Bump Stocks & Biden

On that historic night in November 2016 when Donald Trump beat Hillary Clinton for the presidency, traders weren’t glued to news networks but instead to their trading platforms. As news rolled in that Trump had won enough Electoral College votes to clinch the White House, the S&P 500 futures dropped more than 5% in the overnight session. As reality set in, investors realized that this was a gross overaction to a newly elected president, Democratic or Republican. So, the futures started to climb back. By the time the market closed the day after the election, the S&P 500 gained over 1%.

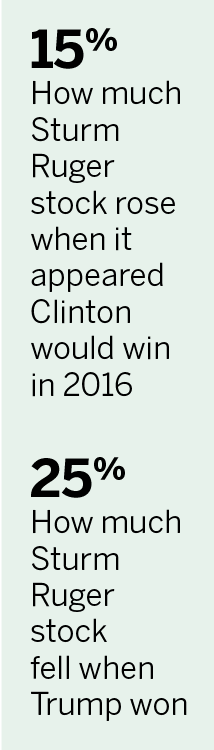

Moving away from the broad market, consider two specific stocks and their movement around the 2016 election: Sturm, Ruger & Co. (RGR) and American Outdoor Brands Corp. (SWBI). Both are large firearms manufacturers. American Outdoor is the parent company of the better-known Smith and Wesson brand. Leading up to the 2016 election, both Ruger and American Outdoor saw gains in their stock prices. That was attributed to the belief that Hillary Clinton would win the presidency and be tougher on gun rights, potentially making it harder to acquire firearms. Thus, traders assumed consumers would quickly buy more firearms immediately after Clinton was elected. In the month preceding the 2016 election, Ruger and American Outdoor rallied 15% and 12%, respectively. After it was confirmed that Trump won the White House, both gun stocks dropped more than 25% in just three days.

What insight does that anecdote impart to traders? Elections can move markets, based on knee-jerk volatility or predicated on slightly more logical, fundamental projections of what a new administration means for a specific industry. As the 2020 election inches closer, models show Joe Biden and Kamala Harris likely to take the White House. At the time of writing, The Economist shows an 89% chance of Biden winning. While investors can make only limited preparations for heightened volatility and the large intraday swings that could come in November, they can position their stock portfolios for more fundamental investments that the election will likely affect.

Firearms stocks

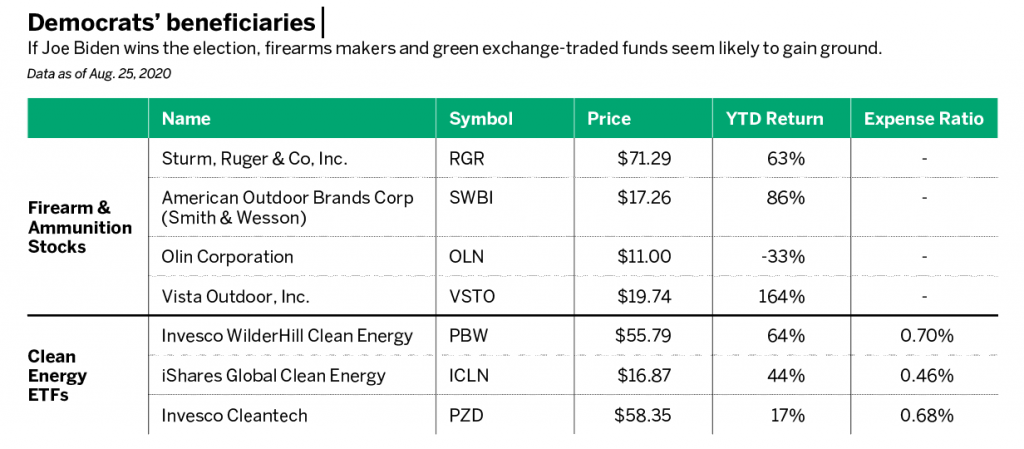

Naturally, the firearms industry is worth considering again in 2020. Both Ruger and American Outdoor have seen large gains this year, but the pullback in late August may present investors with a buying opportunity if they believe a Biden-Harris White House is looking more certain.

Two other stocks for investors to consider adding to their arsenal are Olin Corp. (OLN) and Vista Outdoor Inc. (VSTO). Olin, a large chemicals manufacturer, also operates a sizeable ammunition business that’s grown during the Afghan and Iraq wars. Vista Outdoor also manufactures ammunition, and several of its subsidiaries focus on firearms accessories. Firearm stocks aren’t guaranteed to jump on a Biden win, but investors could look to diversify across these companies. In an ideal world, investors would use a firearm exchange-traded fund (ETF) to gain exposure to multiple stocks in the industry. Given the lack of a gun ETF, investors who believe Biden will win could consider breaking up a portion of their capital across these four stocks. That way they will feel less anxiety about whether they have picked “the right gun stock,” and any profits or losses are distributed across a more diversified portfolio.

Clean energy stocks

Another industry that could experience a boost under a Biden White House is clean energy. Democrats were frustrated when President Trump pulled the United States out of the Paris Climate Accord in 2017. His administration rejected the pursuit of clean energy and instead doubled down on burning oil, coal and gas. If Biden becomes president, it’s likely the United States will rejoin the Paris Climate Accord. Biden would probably take executive action to fight climate change and work with Congress to push the nation back toward renewable energy sources.

Investors who think Biden could win the election and lead a green initiative can choose from multiple clean energy ETFs. Using an ETF can help take the guesswork out of selecting specific stocks, given that the fund holds numerous stocks in a particular industry. Consider three clean energy ETFs with different goals: Invesco WilderHill Clean Energy ETF (PBW), iShares Global Clean Energy ETF (ICLN) and Invesco Cleantech ETF (PZD).

The Invesco WilderHill fund and the iShares Global fund both seek to track clean energy indexes, the Wilderhill Clean Energy Index and the S&P Global Clean Energy Index, respectively. Each fund holds a diverse mix of clean energy stocks. An important differentiator is the geographical representation of stocks each fund holds. The Invesco fund currently holds roughly 80% U.S. stocks, while the iShares fund holds 40%. The more global exposure of the iShares fund could make a compelling investment for those looking to diversify with a more non-U.S. focused product. However, given that the proposed goal is to find exposure to stocks that might benefit from a Biden win, the more U.S.-focused Invesco WilderHill fund may represent the better choice.

The Invesco Cleantech fund is another interesting possibility for clean energy exposure. The stocks in that fund must derive at least 50% of revenues from clean energy business operation. A Biden win and bigger push for green energy could mean more companies pivot to green energy, giving this fund more flexibility. As with any ETF purchase, it’s important to consider the goals and expenses of any potential fund. (See Democrats’ Beneficiaries, below.)

While a Biden win looks possible, investors should prepare for all scenarios and have a game plan if positions move against them. Regardless of an investor’s political sentiment, it’s important to diversify and, as always, do due diligence.

James Blakeway serves as CEO of Quiet Foundation, a data science-driven subsidiary of tastytrade that provides fee-free investment analysis services for self-directed investors.@jamesblakeway

Click here to learn how to evaluate any portfolio with Quiet Foundation.