Challenges Mount for Automakers

Rising delinquencies and China’s supply are squeezing margins

The post-pandemic years have proved challenging for global automobile manufacturers, especially companies making electric vehicles. Look no further than their share prices for proof.

While both the S&P 500 and Nasdaq 100 have traded to fresh all-time highs, the Global X Autonomous & Electric Vehicles ETF (DRIV) is down more than 25%, and the iShares Self-Driving EV and Tech ETF (IDRV) is down nearly 46% from the November 2021 highs.

A significant precipitating factor for weakness in auto manufacturers’ stock in recent years has been the undoing of pandemic-era supply chain pressures. That process has increased availability of new cars.

Meanwhile, rising interest rates have started to push up auto loan delinquency rates, with 2.66% of auto loans now in “serious delinquency” as of Q4 ’23, up from 2.22% in Q4 ’22, according to the New York Federal Reserve’s latest quarterly report on household debt and credit.

Spreading to used cars

The effects of rising delinquencies and an ample supply of new cars have spilled over into the used car market. Prices there have been receding rapidly, down 13.4% across all models over the past year, according to the Cox Automotive Manheim Index.

Absent a new supply chain crisis, the near-term trend points to a continued increase in relative supply in the global automobile market, keeping downside pressure on vehicle prices—both new and used—in 2024.

Then there’s China and its burgeoning car industry.

The Chinese threat

The oversupply problems seem particularly damaging for U.S.- and European-based companies. The biggest change to the global auto manufacturing industry may not be the undoing of pandemic era supply chain issues, but instead the surge in Chinese automobile (especially EV) production and exports in recent years.

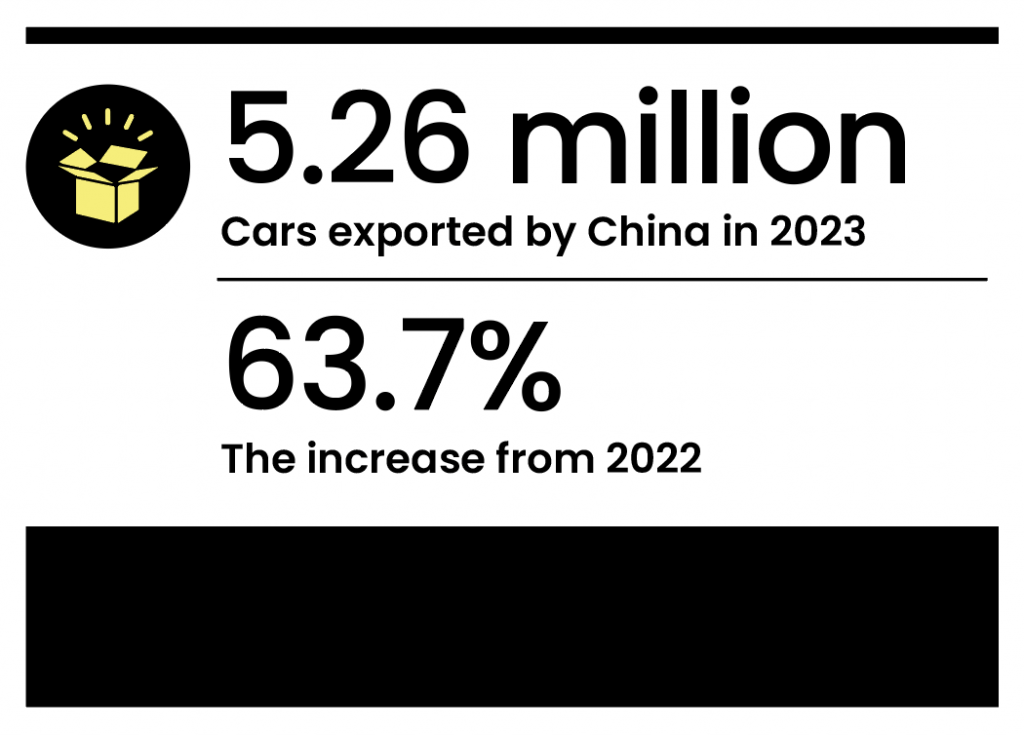

Chinese carmakers produced 30.16 million vehicles in 2023, with 5.26 million units shipped abroad for a staggering 63.7% rise in exports over the previous year. By comparison, the U.S. shipped 1.8 million units abroad in 2023. China has quickly surpassed the U.S., and now is on pace to topple Japan, as the world’s largest exporter of automobiles in the span of a few short years.

So, what kind of vehicles will the Chinese auto industry export for the remainder of 2024 and beyond? Around 50% of them are expected to be EVs, a share likely to increase in the future. Prices of electric vehicles are coming down, which is good for consumers but also means margins on these vehicle sales are in a stable downtrend.

Struggles with their share prices, just like those in Tesla, should not be dismissed lightly. After all, if stocks like Ford (F), General Motors (GM) and Tesla (TSLA), or ETFs like DRIV and IDRV, can’t rally to all-time highs during one of the best bull markets in U.S. equity market history, who’s to say that the future holds more promise given the difficult landscape for global automakers in 2024 and beyond?

Christopher Vecchio, CFA, head of futures and forex at tastylive, forecasts economic trends in a number of countries. @cvecchiofx