Diversify With Alibaba & Baidu

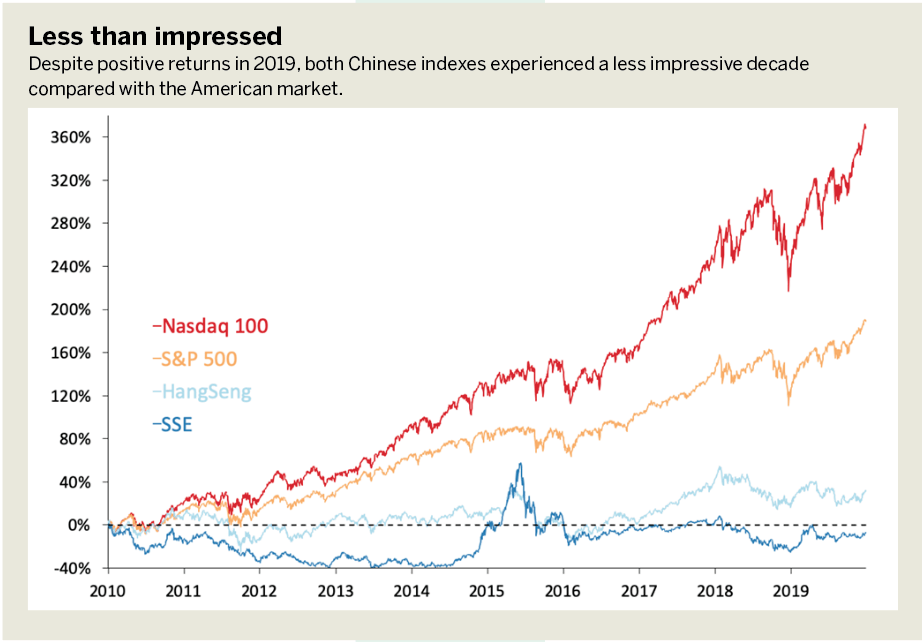

The U.S.-China trade war creates far-reaching ramifications for the economies of both nations. The ebb and flow of negotiations only exacerbates tensions and casts uncertainty on the future. But despite such disputes, the close of 2019 marked the end of a stellar year for U.S. investors. It also capped off an incredible decade for the U.S. stock market. The S&P 500 index grew 29% last year and 190% since the end of 2009. Across the same time frames, the tech-heavy Nasdaq 100 index grew 38% and 369%, respectively.

On the other side of the Pacific, Chinese investors saw sizeable returns in 2019 with the Shanghai Stock Exchange Composite Index (SSE) rallying 22%. The Hong Kong Hang Seng Index lagged behind the mainland, growing 9% by year’s end. Despite the positive returns in 2019, both Chinese indexes experienced a less impressive decade compared with the American market, with both fairly close to where they started in 2010. (See “Less than impressed,” below.)

The Chinese market’s underperformance over the last decade may present opportunities for investors. Aggressive investors and traders may choose to deal with individual Chinese stocks because many are available as American Depository Receipts (ADRs). ADRs represent foreign stocks that are traded at U.S. exchanges. Two popular Chinese firms, for which ADRs are traded, are Baidu Inc. (BIDU: $138.31) and Alibaba Group (BABA: $219.30).

Baidu, an internet conglomerate, operates the most popular search engine in China and offers other services. Its shares saw negative returns in 2019 after falling from their mid-2018 highs.

Alibaba hit new highs in January after strong returns last year. Alibaba’s primary business is E-commerce, with an emphasis on business-to-business sales.

Shares in both Baidu and Alibaba have become popular trading vehicles over the last few years. Each has liquid option markets with high open interest and volume. The rich option premium and large price movement may be ideal for derivatives traders, but the individual stocks likely won’t add enough diversification to offset the risk for long-term investors. Luckily, investors have multiple choices if they’re looking to add exposure to the Chinese markets with layers of baked-in diversification.

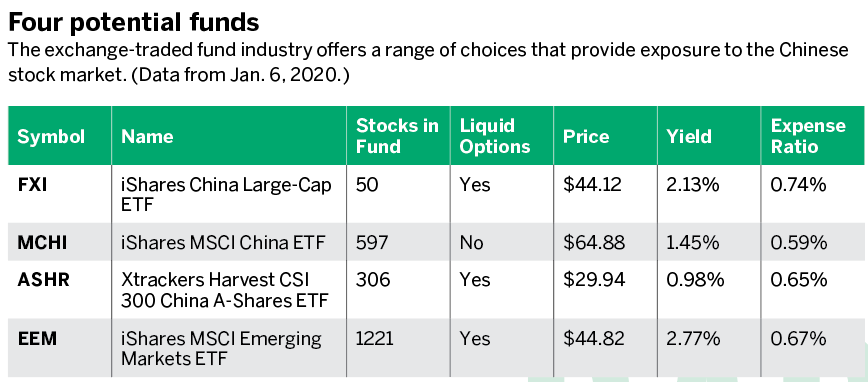

The exchange-traded fund (ETF) industry offers a range of choices that provide exposure to the Chinese stock market. (See “Four potential funds,” below.) The table highlights four potential ETFs that offer interesting diversification possibilities. The ETFs, which are FXI, iShares MCHI, and ASHR, are built to provide exposure to the Chinese stock market. All three hold diversified portfolios, though FXI and ASHR have larger holdings in the financial sector, 46% and 33%, respectively. At 25% of its portfolio, MCHI’s largest sector exposure is consumer cyclical.

The last ETF listed in the table is not strictly a China fund. It’s called iShares MSCI Emerging Markets Index (EEM), and it provides exposure to equity holdings in 12 emerging market countries, including China. The Chinese holdings of EEM constitute 34% of the portfolio, and many of the stocks are the same large Chinese companies in the aforementioned China ETFs. The other 66% of the portfolio comprises more than 700 stocks from emerging market countries. EEM could make for a compelling investment for those looking to diversify with some Chinese exposure but also some broader global assets.

Running an equal-weighted portfolio of these four ETFs through the free Quiet Foundation analysis system yields some interesting metrics. Two areas that stand out are liquidity and opportunity. These ETFs scored high in both categories because of liquid stock and option markets. MCHI scored slightly lower in both categories because of limited available options and a less-liquid share market.

The analysis report indicates the three-month correlation among the four ETFs is high at 0.88. That’s because the portfolios have a concentration of large cap Chinese stocks.

More intriguing was the metric comparing the portfolio to the S&P 500, a correlation of 0.68. From August 2019 through the end of the year, global markets rallied alongside U.S. stock indexes, explaining the high correlation. It’s possible that a drop in U.S. stock indexes would be accompanied by a similar downturn in the Chinese markets.

The global diversification provided by these ETFs does come at a higher cost than typical U.S. sector or index ETFs. All four of these ETFs have expense ratios above 0.5%. However, investors may consider this a fair price, given the international exposure afforded by the funds. These ETFs grant

U.S. investors access to investments they couldn’t make on an individual basis because most foreign stocks are not listed on U.S. exchanges and aren’t available through domestic brokers.

Investors itching for some immediate diversification may find comfort in siphoning off some funds into one of these ETFs. More-skittish investors may hold off if they anticipate a global slump this year. As always, whether investing for the long haul or trading for short term swings, investors should continue to perform their due diligence.

James Blakeway serves as CEO of Quiet Foundation, a data science-driven subsidiary of tastytrade that provides fee-free investment analysis services for self-directed investors. @jamesblakeway