Zillow: Flippin’ Lucky Despite Prophetic Losses

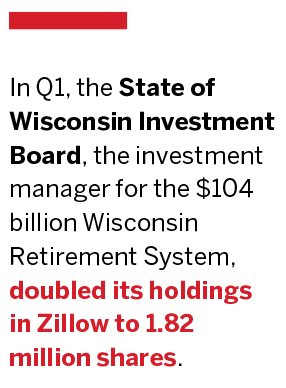

illow Group Inc. (ZG), which has generated an unbroken series of annual losses since its initial public offering in 2011, has figured out how to lose even more money—a lot more money—and at the same time boost revenue and make its shares jump: house flipping.

In its most recent quarterly earnings report, Zillow disclosed the dollars and cents of its newest enterprise, “Zillow Offers,” which buys and sells homes. The company describes this as “a new, hassle-free way to buy and sell homes directly through Zillow.”

The report splits out the business segments, including the “Homes” segment, which is its house-flipping operation. So let’s see how Zillow’s new business did in the quarter ended March 31:

- Sold 414 homes.

- Sales proceeds added $128.5 million to revenues, for an average selling price of $310,400 per home.

- The purchase cost of these homes added $122.4 million to cost of sales, for an average purchase price of $295,700 per home.

- This amounts to an average gross profit (selling price minus purchase cost) of a meager $14,700, or 4.9% per flip.

But it costs money to buy homes, get them ready to flip, market them, finance them until they’re sold, and deal with the transactions in a corporate manner. So Zillow booked the following expenses associated with its home-flipping operations:

- $20.8 million in sales and marketing expenses.

- $12.3 million in technology and development expenses.

- $18.2 million in additional administrative expenses.

- So, revenues of $128.5 million from selling the homes, minus $173.7 million in costs and expenses associated with these home sales, yields a loss on its home-flipping operations of $45.2 million.

This loss of $45.2 million on 414 home flips means:

- Zillow lost $109,190 per flip on average

. Zillow lost 37% on each flip on average.

So this is a horrendous business.

But it performed miracles because the sales of those houses—a business activity Zillow didn’t engage in a year ago—added $128.5 million to revenues. This constituted three-quarters of the total revenue increase of $154 million (or 51%) to $454 million in total revenues in the quarter.

And because of the loss at its home-flipping business, Zillow’s total loss soared by 263%. In other words, a 51% increase in revenues caused its quarterly loss to soar by 263% to $67.5 million. This loss amounts to a stunning 15% of revenues.

Zillow isn’t a startup. It has more than 4,000 employees. It has been a publicly traded company for eight years. And it has been on an acquisition binge, buying all kinds of other companies. And now it has figured out a way to lose a lot more money.

But Zillow is apparently not yet losing enough money, and so it is going to expand this ruinous home-flipping operation from eight metropolitan areas at the end of March to more markets to boost its revenues and its losses. Home flipping offers few economies of scale; so look forward to a cascade of losses.

Because revenues increased—no matter that this caused Zillow’s losses to more than triple—shares soared 19% on “better than expected” revenues and the prospect that Zillow will expand its ruinous homeflipping operation to many more markets and boost its losses further.

When a stock market rewards companies that have always lost money, such as Zillow, for coming up with a way of losing even more money, it takes the incentive away for management to build a profitable business model. And it shows to what extent this market and the entire hype machine around it are twisted.

But it rewards the short-sighted stockholders who happen to

—Wolf Richter