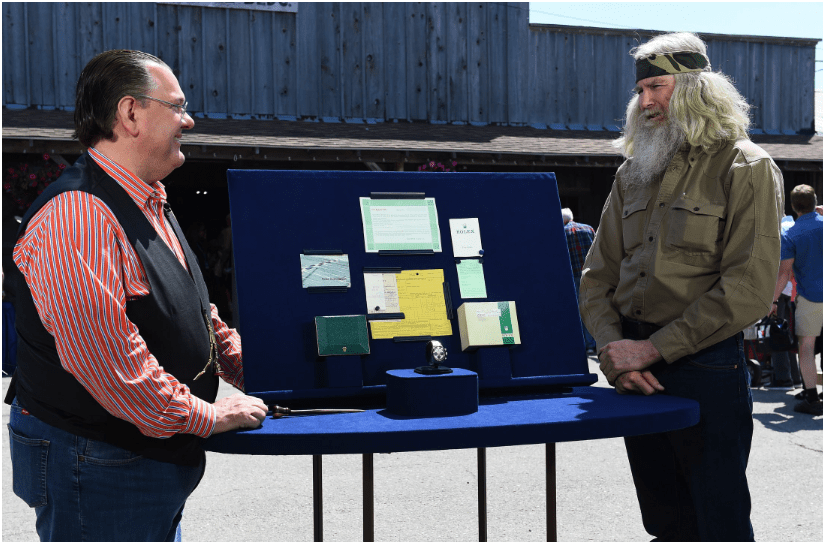

OK Boomer

Instead of choosing an individual for Luckbox of the Month, the magazine is recognizing the blind luck of an entire generation—the baby boomers. The cohort born between 1946 and 1964 has tended to fare well in the markets, often by passively holding onto stock and relying on dumb luck.

There’s also no denying boomers have had the good luck to live in interesting times. They grew up in the optimistic ‘50s and came of age during the sexual revolution of the ‘60s. They fought or resisted an unpopular war, witnessed the space race, navigated the heyday of recreational drugs and tore down the Berlin Wall—all while their passive investments grew exponentially. Boomers have been the luckiest generation since their grandparents hit it big in the markets in the Roaring ‘20s—before giving it all back in 1929.

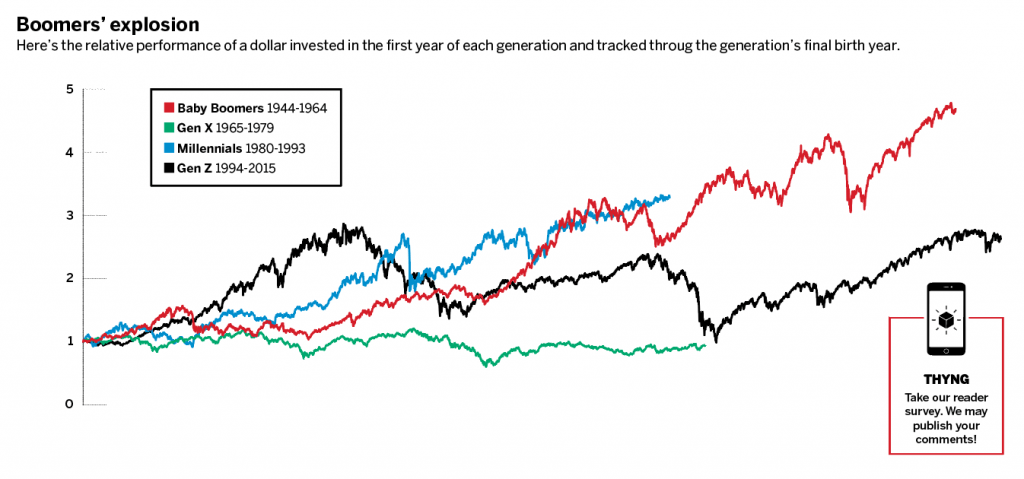

The oldest members of the baby boom probably began investing in the early ‘70s at the age of 25. Based on returns for the S&P 500, anyone investing throughout the period from 1971 to now would have seen her stash of greenbacks grow eight times larger. Of course, the ride wasn’t always smooth. Boomers saw annualized returns of more than 12% from 1971 to 1990 but also suffered through years like 1974 when the market fell almost 27%. Periods of high inflation took a bite out of returns, too.

But the boomers still lucked out. Gen X, born between 1965 and 1980, began investing in the ‘90s, just in time for the recession of 1991-92. Millennials, who came into the world from 1981 to 1996, began investing in 2006, not long before the Great Recession threatened to take down the entire economic system. Members of Gen Z, born in 1997 or later, have been late to the party and are just now beginning to invest.

And here’s a piece of advice: Younger generations shouldn’t rely on passive investing to pay off the way it did for their luckbox parents.