Crude Oil and a Revolution in Retreat

Plus, how to pick a winner among GM, Ford, Toyota and Tesla

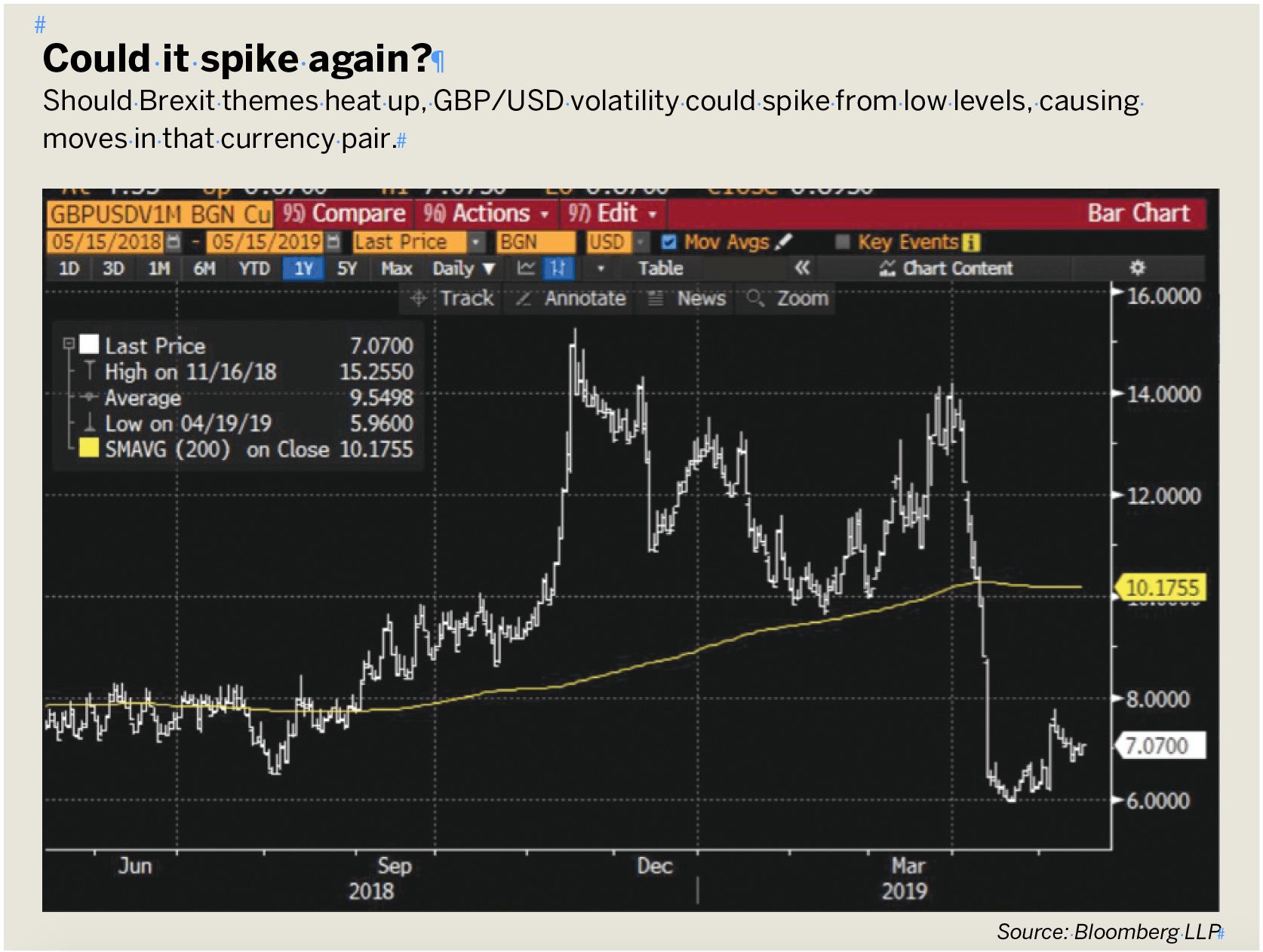

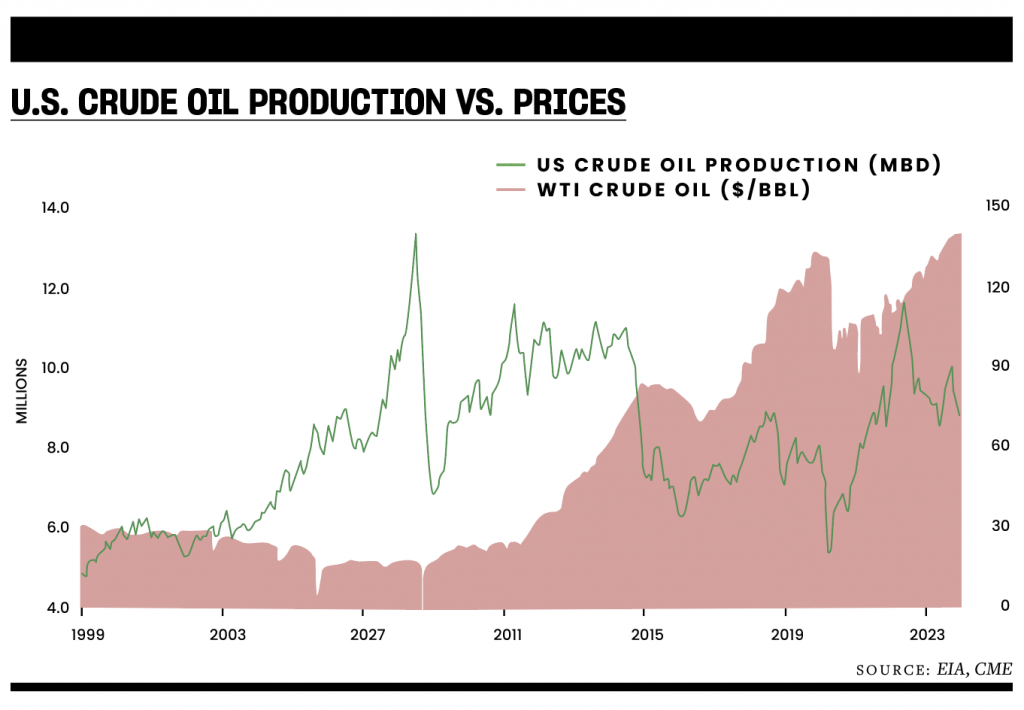

Crude oil prices have been drifting sideways since October 2022.

The benchmark West Texas Intermediate (WTI) contract briefly spiked to $115 per barrel (bbl) in March 2022 as Russia stoked supply disruption fears with its invasion of Ukraine. Concerns cooled by June, with prices easing back to settle in a choppy range between $68/bbl and $91/bbl. They have remained locked in it since.

Meanwhile, the United States is awash in crude supply. Data from the Energy Information Administration (EIA) shows production bottomed out in March 2021, having plunged amid COVID-19 lockdowns, then started to rapidly rebuild. By December 2023, the U.S. was producing 13.3 million barrels per day (mbd), the most on record.

Crude oil prices are stuck

That prices are broadly pinned in place while output continues to build seems somewhat counter-intuitive. One might have expected that growing production would pressure WTI lower. The lingering presence of a speculative geopolitical risk premium embedded in prices might explain the disconnect.

The war in Ukraine continues, and a new front has opened in the Middle East after Hamas attacked Israel on Oct. 7, 2023. The war that followed has brought violent clashes along key shipping routes as Yemen’s Houthi rebels sympathetic to the Hamas cause attacked commercial vessels in the Red Sea. The risk that major Persian Gulf producers could get pulled into the fray is ever-present.

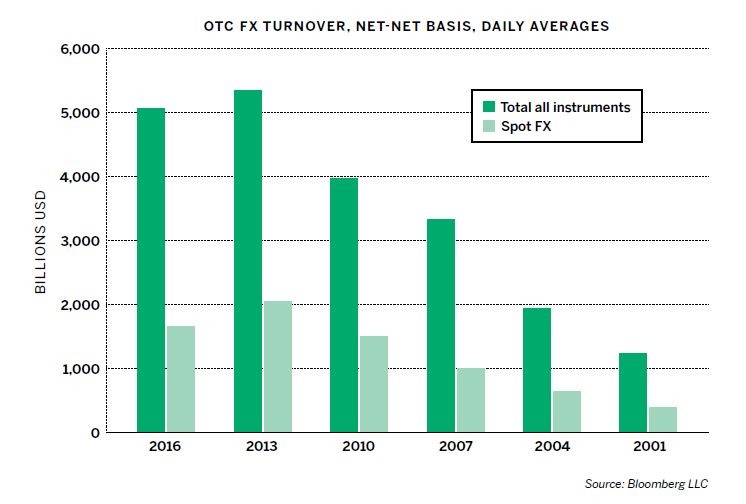

In fact, supply risks seem minimal. Daily U.S. crude oil consumption averages about 20 mbd, leaving a bit of room for imported supplies. From here, making the jump to full self-sufficiency hardly seems challenging.

Crude-oil supply risk?

Imports have flatlined at an average of 6 million to 7 million barrels per week since mid-2021. Over the same period, exports have more than doubled from 2.4 million to nearly 5 million barrels per week. That leaves an average gap of just 2 million barrels per week, the lowest in at least three decades.

At the same time, production efficiency seems to have improved by leaps and bounds. The number of operational oil rigs in the United States has trended steadily lower since peaking just shy of 1,600 in September 2015, energy company Baker Hughes reports. The tally fell to a pandemic low of 183 in August 2020, then rebuilt to settle at about 550 in 2023.

Meanwhile, the number of crews actively engaged in hydraulic fracturing of shale oil deposits, or fracking, has nearly halved from about 500 in mid-2018 to about 260 in the past two years. The extraction method is at

the heart of surging U.S. output over the past decade.

Finally, EIA estimates domestic storage capacity utilization rates are hovering at 50% to 60%.

In all, there appears to be ample room to ramp up output and store it, such that the meager shortfall between domestic and imported supply is briskly closed. Absent a relatively short transition period, this likely insulates the U.S. from global supply disruptions. That means prices might fall once scary headlines spooking speculators begin to abate.

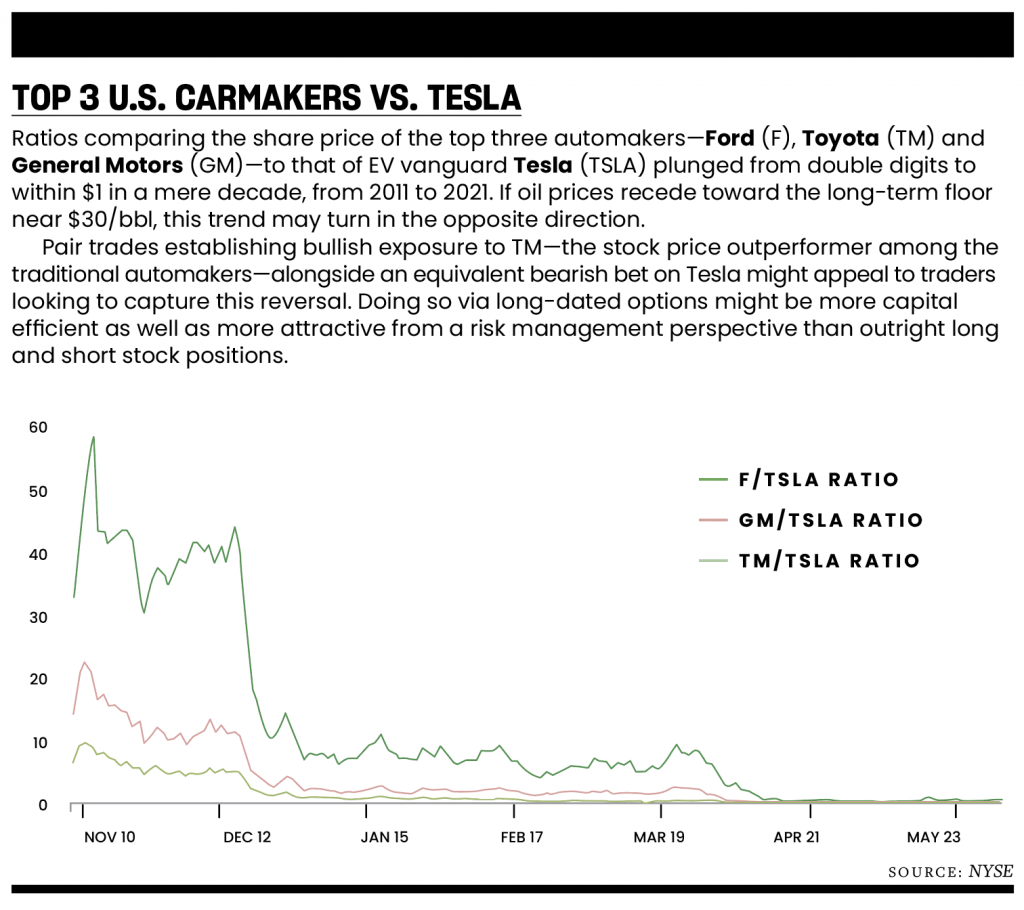

EV revolution in retreat

In turn, declining oil prices might put the brakes on a key forcing function driving

the transition to electric vehicles from conventional options using internal combustion engines.

Ilya Spivak heads tastylive global macro and hosts the network’s Macro Money show. @ilyaspivak