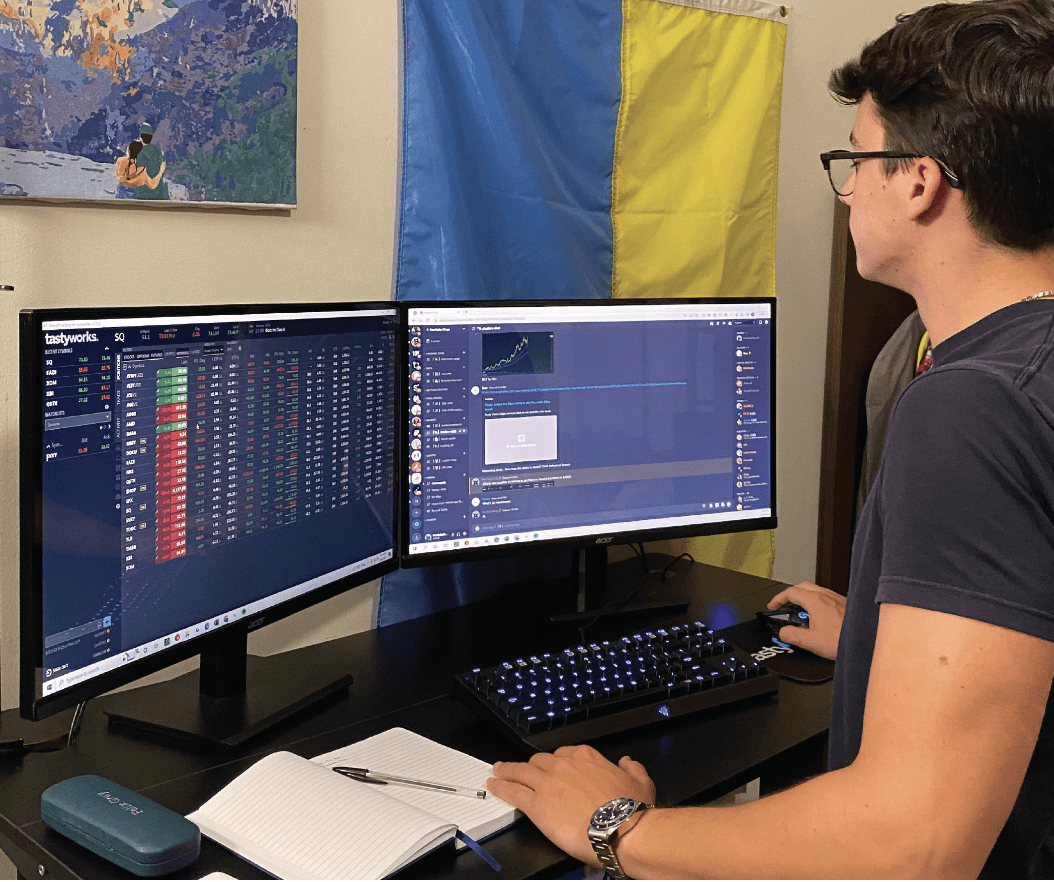

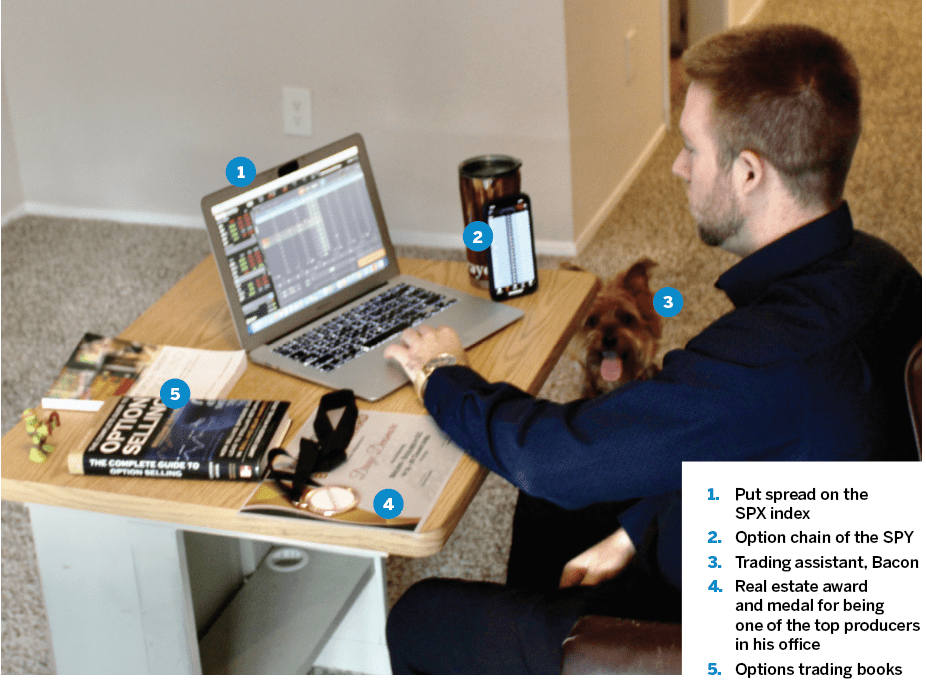

Meet Draye Densmore

Home Houston

Age 25

Years trading 4

How did you start trading?

I’ve always been passionate about the markets and had a strong desire to learn how to trade them. I’ve read many books, watched a ton of tastytrade videos and attended various seminars and conferences to educate myself about the world of finance. Once getting a solid base for the market, I then met my current mentor a few years later: hedge fund manager O’Brian Woods. He’s taught me how to trade options and the various strategies to do this, which have now allowed me to trade options exclusively.

Favorite trading strategy for what you trade most?

I mainly trade strangles, credit spreads and iron condors. The products I typically trade are the indexes and futures, such as the SPX, RUT, /ES, /RTY and SPY. I prefer to stay around the 5-10 delta and 30 days to expiration with my trades, sometimes going over to around 45 days and other times slightly less than 30 days.

Average number of trades per day? 3

What percentage of your outcomes do you attribute to luck?

I don’t necessarily attribute any of my outcomes to luck. I think more along the lines of I know unexpected events are going to happen that affect the market; it’s how you manage your trades to adjust to these events that determines the quality of trader you are. Every time you place a trade you can go off of the delta and determine your chance of success, yet you must do this knowing the delta can change drastically at any moment and it’s your responsibility to react. Some trades will be easier to manage than others, but the market is too complex and affected by too many variables for me to attribute any of my trades to luck.

Favorite trading moment or best trade and why?

My favorite trading moment was when I put my first iron condor on the SPX and watched for hours as it expired out-of-the-money. From then I was hooked. I couldn’t stop trading and had to do it every day. I’ll never forget that moment as I’d wanted to trade and understand options my whole life, and I was finally able to do so, which gave me a sense of gratification. Understanding this gave me great confidence to put on trades I’d always wanted to but never quite knew how to do.

Worst trading moment?

During the wake of the coronavirus pandemic on a Friday at 2:45 when the market was about to close and the S&P 500 shot up 120 in 15 minutes, blowing through my call spread and giving me a max loss. It was tough to handle initially as it happened so fast I barely had time to react or manage the trade. I recovered by simply going back to the basics of trading smaller and more often instead of larger and less often. I do believe going through this made me a better trader and allowed me to realize how important discipline is in being a successful trader.