Unresolved Macro Themes Forecast Forward Volatility

Global directional trends

lobal macro trading benefits from volatility because moving markets create opportunities to trade. It’s also true that macro themes tend to simmer in the background and then come into play suddenly, spiking volatility and creating large, directional moves in assets.

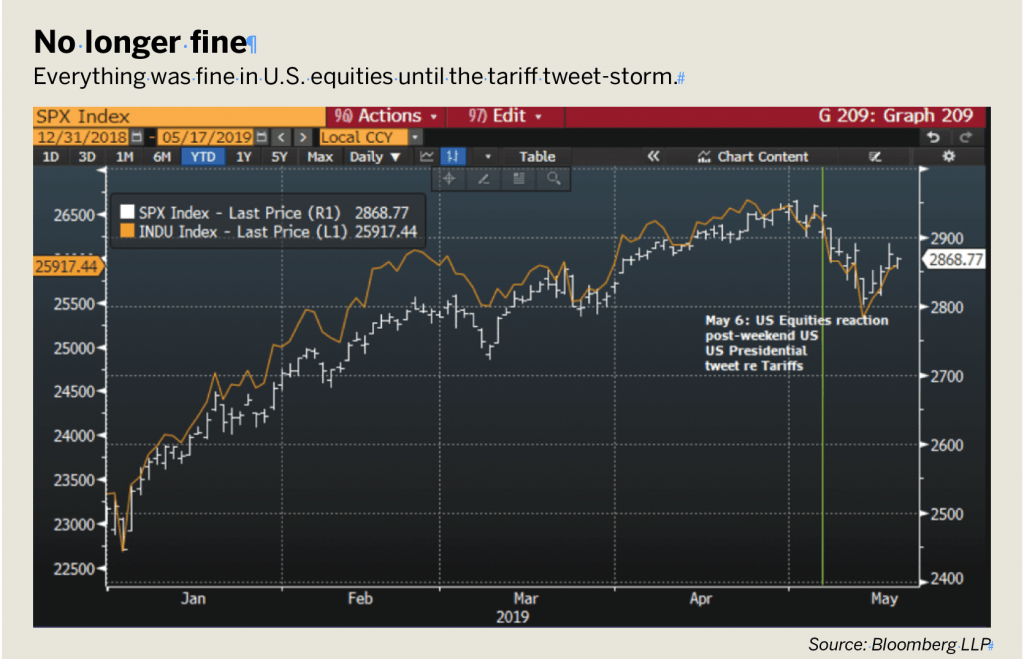

In one example, U.S. equity indexes remained relatively stable in early spring and then trended upward. The S&P 500 made a new high on April 30. Investors had grown somewhat complacent about U.S.-China trade tensions, thinking the two big nations would eventually resolve their differences.

That passivity ended abruptly on May 5 when President Donald Trump tweeted threats to raise tariffs on goods from China. Suddenly, the U.S.-China trade war macro theme became front and center once again. U.S. equities opened lower on Monday, May 6 and continued to fall as trade war rhetoric and tariff announcements from both the U.S. and China escalated.

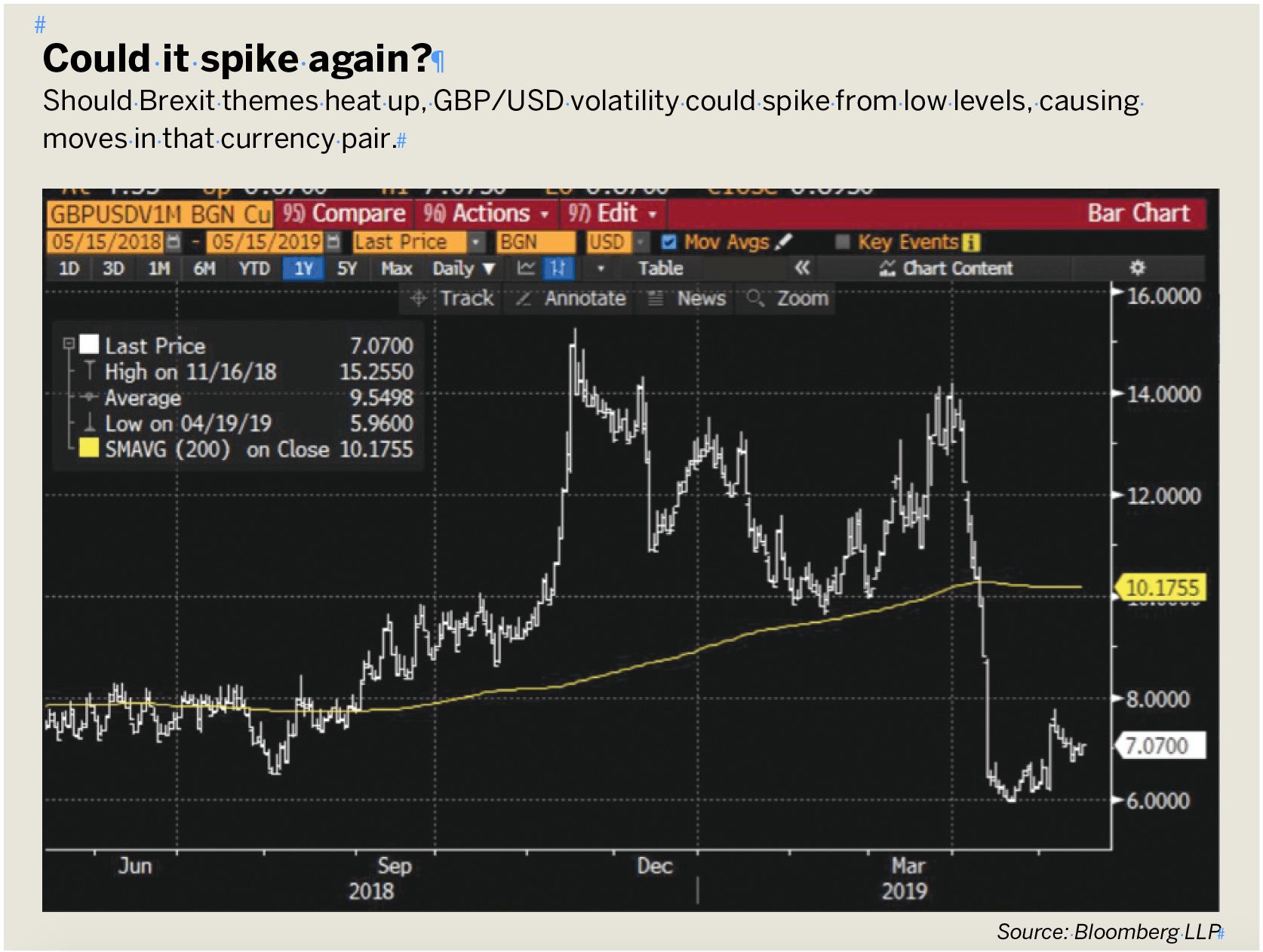

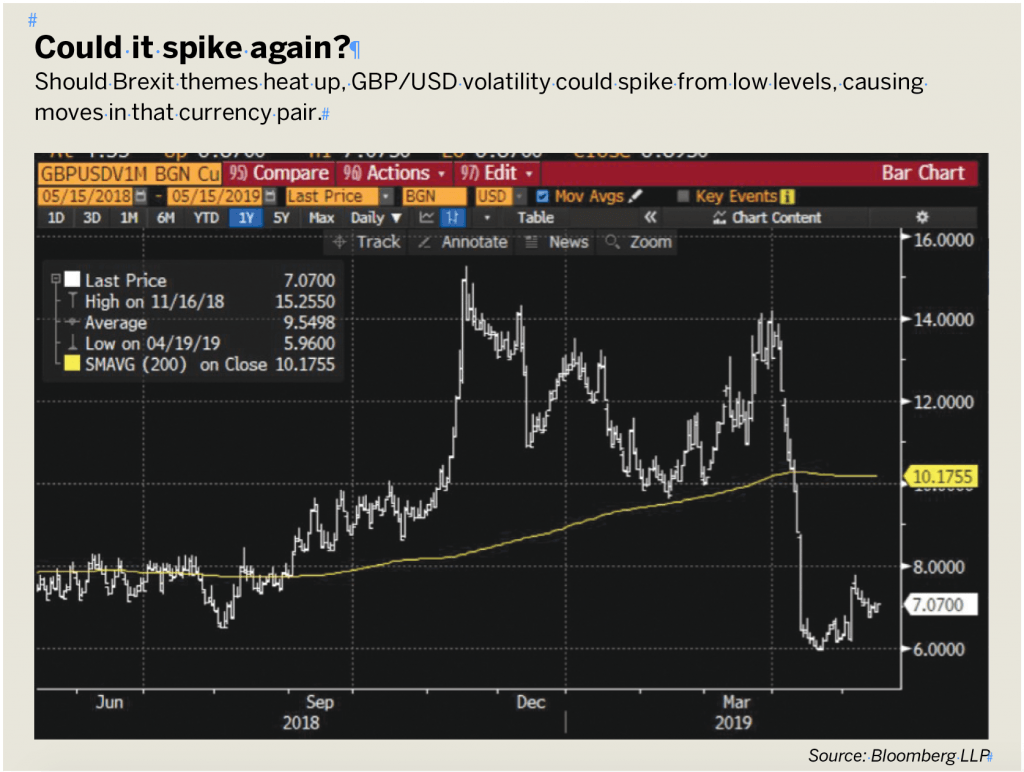

Tracking broader event risk into the back half of this year, another unresolved macro theme lurks in the background—Brexit. In April, the European Union and

At the time of writing, Theresa May had just announced her resignation as the U.K.’s prime minister and parliamentary cross-party Brexit negotiations were in a stalemate. While no one knows the outcome in advance, investors do know that important and unresolved political events that influence economies tend to create market volatility.

After the April 10 announcement that the U.K. would delay Brexit until Oct. 31, the British pound/U.S. dollar (GBP/USD) currency pair implied volatility plummeted as traders became unsure of near-term drivers for the currency. Should Brexit themes heat up, GBP/USD volatility could spike from low levels, causing moves in that currency pair (See “Could it spike again?” below).

Taking a look at narrow or shorter-term event risk, the macro theme that will likely keep repeating for the rest of 2019 is volatility around Federal Reserve press conferences. These shorter-term event risks provide opportunities for more tactical trading. Federal Reserve Chairman Jerome Powell doesn’t seem to have found his footing yet on the market communication front. In addition, this is the first year that the Fed has moved to hold press conferences after every policy decision, leaving room for more instances of communication error.

Lastly, there’s a debate on whether the U.S. economy is in the midst of some late cycle growth resiliency or is starting a bit of a growth resurgence. All of these unknows should keep investors engaged and lead to flairs in volatility.

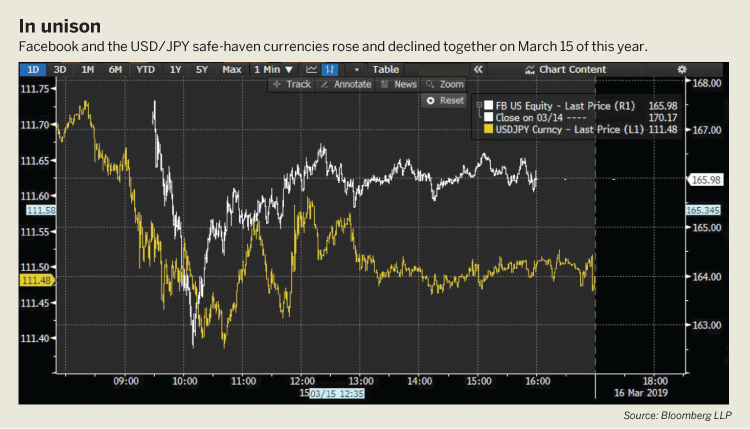

Markets don’t like uncertainty and so safe haven assets tend to benefit in those times. The safe haven currency JPY has been strengthening against USD during spikes in volatility and should continue to do so. With all of the unknowns ahead, buy a 104.00, three-month U.S. dollar/Japanese yen (USD/JPY) put.

Amelia Bourdeau is CEO at marketcompassllc.com,

an advisory firm that provides global macro education and trading strategy to investors at every level.

@ameliabourdeau