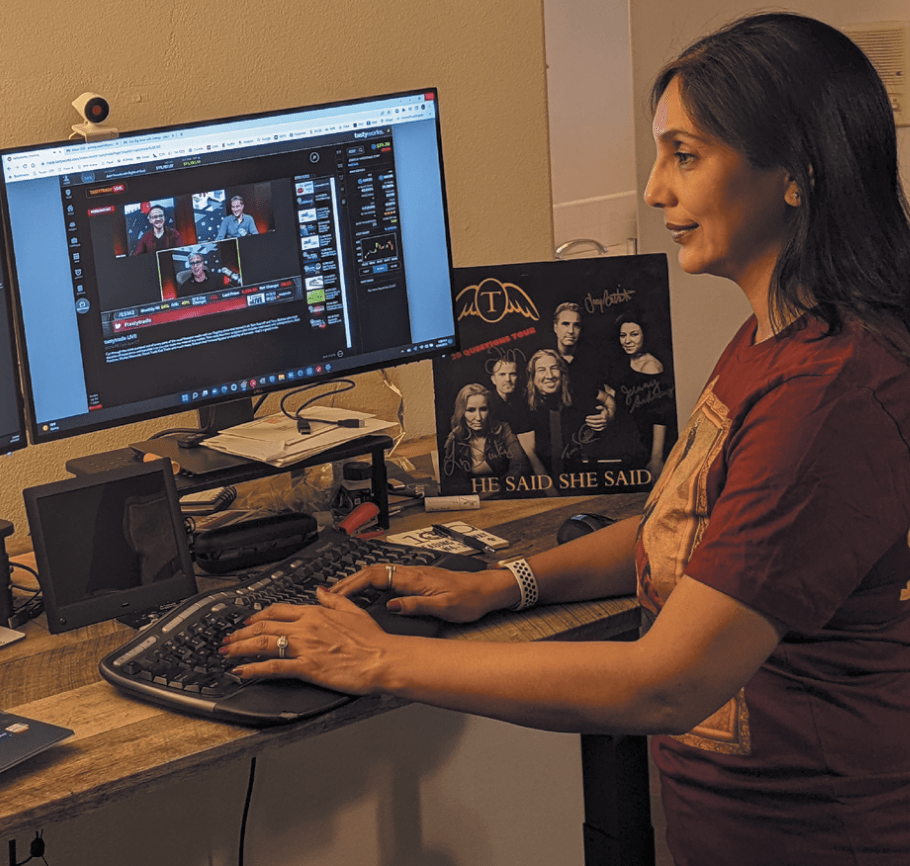

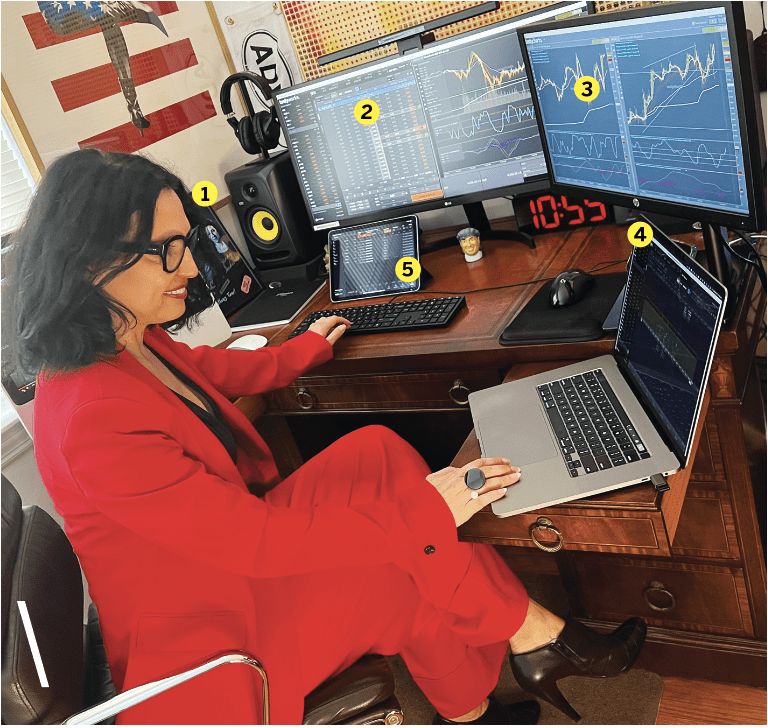

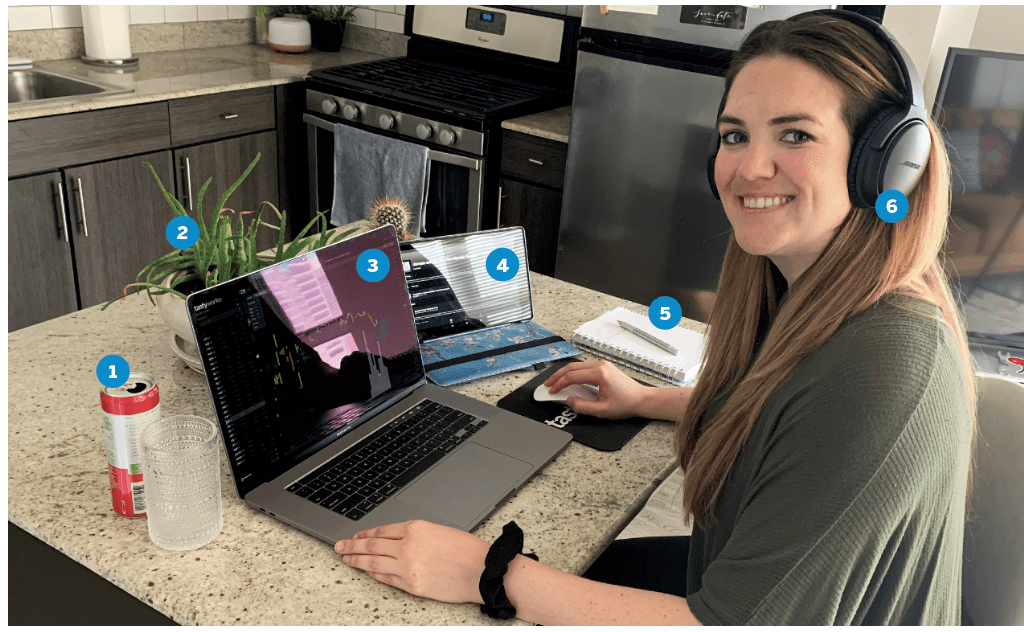

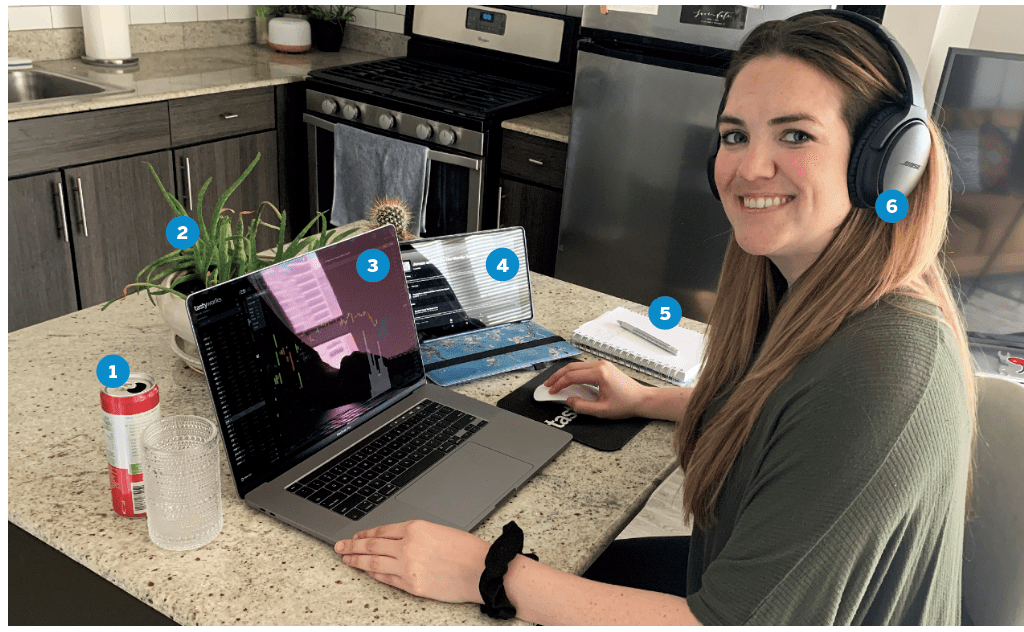

Meet Katie McGarrigle

tastytrade Host & Content Manager

Office Chicago

Age 30

Years trading 7

How did you start trading?

Being at the wrong place at the wrong time. Kidding! I do NOT have a finance background, so this whole thing sort of fell into my lap! I was a new hire on the support team at tastytrade (after interning as a video technician), and in an attempt to get up to speed on the jargon and strategies being talked about all day, I was encouraged to open a brokerage account. A day or two later, Tom Sosnoff found out and decided to throw me in front of a camera to learn options trading in real time before the tastytrade audience. As soon as I started to understand how options incorporate probability, and that I can choose a range OR a direction for a stock to move in, the concepts started to sink in.

Favorite trading strategy

Capital efficiency matters most in a small account like mine (~$25k). Therefore, I’m always looking for ways to keep buying power in check—especially when it comes to futures options—one of my most-used tools. I like iron condors, naked options in inexpensive products. Lately, I’ve been using a lot of strategies that take advantage of skew (broken wing butterflies, jade lizards, iron condors). I also try and make sure to have exposure to the six main asset classes (equity indexes, U.S. Treasuries, metals, energy, foreign exchange and agriculture) and then pepper in a few individual names/ETFs.

Average number of trades per day? 2

What percentage of your outcomes do you attribute to luck?

In all my years of trading, I can probably count on one hand the number of times I’ve said, “Phew! I got lucky!” At tastytrade, we learn to assess the market environment with a variety of metrics and go from there. We like to set up high-probability trades that have a reasonable risk:reward ratio, and we always try to keep size in check. If your positions “check the boxes” before you’re even filled, it’s less about luck and more about letting the probabilities play out!

Favorite trading moment?

When I was still learning, Tony Battista was trying to teach me the concept of delta (a metric used to gauge directional exposure) and how traders can choose their delta in a covered call strategy based on where you place the short option. In that moment, things just clicked! I finally understood the flexibility that options can afford rather than simply trading stock, and how tastytrade mechanics play into that flexibility.

Worst trading moment?

Some trades that still give me a little PTSD are 2019 silver futures (had a strangle that quickly got the better of me), choppy moves in /CL in the first four months of 2020, and a UNG strangle early in my trading career when volatility exploded. The biggest thing I’ve learned is to stay small, follow your gut and be flexible. If you feel like the velocity in the product is getting too swift, it’s OK to cover a position. Most days, I’d rather close out a bad trade and chip away at losses with a new position that has higher probabilities than continue to micromanage something that’s losing money.