Space Stocks Have Limitless Upside

This year marks the 105th anniversary of Boeing (BA), a company known across the globe for its long history of unparalleled innovation and success. But the aerospace manufacturer’s story was also peppered with gut-wrenching hardship when its technology failed.

Through the rallies and falls, Boeing investors have seen it all the last few years, yet long-term stockholders have reaped nothing but reward. Boeing stock first traded on Jan. 13, 1978. A $1,000 investment on that date was worth more than $330,000 by the end of 2020, while the same $1,000 hypothetically invested in the S&P 500 index would have been worth approximately $42,000.

Boeing realized those gains as international flight matured from novelty to familiarity. Now, Boeing and other companies are setting their sights on the stars, and another period of runaway growth appears likely to ensue.

The case can be made that Boeing will replicate its own success in space travel. The company is largely responsible for the innovation and manufacturing that made the International Space Station a reality. As a long-time partner of NASA, Boeing already has skin in the space game.

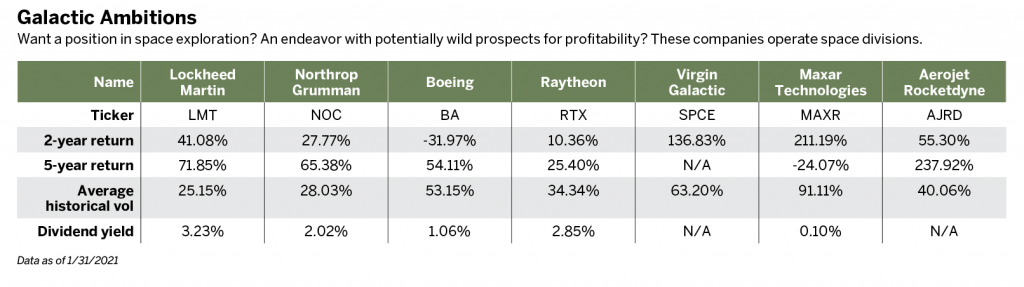

But Boeing isn’t alone when it comes to creating space divisions or pursuing space projects. Both Lockheed Martin (LMT) and Northrop Grumman (NOC) work with NASA and Blue Origin, Jeff Bezos’ space tourism firm.

Lockheed and Northrop both dropped around 15% in the first quarter of 2020 with the pandemic selloff, ending the year down

9% and 13%, respectively. Boeing, with its exposure to passenger aviation, dropped an eye-watering 55% before recovering slightly, ending 2020 down 35%.

After the spring Covid-19 slump, the S&P 500 recovered for a 16% return on the year. These aerospace stocks are clearly still lagging but could provide opportunity moving forward, especially if 2021 brings sector rotation and a reduction in capital flooding to Big Tech.

Buying into space

Investors looking to add aerospace companies to their portfolios can stick with the big names already mentioned, but with a minimum of around $200 per share in Boeing, creating a diverse portfolio becomes expensive for those with smaller accounts.

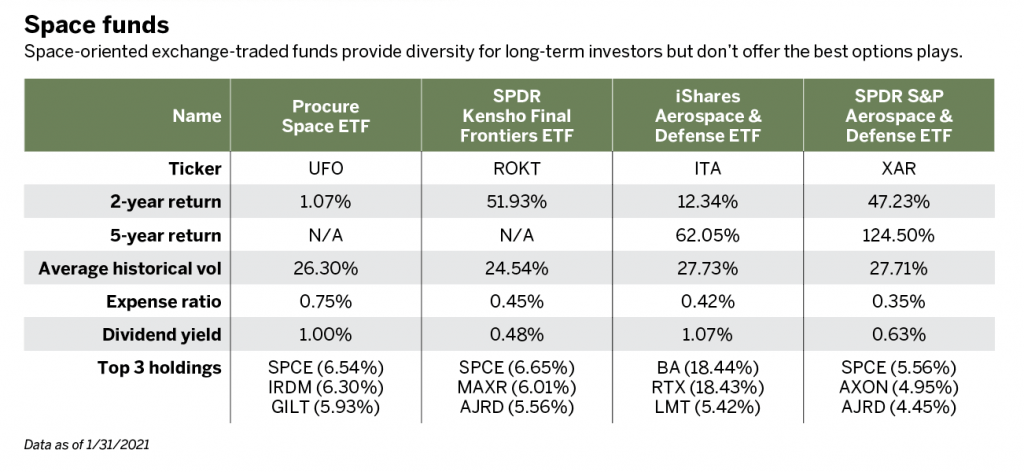

Investors lacking positions in aerospace securities can look to exchange-traded funds (ETFs) for prepacked diversification. The iShares U.S. Aerospace & Defense ETF (ITA) (see “Space funds,” below) is a strong candidate for a diverse aerospace investment. Its top 10 holdings include Boeing, Northrop and Lockheed, while providing exposure to 35 stocks in all. Boeing, the largest holding at 19%, may be attractive given its price is still lagging because of the pandemic’s interference with air travel.

Ethically minded investors may have qualms about investing in aerospace stocks or these ETFs, given their strong ties to defense and the military. However, the innovation these companies pioneer for military craft trickles down to civilian applications. With the advent of Space Force, it’s likely the U.S. government will award more contracts for space-bound technology. Investors will have to weigh those factors when deciding whether to trade these stocks and funds.

Some may seek more direct ways to add space-exploration companies to their portfolios. Blue Origin and Elon Musk’s SpaceX are privately held and thus unavailable to retail investors. A third option, Richard Branson’s publicly traded Virgin Galactic (SPCE), is pursuing space tourism and scientific missions.

Thus, Virgin Galactic represents a direct space-exploration investment but lacks the steady revenue streams of the larger aerospace firms. Virgin Galactic’s stock price soared early this year, fueled in part by the WallStreetBets Reddit stock buying frenzy. Investors keen on jumping in may want to wait for a pullback in the price before hopping on this rocket ship.

Investors who want a diverse ETF with exposure to Virgin Galactic and other space-

focused firms could look to the Procure Space ETF (UFO) or SPDR S&P Kensho Final Frontiers ETF (ROKT). Both of those ETFs hold more than 5% of their assets in Virgin Galactic (because of the 2021 price jump).

Other large concentrations in both ETFs include Maxar Technologies (MAXR), a manufacturer of Earth-orbiting satellites, and Aerojet Rocketdyne (AJRD), which will be acquired by Lockheed Martin later this year (likely increasing Lockheed holdings across the ETFs). Both the Procure Space ETF and the Final Frontiers ETF hold all three previously discussed aerospace and defense firms, as well as Raytheon (RTX), another large defense contractor with a space division.

The Procure Space ETF and Final Frontiers ETF both suffer from lower liquidity compared with iShares Aerospace and Defense fund. A fourth potential choice is the SPDR S&P Aerospace and Defense ETF (XAR), which also holds Virgin Galactic as its largest asset. Given the higher concentration in more stable and income-secure firms, the two aerospace and defense funds stand out as the better choices.

They also charge lower expense ratios than the Procure Space and Final Frontiers ETFs, which, at second glance, are strong marketing products with catchy names and symbols but lack some of the fundamental qualities of an investible ETF.

Problematic ETFs

Sadly, all four ETFs are weak candidates for options trades and would likely be best for longer-term purchases. Those looking for options plays would be better off sticking with the single stocks discussed earlier. Boeing, especially, has a deep options market with consistently high open interest. Traders can look to single options or spreads, provided they can execute trades at prices that match their goals and probabilities.

Regardless of investors’ chosen space (investing) vehicles, they should take care to perform their preflight checks and never skimp on the due diligence.

James Blakeway serves as CEO of Quiet Foundation, a data science-driven subsidiary of tastytrade that provides fee-free investment analysis services for self-directed investors.@jamesblakeway

Click here to learn how to evaluate any portfolio with Quiet Foundation.