The Fickle Influence of Politics on Stock Prices

Elections affect the markets, sometimes in unpredictable ways

Two years ago, as America geared up for the showdown between incumbent President Donald Trump and former Vice President Joe Biden, this column analyzed the potential impact of the election on stocks and exchange-traded funds (ETFs). The focus was on clean-energy ETFs and manufacturers of firearms and ammunition.

Now, as President Biden’s second year comes to a close and a crucial midterm election nears, let’s examine how those stocks and ETFs have performed since the 2020 election.

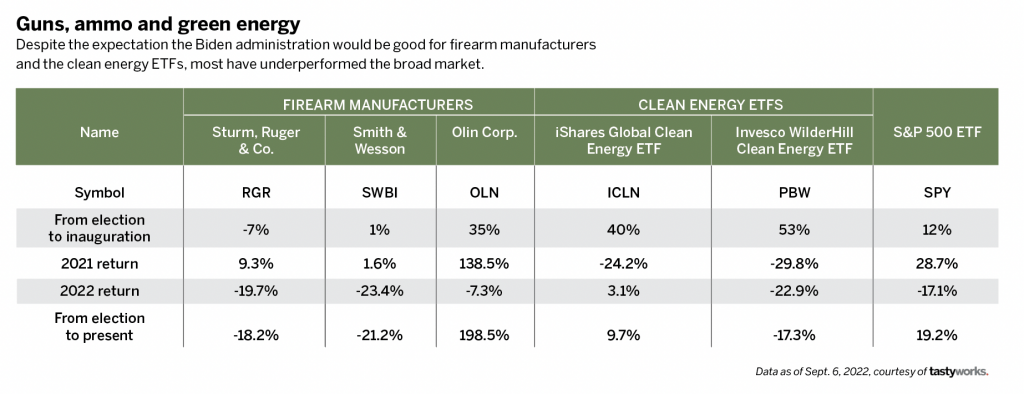

Perhaps counter to what many might have expected, the two firearm stocks under scrutiny—Sturm, Ruger & Co. (RGR) and Smith & Wesson (SWBI)—have not performed that well since the 2020 election of now President Biden.

Both stocks saw positive returns in 2021 but grossly underperformed the broader S&P 500. (See “Guns, ammo and green energy,” below.) This year, Sturm, Ruger & Co. shares are down over 18%, with Smith & Wesson shares down 21%. Despite this year’s market difficulties, the S&P 500 ETF (SPY) is still up over 19% from the election.

But the price action of shares doesn’t always tell the whole story of how a company has performed. Many assumed firearm stocks might rally if the Biden administration and a Democratic Congress tried to curb gun violence by limiting access to firearms. They thought that might lead more Americans to run out and buy guns before it became more difficult.

In fact, Sturm, Ruger & Co.’s financials suggest that’s exactly what transpired. In 2020, revenue for the firearm maker totaled $568.9 million. In 2021, that number grew to $730.7 million, a 28% increase. What’s more, the company’s sales and marketing expenses stayed the same year to year, meaning the company sold more firearms without expending more effort.

Meanwhile, Smith & Wesson saw 2021 revenue leap to $1.06 billion, up 55.8% from $680 million in the previous year. It happened while the company was slashing the cost of selling and marketing to $40 million last year, down from $70 million the year before.

Another company discussed in the 2020 article, Olin Corp. (OLN), manufactures ammunition and owns the Winchester firearm brand. Stock in Olin, which also produces chemicals, rose a truly dramatic 198% since the 2020 election. Winchester sales grew from $927.6 million in 2020 to $1.58 billion in 2021, an increase of 71%. The company’s annual report attributed the growth at Winchester mainly to increased ammunition sales.

Interestingly enough, on Jan. 6, 2021—the day protestors stormed the Capitol—stock in all three companies rallied well above the S&P 500’s 0.6% rise. Smith & Wesson soared 18% that day, while Sturm, Ruger & Co. climbed 12% and Olin increased by 8%.

But reactions to the Biden administration haven’t been limited to the small arms business. The president campaigned on a pledge to work toward a greener future, and he began to make good on that promise by arranging for the U.S. to rejoin the Paris Climate Accords on his first day in office.

Yet, even before that move, the effects of the administration’s energy policies were manifested on Wall Street. iShares Global Clean Energy ETF (ICLN) rallied 40% between election day and Biden’s inauguration. The S&P 500 ETF climbed 12% in the same time frame.

The Invesco WilderHill Clean Energy ETF (PBW) rose a staggering 53% between Biden’s election and inauguration. But by September of this year, the fund gave back all of its gains and was down 17%, losing nearly 30% last year and 23% this year.

Up or down, these stocks and ETFs show how sentiment may shift in certain industries when changes occur in Washington. Spending on firearms and ammunition rose at a dizzying pace in 2021, even if stocks in the manufacturers didn’t reflect the surge. Clean energy got an immediate boost when it became clear Democrats were coming to power but it has ultimately lagged behind the broader market.

Politics can drive markets, but betting on their impact can prove challenging.

James Blakeway, Luckbox technical editor, serves as CEO of Quiet Foundation, a data science-driven subsidiary of tastytrade that provides fee-free investment analysis and trade ideas for self-directed investors.

@jamesblakeway