Special-Purpose ETFs

Despite the tragic events of the pandemic, many fortunate households have struggled with only one issue: boredom. Working or studying from home, financially stable Americans baked sourdough, flocked to TikTok and hunted down new PlayStations or Xboxes.

But people soon tired of Fortnite and Call of Duty. And with their wallets lined with stimulus cash, many took to the financial markets for the first time. Fueled by Reddit’s WallStreetBets message board, chaos broke out in frenzied trading of stocks such as GameStop (GME) and AMC Theaters (AMC). But as the excitement waned, new market participants joined longtime Wall Streeters in turning their sights to the SPAC market.

Special-purpose acquisition companies, or SPACs, aren’t a Covid-era innovation, but they’re an increasingly popular way for firms to go public. Unlike the Reddit-driven stocks, SPACs provide a bit of sustainable opportunity for investments, instead of just erratic volatility. These “blank check companies,” as they’re sometimes known, compete to find cutting-edge companies that are pioneering technology in a variety of sectors.

That leaves investors with difficult choices. Do they purchase SPACs when they’re still a blank check with no specific company as a merger target? Or do they wait until the merger is complete and hope for continued growth in the company, while potentially missing out on the rally spawned by the initial announcement of the merger?

ETFs to the rescue

Regardless of whether investors buy into the SPAC before or after the merger, narrowing the choice of which stocks to purchase can prove as daunting as any other investment decision. For those looking to reduce analysis paralysis, the exchange-traded fund (ETF) industry once again comes to the rescue, offering investors diversified access to the SPAC market. The markets already offer three prominent SPAC ETFs—two actively managed funds and one passive.

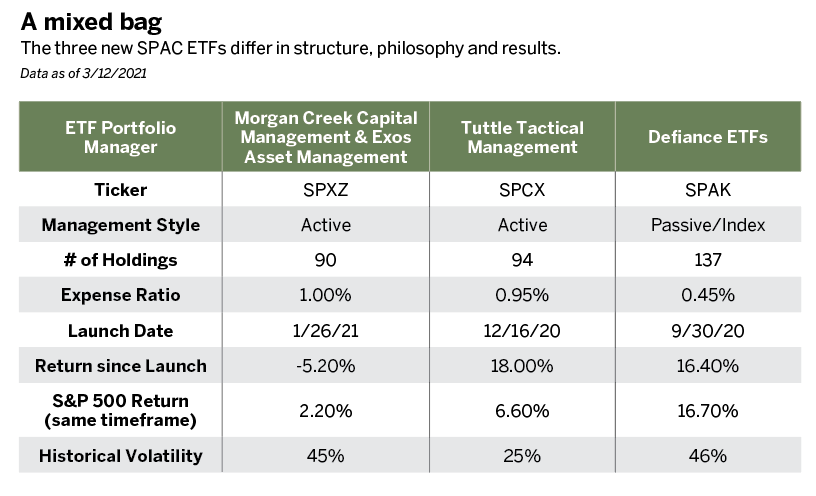

The Tuttle Tactical Management SPAC ETF (SPCX), launched in mid-December, is actively managed and focuses on SPACs still seeking companies to acquire. Investors benefit because the ETF studies blank-check firms, evaluates their management teams and assesses acquisition targets.

A little later to the party, Morgan Creek Capital Management (sub-advised by Exos Asset Management) launched its SPAC ETF (SPXZ) in late January. Taking a slightly different approach from Tuttle, it instead focuses on a blend of SPACs. It maintains approximately 66% of its assets in the largest post-merger SPACs from the last several years, while retaining the other 33% to purchase some of the largest pre-merger SPACs.

Finally, the Defiance ETFs SPAC fund (SPAK), launched in September 2020, tracks an index of SPACs with no active management. The index, and therefore the ETF, focuses on a 60/40 split between post- and pre-merger SPACs, respectively.

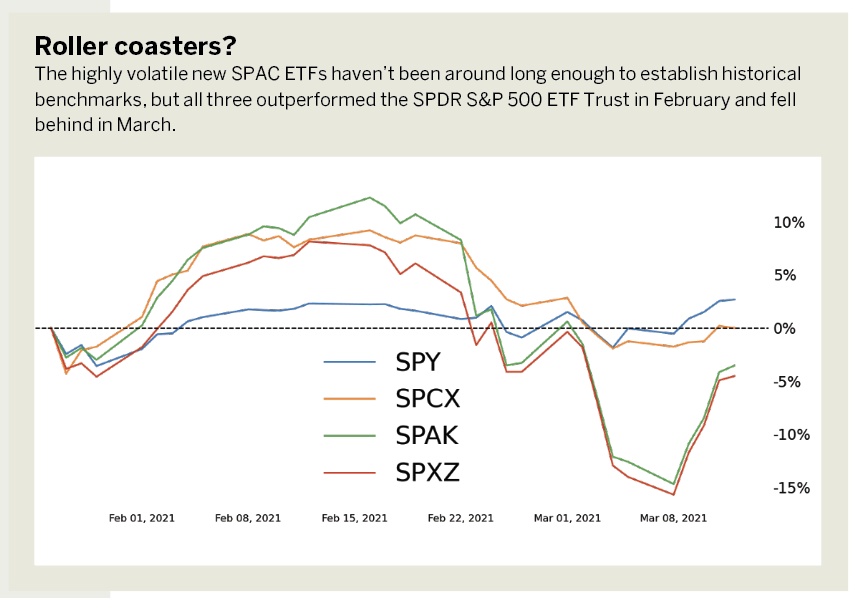

Not much history

All three ETFs are so new that it’s difficult to assess their performance relative to any benchmark. But investors should remember that these are riskier markets, even in ETF form. Recent volatility for all three funds was above the S&P 500, which is expected given the nature of SPACs and the current market enthusiasm, often met with fast selloffs.

That said, the SPAC ETFs offer a lot of internal diversification. Even the Tuttle Tactical fund holds 90 SPACs, more positions than many sector or global ETFs. That reduces the risk of allocating capital to SPACs via these ETFs, enabling investors to gain overall exposure.

Another compelling aspect of this diversification is that SPACs span a variety of industries. While they often focus on new technology, these ETFs provide exposure to pre- and post-merger SPACs in a variety of sub-sectors. More aggressive investors who own specific SPACs, as well as the ETFs, might consider their full exposure if the fund builds a larger position in the same individual name.

As with any ETF, diversification isn’t free. The Defiance ETF fund charges the lowest expense ratio (0.45%), which is expected with an index-based fund. Tuttle Tactical (0.95%) and Morgan Creek (1.00%) charge higher expense ratios to cover the costs of actively managed ETFs. These funds incur expenses for research and operations that an index fund avoids.

Remain vigilant

As with any ETF, investors should be aware of changes in the portfolio and parameters that could have impact down the road. These funds do target certain allocations to pre- and post-merger SPACs, but they also provide caveats in their documentation.

The Tuttle Tactical fund, for example, indicates that it could convert all of its assets into short-term debt securities if market conditions become unfavorable. If that happens, investors who aren’t paying attention would assume they own a SPAC ETF when they’re really holding an overpriced money market fund (that could be losing money).

Investors whose interest in the markets was sparked by the recent SPAC hype may be interested in other growth products. Consider the Vanguard Small-Cap Growth ETF (VBK) and the iShares S&P Small-Cap 600 Growth ETF (IJT). Both outperformed the S&P 500 during the last 10 years and boast expense ratios below 0.2%. While not as flashy as SPACs, these ETFs provide effective low-cost exposure to longer-term growth potential.

For investors looking to jump into SPACs but who are unsure of where to start, the SPAC ETFs could provide a diversified addition to an already balanced portfolio. With the current volatility and frenzied attention to the SPAC space, it’s hard to know the longevity of these products, especially given their recent inception. Investors hoping for huge returns will not find them with these ETFs. The expense ratios pay for thorough diversification, not lottery tickets. Whether they choose a SPAC product, be it a pre-merger company, post-merger company or ETF, investors should take the time for research and consistent due diligence.

James Blakeway serves as CEO of Quiet Foundation, a data science-driven subsidiary of tastytrade that provides fee-free investment analysis services for self-directed investors. @jamesblakeway

Click here to learn how to evaluate any portfolio with Quiet Foundation.