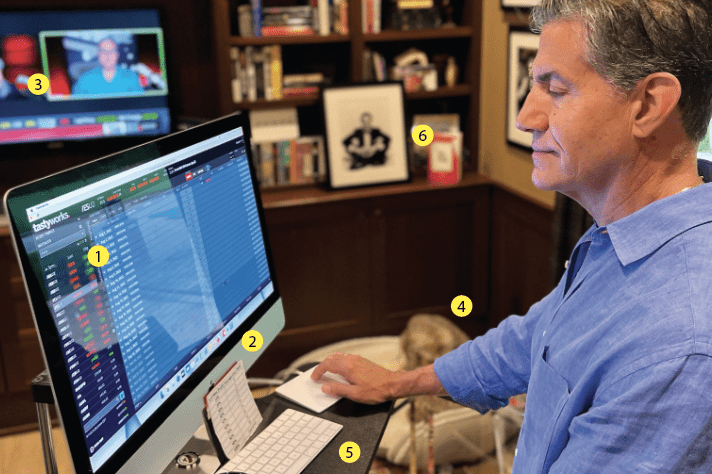

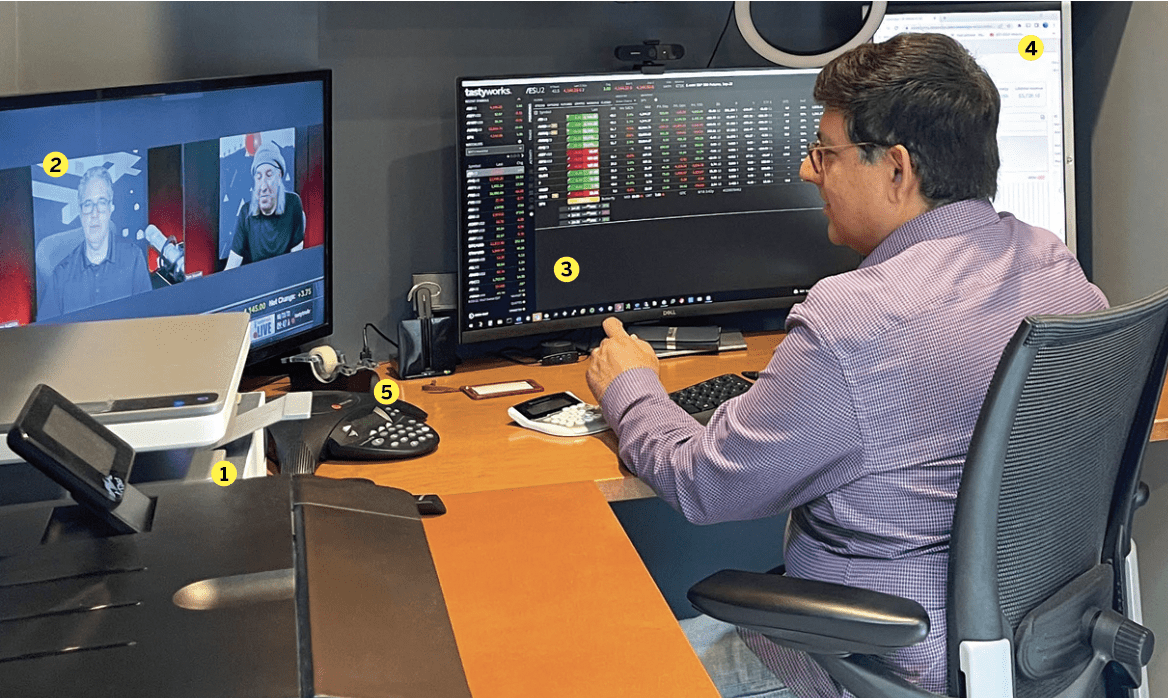

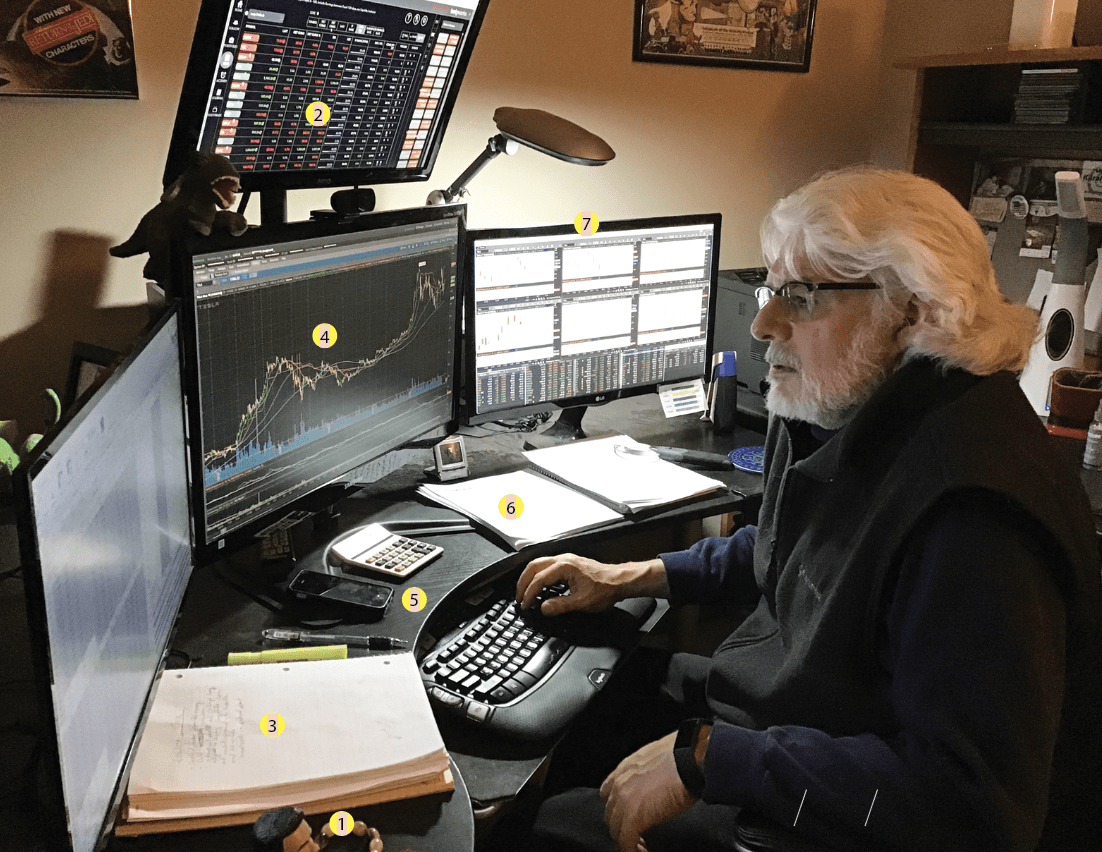

Meet Michael Rechenthin

Head of data science, tastytrade

Home Chicago

Age 42

Years trading 20+

Office tastytrade, Chicago

How did you start trading?

I became interested early on, in junior high. My dad was getting an MBA at the time and had a ton of books on finance and trading. I became interested in trading and stocks because of the excitement and the potential. We never talked sports at home—instead we regularly talked business.

Your favorite trading strategy?

I’ve had the best consistent luck with the basic covered call and the short put. Each month I take money out of my checking account and put it straight into my investment/trading account. I can always find something that I think is worth purchasing. And depending on how bullish I am on a particular stock or exchange-traded fund, I either stick closer to the current price or place my call farther away. Options, along with a strategy, have the advantage of being able to reduce overall volatility.

Average number of trades per day? One.

What percentage of your outcomes do you attribute to luck?

What part of life can’t be attributed to some degree of luck? I personally want to minimize luck as much as possible. Is it too presumptuous to think that only 30% of my success can be attributed to luck? Luck is part of the great unknown! So, I do things that work in my favor. I make thoughtful decisions as to where I place my money. I sell options to try to lower the overall costs around my positions.

Favorite trading moment?

My most memorable moment was when

I was a clerk on the floor of the Chicago Stock Exchange. I started as a clerk, which is a glorified lunch and coffee scout. One of the senior traders had the day off, so the head of the firm let me trade for him. The stock dropped, I got short, all the while thinking I was long, and got long when I thought I was getting short, and made a ton of money. Complete accident. Everyone thought I was a genius. I played it up and got promoted the next day. But it was a complete mistake; I was the ultimate luckbox.

Worst trading moment?

Again, I was trading on the floor. I was making markets and short a large position when Jim Cramer started hyping the stock up on television. I received a complete onrush of orders to buy, couldn’t get out of my own position since I had customer orders to fill and I got completely run over. I had a huge loss and felt completely exhausted. Think about how scary something as abstract as shares of stock going against you can be.