Don’t Fear a Market’s Uncertainty; Manage It

"The most important thing is never certainty. Certainty comes when it is ready. The most important thing is having a clear and healthy framework for dealing with uncertainty, which is what most of life turns out to be."

– Ethan Nichtern, Buddhist teacher

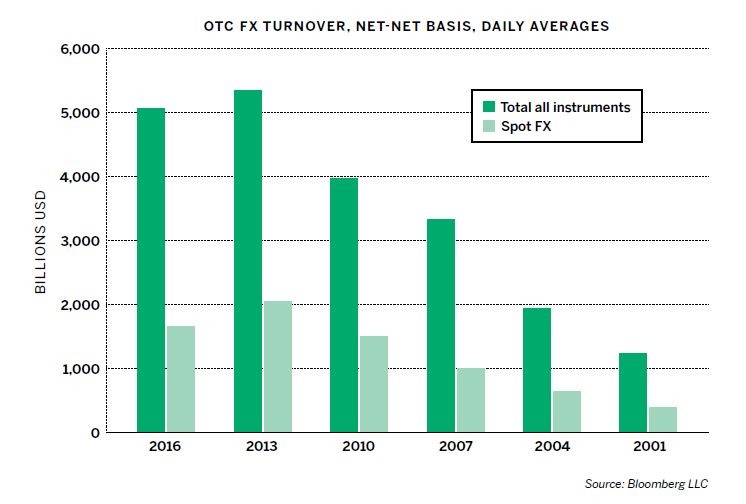

Global macro investors sift through voluminous information from a wide range of economic, geopolitical and market sources to form their trade ideas. That’s why they should consider developing a framework for examining markets. Applying that framework consistently as market conditions change can help them deal with uncertainty.

After all, uncertainty can mean opportunity. In fact, macro traders tend to look for events that could dislocate markets, and they try to find assets that they view as mispriced. So, volatile market conditions can provide an opportunity for macro trading to shine. And the themes that emerge can become important building blocks of a macro framework for examining the markets.

Ferreting out market themes can seem like crossing a river by feeling the stones underfoot. But tracking how the themes develop provides a compass that macro traders can use to initiate or manage positions.

Themes influencing the market for 2019 include mid to late U.S. economic cycle market dynamics, the China growth slowdown, the fate of BREXIT, and the European Union’s growth slowdown and its May parliamentary elections.

In times of noisy and volatile markets, tracking market themes keeps traders open-minded, even when other traders become discouraged and wary of taking risks.

Market themes act as a guide for broad event risk. Some are associated with key dates or timeframes. Macro themes tend to simmer in the back- ground, but they can trigger volatility when they come to the forefront. That’s why market themes have the potential to cause big, directional moves. Those are opportunities to pursue alpha. There’s a saying in macro trading – “never waste a crisis.” Staying on top of market positioning, expectations and commentary on a market theme

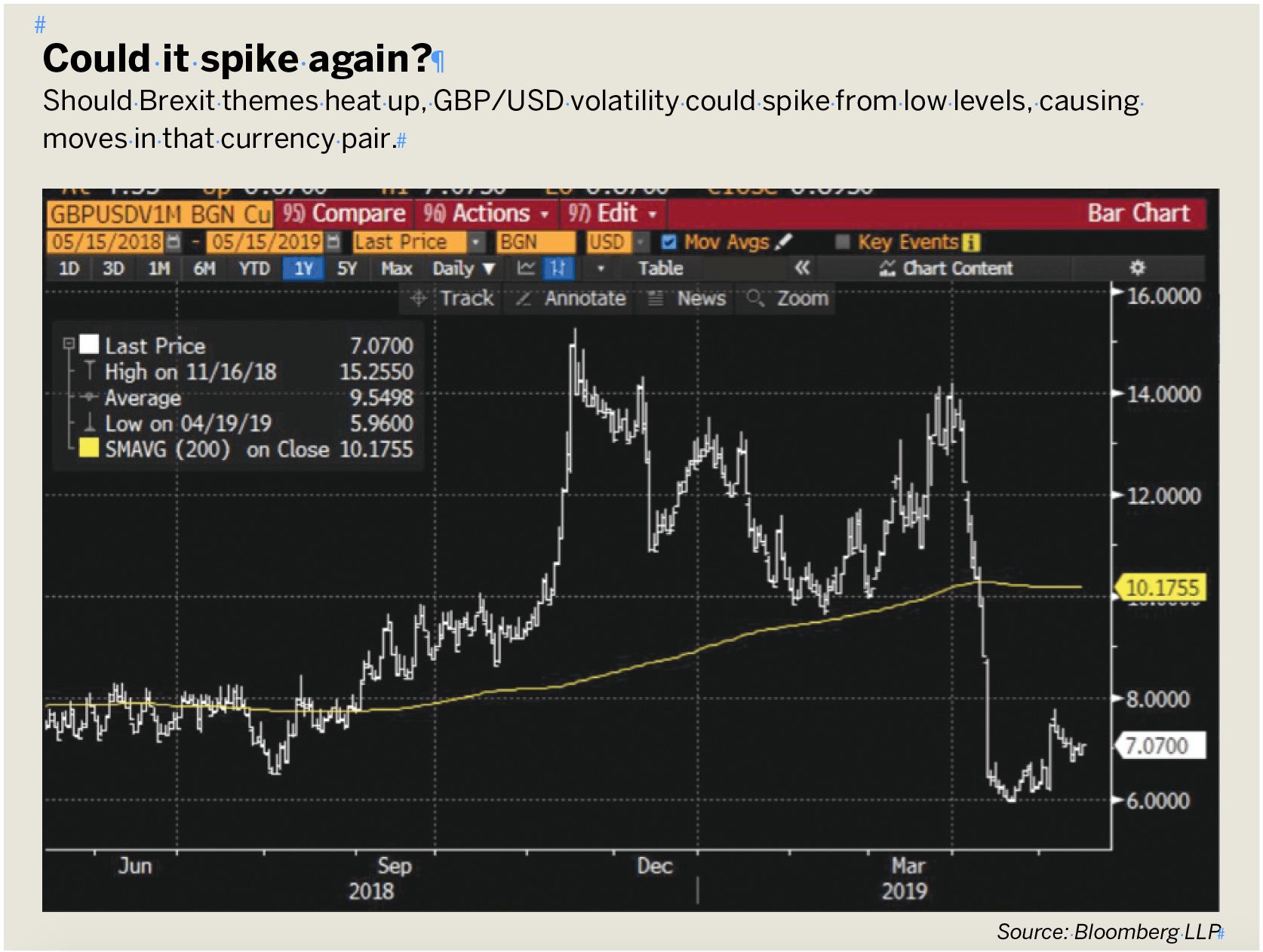

The Binary Response

If the market theme triggers an event that has a binary outcome, use a trading plan that opposes the market consensus in the event of a surprise result. Remember when traders were long the British pound/U.S. dollar (GBP/USD) currency pair heading into the June 23, 2016, UK BREXIT referendum? Even though the polling was too close to call, traders thought voters would not vote to leave the European Union. The vote in favor of leaving shocked traders, and GBP/USD currency pair plummeted and global equity indices fell heavily (see “Slowdown signals,” page 16). Hindsight is 20/20, but it would have been beneficial to have had an anti-consensus short GBP/ USD trade of even a small size for that binary event.

While broad event risk provides conditions to make or break a trading year, narrow event risk provides opportunities for tactical shorter-term trading – even intra-day. Look at the market data and events calendar for the month and then one week out. Considering the broad themes and current market conditions, which near-term data release or event will the market give more weight?

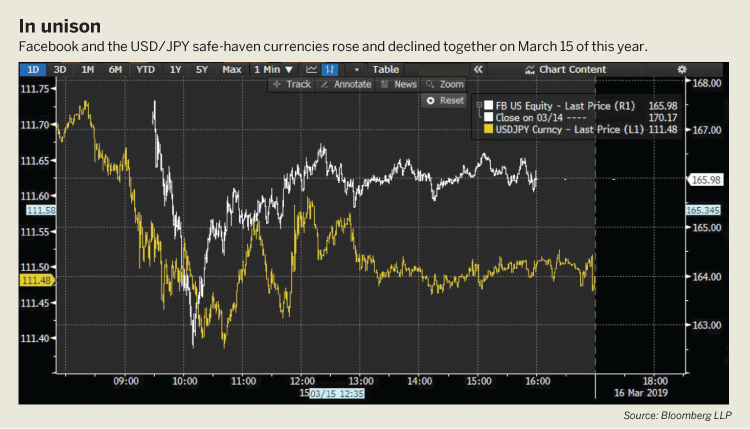

Examples of narrow event risk include G10 central bank policy announcements and speeches, the U.S. employment report and corporate earnings releases. Late last year, the Fed emphasized it will be “data dependent” with regard to monetary policy. That gives each U.S. Tier 1 economic data release more potential to cause volatility – influencing interest rates and fed funds rate expectations, which in turn affect U.S. equity indices on the day. Intraday U.S. equity index moves, can drive G10 currency moves, strengthening high beta currencies (the Aussie, the New Zealand dollar and the Canadian dollar) if U.S. equity indices rise or strengthening safe haven currencies (the U.S. dollar, the Japanese yen and the Swiss Franc) if U.S. equity indices fall.

Trading These Themes

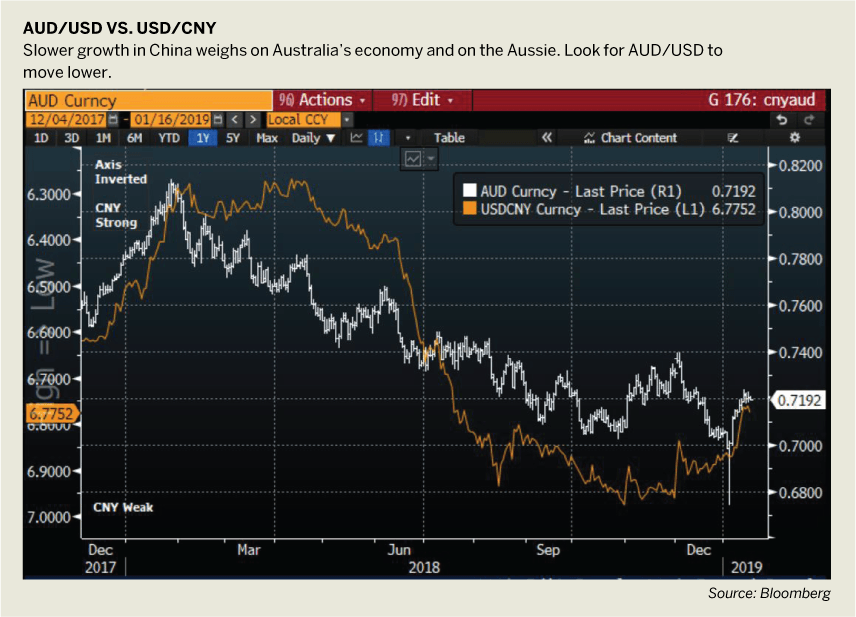

Here are some ways to trade the market themes mentioned . Short the Australian dollar/U.S. dollar (AUD/USD) currency pair on the China Growth slowdown. Slower China growth hurts Australia’s economy from trade, investment and commodity price standpoints. In addition, domestically, Australia has a housing sector slump – falling house prices combined with tighter financial conditions are damaging that sector. China’s growth slowdown will weigh further on AUD/USD. Short AUD/USD in the 0.72 to 0.74 range. Target is 0.60 – the 2008 low.

Even though the U.S. economy is growing less rapidly, the rest of the world looks worse by comparison. Global economic slowdown combined with political uncertainty in both Europe and the UK should keep the U.S. dollar bid, especially as it is a safe-haven currency.

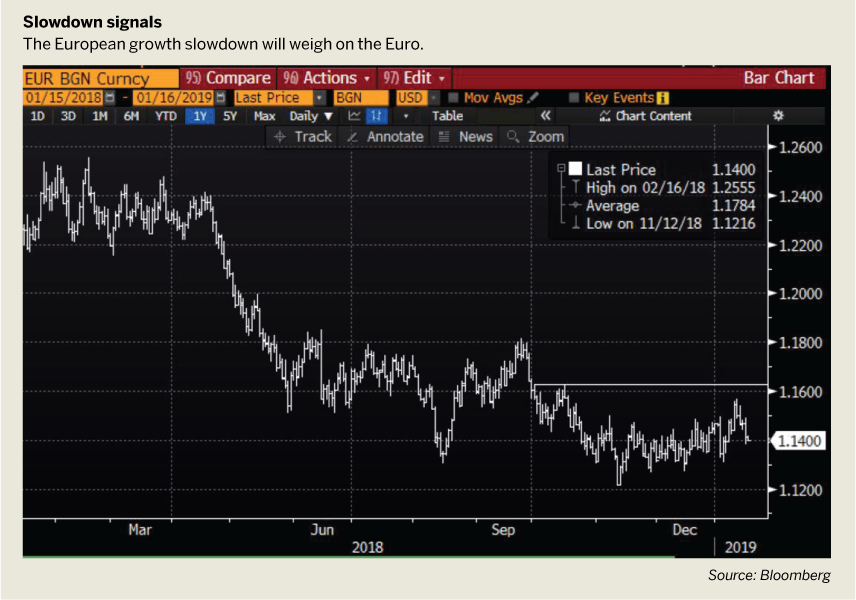

In Europe, growth is slowing, the May EU Parliamentary elections carry political risk and there’s uncertainty about whether Italy can meet its fiscal targets. The European Central Bank (ECB) ended quantitative easing in December 2018. It appears unlikely that the ECB will be able to raise its policy rate anytime soon. An alternative way to trade this opportunity is to short the EUR/USD through an option, such as buying a 1.1200, six-month EUR/USD put.

A lower-cost alternative is a put spread. The strategy involves buying a 1.12 put while financing, by selling, the 1.115 put. While the payoff is not as great as simply buying the 1.12 put, it can be done for considerably less money. Both trades can be done using the Euro/U.S. dollar futures.

Amelia Bourdeau is CEO at marketcompassllc.com, an advisory firm that provides global macro education and trading strategy to investors at every level. @ameliabourdeau