An Aussie Currency Trade

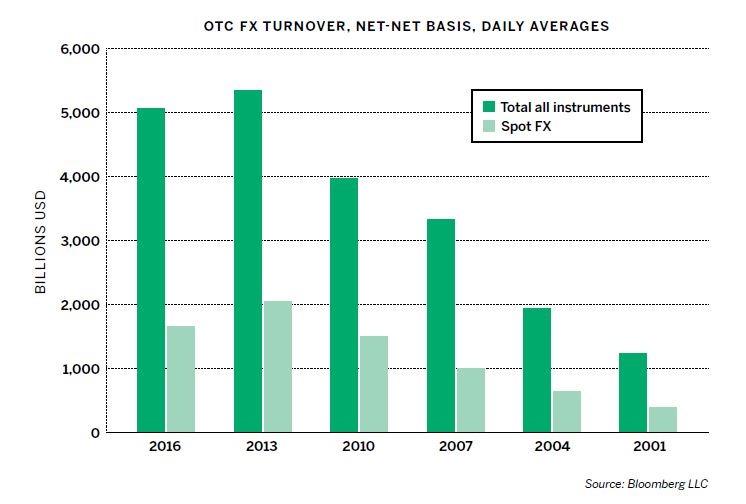

The Bank of International Settlements (BIS) operates as a bank for central banks, offering financial services to help central banks manage foreign reserves. It’s also known for its Triennial Survey of Foreign Exchange and OTC Derivatives Trading.

That survey tracks foreign exchange turnover— total and by currency. The BIS released the latest full survey in 2016 and showed that daily foreign exchange (FX) turnover was U.S. $5.07 trillion (See “One in a series,” right).

In September 2018, the BIS released the report called Monitoring of Fast-Paced Electronic Markets. It defined fast-paced electronic markets (FPM) as “markets where the price discovery process predominantly occurs via electronic means and which are characterized by a sizeable penetration of high-speed, algorithmically driven order placements.” Spot FX in the major currencies is one such market.

In its September 2018 FPM report, the BIS found that for spot FX, the “share of trading volume executed electronically has almost doubled over the last decade.” Also, “Survey data suggest that, since 2013, more than 70% of spot trading is executed electronically, while an estimated 70% of orders on EBS, a primary central limit order book and a major interdealer platform for spot FX, are now submitted by algorithms, rather than manually.”

The BIS also found that the nature of market participation has changed. Liquidity is still concentrated among the large banks, and other banks have found it hard to compete and have exited or scaled back their activity. In addition, a new set of non-bank intermediaries— proprietary trading firms—have become more important in the industry.

That’s reflected in the 2018 Euromoney FX Survey, which ranks the top FX liquidity providers by market share. The three biggest providers that year with respective market shares were JP Morgan with 12.13%, UBS, 8.25%, and XTX Markets, 7.36%. Non-bank XTX Markets had increased its standing to third, up from 12th the previous year—which is a big move.

One in a series

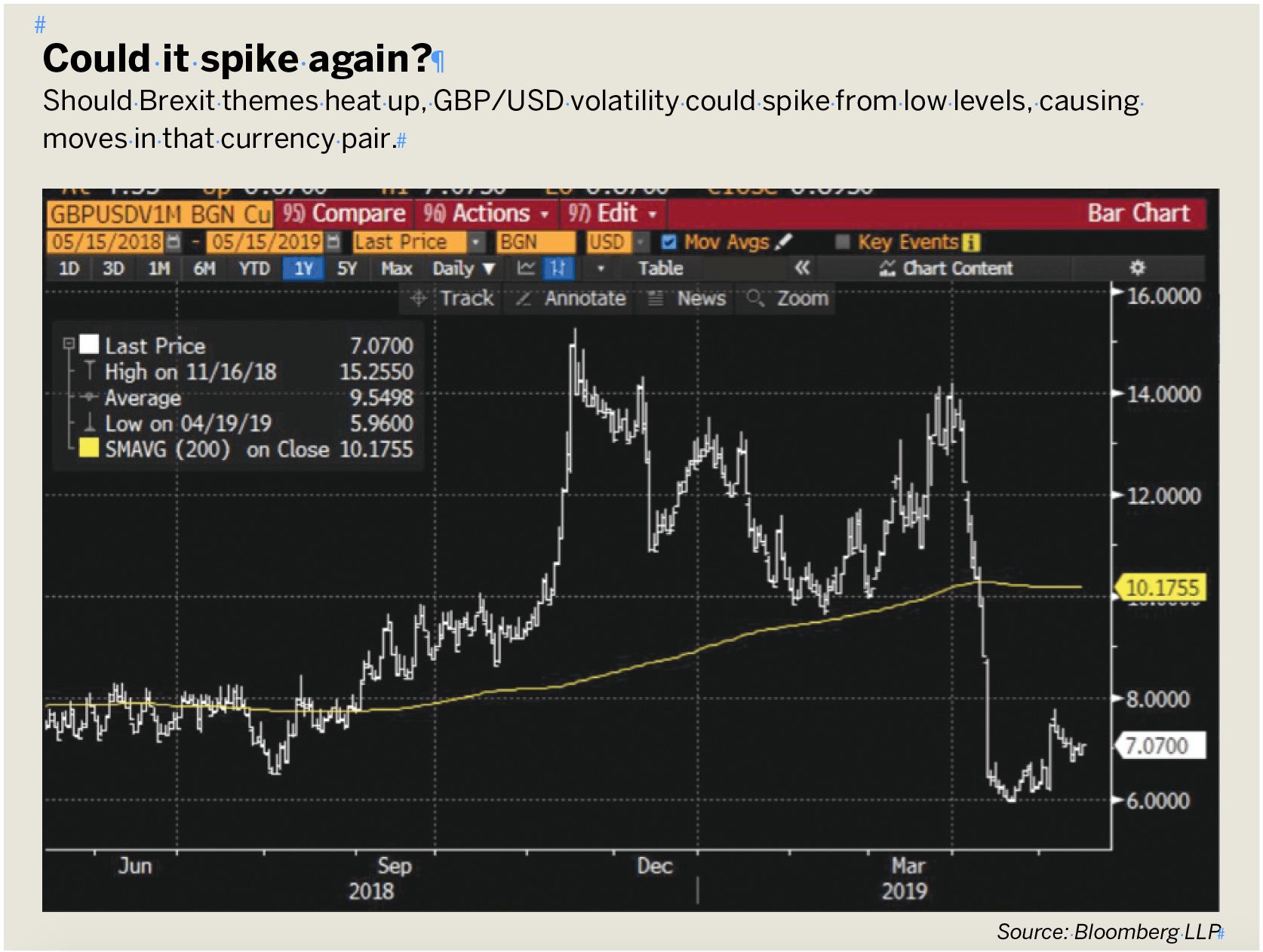

On Oct. 7, 2016, the British pound fell 9% relative to the U.S. dollar in early Asian trading but soon recovered. The Bank of International Settlements viewed it as part of a pattern.

As a result of the changing market structure, end-users have more access to a wider choice of trading venues. Advances in technology and increased competition for flow have resulted in more competitive pricing—in other words, narrowed bid-ask spreads in FX. End-users also have demanded reduced market impact when putting trades through. That has led, according to the BIS, to “new types of venue, including electronic single and multi-bank platforms and other venues designed to allow end-users to compare and/or aggregate quotes from a number of dealers.”

The share of trading volume executed electronically has almost doubled during the last decade

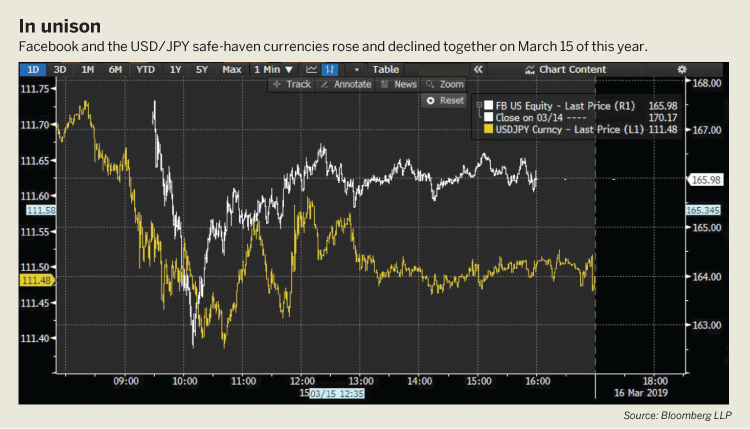

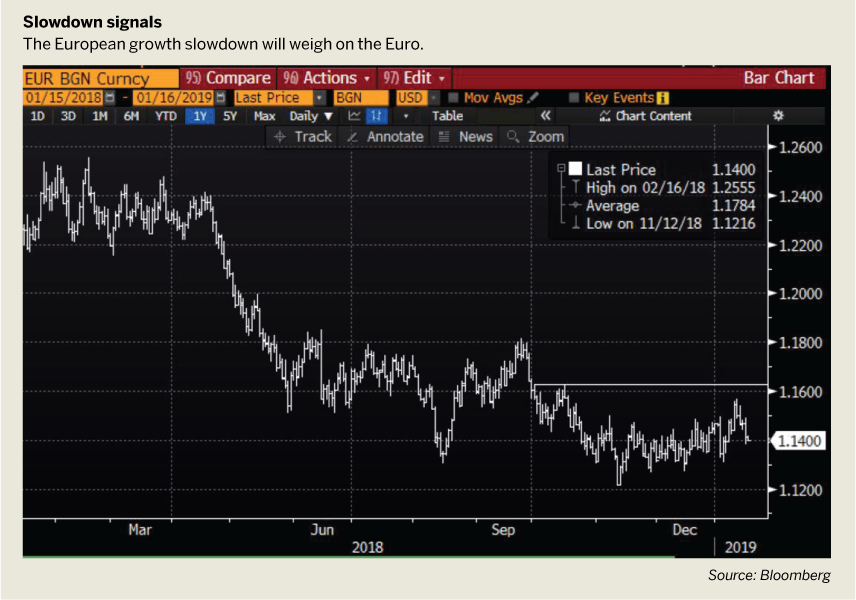

While the rise of electronic trading has brought benefits, some of the challenges associated with it center around monitoring, harnessing and understanding the increased data flow. The BIS found that, “the frequency of activity and speed of information flows in FX markets has increased drastically.” That affects end-users, banks, non-banks and central banks alike. It has become more difficult to understand, at times, the factors moving the FX market or certain currencies.

Triennial Reports

Research by The Bank of International Settlements tracks daily foreign exchange and is shown here in U.S. dollars.

The BIS report notes that “Algorithmic execution designed to minimize market signature (e.g., by decomposing orders into multiple smaller blocks) can mask trading patterns and volume while prime brokerage on electronic communication networks masks the identity of the economic counterparty to the trade. Traditional market contacts (such as voice dealers) may have less visibility over flows that are driving short-term price formation.”

It’s not unusual for clients to call a major bank’s FX trading desk and ask what’s happening with a sudden price movement. At times, it’s difficult to know the answer to that question, and that will likely remain the case. Occasionally, mini “flash-crashes” can occur between trading sessions, when liquidity tends to be thinner. For central banks, monitoring sudden FX movements is important for financial stability mandates.

FX liquidity is still concentrated among the large banks

One instance that highlights that importance is the Oct. 7, 2016, flash crash of Sterling (Great Britain pound—U.S. dollar, PUSD, see Triennial Reports, above). Sterling fell around 9% versus the USD in early Asia market trading, before quickly retracing most of the move. The BIS investigated that flash crash and in its January 2017 report said: “This event does not represent a new phenomenon but rather a new data point in what appears to be a series of flash events occurring in a broader range of fast, electronic markets than was previously the case in the post-crisis era, including those markets whose size and liquidity used to provide some protection against such events.”

The Trade

Turning from the e-trading market structure to the current landscape of G10 FX markets, Australia’s first-quarter Consumer Price Index came in weaker than expected. That has brought a possible 25 basis point rate cut by the Royal Bank of Australia (RBA) onto the radar screen. Debate on the timing of an RBA policy rate cut and whether Australia’s employment will remain strong, should weigh on AUD vs. USD. Short AUD/USD by buying a three-month 0.6500 AUD/USD put.

Amelia Bourdeau is CEO at marketcompassllc.com, an advisory firm that provides global macro education and trading strategy to investors at every level. @ameliabourdeau