Stocking up on Gaming Stocks

K, put down the game controller and back away slowly. Now, move to the trading platform and load some of the symbols in this article. It’s time to put those speedy clicking fingers and twitching eyeballs to work. Gaming’s fun. But so is trading. And both are potentially profitable.

Since 2000, the video game industry has continued to benefit from lower technology costs coupled with improved graphical fidelity and processing power. The last two decades saw Microsoft (MSFT), Sony (SNE) and Nintendo (NTDOY) duke it out to sell home video game consoles and earn a place in the family room entertainment center. Combined, those companies have sold more than 900 million home and hand-held consoles in the last 20 years. They sold the vast majority in North America, Europe and Japan.

Investing in either Microsoft or Sony constitutes a partial investment in their video game branches. Both are multi-national corporations with other, more prominent, divisions. Nintendo’s sole focus is the video game industry, having been a leading hardware manufacturer and software developer for the last 30+ years. Despite creating and owning the iconic Mario franchise, Nintendo has seen a mix of success and failure with their hardware over the decades.

With each iteration of hardware, Nintendo, Microsoft and Sony back themselves into a corner and hinge their success on consumer purchases and reception of that console. If more customers purchase the consoles, third-party publishers will develop more games. The publishers release games for Microsoft, Nintendo and Sony hardware but also offer games for PCs and Smartphones. The ability to remain hardware-agnostic enables the publishers to stay nimble and pivot with changing consumer trends.

Three of the world’s largest video game publishers are publicly traded U.S. corporations: Electronic Arts (EA), Activision Blizzard (ATVI) and Take-Two Interactive Software (TTWO). Those companies are responsible for some of the most popular and lucrative games and game series. Electronic Arts is known for the yearly iterations of the Madden NFL and FIFA soccer video game franchises, which, combined, sold more than 14 million copies last year. Activision Blizzard is perhaps best known for the annual Call of Duty games that have ranked in the Top 5 selling games for the past nine years. Take-Two Interactive is known for its subsidiary Rockstar Games, creator of the Grand Theft Auto game series. Grand Theft Auto 5 has grossed more than $6 billion since its release in 2012, making it one of the highest-grossing media properties of all time.

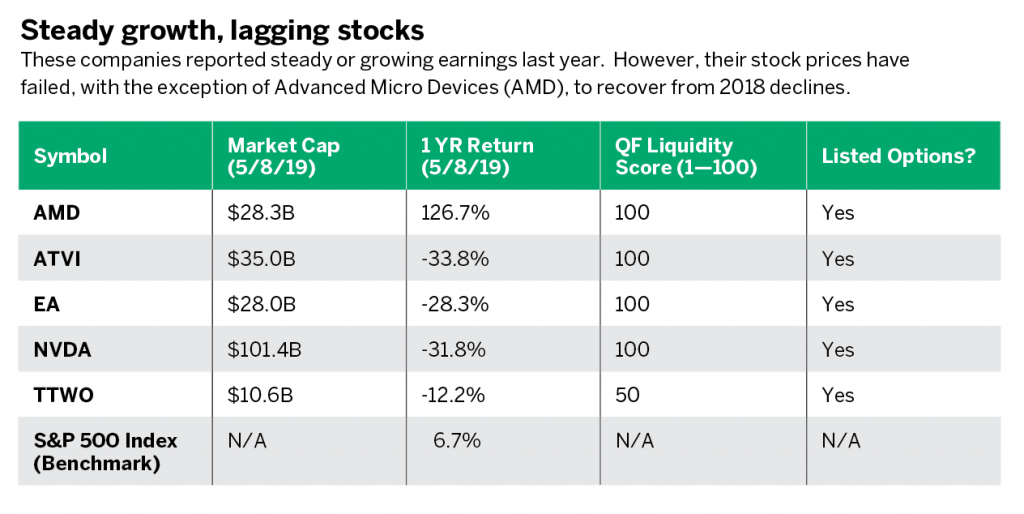

All three companies reported steady or growing earnings last year, but their stock prices lagged behind the S&P 500 and did not fully recover from the late 2018 U.S. stock market decline. Activision Blizzard’s price drop was partially fueled by controversial layoffs and a corporate restructuring despite posting record earnings. Even with the lagging recovery, these companies represent $73.6 billion in market cap (See “Steady growth, lagging stocks,” below.)

Another sub-sector of the video game industry is populated by the companies behind state-of-the-art graphics and processing power. Standouts in that space include NVIDIA (NVDA) and Advanced Micro Devices (AMD). AMD’s processers are used in both the Microsoft XBOX One and Sony PlayStation 4, while NVIDIA tech is used in the fast-selling Nintendo Switch. As with the third-party software developers already mentioned, NVIDIA and AMD are not just tied up with Microsoft, Sony or Nintendo. Products from both companies have seen mass adoption in both the PC and mobile markets. This tech helps boost processing power in phones, which allows for more impressive games on smaller screens. Computers continue to become more powerful thanks to this same tech, which pushes the capabilities of business and research to new levels. Both mobile and PC gaming have become more prominent in large developing markets like China. While investing in AMD and NVDIA adds exposure to the video game technology, it’s really a stake in the growth of computer processing power.

Running an equally weighted portfolio of the three game developers and two processor manufactures through Quiet Foundation’s (QF) free analysis system yields some interesting metrics on these stocks. The portfolio scored 60 (out of 100), achieving the second-highest overall rating, “On Track.” One area of weakness for this hypothetical portfolio was the historical metric of “Portfolio-to-Benchmark Evaluation.”

The portfolio received the lowest possible score for this metric because of its lower three-month return, compared with the S&P 500 benchmark (3.4% versus 5.4%), while demonstrating higher risk and volatility. The analysis also concluded weak diversification among these stocks, likely because of their single sector concentration. These stocks scored highly in the liquidity metric, with all sharing a perfect liquidity score with the exception of TTWO. The portfolio also scored highly in the opportunity metric because all five stocks have options markets.

Are there any video game funds to give investors exposure to the sector? In short, no. The ETF industry offers a plethora of funds focused on tech but very few related to the video game industry. The only one that stands out is GAMR, offered by ETF Managers. This fund holds a portfolio of 79 different stocks related to the video game industry. The fund has a position in all the companies mentioned above as well as other tech companies that have ties to video gaming, such as Intel (INTC) and Alphabet/Google (GOOG). GAMR also holds a diverse mix of software developers from Europe and Asia that are harder to trade in the United States.

The drawbacks of this ETF are higher costs and lower liquidity. GAMR has a 0.75% expense ratio, which is steep in the age of low cost ETFs. Additionally, the average daily share volume for the past year in GAMR was less than 23,000 (a 31% QF liquidity score). For comparison, XLK (the SPDR Technology Sector ETF) has seen an average daily share volume of 14.8 million, with an expense ratio of 0.13%. A lot of this comes down to economies of scale, making GAMR appear an expensive and fairly illiquid investment.

While there’s no plausible ETF for investors seeking exposure to the video game industry, some stocks could merit inclusion for a diversified stock portfolio. The third-party software and tech manufacturers may be more appealing given their ability to pivot faster than the console makers. As always, investors should remember to perform their due diligence and never put all their eggs in one basket.

James Blakeway is CEO of Quiet Foundation, a data science-driven subsidiary of tastytrade that provides fee-free investment advisory service for self-directed investors.