On the Back Burner

Even with last year’s impressively robust sales, IPOs fizzled for two outdoor grill makers

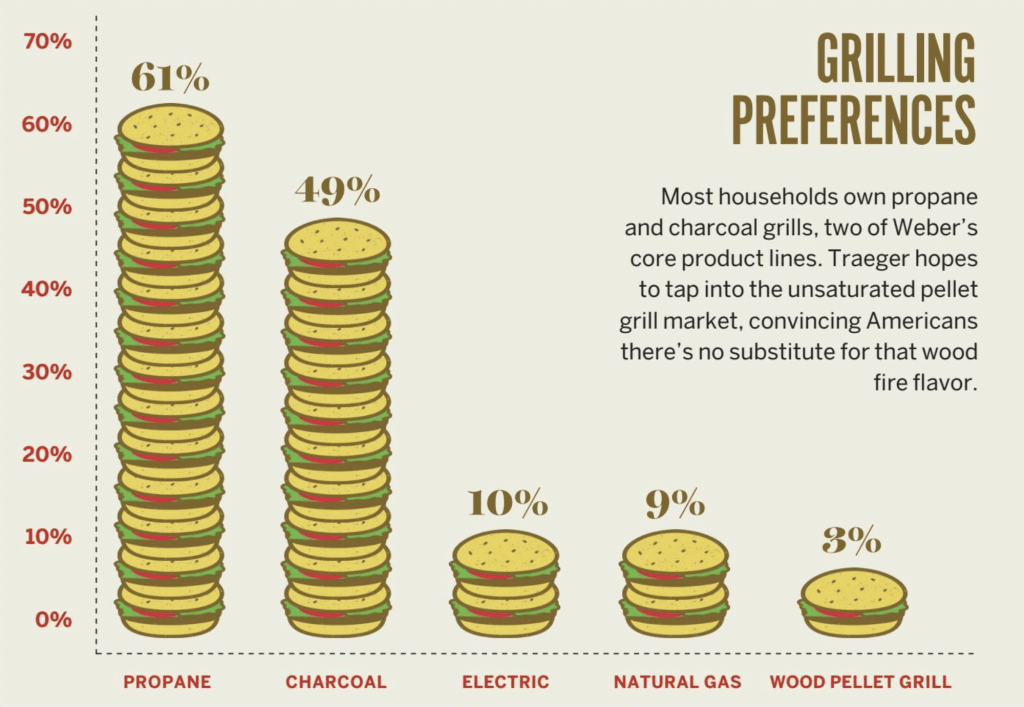

Two manufacturers of outdoor grills turned up the heat last year—Weber and Traeger both went public at the very moment they were posting astounding increases in sales. Yet, neither company’s stock has been cooking with gas.

Weber (WEBR) revenue climbed 17.7% in 2020 from $1.30 billion to $1.53 billion. Not bad for a 70-year-old company, though revenue did fall 3% from 2018 to 2019. Traeger (COOK) saw an even more substantial revenue increase for 2020 of 50%, from $363 million to $546 million.

The companies were raking in cash because consumers stuck at home during the pandemic were spending thousands of dollars to upgrade their houses and yards.

They could afford home improvements because they couldn’t spend their money dining out or traveling. What’s more, their income was supplemented by stimulus checks and child tax credit payments.

Meanwhile, the companies had their initial public offerings when the markets seemed positively giddy for IPOs. A total of 431 IPOs occurred in 2020, the most since 1999, according to Statista. But it didn’t end there. Last year, 951 companies went public.

Traeger hit the markets first, with an IPO price of $18 and a first trade price of $22 per share on July 29. Weber debuted one week later with a first trade price of $17, 21% above the IPO price of $14. Both stocks appreciated after the debut and found high prices on Aug. 10, Weber hitting $20.36 (45% return from IPO price), while Traeger peaked at $32.59 (81%).

Unfortunately, it was downhill from there. While the broad market rallied the last few months of 2021, Traeger and Weber both initiated their descent.

It got worse for the grill manufacturers as the overall market moved lower in early 2022. From their IPO prices, Traeger and Weber lost 77% and 49%, respectively, by the middle of June. They were losing value as quickly as cryptocurrencies.

But investors interested in adding a position in Traeger or Weber might see now as a good time to buy. The overall market sell-off possibly dragged the two stocks down farther than necessary. With shares priced below $10, the downside is limited for investors who want to add small amounts of either stock. After all, the lowest they can go to is zero.

Wall Street analysts remain optimistic about Traeger. With the current stock price below $5, analysts believe it could recover to more than $10. They’re less optimistic about Weber and say the stock may be fairly priced at around $7.

Active investors who believe Traeger could maintain its sales momentum and convince more consumers to buy pellet grills might look for an aggressive trade in the options market. With the stock trading below $5 per share, a 7.5 strike call option for December expiration costs $30. A call option gives buyers the exposure to 100 shares. So, if Traeger’s price rallies to $9 or $10 by the end of this year, that option would be worth more than $100 or $200, respectively.

Weber and Traeger shares took some heat after their IPOs, but at these low prices they may provide opportunity for investors who believe the grill makers could recover.

James Blakeway, Luckbox technical editor, serves as CEO of Quiet Foundation, a data science-driven subsidiary of tastytrade that provides fee-free investment analysis and trade ideas for self-directed investors. @jamesblakeway