Japanese yen twice since 1990 and stayed at those extremes for an average of six months.

The last time EUR/USD broke below parity, dollars held the upper hand for nearly two years.

The FX market was in extreme territory for three months when Luckbox went to press, which might make a 2023 U.S. dollar reversion a good bet for investors who can ride out the short-term turbulence.

There’s almost always a price extreme on the menu. But even though this year is one of the juiciest in recent history, don’t be a glutton.

Frank Kaberna, senior content strategist for IG Group North America, is an expert in futures, options and currency trading. @frank_kaberna