Trades

Kickoff to Q4 Earnings Season

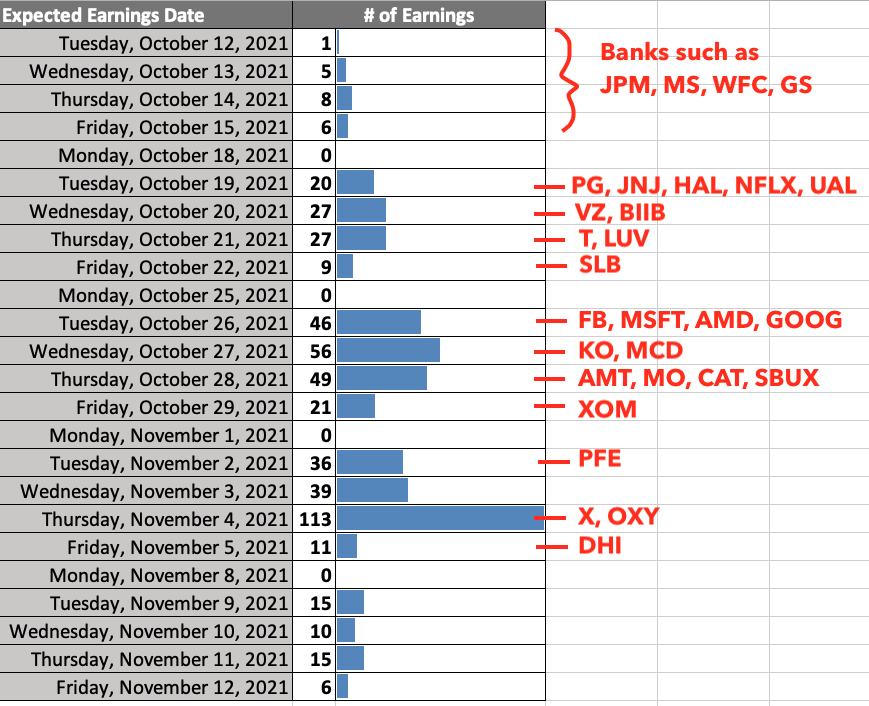

Earnings: Daily Breakdown

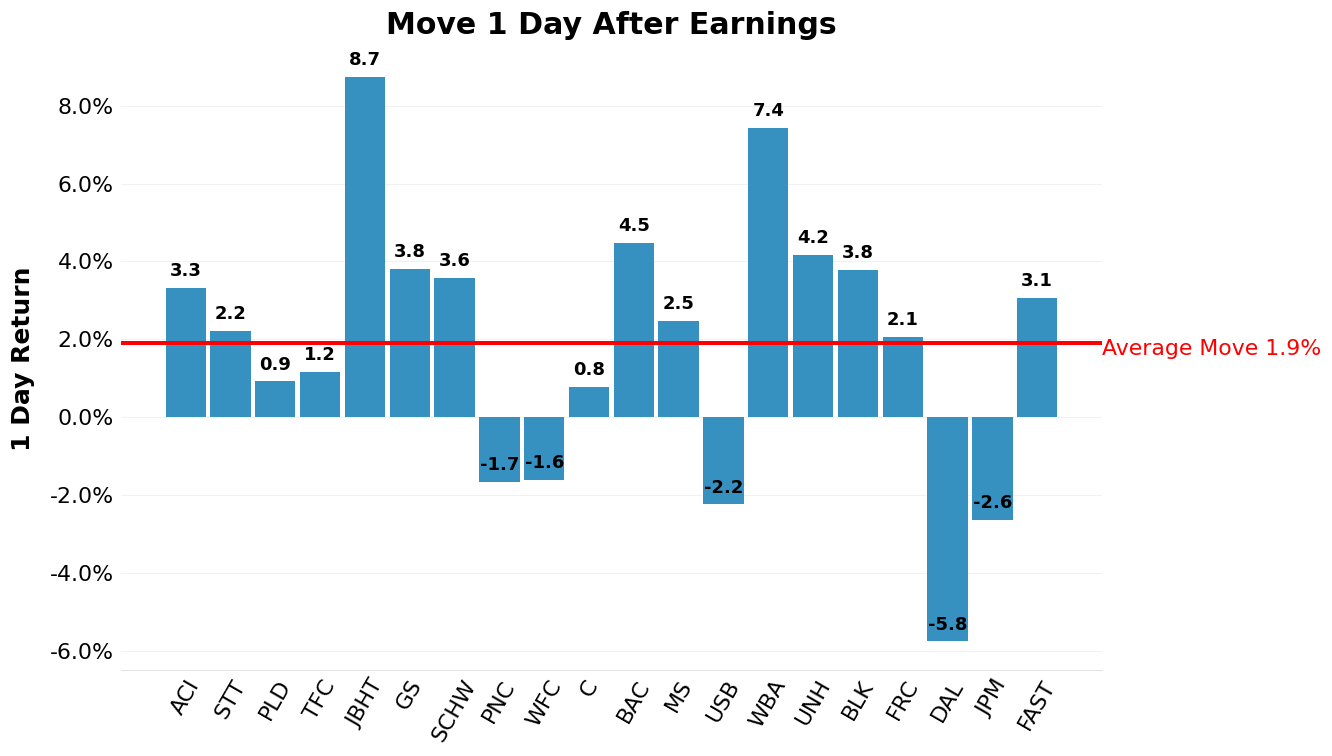

Earning Season “officially” begins with the big banks. Expect to see the bulk of earnings at the end of this month and beginning of next. One way to play earning stocks is to look for a “volatility crush” that tends to happen immediately after the release of the earning announcement. This is usually done with a short strangle or iron condor using the weekly expiration. Always keep positions small.

Examine the risk and probabilities using tastytrade’s free backtesting platform: lookback.tastytrade.com.

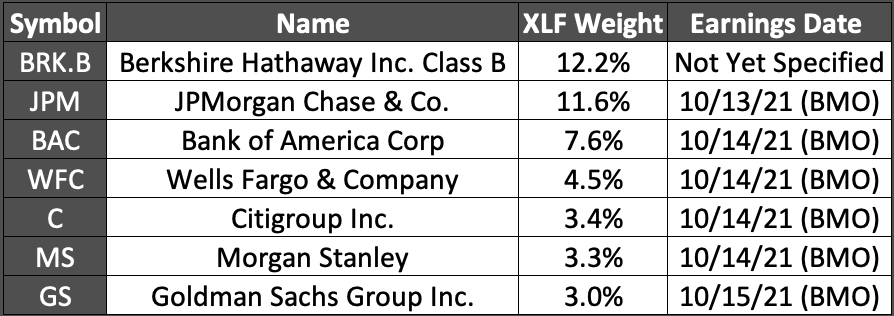

Financials Up First

Most of the major banks report earnings this week, with the exception of Berkshire Hathaway (BRK.B). These major banks make up a large percentage of the S&P Financial ETF (XLF) which has a current implied volatity rank of 26. XLF may move this week if we see large moves in these banks.

Download the Earnings as a Spreadsheet

If you would like the full list of upcoming earnings, click here!

The free weekly Cherry Picks newsletter from tastytrade is stuffed with market research studies, data-driven trade ideas, and unique insights from the geekiest of geeks. Conquer the market with confidence … get Cherry Picks today!

Cherry Picks is written in collaboration with Michael Rechenthin, PhD, Head of Research and Development at tastytrade; and James Blakeway, CEO of Quiet Foundation, a data science-driven subsidiary of tastytrade.

Cherry Picks

-

12 of the Most Boring Stocks

|Traders are not a monolithic group. Some have a high risk tolerance, while others are more risk averse. Those with higher risk tolerance would probably prefer to trade TSLA, while… -

Yields and Historical Volatilities

|Yields Below, check out the 2-, 5-,10-, 20-, and the 30-year Treasury yield to maturity. To see how the yields have changed, look at the different color lines. The 30-year… -

Sizing Futures and Holiday Movement

|Futures sizes? We got the hook up for you! Don’t trade without knowing the true size. That said, futures are extremely capital efficient. Black Swan Black Fridays Most traders anticipated… -

Straddle Up

|When you’re expecting a big price move but aren’t certain of the direction Implied volatility is one of the most useful metrics to consider when looking at a stock’s movement.… -

Index Breakdowns and Implied Volatilities

|The S&P 500’s Expected Move From now until the end of the year the S&P 500 is projected to move somewhere around ±6%. This is the theoretical expected price range… -

Tom Sosnoff’s Current Outlook, Trade Ideas and Crypto Moves

|Tom Sosnoff’s Portfolio and Potential Trade Ideas We asked Tom his current outlook on various markets right now, here’s what he had to say: Short: Nasdaq-100, Chip stocks, Bonds Neutral:… -

Recent Earnings Moves and a Cheaper Gold Alternative

|Earning season so far Fifty-one percent of symbols were positive after the release of recent earnings. Below are the stocks with the biggest shocks this season. Looking for a lower… -

Asymmetric Leverage, Plus the Current IV & IVR Landscape

|Asymmetric Leverage If you lose 50% in a trade, you’ll need a 100% return on the next trade, just to breakeven. Here is the math: Required Gain to Breakeven =… -

Where the Action Is

|Understanding volatility helps traders manage risk. Here’s how sectors and indexes compare for their tendency to move in price. Volatility is synonymous with the probability of movement. Consistently volatile sectors,… -

Problems with BITO, the ProShares Bitcoin ETF

|BITO is not a suitable long-term investment The ProShares Bitcoin ETF (BITO) started trading today. According to the prospectus, it does not invest directly in bitcoin. Instead it uses the… -

Recent Volatile ETFs and 2021’s Current Winning and Losing Stocks

|Most and Least Volatile Equity ETFs Below we sorted the sector and index ETFs from high to low for each week. Oil ETFs (not surprisingly) are consistently, week after week,… -

Metals, Yields, and Trades Ideas

|Metals Metals are moving. Perhaps this can be explained by metals becoming less attractive as Treasury Yields are increasing. Metals, after all, are non-interest bearing. This can be seen below… -

Sector ETF Slumps, Volatility Curve and Debt Instruments

|Monday Sector ETF Slumps With last Monday’s large sell off, the hardest hit sectors in the S&P 500 were Energy, Financials and Consumer Discretionary. Volatility Curve Below is a current… -

No Crypto? Consider These Proxies

|Cryptos have a weak relationship with the major equity indexes. Anything between -0.15 and 0.15 is considered to have no relationship. Digital currency’s correlation with the S&P 500 is 0.13,… -

Lookback: Introducing Options Backtesting by tastytrade

|Lookback is now live and open to everyone—you just need a tastytrade account. Perform Option Analysis, Backtest using historical data, expected trade simulation and projection using the Black-Scholes algo, plus… -

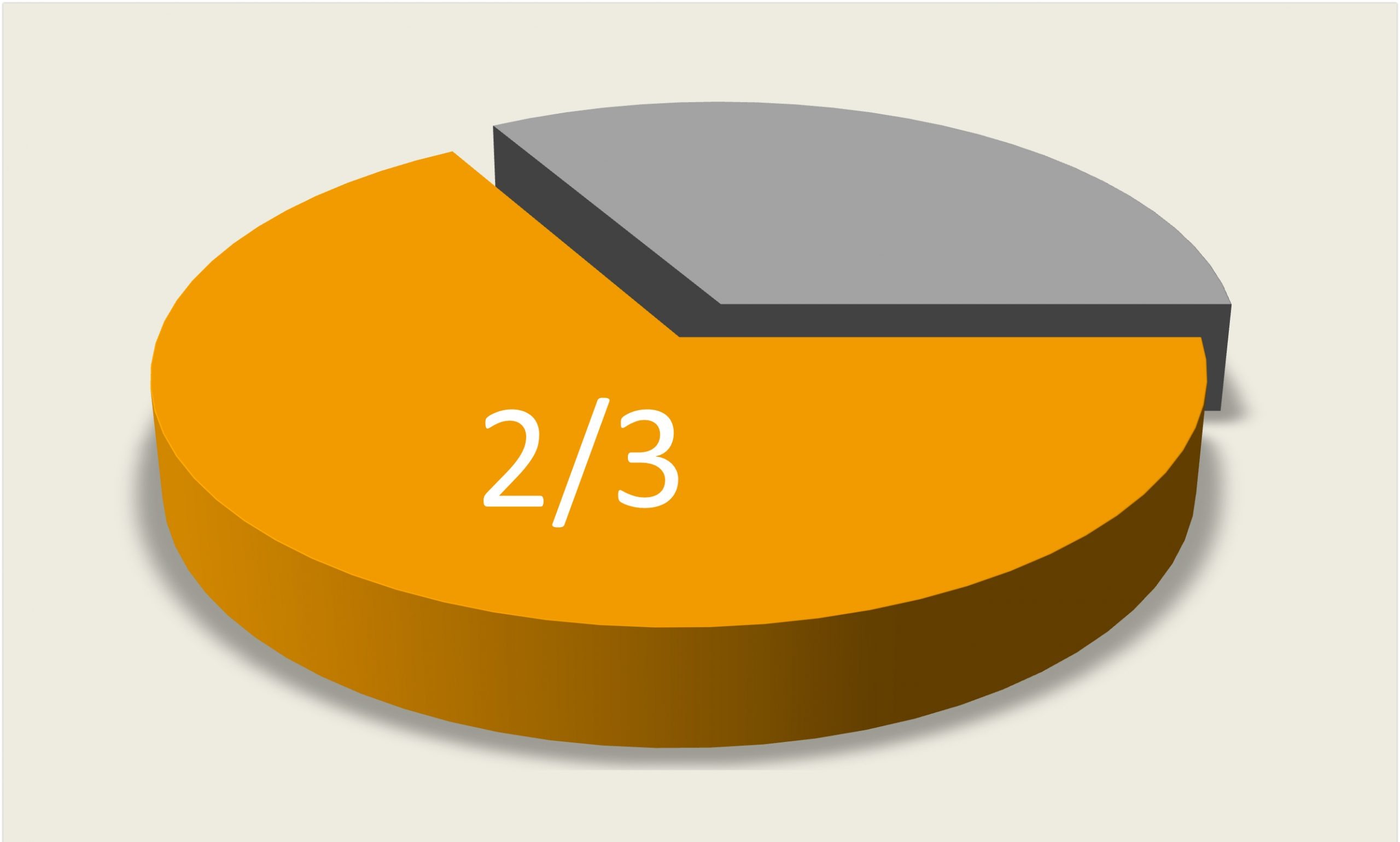

Two-Thirds In

|The S&P 500 rallied over 20% for the first 8 months of the year, the largest such rally for the first two thirds of the year since 1997. The historical… -

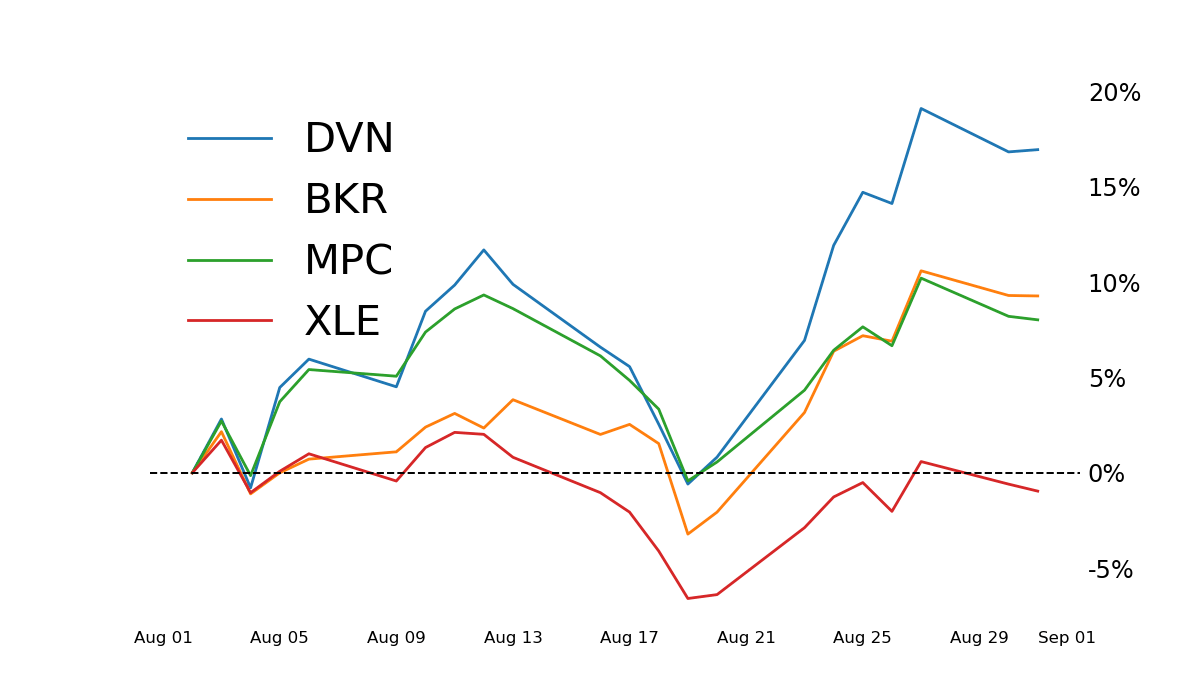

Stocks and ETFs to Trade Gold and Energy

|Gold Bug? Gold is down 8% over the past year; many gold stocks are down even more. For the Gold Miner ETFs, take a look at GDX and GDXJ. For… -

Recent Futures Ranges & Trade Ideas in Chinese Stocks

|Popular Futures Contracts: Intra-day, Median High-to-Low Ranges Per Month Check out Oil— huge moves in the month of August (see the Small Exchange’s /SMO contract for a 100 barrel alternative).… -

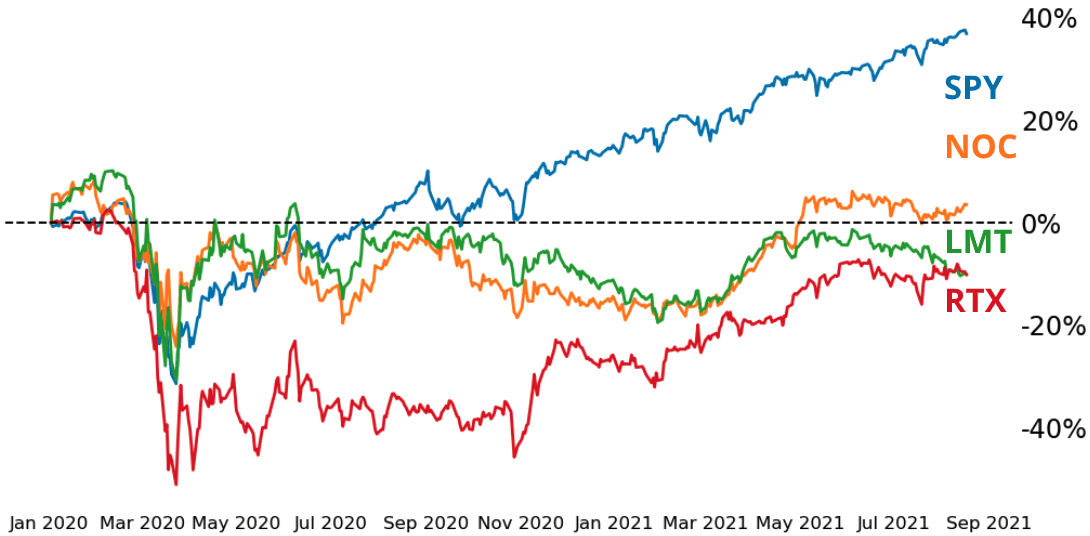

Earnings Impact and a Look at Defense Stocks

|Home Depot (HD) and Walmart (WMT) earnings were this morning. Lowe’s (LOW) and Target (TGT) is tomorrow. Download the full list here. Defense Stocks Three companies that are often synonymous… -

Futures-to-ETF Cheat Sheet

|Here’s a handy guide to convert your favorite futures to ETFs! The free weekly Cherry Picks newsletter from tastytrade is stuffed with market research studies, data-driven trade ideas, and unique…