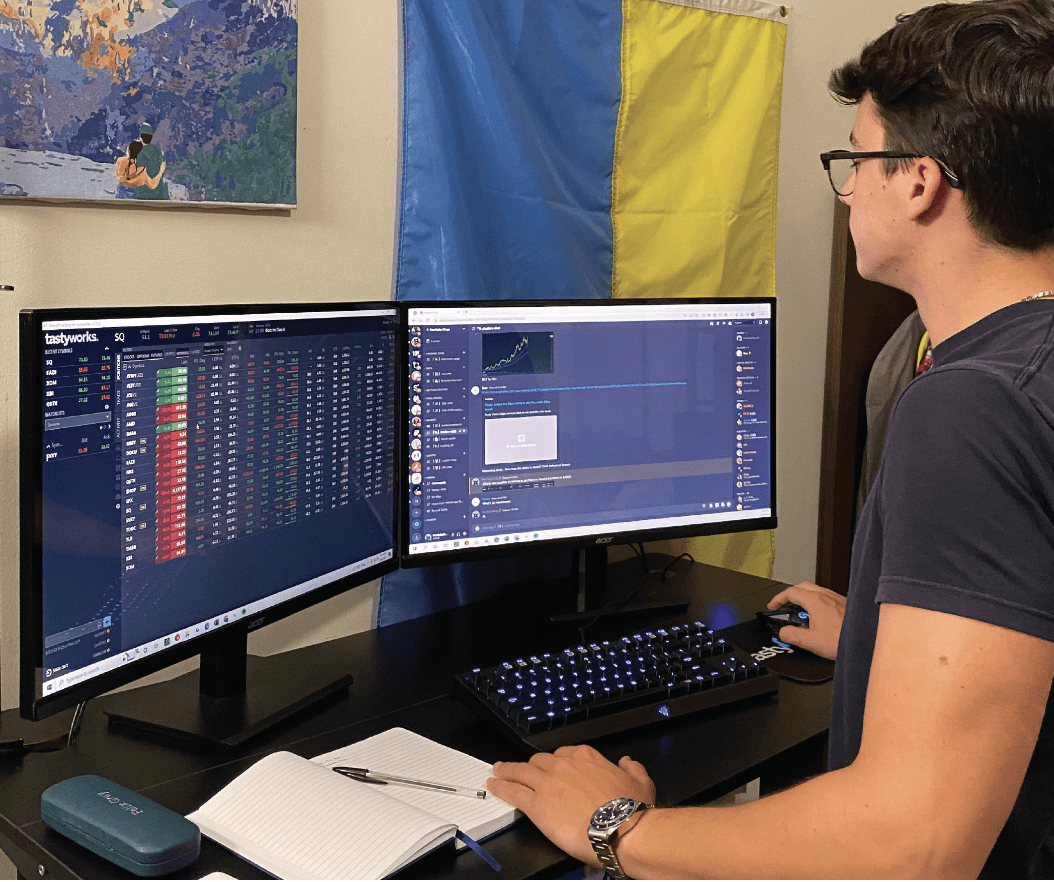

Meet Harvinder Singh Dhillon

Trader & Entrepreneur

Office London

Age 28

Years trading 5

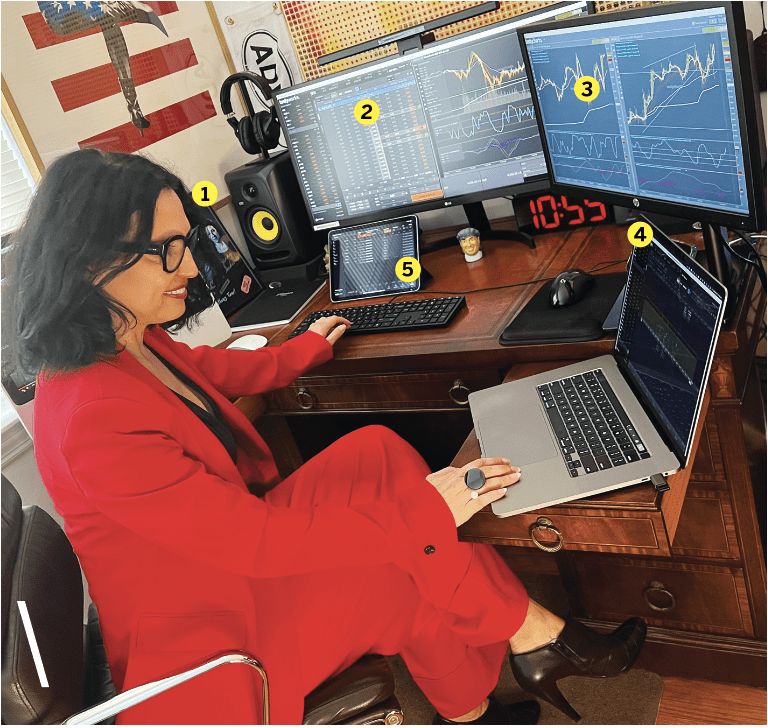

4. Options chain for placing positions, new position review screen; 5. Mobile phone with social media groups with the tastytrade community to generate trade ideas; 6. Surface pro with tastyworks platform for managing parents’ account, tastytrade watch list and the follow page; 7. Microphone and headset to manage employees in multiple locations

How did you start trading?

Having a finance background, I always saw trading as the pinnacle. I used to watch movies like Wall Street and get a real buzz from it. So, in the summer of 2014, I decided to get my feet wet and bought some stocks. My first three trades worked out beautifully. I bought stocks when they were oversold, and they went up. I’ll never forget my fourth trade—I bought an Indian mining company called Vedanta, and I saw the chart. The price used to be at 1,000 points, and it had dropped down to 500 points. Being the rookie that I was back then, I thought, “This is great! I will buy this at 500 points and sell it for 600 points.” That’s when I realized it doesn’t always work out that way. I had no real strategy; it was just buy and pray. During that time, I was fortunate to sit next to someone at work who showed me the tastytrade way of trading, with volatility and probabilities. We spent two months paper trading. I was hooked and confident that this would be the beginning of a lifetime journey in trading.

Favorite trading strategy for what you trade most?

I vary my positions as much as possible, but my favorite strategy is selling premium with strangles, as the implied move in an underlying is often overstated compared to the realized move. I skew the strangle according to my assumption in the underlying by varying the deltas on the put and call. Strangles benefit from greater capital efficiency than selling naked puts or calls, as no additional buying power is required by selling the other side. Although strangles are undefined risk, they actually increase your probability of profits in two forms: 1. By not buying the wings you increase your breakeven points. 2. Profits are realized faster, which means you can take advantage by taking your profits quicker, which in itself increases your probability of profit. Also, when a trade goes wrong, strangles are much easier to adjust than any other strategy.

Average number of trades per day? 15

What percentage of your outcomes do you attribute to luck?

I first began my trading journey by trading stocks, which was a pure 50/50 gamble. Having moved to selling out-of-the-money options, I have increased my probability of profit and have improved my diversification across both underlyings and strategies to absorb an adverse market impact. So, I have made my trading more about strategy and probabilities rather than luck. However, it would be foolish to say that I don’t need luck. My average probability of profit is 70%, but my actual winners were 80%, so I would assume 10% would be due to luck.

Favorite trading moment or best trade?

Diversification is often misunderstood in the industry. The masses seem to think that trading multiple underlyings is diversification. However, what most don’t understand is that the correlation tends to increase during times of market stress. True diversification can only be found by trading uncorrelated positions coupled with strategy diversification, which ultimately will reflect in a low beta weighted delta. I have this ingrained within my trading strategy and often look at my beta weighted delta, but the first real test for my portfolio was on the day Britain voted Brexit on June 23, 2016. This wiped out the year-to-date gains for the S&P 500, however my portfolio only lost $125 out of $25k invested (0.5%). Experiencing how true diversification protected me from a large market downturn was incredible to see and gave me the utmost confidence of trading in both bull and bear markets.

Worst trading moment or worst trade?

Having a finance background, producing financial forecasts and targets for my ventures is the norm, and trading was no different. I used to set myself a target and calculate the daily theta needed to reach that goal. Unfortunately, this backfired, as I was so ingrained with this target that I forced theta at the targeted level, even when the opportunity was not present. This taught me the biggest lesson in both life and trading—that you can only take advantage of the opportunities available to you. They simply cannot be conjured up. I now vary my portfolio theta and the number of open positions depending on volatility levels and, in essence, the opportunity available.