Trading Volatility in 2024

Look to energy, gold and consumer discretionary

Stability or volatility—what’s your pleasure?

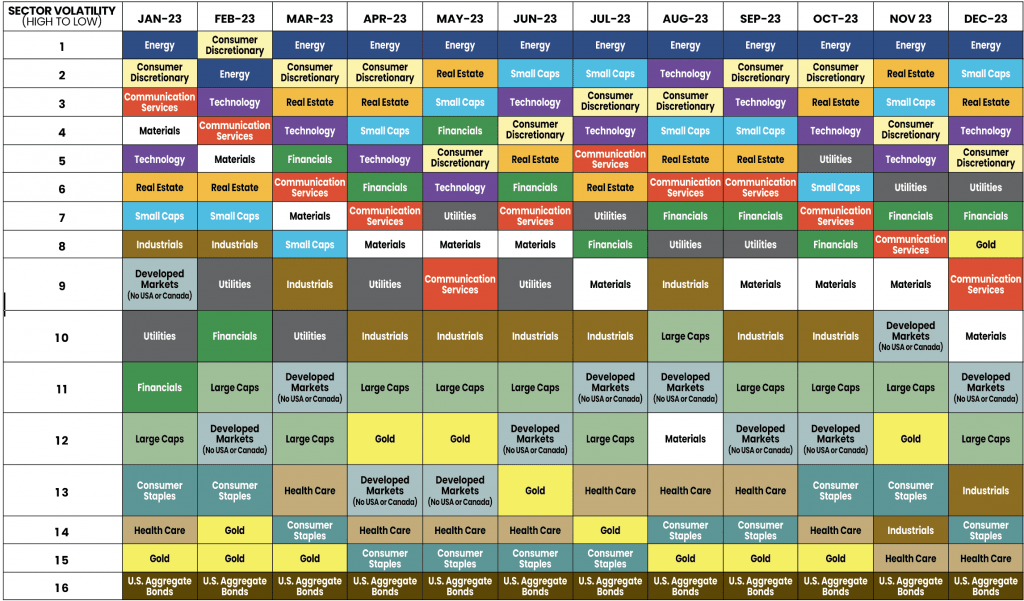

From the most price fluctuation to the least, the table below displays the volatility rankings of a grab bag of sectors and indices.

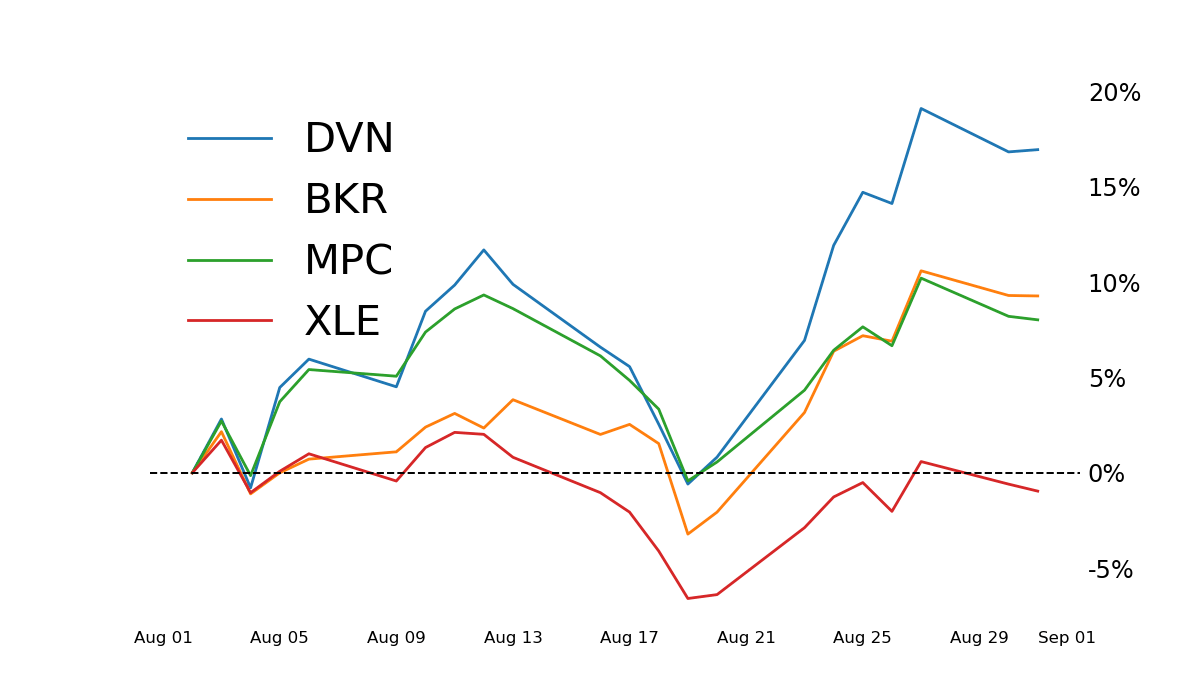

The energy sector, denoted by XLE, is perpetually near the top of the volatility spectrum and that appears likely to continue in the new year. Within that sector, behemoths like Exxon Mobil (XOM) and Schlumberger (SLB) stand out.

Trailing the energy sector are the small caps, typically companies with market capitalization of less than $1 billion. The Russell 2000 index (IWM), the go-to instrument for engaging with small caps, has recently shown improved performance after a sluggish presence throughout much of 2023.

Next in line is the consumer discretionary sector, with its representative exchange-traded fund (XLY). This sector thrives on increased consumer spending and includes renowned companies, such as Nike (NKE) and Starbucks (SBUX).

Gold, generally on the lower end of volatility, has recently increased significantly in price and volatility. A popular way to play gold is the Gold ETF (GLD). Don’t just buy gold—use options to make it “work” for you. A covered call is one way to play it.

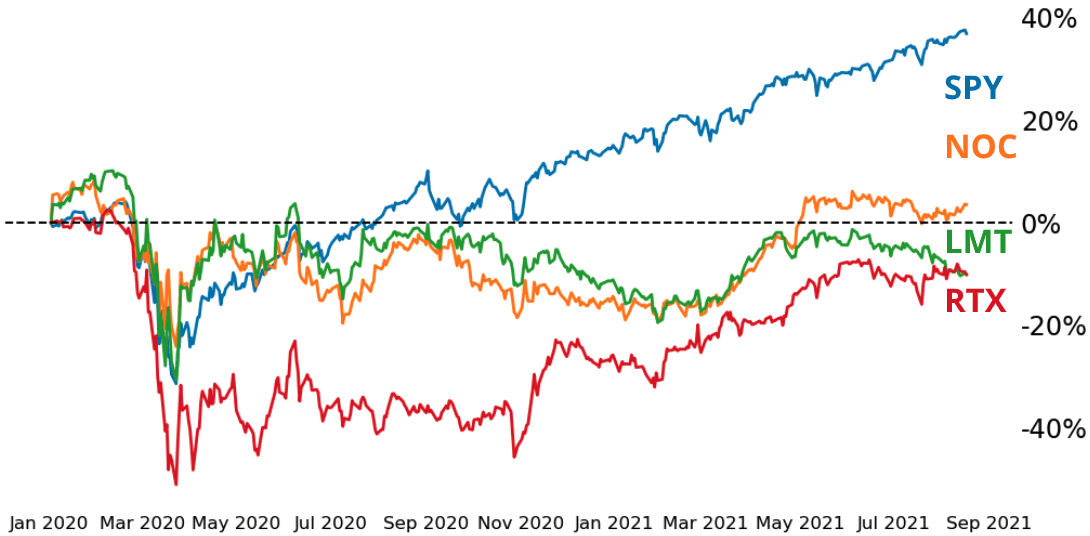

Industrials, represented by the ETF (XLI), are decreasing in volatility notably as the year ends. The sector includes major players like Boeing (BA) and 3M (MMM).

On the stable end of the spectrum lie the consumer staples (XLP) and health care (XLV) sectors, both of which have exhibited lower volatility.

Michael Rechenthin, Ph.D. (aka “Dr. Data”), is head of research & development at tastylive. @mrechenthin