Trades

The Dollar, Boomers & AI Stocks

By Ilya Spivak

A shortage of workers is boosting wages, but AI may soon help the economy do more with less

Wages are on the rise.

Even after a year of inflation-fighting interest rate hikes, average hourly earnings are growing much faster than usual. The 4.4% year-over-year increase recorded in January was far greater than the longer-term average of about 3%.

Some observers trace the trend to COVID-19, but that’s only the most recent part of a story that begins with demographics.

Workers who are 55 or older constitute the largest contingent of the U.S. labor force at 24%. That’s true even though only 39% are participating in the labor market, by far the lowest percentage of any age group. In contrast, nearly 80% of Americans aged 20 to 54...

Macro

-

Gold Doesn’t Rule

By Ilya Spivak

|The bright yellow metal hasn’t kept pace with most stocks and bonds -

Crude Oil and a Revolution in Retreat

By Ilya Spivak

|Plus, how to pick a winner among GM, Ford, Toyota and Tesla -

Dollar Days: Looking Beyond the U.S.

By Ilya Spivak

|As the U.S. dollar declines from the heady highs of 2022, it’s time to revisit the Australian and Canadian dollars The value of the U.S. dollar soared in 2022 as… -

The U.S. Dollar Will Crash

|A mean-reverting macro currency trade explained by a meaty metaphor Extreme prices can make an active investor salivate. Contrarians and trend followers alike tend to view hamburger meat as Kobe… -

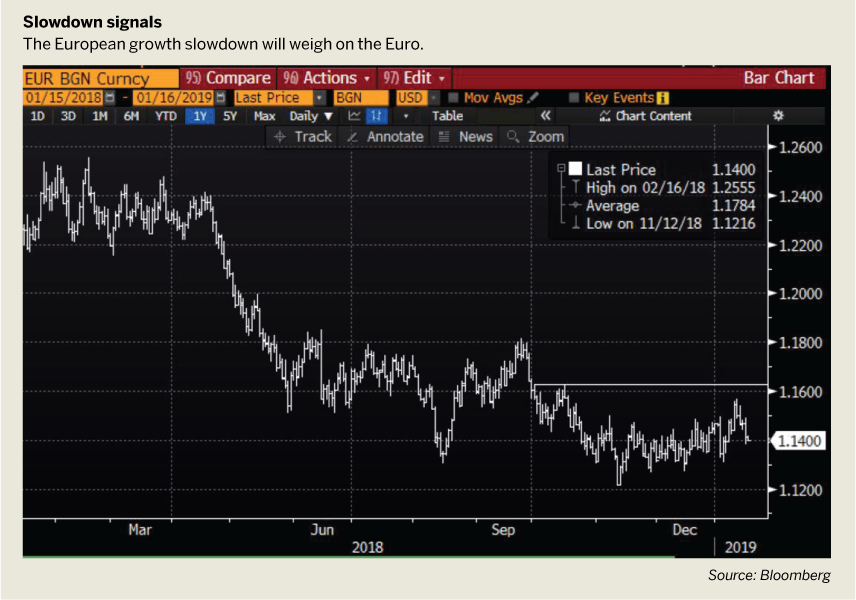

Oil, Ukraine and the Krone

By Ilya Spivak

|Europe’s energy shortfall will boost Norway’s currency The Norwegian krone tends to rise against the euro when crude oil prices are on the upswing. Indeed, the 12-month rolling correlation between… -

Fed Hike Hype

|Higher interest rates will keep the markets volatile When the Federal Reserve raises interest rates, financial markets can turn volatile. The hikes in the early 2000s bore this fruit and… -

Hikes at the European Central Bank

|The reliably timid ECB is hinting at raises in interest rates Something shocking happened in early February—the European Central Bank opened the door to rate hikes later this year. For… -

US-China Trade Impacts Aussie Dollar

|U.S. equity indexes have hit historic highs, but the price action included periods of drawdowns throughout last year. Some drawdowns were related to negative U.S.-China trade war headlines, a major… -

2020 Foresight

|January’s the time to gauge macro themes that will shape trading and investing in the coming year. “Why bother?” some ask. Unforeseen news and updated data will change investor sentiment… -

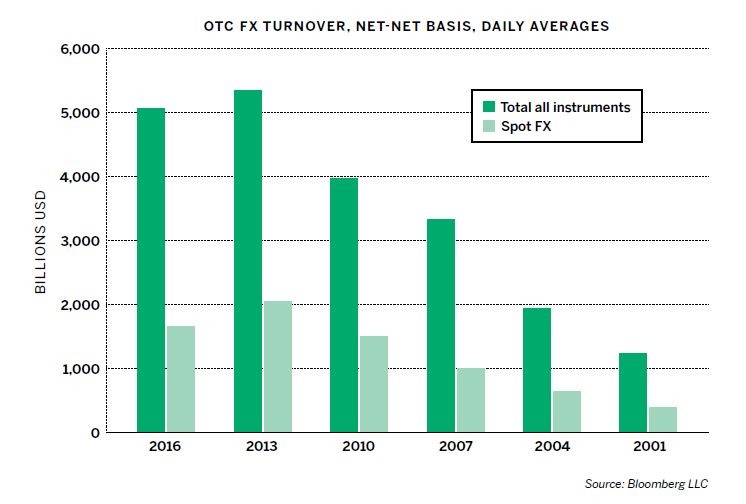

Take a look at the Krona

|The U.S. dollar(USD), the world’s most traded currency, is followed in trading volume respectively by the euro (EUR) and the Japanese yen (JPY), according to the The Bank of International… -

5 Tips for Choppy Markets

|These markets are untradeable—there’s too much uncertainty. I’m getting chopped up.” Does that sound familiar? It might. Portfolio managers and traders have been expressing those sentiments on financial television most… -

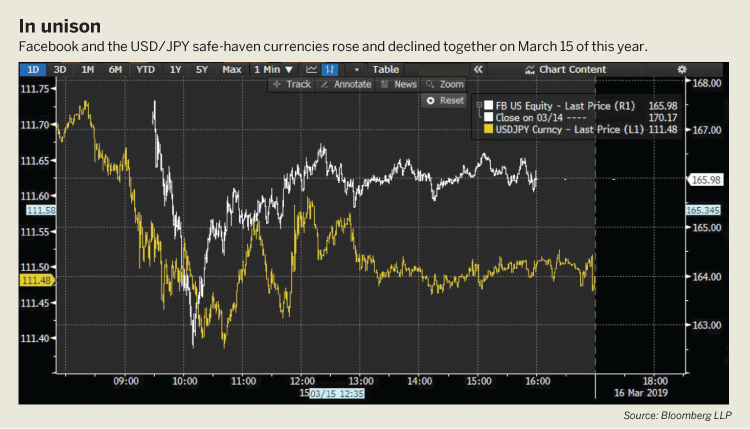

Risk-Off FAANG Trades

|Opportunities in global market directional trends FAANG, an acronym for a collection of tech and communication companies that have changed the way most people live, is comprised of Facebook (FB),… -

Trading Around Uncertainty

|Some financial media experts say that all trading and investing is uncertain by nature. Therefore, why should uncertainty in the markets matter? Well, while there’s some truth to this sentiment,… -

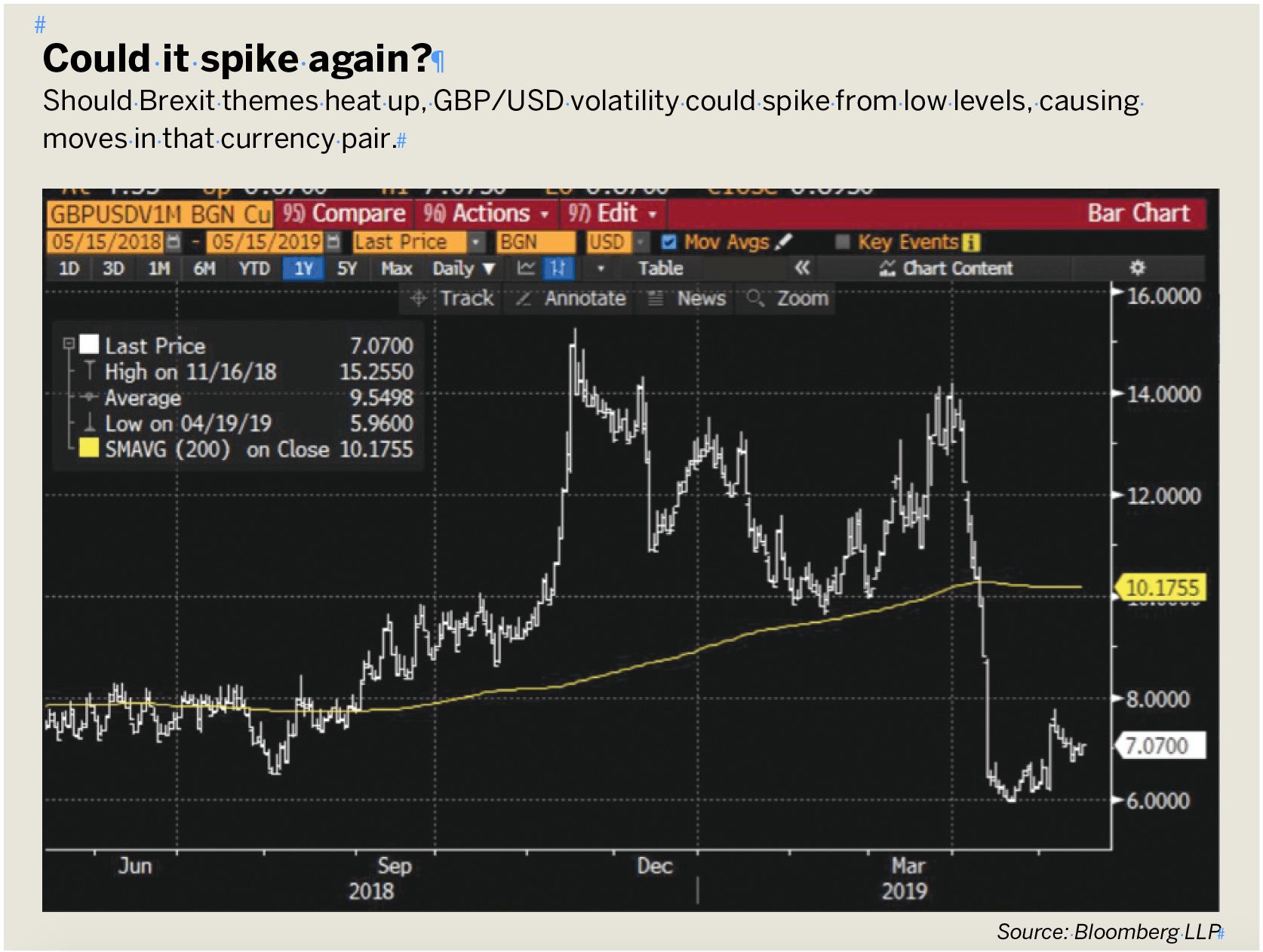

Unresolved Macro Themes Forecast Forward Volatility

|Global directional trends lobal macro trading benefits from volatility because moving markets create opportunities to trade. It’s also true that macro themes tend to simmer in the background and then… -

An Aussie Currency Trade

|The Bank of International Settlements (BIS) operates as a bank for central banks, offering financial services to help central banks manage foreign reserves. It’s also known for its Triennial Survey… -

The Forex FAANG Trade

|Intraday declines on tech giants can indicate a short dollar-to-yen trading opportunity -

Don’t Fear a Market’s Uncertainty; Manage It

|"The most important thing is never certainty. Certainty comes when it is ready. The most important thing is having a clear and healthy framework for dealing with uncertainty, which is…