Down But Not Out

When euphoria fades, the hangover may drag down the price of a healthy company’s stock

Technology stocks are taking a hit this year, but it’s important to remember the lessons of history. When fear takes over, prices can fall well below their theoretical value. Some—but not all—will rally back to prior levels.

Think back to the end of the post-dot-com slump in 2002. Stocks were beaten down for nearly two straight years after the peak of the bubble in 2000. Many companies didn’t survive, proving their lofty valuations were nothing but a pipe dream.

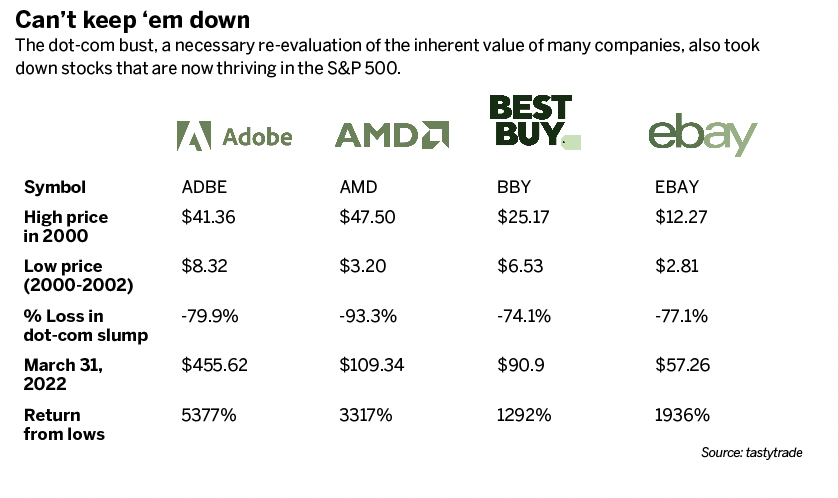

Companies like Pets.com and eToys.com went bankrupt or were bought out. The bubble had to burst to bring on a necessary re-evaluation of the inherent value of many companies, but it also took down legitimate stocks that continued to be profitable and are now powerhouses in the S&P 500.

By the time Adobe (ADBE) hit its $41 peak in November 2000, the company’s PDF technology was 7 years old and its Photoshop software was 11 years old. The company’s stock began the millennium by rallying from below $17 to above $40. But that’s where it ended, as the stock fell precipitously and consistently for nearly two years, bottoming out at $8.32 in August 2002.

In that time frame, earnings remained steady. Some quarters were better than others, but profits were consistent. Adobe, like many other stocks, was dragged down when the end of the dot-com euphoria brought panic selling. Perhaps Adobe wasn’t worth $41 in 2000, but the continued growth of its businesses has turned it into a $206 billion company.

Best Buy (BBY) was also yanked down by the early millennium stock sell-off. By the turn of the century, the company was trading with a price-to-earnings (P/E) ratio of 17, and it now has a P/E ratio around 9. (See Tactics Basic on p. 58 for more on P/E ratios.) Even though Best Buy was possibly overvalued in 2000, it likely didn’t deserve to plummet below $7. Twenty years later, competitors RadioShack and Circuit City were long gone, and Best Buy remains alive and well.

Advanced Micro Devices (AMD) has almost become a household name as consumers scramble for graphics cards to build powerful PCs for gaming and cryptocurrency mining. In 2000, the company was trading at $47 per share and had a P/E ratio of around 37. That P/E ratio is similar to the first quarter of 2022 with the stock’s recent sell-off. The company hit a rough patch in the early 2000s and had some losing quarters in 2001 to 2003. However, investors who believed in the company were handsomely rewarded because the shares trading at $3.20 in 2002 were worth as much as $164 last year.

eBay (EBAY) was founded in 1995 and went public in 1998. After a huge rally in 1999 and another in 2000, the stock peaked just over $12 in March 2000. The company’s collapse came swiftly, with the stock bottoming out at $2.81 in December 2000. While many internet stocks continued to fall throughout 2001 and 2002, eBay found its lows early in the downturn, recovering some of its value in the next two years. While Amazon became the internet shopping sensation and Pinterest brought many small businesses to wider audiences, eBay soldiered on. In 2022, eBay is a $32 billion company, and the stock reached an all-time high last year of more than $80 per share.

So, what’s the moral of the story? While euphoria may cause long periods of stock market rallies, the resulting hangover may drag down legitimate companies with solid business models. Often, stocks fall below their actual value and underrepresent their future potential.

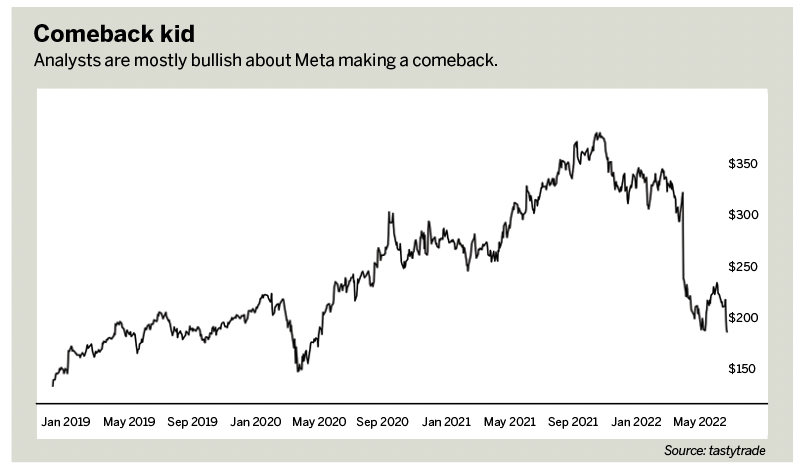

One company that may present a comeback opportunity is Meta Platforms (FB), the parent company of Facebook, Instagram and WhatsApp. Trading around the $200 level in late April, Meta is at about the same price as before the pandemic, except now the company is more profitable. In January, Meta was trading with a P/E ratio around 27, meaning shares were valued at 27 times the earnings for the prior year. In April, the P/E ratio was 16. Wall Street analysts are predominantly bullish about Meta making a comeback. The average buy-side ratings are over $300, meaning analysts anticipate the stock will recover at least half of its losses from that $384 high.

Time will tell if Meta shares can recover to anywhere near prior levels. Investors willing to find out will likely have some rough days ahead as the bears continue to hit tech stocks in 2022. As with those who held onto worthwhile stocks after the dot-com bust, waiting for a Meta revival will take patience.

Buying stocks when others are selling can be a grueling endeavor. Investors are often early to the party and have to endure some downside pain before reaping the benefits of the reversal.

James Blakeway, Luckbox technical editor, serves as CEO of Quiet Foundation, a data science-driven subsidiary of tastytrade that provides fee-free investment analysis and trade ideas for self-directed investors.

@jamesblakeway