Risk-Off FAANG Trades

Opportunities in global market directional trends

FAANG, an acronym for a collection of tech and communication companies that have changed the way most people live, is comprised of Facebook (FB), Amazon (AMZN), Apple (AAPL), Netflix (NFLX) and Alphabet (GOOGL). These companies, with the exception of Netflix, rank among the Top 10 most-valuable publicly traded companies in the world. As of July, their combined market capitalization was $3.4 trillion, representing approximately 11% of the S&P 500.

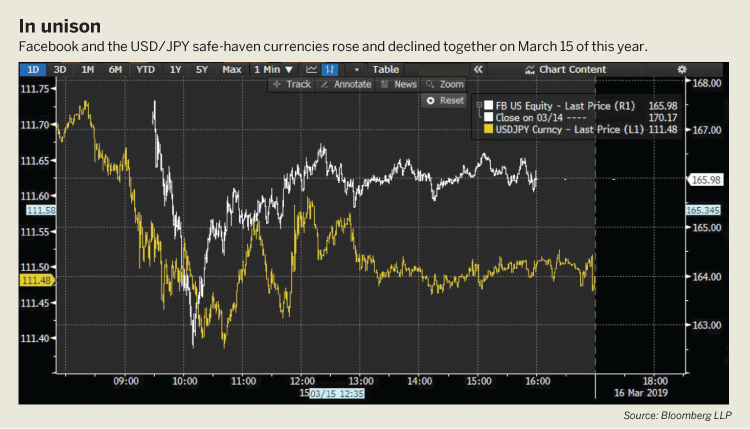

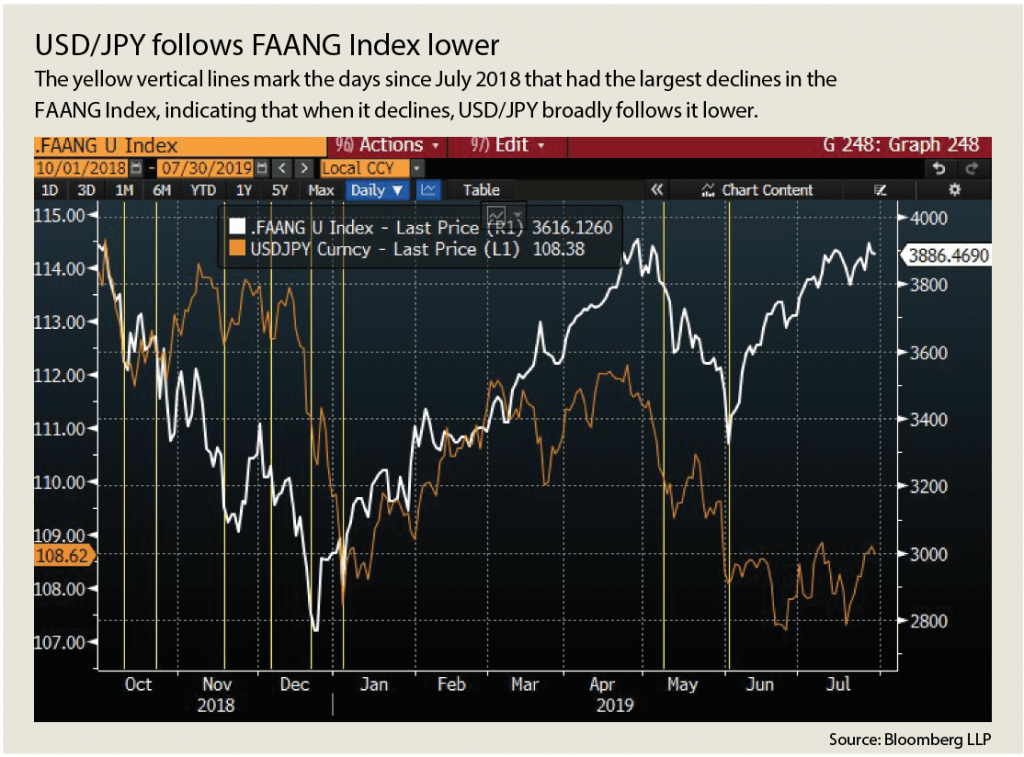

To see the impact of those stocks on selected assets, refer to the revised FAANG Index weighting each company by its market capitalization. In the chart “USD/JPY follows FAANG Index lower” (below), the (cap-weighted) FAANG Index (white line) is plotted against U.S. dollar/Japanese yen (USD/JPY) currency pair (orange line). The yellow vertical lines mark the days since July 2018, that had the largest declines in the FAANG Index. The chart indicates that when the FAANG Index declines, the USD/JPY broadly follows it lower.

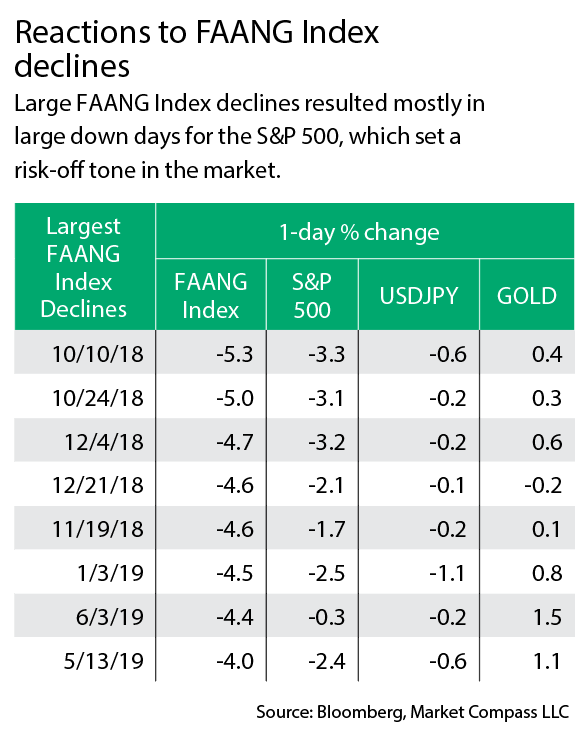

However, take a closer look at the reaction function of some assets on the days with the largest FAANG Index declines. The table shows the largest down days in the FAANG Index over roughly the past year and also what happened to the S&P 500, USD/JPY and gold on those days. The S&P 500 was chosen because each of the FAANG stocks is included in it—so it indicates the broader equity index reaction. USD/JPY and gold were included to show the reactions of safe haven assets.

As seen in the “Reactions to FAANG Index declines,” below, large FAANG Index declines resulted mostly in large down days for the S&P 500 as well. That means, large declines in the FAANG Index set a risk-off tone in the market. Risk-off days are generally good for safe-haven assets, and the table shows that USD/JPY declined on all of the days that had a large decline in the FAANG Index. So, safe-haven JPY strengthened versus USD on those days. Safe-haven gold also strengthened as well, with the exception of one date. The table above also acts as a quick reference guide for any future down days in FAANG stocks that lead to broader equity market losses—so keep it handy.

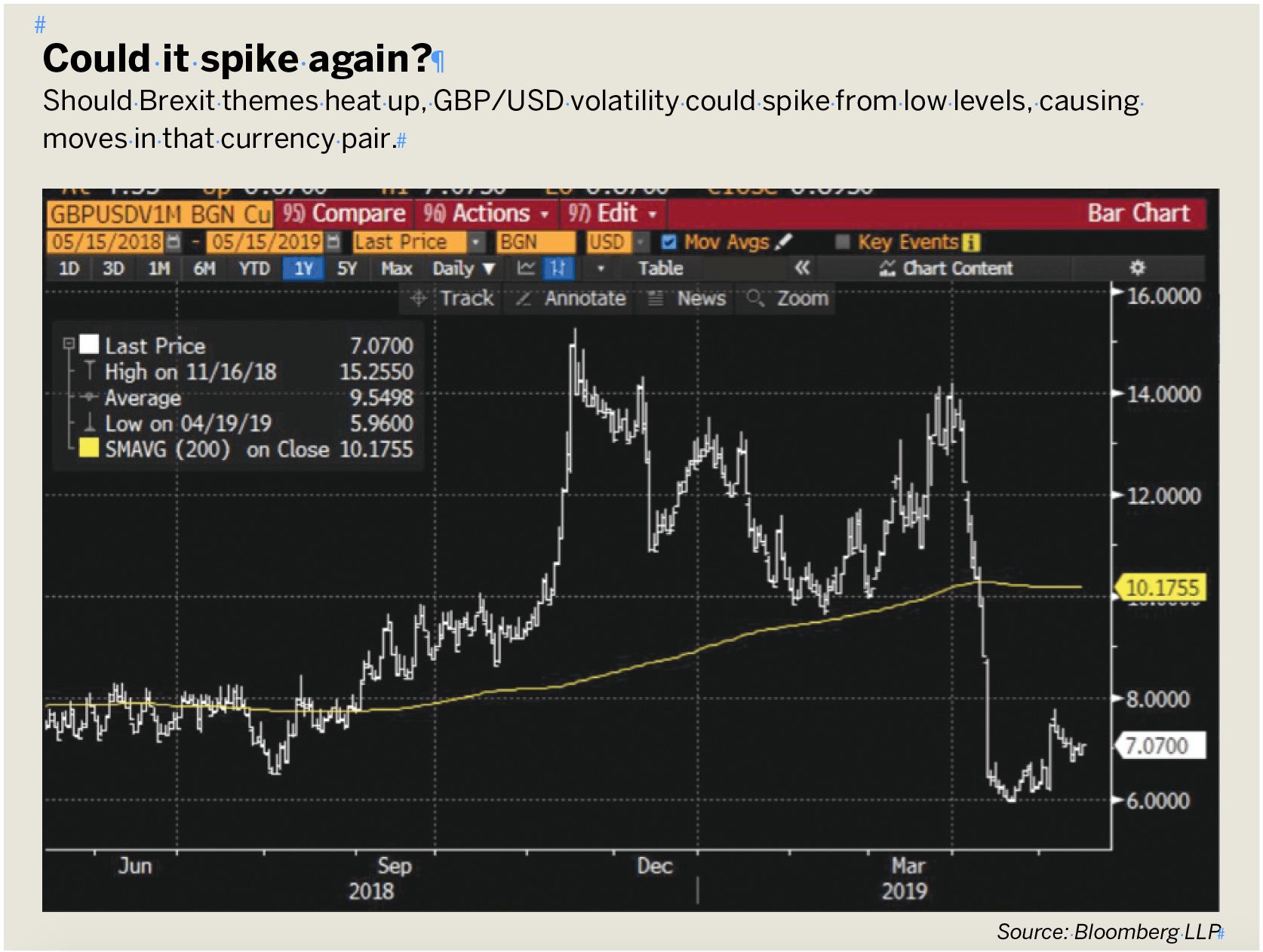

Trade Idea: Boris Johnson has been named prime minister of the United Kingdom, and BREXIT remains unresolved. Talks with the European Union are stalled, and the possibility of a no-deal Oct. 31 exit has risen. This is a dominant theme in macro markets.

Short the British pound (GBP) versus USD: Buy a three-month 1.1000 GBP/USD put.

Amelia Bourdeau is CEO at marketcompassllc.com, an advisory firm that provides global macro education and trading strategy to investors at every level. @ameliabourdeau