Auto Show: Ford vs. Tata

In November 2019, Mustang enthusiasts gawked and cringed when Ford (F) unveiled the latest addition to the Mustang lineup: the Mach-E. It wasn’t a louder, faster, 550-horsepower V8 pony car, but rather a silent, all-electric SUV. While this left Mustang purists confused, some outside observers saw it as a logical move for Ford.

Most car makers, especially luxury brands, are expanding their SUV offerings. Twelve years ago, BMW offered consumers only two SUVs—the X3 and the X5. Now, that line has expanded to seven X models. Similarly, Mercedes-Benz now offers seven SUVs, with two more on the way.

At Tesla (TSLA), which makes only electric vehicles, models have been proliferating. In 2013, the company made just one model, the Model S sedan, and sold under 17,000 cars. Fast-forward to 2019, and Tesla sold 97,000 cars in Q3 alone. While sales grew for the Model S and the newer Model X SUV, the bulk of sales, 79,600, were of their latest economical sedan, the Model 3. The Model 3, a cheaper and smaller alternative to Tesla’s pricier vehicles, has been a hit with consumers, selling 403,000 units since its launch in 2017. In 2020, Tesla is scheduled to start selling the Model Y, a smaller, cheaper SUV. The Model Y will compete directly with the electric Mustang SUV.

Shifting to the financial outlook of the top automotive players, Ford has struggled to maintain consistent net income for shareholders. While the stock recovered from the 2008 financial crisis, it saw steady declines from 2014 to present. Despite Tesla’s growing popularity, the company has yet to generate an annual positive earnings per share. While the stock saw a rally in 2013 and again in 2017, it’s been a nail-biting, long-term investment with excessive volatility. Active traders rejoiced in the two-sided action, making TSLA a compelling trading vehicle for those who can stomach the swings.

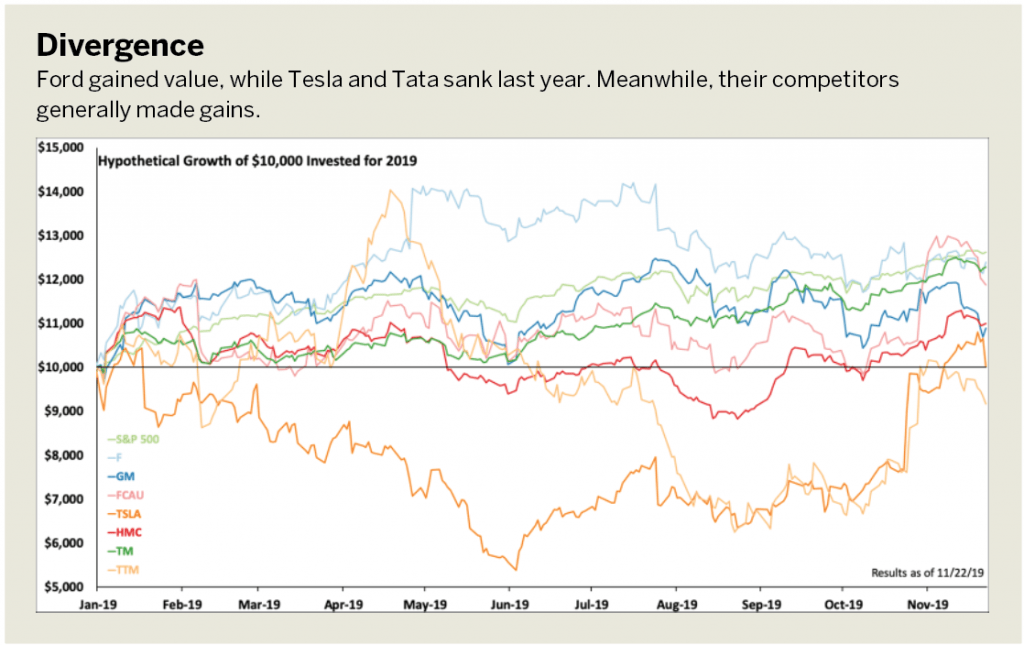

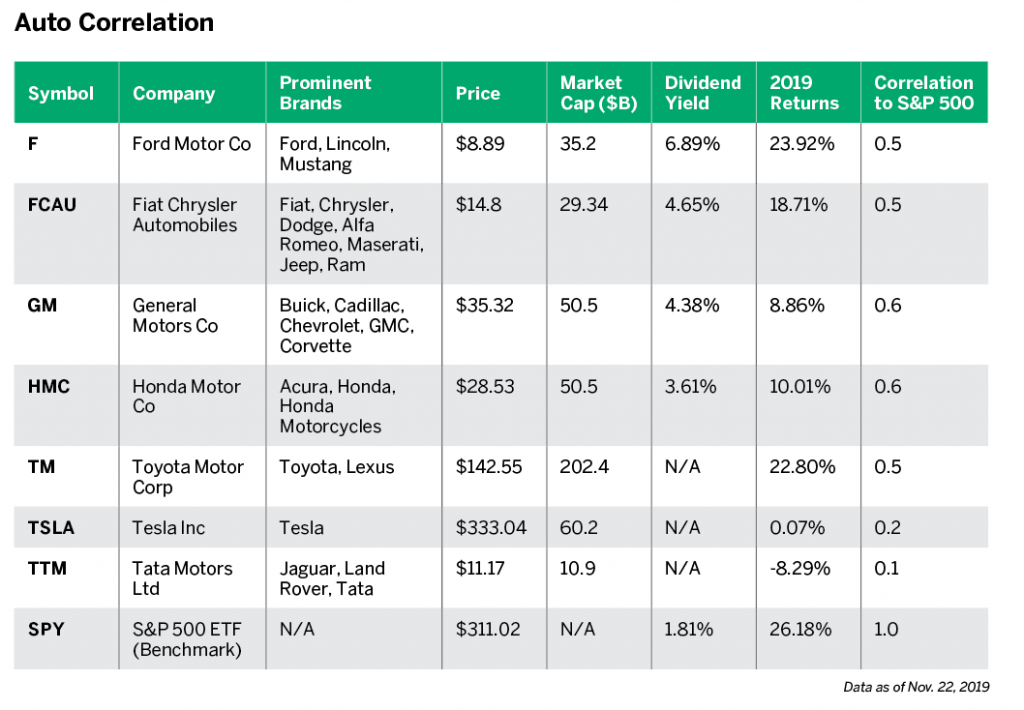

But what about the rest of the automotive sector? In a year with aggressive growth in the U.S. stock market, with the S&P 500 up over 25%, the automotive industry saw mixed returns. Consider the table and graph, which reflect the performance of publicly traded automotive companies, both U.S. and international.

During the observed period, all seven manufacturers fell short of the S&P 500’s growth. Tata Motors, the parent company for Jaguar-Land Rover, slumped in Q3 but recovered most of its losses. Tesla’s stock struggled for most of 2019, finally catching a break thanks to a positive quarterly net income and strong sales numbers reported at the end of October. This recovery was negated after the unveiling of Tesla’s new model, a polygonal, Blade Runner-inspired pickup truck.

An equally weighted portfolio of these seven automotive stocks purchased at the beginning of 2019 would have returned 10.8%, compared to the S&P’s 26.2%. A portfolio of the stocks, weighted by market cap, would have returned a slightly higher 15.7%, thanks to Toyota’s larger allocation in the weighted portfolio. Overall, the auto manufacturing sector is lagging behind the broad market.

Further insight was obtained by running the equally weighted portfolio through Quiet Foundation’s free portfolio analysis software. The analysis revealed the portfolio’s overall correlation to the S&P 500 was 0.45, a fairly low correlation. The least correlated were Tesla (0.2) and Tata Motors (TTM) (0.1).

Given the lower correlations to the overall market, auto stocks could make a compelling addition to a diverse portfolio. While uncertainty surrounding global trade wars and warnings of a potential economic slowdown could make investors skittish about buying into an already lagging industry, it may be worthwhile for investors to monitor the auto industry in the event of a downturn. If the S&P 500 starts to fall, stocks like Apple (APPL), Microsoft (MSFT) and Facebook (FB), that make up large percentages of the index, could fall to rational prices. These stocks would likely drag down the rest of the market with them, meaning auto stocks could become undervalued by the market, creating a potential buying opportunity.

In the crisis of 2008, “The Big Three” U.S. automakers (Ford, Chrysler and GM) were bailed out by the U.S. government and ultimately survived, recovering in the last decade. While these companies are hopefully more recession-proof than 10 years ago, the government may be less willing to step in a second time around. As a result, investors tempted to dive into these stocks may look to diversify across multiple auto companies. Unfortunately, the sector is not well covered by the exchange-traded fund (ETF) industry. The First Trust NASDAQ Global Auto Index Fund (CARZ, $33.74) is one possible investment choice for adding automotive stocks. However, the fund is fairly illiquid, with very few shares traded—an average of 3,350 per day last year. That could make it harder for investors to exit positions when capturing profits or mitigating losses. Investors could instead consider creating their own diversification, using multiple stocks across the industry.

Opportunity may or may not present itself in the auto manufacturers, but it is a sector worth watching. As always, investors should stay nimble and remain patient but, most important, do their due diligence.

James Blakeway serves as CEO of Quiet Foundation, a data science-driven subsidiary of tastytrade that provides fee-free investment analysis services for self-directed investors.

Past performance is no guarantee of future results. Information provided in an EPI Report does not consider the specific profile, objectives or circumstances of any particular investor or suggest any specific course of action. Investment decisions should be made based on an investor’s objectives and circumstances and in consultation with his or her investment professional. Investment suitability must be independently determined for each individual investor. QF does not make suitability determinations or investment recommendations for investors. EPI utilizes the S&P 500 as its benchmark given that the S&P 500 is considered a barometer of stock performance in the United States. Aspects of the analysis and information found in an EPI Report are based upon simulated and/or hypothetical performance. Simulated and hypothetical performance have inherent limitations and do not represent the actual performance results of any particular investment products. The EPI Report does not guarantee any results or outcomes in the financial markets. Investors should be aware of the methodology used to produce an EPI Report and the inherent limitations when placing reliance on the results. For additional information about EPI Reports, visit the QF website: quietfoundation.com.