Trades

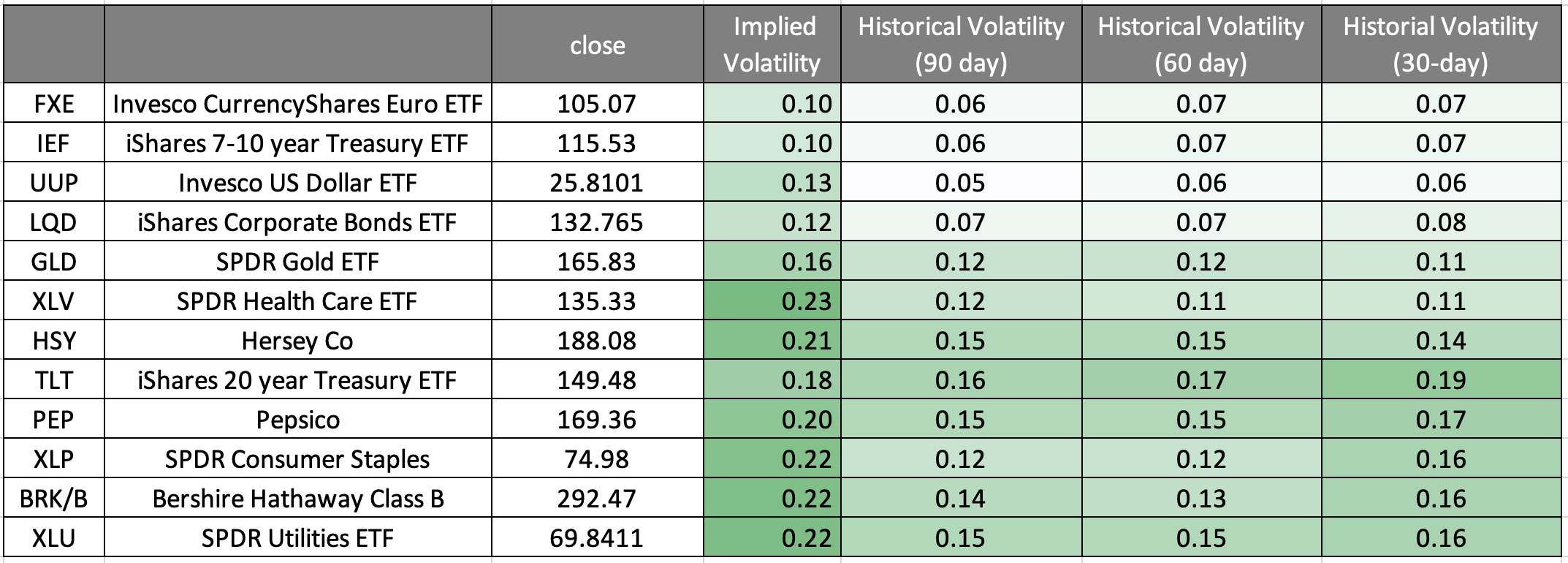

12 of the Most Boring Stocks

Traders are not a monolithic group. Some have a high risk tolerance, while others are more risk averse. Those with higher risk tolerance would probably prefer to trade TSLA, while those that are more risk averse would lean toward XLU.

Here are 12 of the most “boring” stocks and ETFs as measured by a combination of historical and implied volatility. All have options, so it is possible to reduce theoretical risk by selling calls against positions held.

Historical Volatility is simply a measure of how much the stock has moved with respect to price. This is different from Implied Volatility which is a measure of how much the stock is expected to move with respect to move going forward.

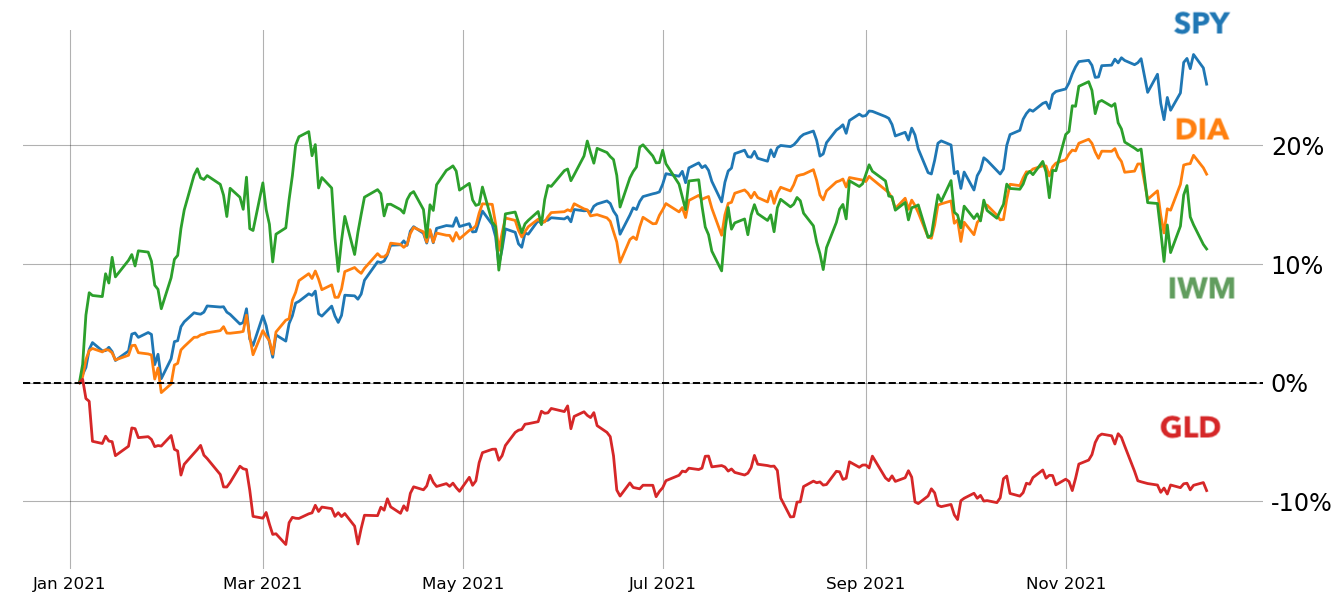

2021 so far

Here are the ETFs returns for the S&P 500, Dow Jones, Russell 2000 and Gold from the beginning of the year to now.

The free weekly Cherry Picks newsletter from tastytrade is stuffed with market research studies, data-driven trade ideas, and unique insights from the geekiest of geeks. Conquer the market with confidence … get Cherry Picks today!

Cherry Picks is written in collaboration with Michael Rechenthin, PhD, Head of Research and Development at tastytrade; and James Blakeway, CEO of Quiet Foundation, a data science-driven subsidiary of tastytrade.

Cherry Picks

-

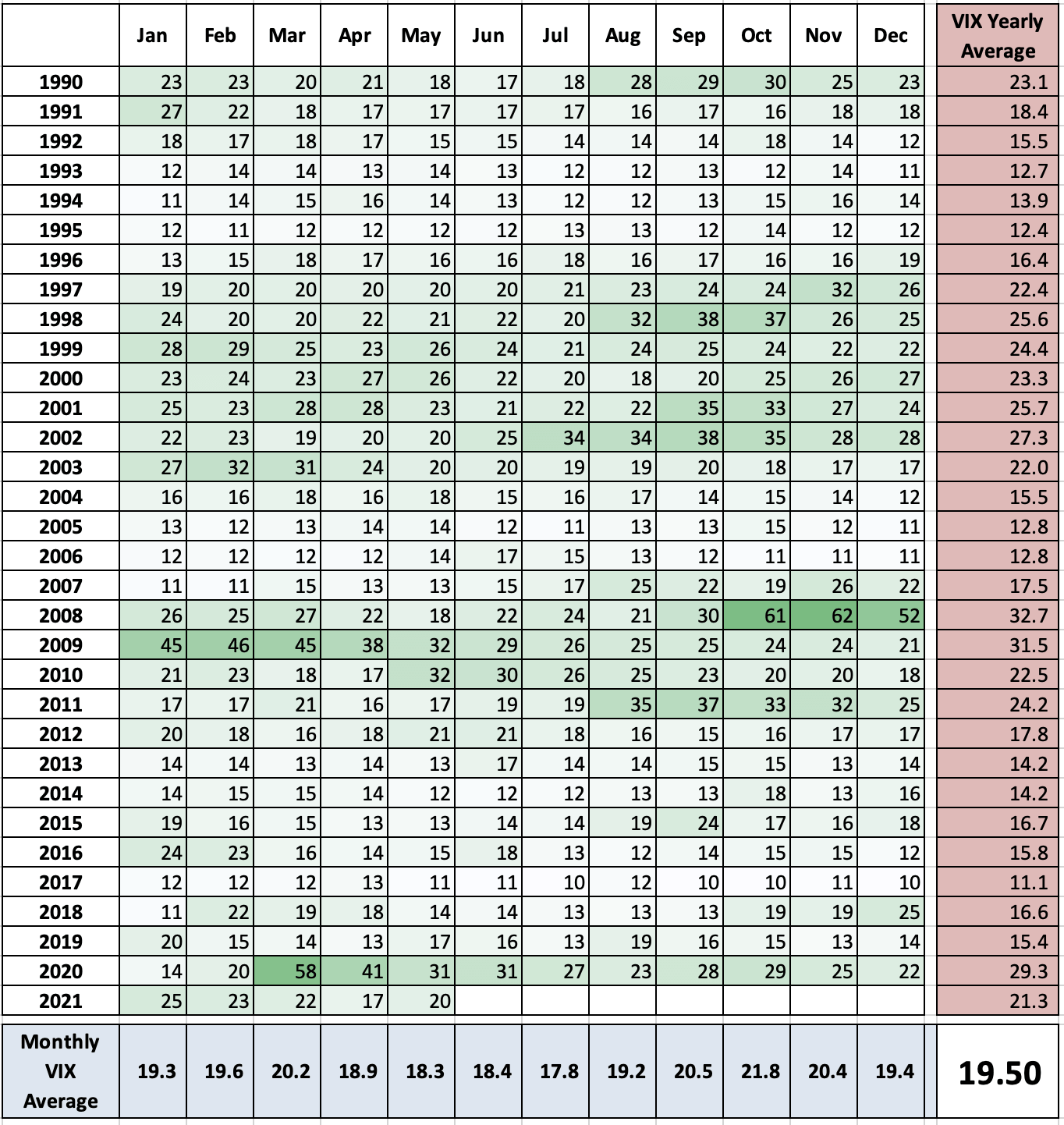

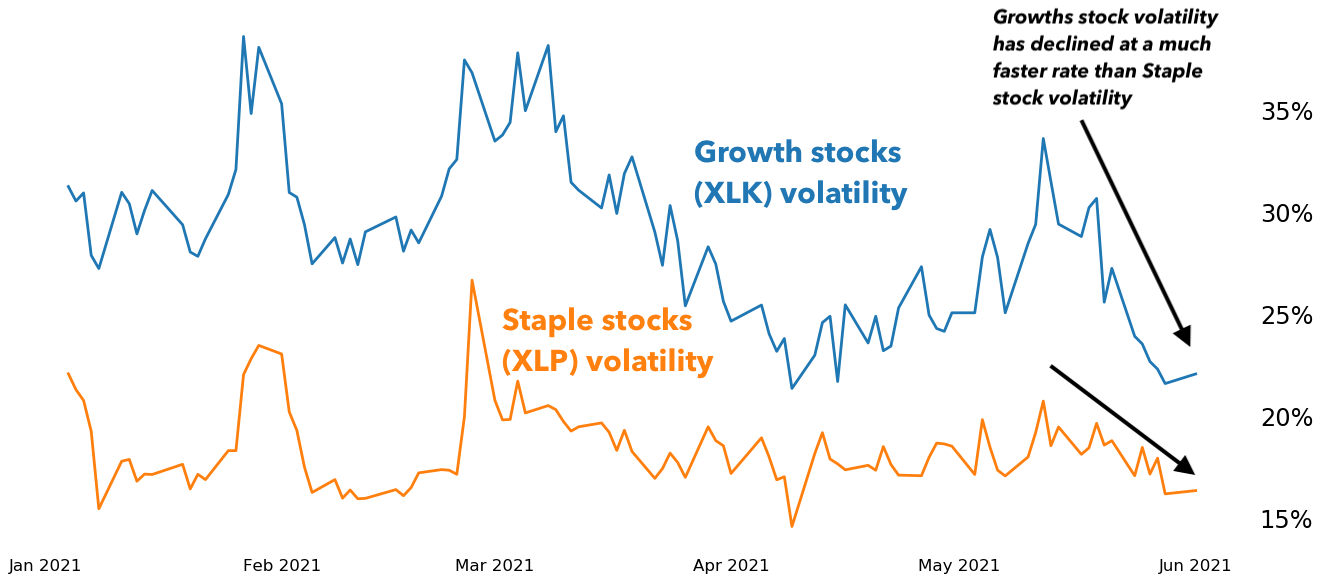

Volatility is Waning, Again

|The data below reflects Aug. 3 prices. Check out the VIX prices per month. At the bottom, we show the 5-, 10- and 30-year VIX averages. We are including this… -

Naked Puts for the Risk Averse

|In the Tactics section of this issue, an article entitled Three Ways to Play Long Odds offers three strategies for placing speculative trades. Here, readers will find an “anti-speculative” strategy… -

Diversification & Correlations

|Diversification is spreading money across multiple assets as opposed to just 1 or 2 (i.e. “don’t put all your eggs in one basket”). So how do you pick those assets?… -

The High Probability of Low Standard Deviation Option Strategies

|We wanted to see where the most theoretical opportunity for short-premium based strategies on the historical percentage of time that the stocks went “outside of the 1, 2 or 3… -

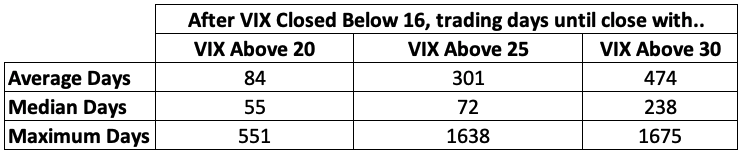

Is fear dead?

|The VIX (aka the “Fear Index”) dropped below 16 for the first time since before the pandemic. Judging from past performance, it may stay low for a while. Historically, when… -

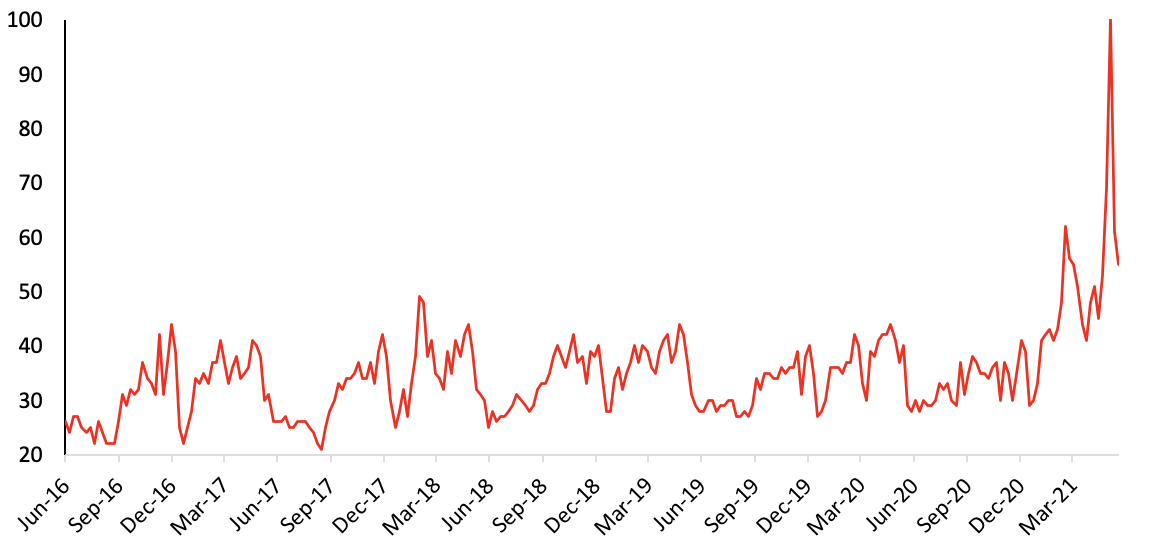

Cherry-picking Inflation

|Inflation is in the news a lot lately. Check out the Google Search spikes. Google Trend searches are measured 0-100 with 100 being the peak of searches for the measured… -

Summer Doldrums? There is a Trade For That

|Volatility tends to be low in the summer! May, June and July tend to have the lowest monthly VIX average prices. Traders and business tend to slow down in the… -

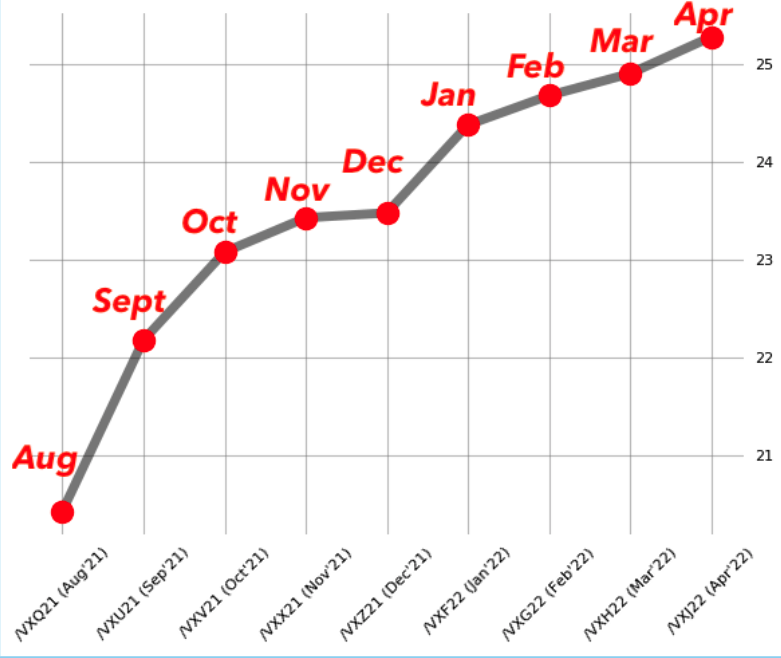

Hey Volatility, What are you implying?

|Implied Volatility readings across various liquid asset classes continue to deflate, generating much the same assumption that seems to be applied to the S&P 500-based VIX: ’“perhaps the summer doldrums… -

Playful Summer Stocks

|Last week we included a sweet graphic. May, June, and July tend to have the lowest monthly VIX average prices. Everything tends to shut down during the summer, but recreational… -

Crypto Scalping

|It is easy to purchase any of these coins on the tastyworks platform. Check out the daily “scalping range” of BTC/USD. A single coin has had a daily range of… -

Retail Options

|The list of retailers, right, is sorted from high to low with respect to volatility. Etsy has the highest volatility among the group, while Costco has the lowest. So how… -

For Moonshots, Avoid ETFs

|Sometimes traders strain to achieve a “moonshot.” They dream of picking a single stock that quickly moves from $1,000 to $100,000. But they shouldn’t expect that to happen with a… -

Options With Futures

|Why trade E-mini S&P 500 futures when Micro E-mini S&P 500 futures is also liquid and more appropriate for smaller accounts? Trading the /ES on the Chicago Mercantile Exchange (CME… -

Volatility “Sweet Spot”

|Securities are ranked on this page according to their forward-looking volatility from last year. Traders seeking safer investments—at least those expected to move less—might lean toward the exchange-traded funds (ETFs)… -

More Bang for Your Buck

|As a trading vehicle, nothing beats futures in terms of cost efficiency, liquidity and, for some, tax treatment. Take a look below. First, note the “Futures USD Notional,” which… -

All Your Options

|Have a directional assumption about a stock? With options, traders have a much larger range of possibilities than with stocks. Instead of being just “bullish” or “bearish,” options provide ways… -

Futures: Ticked Off

|Differing tick sizes and varying dollars per tick can make futures trading confusing. This handy crib sheet can help. Keep an eye on the “Median Day-to-Day Movement” column, and don’t… -

Digging Gold

|When the markets are in turmoil, money tends to flow out of stocks and into “safer” investments. The market’s definition of “safe” changes, but when stocks declined in March, money…