Value is a Relative Term

Emerging financial technology helps proactive investors understand their portfolios

The John Hancock Disciplined Value mutual fund (JDVNX) has seen some good years. The Fund’s portfolio managers have managed the fund using a hybrid quantitative and fundamental stock-picking approach since 2000. Morningstar assigns the fund an “average” return rating and an “above average” risk rating. They award the fund a three-star (neutral) rating out of a possible five stars, but that hasn’t prevented the fund from accumulating more than $14.5 billion in assets from investors willing to delegate their assets to a “pro.”

And why not? Despite the lukewarm rating and the cautionary note that “fees could be more competitive,” Morningstar still declares the fund a “strong option.”

Most individual investors – particularly those invested in mutual funds – have not paid to access Morningstar’s research database. But as financial technology develops, proactive investors have more options to take a comprehensive look under the hood at their own investment portfolios.

One such tool is Quiet Foundation (QF), which provides users a comprehensive portfolio analysis at no cost. The platform employs Exploratory Portfolio Intelligence, a blend of proprietary research, technology and machine learning, to produce six-point analysis rooted in data science. The free service analyzes the user’s portfolio diversification, liquidity and the probability of gains or losses within one year.

The goal is to ensure investors don’t have many surprises. They can simply input stock and mutual fund positions and receive an on-demand customized report detailing the portfolio’s level of risk and potential for reward.

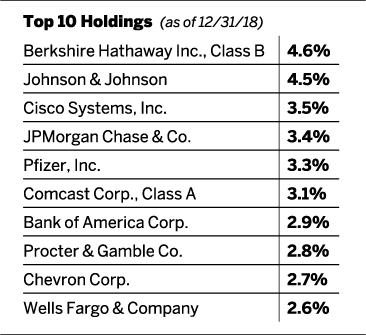

So how does this “disciplined value” approach fare? The JDVNX fund, according to its literature, “seeks capital growth from its equity holdings.”

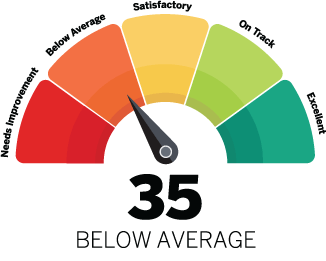

Running JDVNX through the QF analysis, the portfolio scores a “below average” 35 (out of 100). What contributied to this result?

This under-the-hood analysis reveals certain vulnerabilities. To begin with, it strongly correlates (1.03 Beta) with the overall market. There are alternatives to a fund with a lofty expense ratio of 0.69%, including funds that track the S&P 500 Index that may have much lower fees. Nearly half of the 30,000 mutual funds correlate with the S&P 500 – which makes a case that nearly half of all funds provide little or no variation despite having an “industry veteran” at the helm.

Examining JDVNX further, the portfolio-to-benchmark underperforms the market. Not only has it produced lower returns over the past year, but it also has had considerably higher volatility of returns. Specifically, year- over-year, JDVNX has lost -7.5% compared with a -2.3% decline in the S&P 500. The S&P 500 had 19% volatility while JDVNX was sharply higher at 31%. Those factors helped lower the fund’s score.

Another metric from the QF output is a forward-looking metric focused on large moves in the portfolio, compared to the market. The portfolio components are run through thousands of simulations based on projections of where the individual components are expected to fall over the following year. The goal is to see the likelihood of a gain or loss greater than 10%, compared to the S&P 500. JDVNX actually had higher probabilities of movement compared to the S&P 500, which means it’s less likely to be stable.

The QF rating of the JDVNX portfolio, in the context of the neutral rating received from Morningstar, provides another reminder that proactive investors willing to engage in active trading should consider relying upon more than the advice of a broker, or any one research resource – especially as more sophisticated portfolio analysis platforms become available at little or no cost.

Past performance is no guarantee of future results. Information provided in an EPI Report does not consider the specific profile, objectives or circumstances of any particular investor or suggest any specific course of action. Investment decisions should be made based on an investor’s objectives and circumstances and in consultation with his or her investment professional. Investment suitability must be independently determined for each individual investor. QF does not make suitability determinations or investment recommendations for investors. EPI utilizes the S&P 500 as its benchmark given that the S&P 500 is considered a barometer of stock performance in the United States. Aspects of the analysis and information found in an EPI Report is based upon simulated and/or hypothetical performance. Simulated and hypothetical performance have inherent limitations and do not represent the actual performance results of any particular investment products. The EPI Report does not guarantee any results or outcomes in the financial markets. Investors should be aware of the methodology used to produce an EPI Report and the inherent limitations when placing reliance on the results. For additional information about EPI Reports, visit the QF website: quietfoundation.com. Morningstar reports can be found at Morningstar.com

James Blakeway is CEO of Quiet Foundation, a data science-driven subsidiary of tastytrade that provides fee-free investment advisory service for self-directed investors.