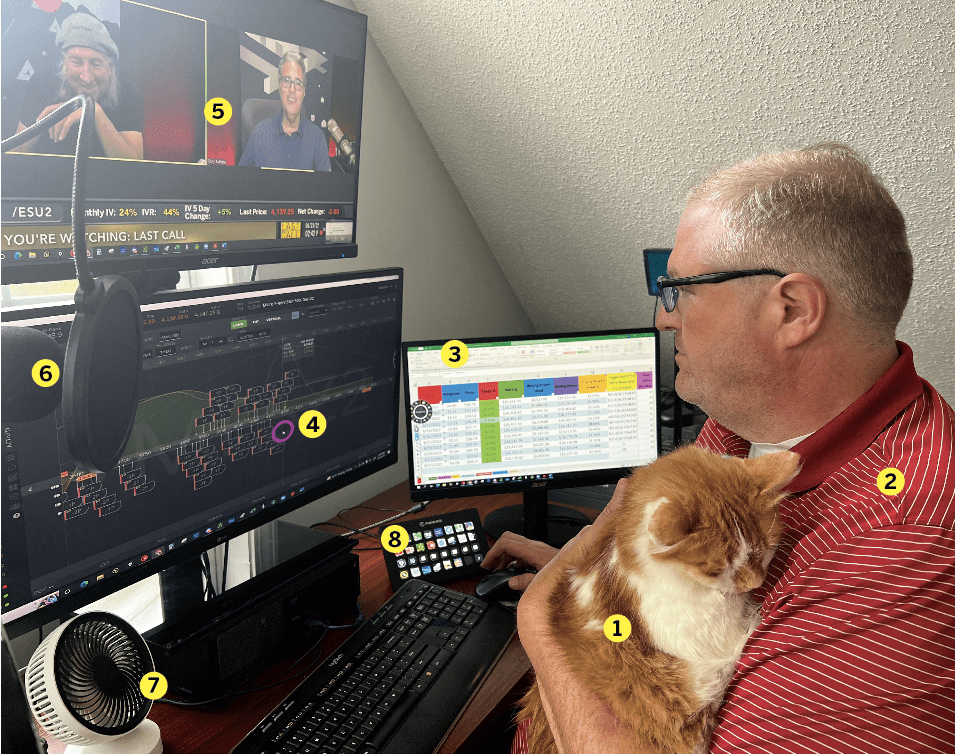

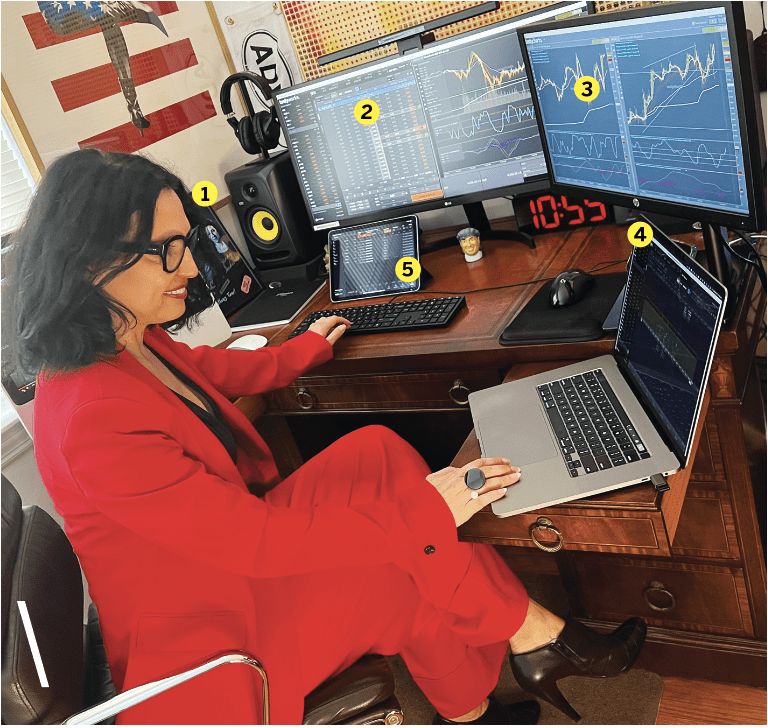

Meet Rob Hoffman

CEO and founder, becomeabettertrader.com

Age 49

Years trading 25

Office Lake Geneva, Wisc.

1. Economic calendar and trade ideas

2. Multi-timeframe screen with tastytrade broadcast

3. Rob’s ITP indicators

4. Multi-market display

5. Email: Always up to keep up

6. ITP and TRP indicators and OptionsPlay research tool

7. The tastyworks platform

8. WealthCharts social platform where Rob posts his trading research

9. Phone—ringing off the hook

10. Yeti microphone

What did you start trading?

Since childhood I’ve always enjoyed playing chess and thinking several moves ahead. As I grew up, I found that same perspective was a perfect fit for trading. One key aspect of that is identifying statistically significant trends and looking for re-entry opportunities within those trends prior to, or on resumption of, the quality trend. So when I look at the market, I don’t really look at it as a chart and if I am going to go long or short, instead I am focused on where the market looks like it is to the general public. Once I know where public perception expects trends to go, I can take a step back and see where the pieces on the board really are in the big picture.

Favorite trading strategy? The biggest problem I see is the use of oscillators at the wrong time. For trending markets, which is where most people get into trouble with oscillators, I only use one side of the oscillator. In a long side trending market I will wait until the stochastic comes from approximately the 80 level and above, and rather than shorting the market as it starts to pull back, I will wait until the market falls down below the 20 level and starts to firm up and look for the long side trade for a fresh entry or re-entry in the direction. In the short side market, rather than buying the market as it comes from below the 20 level and starts to rise back up, I want to trade with the trend, so I will wait for the market to pull back above the 80 level and start to weaken, and look to do a fresh entry short.

Average number of trades per day? 3

What percentage of your outcomes do you attribute to luck? Every trade has an element of luck. Most of my strategies are focused on 80% to 90% probability, but you can’t control everything, so by default there’s a 10% to 20% chance for risk of failure, or need for luck.

Favorite trading moment? Recently I competed against several of the top traders from Europe. One of those competitors was using a completely automated algorithmic trading program. I saw it as my chance to take on the machine. The program fired off trade after trade successfully. Through much of the event I was behind. Then something changed that allowed live traders to demonstrate the benefit of human intuition. The market started to shift its behavior and trend, and that was something I was able to see and feel before the machine could. In the end, by continuing to trade well through the market turn while the machine had to slow down and identify what the current action meant, I ended up nearly twice as profitable as the machine.