Lucky Gambling Stocks

There was a time when Americans who felt the itch to gamble packed a bag and flew to Las Vegas to revel in one of the few meccas of legal gambling on the continent. Failing that, they could make a cash bet with a buddy that Michael Jordan would score more than 30 points that night.

But times have changed. More states have legalized gambling and online sports betting, paving the way for companies to cash in on Americans’ love of wagering.

That brings opportunities for investors because some of the nation’s top gambling firms are publicly traded. It provides a sub-sector for diversification, but keep in mind that investing in gambling firms represents another bet on discretionary consumption.

For investors looking to stick with the traditional Las Vegas companies, stocks offer access not just to casino profits but also to a post-COVID resurgence in tourism.

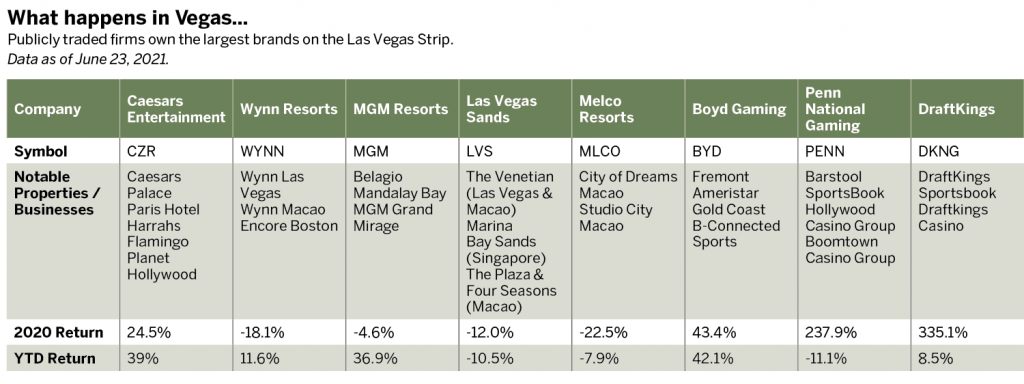

Publicly traded firms own the largest brands on the Las Vegas Strip. In the traditional hotel and casino market, investors can choose among shares in Caesars Entertainment (CZR), Wynn Resorts (WYNN), MGM Resorts (MGM) and Las Vegas Sands (LVS).

Both Caesars and MGM have more than recovered from the slump of early 2020, while Wynn and Las Vegas Sands both saw their peak prices in 2018 and have not touched them since.

Macau and beyond

Of the four companies, Las Vegas Sands is betting the most on international markets. Despite still trading on the New York Stock Exchange, many of Las Vegas Sands’ properties are now located in Asia, with five in Macau and the iconic Marina Bay Sands in Singapore.

Keep that international concentration in mind. With the company’s stock well below its 2018 high of $81.45, investors may find upside opportunities as the tourism industry continues to recover around the world.

For other exposure to the Macau gambling market, investors can analyze Melco Resorts (MLCO), which trades on the NASDAQ. Much like Las Vegas Sands, Melco is above the 2020 lows but still far from its 2018 peak of $32.95.

While many still consider Las Vegas the gambling hub of the country, wagering-oriented firms continue to expand across the nation. States continue to relax gambling bans and restrictions, happy to accept the tax revenue and economic opportunities that gambling affords.

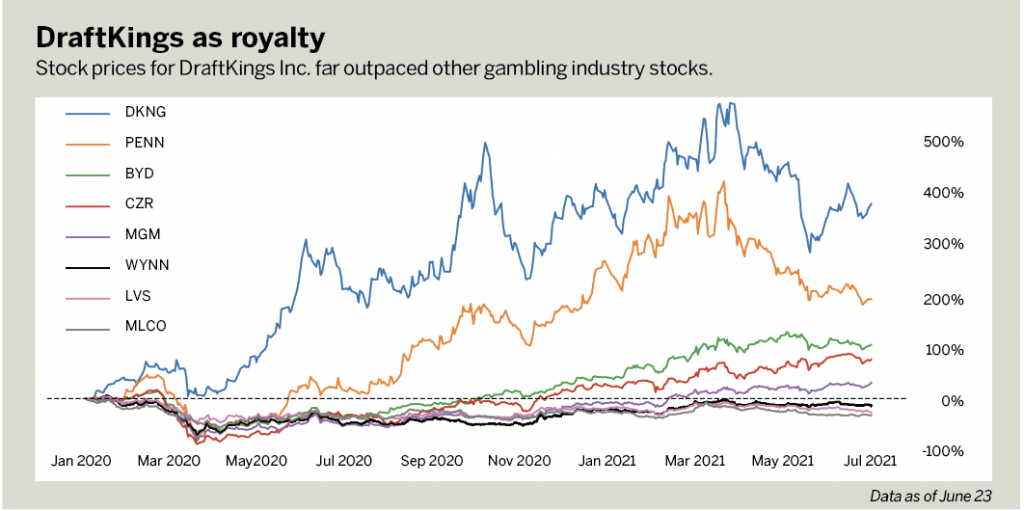

Two companies that stand out are Boyd Gaming Corp. (BYD) and Penn National Gaming Inc. (PENN). Both operate portfolios of casinos across the country. In January 2020, Penn acquired a 36% stake in Barstool Sports, and the companies launched Barstool Sportsbook in September. They plan to continue expansion of their online sports-betting business. Both Boyd and Penn saw massive rallies in their stock price from the middle of 2020 to early this year before recent pullbacks.

Investors looking for a more direct sports-betting investment can look to DraftKings Inc. (DKNG), which IPO’d via a SPAC (special-purpose acquisition company) merger in late 2019.

Since then, DraftKings’ shares experienced a volatile rise to a high of $74.38 in March. Investors feeling bullish on the company’s continued expansion into new markets and product offerings may wish to take advantage of any steep slumps in the stock price.

Longer-term, investors should keep their eyes on California in 2022, when sports gambling will be up for legalization via ballot initiative. Legalized sports gambling in the country’s most populous state would be a game-changer for companies.

Exchange-traded funds

In many industries and subindustries, exchange-traded fund providers capitalize on the chance to offer a bundled investment option. That holds true for the gambling industry with VanEck offering the VanEck Vectors Gaming ETF (BJK).

The fund holds 40 national and international gambling firms, including all of the stocks mentioned above. The ETF seeks to track the MVIS Global Gaming Index but does so with a higher expense ratio (0.65%) than a typical index ETF.

Additionally, the VanEck ETF saw an average of only 49,000 shares traded per day in 2021, often trading with a $0.20 bid-ask spread. That combination of a higher expense ratio and lower liquidity could make investors wary.

Instead, investors may choose to allocate capital across a variety of gambling-focused firms.

Most of the stocks listed here cost $100 per share or less, making diversification an easier endeavor for small accounts in the new age of zero stock commissions.

Larger bullish traders, comfortable with the risks of short put options, may look to sell puts in Las Vegas Sands and Melco Resorts, both of which show negative returns for 2020 and 2021. As indicated, this is a bet that tourism and gambling will bounce back in Asia, especially in Macau.

Despite the recent pullbacks in DraftKings and Penn National, some traders may still believe the stocks are overvalued. Those with bearish outlooks may consider long put spreads or long put calendars as a strategy, given the current low implied volatility.

Options traders looking for ideas to enhance their positions and add new diversified trades may be interested in Alpha Boost. This upcoming service from Quiet Foundation will analyze a portfolio and present options trade ideas in names like Las Vegas Sands and DraftKings, as well as other liquid stocks and ETFs.

While it can be tempting to go all-in, remember to stay diversified, never bet it all on black and always do your due diligence.

James Blakeway serves as CEO of Quiet Foundation, a data science-driven subsidiary of tastytrade that provides fee-free investment analysis services for self-directed investors. @jamesblakeway

More Guidance Quiet Foundation measures your portfolio’s risk