Errant Burr

When the Stop Trading on Congressional Knowledge Act, or STOCK Act, was passed in 2012, it came as a surprise to many that up until that point insider trading among members of Congress was technically legal.

The framers of the act, which received broad bipartisan support, sought not only to stop employees of Congress from profiting from nonpublic information, but also to increase transparency by calling for detailed financial disclosures. The bill passed the Senate by a 96-3 vote.

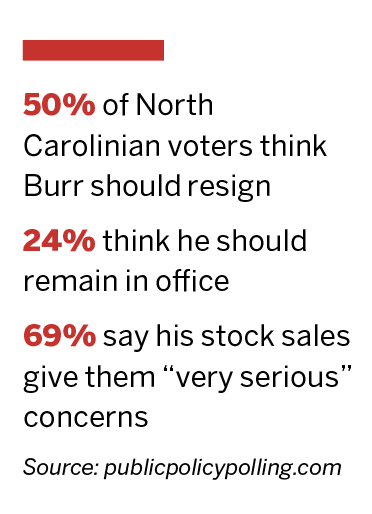

Notably, among the three holdouts, and the only one still serving as a member of the Senate, is North Carolina Republican Sen. Richard Burr, who afterward defended his opposing vote by saying the act was “ludicrous” and “political theater.”

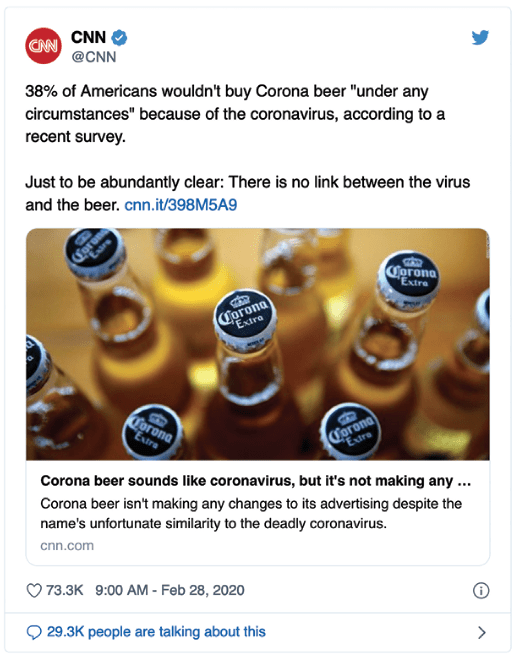

Burr, who since 2015 has served as chairman of the Senate Intelligence Committee, dumped somewhere between $628,000 and $1.72 million in stock, representing the bulk of his net worth, in 33 transactions on Feb. 13. The selloff came shortly before the markets took a brutal beating because of increasing concern about the impending COVID-19 pandemic. Great timing for Burr’s portfolio, but his trades—and the circumstances surrounding them—raised eyebrows.

Burr, as chair of the Senate Intelligence Committee, is a full-fledged member of the “gang of eight”—the eight congressional leaders that the executive branch briefs on classified and sensitive intelligence matters.

And the tale gets another twist. Burr’s stock sales included up to $350,000 in hospitality and travel-dependent stocks, all of which were hit particularly hard by pandemic travel bans and orders for social distancing.

Burr has since self-reported to the Senate Ethics Committee to review his stock sales. He acknowledged the sales came about because of the coronavirus but maintains he relied solely on public news reports from CNBC to inform his decisions.

It’s not the place of Luckbox magazine to say whether Burr is innocent or guilty of violating the STOCK Act but, in either case, he’s still a resounding luckbox.

If innocent, Burr caught perhaps the luckiest break anyone could have in the financial markets, dodging the brunt of the coronacrisis fallout in assets exposed to the worst of the market’s downturns.

If guilty, it’s unlikely much will happen as a result. Only one member of Congress, former Rep. Chris Collins, who represented a district in and around Buffalo, N.Y., has ever been charged with insider trading since the STOCK Act was enacted. Collins pleaded guilty and received a 26-month prison sentence and a $200,000 fine this past January.

But Burr maintains his innocence, and proving otherwise could require a massive—and likely fruitless—undertaking. At press time, prediction market traders on predictit.org gave Burr a 94% likelihood of staying in office through May 1.

And while it might seem uncouth to suggest anyone is lucky because of the deadly coronavirus, the widespread news coverage of the once in a hundred years pandemic has pushed Burr’s controversy below fold.

Burr was lucky enough to win election to the Senate. Saving his net worth from being brutalized by the coronacrisis and likely not having to answer for the suspicious nature of his trades has made him May’s Luckbox of the Month.

One lucky bunch

“As prominent participants in the government decision-making process, U.S. senators are likely to have knowledge of forthcoming government actions before the information becomes public. That could provide stock investments of members of the U.S. Senate … the large difference in the returns of stocks bought and sold (nearly one percentage point per month) is economically large and reliably positive.”

Source: Abnormal Returns from the Common Stock Investments of the U.S. Senate, Journal of Financial and Quantitative Analysis, 2004