Canon Poised to Compete in the Chipmaking Industry Against ASML

Canon has devised a new approach to lithography, and is poised to expand its role in the chip manufacturing industry.

- Canon recently announced that it had devised a new approach to lithography, the latter of which is a critical part of the chip making process.

- Canon has indicated that its platform reduces costs by as much as 40%, and requires 90% less energy.

- Canon currently controls about 30% of the lithography market, and is hoping this new approach will help the company expand its role in the chip manufacturing industry.

If there was an award for the “comeback player of the year” in the business world, Canon (CAJPY) might be one of the top candidates in 2023.

In mid-October, Canon announced it had designed and created a new lithography system—the latter of which represents a critical process in the manufacturing of advanced semiconductors.

Lithography—also known as photolithography or optical lithography—refers to the transference of circuitry patterns onto silicon wafers. This is a crucial step in the production of the microchips, because the accuracy and resolution of the lithography process directly impacts the quality and performance of the chips.

As it stands, the Dutch company ASML Holding (ASML) has a stranglehold on this niche of the technology sector, controlling more than 60% of the market. That reality probably helps explain why shares of ASML are up roughly 325% over the last five years.

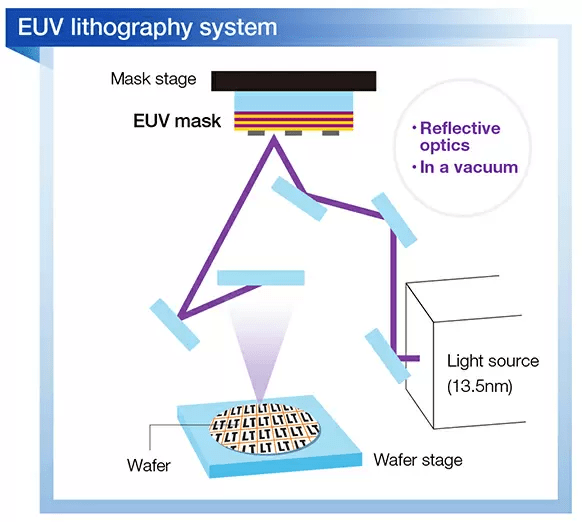

Back in 2010, ASML introduced what’s become the gold standard in lithography—a technology known as extreme ultraviolet (EUV) lithography. EUV lithography enables finer feature sizes and greater detail, which ultimately allows for higher precision etching on silicon wafers.

Moreover, the successful commercialization of EUV technology has helped enable the continued miniaturization of microchips, allowing for greater efficiency and power in smaller and smaller packages.

That trend is typically referred to as “Moore’s Law,” which stems from Gordon Moore’s observation back in 1965 that the number of transistors on a microchip tend to double every two years.

Considering their key role in the chipmaking process, these machines are expensive.

Customers of ASML, such as Intel (INTC), Samsung (SSNLF) and Taiwan Semiconductor Manufacturing (TSMC), pay upwards of $135 million per machine.

Canon’s New Innovative Approach to Lithography

Prior to the emergence of ASML in 2010, two Japanese companies—Canon (CAJPY) and Nikon (NINOY)—were the dominant players in the lithography business.

Today, however, their respective market shares have dropped to 31% (Canon) and 7% (Nikon). But based on recent developments, there’s a good chance that one (or both) of these companies could re-emerge as a realistic challenger to ASML’s current hegemony.

In mid-October, Canon announced that it had developed a new approach to lithography, which it says greatly reduces the associated costs and requires far less energy as compared to EUV systems. The early figures floated by Canon suggest that their machines are 40% less expensive than ASML’s and require 90% less energy.

Canon refers to its new nanoimprint lithography machine as the “FPA-1200NZ2C,” and says that this system imprints circuit patterns “like a stamp,” instead of etching them with lasers. The company appears confident that this technology can be used to help produce the smallest and most advanced chips (5 nm to 2 nm).

Canon has already started building a new manufacturing facility for these machines, which are expected to be available in early 2025.

That’s the good news. The bad news is there’s no guarantee the industry will adopt Canon’s new standard. At present, most of the industry is already familiar with, and reliant upon, the EUV technology developed by ASML. That means it could take some time for Canon to break through with ASML’s customers.

Moreover, some experts have raised concerns that Canon’s new platform won’t be able to match the quality offered by ASML’s EUV technology, due to the associated “stamping” process.

Importantly, EUV machines optically etch upon the silicon wafers, and don’t touch the wafer directly to imprint their designs. Canon’s approach, on the other hand, requires that the template touch the wafer to imprint the design. And it isn’t clear whether the aforementioned physical contact will adversely affect the precision and accuracy of the process. For smaller chips, this is viewed as potentially problematic.

Engineers at Canon have undoubtedly considered these factors as well, and may have already concluded that the company’s new approach offers the same level of quality as ASML’s, even on the most advanced (and smallest) chips. If that’s the case, Canon may have a winner on its hands.

Assuming that Canon’s assertions about cost and energy savings are accurate, the company might be able to successfully pitch their approach to new customers, and potentially peck away at ASML’s dominant market share.

How traders can proceed

For investors and traders that are bullish on Canon’s chances to compete effectively in this market, shares of Canon may therefore represent an attractive opportunity. Year-to-date, the stock is up 14%, but over the last six months, the stock has traded almost perfectly flat.

That means Canon’s recent lithography announcement hasn’t yet moved the stock. As such, investors and traders entering a long position today wouldn’t theoretically be paying a premium to take a shot on a potential best case scenario.

On the other hand, if Canon’s stock had already rocketed higher, investors and traders new to the stock would arguably be shouldering a high degree of risk. Under that scenario, investors could suffer significant losses if the new venture fails.

But as it is, Canon was founded in 1937, and has operated a profitable enterprise for nearly 90 years. If the new lithography venture fails, it’s hard to imagine Canon succumbing to bankruptcy. And as of right now, there’s no premium built into the stock in terms of future expectations.

Of course, there’s risk in any market position, including shares of Canon at current levels. If the stock market enters a correction, shares in Canon would undoubtedly pull back in sympathy with the broader market. However, under that scenario, virtually all stocks would be susceptible to the same risk.

Of course, if one is bearish on the markets after the recent run-up, he/she may elect to wait for a more opportunistic entry point. It all depends on the investor/trader in question, and his/her outlook, risk profile and strategic approach.

To follow everything moving the markets, including the options markets, tune into tastylive—weekdays from 7 a.m. to 4 p.m. CDT.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor Luckbox Magazine.

For daily financial market news and commentary, visit the News & Insights page at tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.